Understanding homeowners' insurance policies can sometimes feel like deciphering a foreign language. Many homeowners are unsure about the coverage details and the fine print, which is essential to protect your investment. From dwelling coverage to liability protection, each component serves a vital role in safeguarding your home and belongings. Dive into our article to unravel the mysteries of homeowners' insurance and find out what you really need to know!

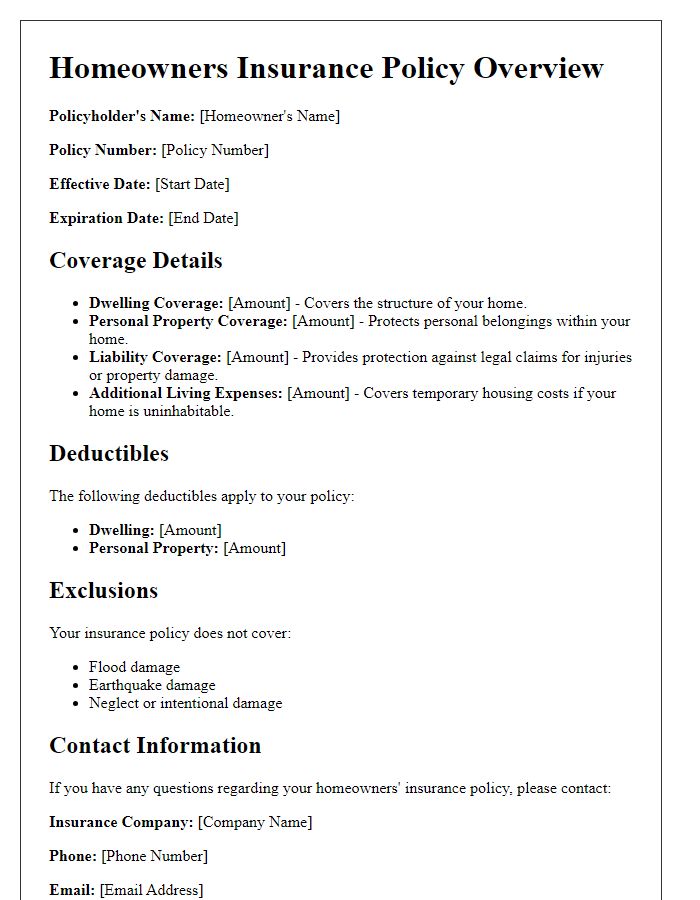

Coverage details and inclusions

Homeowners' insurance policies provide essential coverage for residential properties, safeguarding against various risks such as fire, theft, and natural disasters. Standard policies often include dwelling coverage, which typically amounts to a percentage of the home's replacement value (often around 80% to 100%). Personal property coverage insures belongings within the home, generally up to 50% to 70% of the dwelling amount. Liability coverage protects homeowners against legal claims for injuries occurring on the property, often starting at $100,000. Additional living expenses can cover temporary housing costs if the home becomes uninhabitable due to a covered incident. Important exclusions often include flood, earthquake damage, and maintenance-related issues, emphasizing the need for separate policies or endorsements. Understanding these details helps homeowners choose adequate coverage tailored to their specific needs.

Policy limits and deductibles

Homeowners' insurance policies provide financial protection against various risks associated with homeownership, particularly in events like fire or theft. Policy limits refer to the maximum amount an insurer will pay for a covered loss, typically outlined in monetary value, such as $300,000 for dwelling coverage. Deductibles represent the amount that policyholders must pay out of pocket before the insurance coverage kicks in, which can range from $500 to $5,000 depending on the chosen plan. Understanding these key components is essential for homeowners to ensure adequate protection and financial preparedness in times of unexpected disasters, helping to minimize losses and facilitate a smoother claims process.

