As the year comes to a close, we take a moment to reflect on the milestones achieved in our real estate investments. This annual summary not only highlights our successes but also offers insights into the trends that have shaped our portfolio over the past twelve months. Whether you're a seasoned investor or just beginning to explore the world of real estate, understanding these dynamics is key to making informed decisions. Dive into our detailed overview to discover how we navigated the market and what it means for the year ahead!

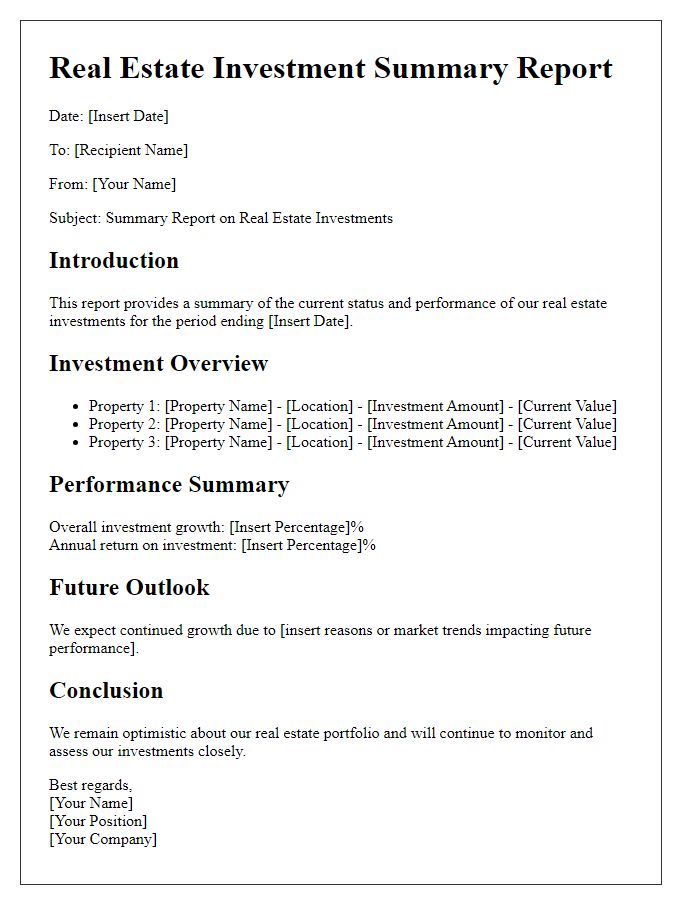

Property Performance Metrics

The annual real estate investment summary highlights key property performance metrics, focusing on critical figures such as rental income, occupancy rates, and capital appreciation. In 2023, the multifamily housing complex located in downtown Austin, Texas, generated a total rental income of $1.2 million, marking a 10% increase from the previous year. Occupancy rates averaged 95%, showcasing demand amidst the competitive market. Additionally, the property appreciated by 8% in value, supported by ongoing urban development initiatives and increased infrastructure investments in the area. Operating expenses remained stable at $300,000, contributing to a net operating income of $900,000, further emphasizing the investment's financial health and potential for future growth.

Market Trends Analysis

The annual real estate investment summary highlights significant market trends influencing property values and investment strategies in 2023. Urban areas such as New York City and San Francisco have seen a surge in demand for residential units, with prices increasing by approximately 8%, driven by a post-pandemic desire for urban living. Conversely, suburban markets, like those in Austin and Charlotte, are experiencing a boom due to remote working flexibility, attracting families seeking more space and better quality of life. Additionally, the commercial real estate sector, particularly retail and office spaces, grapples with challenges from ongoing shifts towards e-commerce and hybrid working models. Vacancy rates in office buildings in major metropolitan areas remain high at around 15%, affecting rental income streams. Meanwhile, the industrial sector continues to thrive, benefitting from increased logistics demands, with warehouse prices rising by 10% nationwide. Key interest rates, set by the Federal Reserve at 4.25%, are influencing mortgage rates, leading to a cautious approach among potential homebuyers and investors.

Investment Returns and Yields

Real estate investment returns reflect the profitability of properties, often measured by metrics such as cash-on-cash return and internal rate of return (IRR). For instance, in 2022, the average cash-on-cash return for multifamily properties in urban areas like New York City reached approximately 8.5%, with some high-demand neighborhoods offering yields exceeding 10%. Yield performance can vary significantly based on location, property type, and market conditions, highlighting the importance of thorough market analysis. Moreover, several economic factors, including interest rates and rental demand, significantly influence investment yields. Tracking these variations is crucial for understanding overall asset performance and making informed investment decisions for future years.

Risk Assessment and Mitigation

The annual real estate investment summary emphasizes the importance of risk assessment and mitigation strategies crucial for safeguarding assets and maximizing returns in the competitive market landscape. Key risks include market volatility, a primary concern affecting property values, often influenced by economic indicators such as interest rates (currently around 3.5% in 2023) and regional employment data from the Bureau of Labor Statistics. Additionally, property-specific risks, including natural disasters (e.g., hurricanes affecting Florida coastlines) and tenant default rates (averaging 5% in urban areas), necessitate comprehensive evaluation. Implementing proactive measures such as diversified portfolios, comprehensive insurance policies, and regular property maintenance enhances resilience against these challenges. Furthermore, adopting advanced data analytics for market trends helps in making informed decisions while monitoring legislative changes relevant to zoning laws or taxation (e.g., property tax increases in New Jersey by 2% in 2023). Together, these strategies form a robust framework for minimizing financial exposure and optimizing investment returns.

Strategic Recommendations and Projections

The annual real estate investment summary reveals significant trends and insights for stakeholders in the commercial property market across major metropolitan areas, such as New York City and Los Angeles. Data indicates a projected increase in property values, with estimates suggesting a rise of 5% to 7% in the next fiscal year, driven by factors like increasing demand for residential units and commercial leases. The analysis highlights strategic recommendations, including diversifying investment portfolios to include emerging markets such as Austin and Raleigh, which have shown resilience and growth potential. Furthermore, the summary emphasizes the importance of incorporating sustainable building practices in new developments, aligned with current consumer preferences for eco-friendly living spaces, likely enhancing long-term value. Comprehensive market analysis points to potential challenges, such as rising interest rates and supply chain disruptions, necessitating proactive risk management strategies to safeguard investments. The report concludes with projections indicating a robust investment climate, making this an opportune moment for informed capital allocation in the real estate sector.

Comments