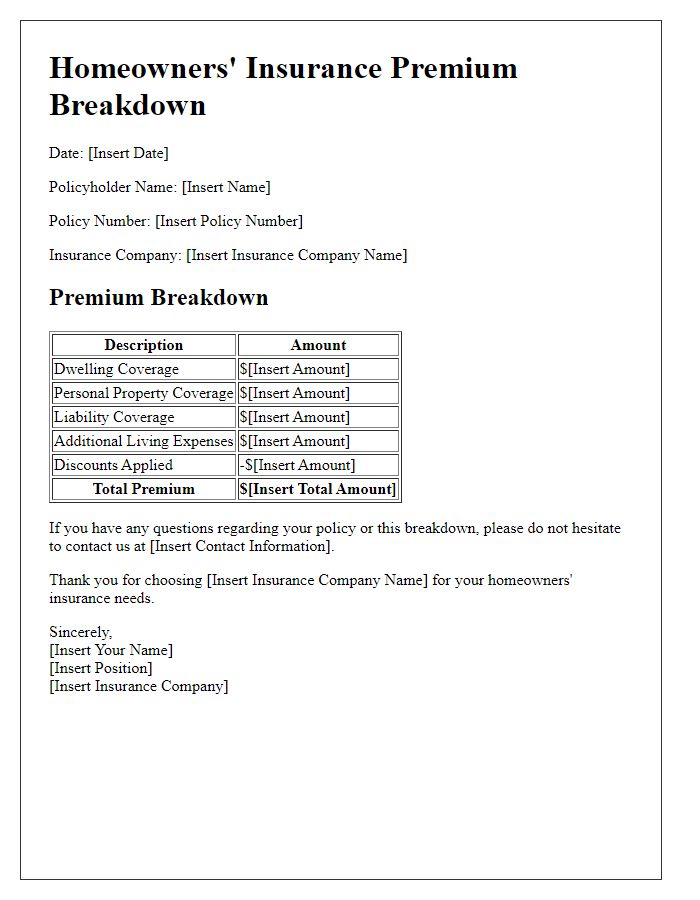

Premium costs and payment options

Homeowners' insurance policies typically encompass various essential components, including premium costs and payment options. Premium costs, determined by factors such as property location (like fire-prone areas or flood zones), home value, and coverage limits, can significantly vary. For example, in high-risk areas, premiums may be higher due to increased likelihood of claims. Payment options for homeowners' insurance often include annual, semi-annual, quarterly, or monthly installments, allowing flexibility in budgeting. Discounts may apply for bundling policies or maintaining a claims-free history, which can reduce overall financial burden. Understanding these aspects is crucial for homeowners to secure adequate protection for their assets.

Claims process and procedures

Homeowners' insurance policies encompass essential coverage for property damage and liability protection for homeowners. The claims process begins with notifying the insurance provider immediately after experiencing a loss, such as damage from a severe weather event, like hurricanes or floods. Documentation is crucial; homeowners should gather evidence including photographs of the damage, a detailed inventory of lost or damaged possessions, and any relevant receipts or appraisals. This documentation supports the claim's validity and facilitates the investigation by claims adjusters, who evaluate the incident based on policy terms, coverage limits, and exclusions. Following the assessment, the insurance company will issue a settlement offer, which homeowners should review carefully to ensure it reflects adequate compensation for losses incurred. Timely communication with the insurance agent and adherence to the outlined procedures can streamline the resolution process, ensuring homeowners receive the necessary support and financial restoration they deserve.

Policyholder responsibilities and requirements

Homeowners' insurance policies outline essential responsibilities for policyholders to ensure comprehensive coverage and risk management. Homeowners must maintain property integrity, addressing structural repairs and safety hazards promptly. Regular maintenance of crucial systems, such as plumbing and electrical, is necessary to prevent damage from leaks or electrical failures. Additionally, documentation of valuable items via photographs or inventories aids in claim processes, particularly in incidents like theft or natural disasters. Policyholders should also be aware of specific requirements such as updating the insurance provider about any renovations, increases in property value, or new occupants to avoid potential coverage gaps. Furthermore, timely payment of premiums, often due on an annual or semi-annual basis, is crucial to keep the policy active and prevent lapses in coverage, which can leave homeowners vulnerable to unexpected losses. Overall, adhering to these responsibilities enhances the effectiveness of homeowners' insurance in protecting personal assets.

Comments