Are you thinking about buying your dream home but feeling overwhelmed by the mortgage process? Understanding the ins and outs of mortgage pre-approval is the first step towards making your homeownership dreams a reality. In this article, we'll break down everything you need to know about securing a mortgage pre-approval, from documents required to tips for strengthening your application. So, grab a cup of coffee and let's dive into the essentials that will help you on your path to owning a home!

Personal Information

Mortgage pre-approval serves as a crucial step in the home buying process, offering potential homeowners financial assurance when making offers on properties. This process involves a lender evaluating essential personal information, such as income, credit score, and debt-to-income ratio. A strong credit score, typically above 620, can significantly improve the chances of receiving favorable loan terms. Personal details must include employment history, which should ideally show stability over the past two years, and assets, including savings accounts and other investments. The lender also reviews outstanding debts, ranging from credit card balances to student loans, to calculate the debt-to-income ratio, allowing them to determine how much mortgage a borrower can afford. Once pre-approved, individuals gain an advantage in the competitive real estate market, enabling them to secure financing efficiently.

Loan Amount and Type

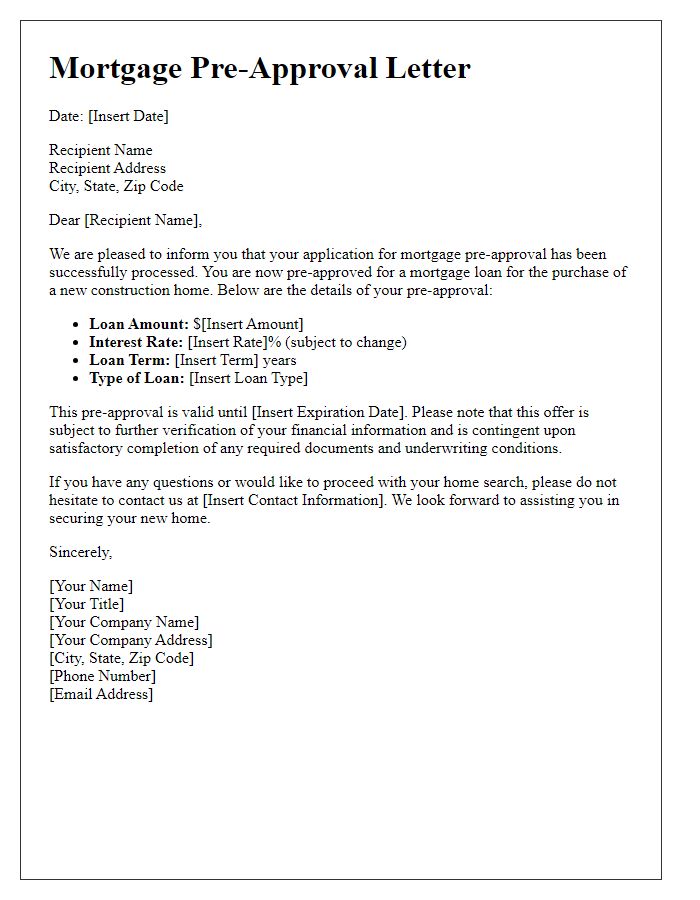

Obtaining a mortgage pre-approval can significantly streamline the home-buying process, offering prospective homeowners insight into their financial capabilities. A loan amount, typically ranging from $100,000 to $1,000,000, is determined based on various factors such as income, credit score, and debt-to-income ratio. Conventional loans often carry fixed or adjustable rates, while FHA loans provide options for lower down payments, appealing to first-time homebuyers. Additionally, obtaining pre-approval can expedite negotiations, as sellers often favor buyers who are financially vetted and ready to proceed with the purchase.

Interest Rate Details

Mortgage pre-approval serves as a crucial step in the home buying process, often necessary for securing a property in competitive housing markets. The interest rate is a key element, influencing long-term financial commitments. Current average rates (around 7.00% as of October 2023) vary by lender and depend on several factors, including credit score, loan amount, and loan-to-value ratio. Fixed-rate mortgages maintain a constant interest rate throughout the term, while adjustable-rate mortgages may fluctuate based on market conditions. Additionally, economic indicators such as inflation rates, Federal Reserve policies, and housing market trends impact these rates. Understanding these details is vital for prospective homebuyers to navigate their options effectively.

Financial Documentation Requirements

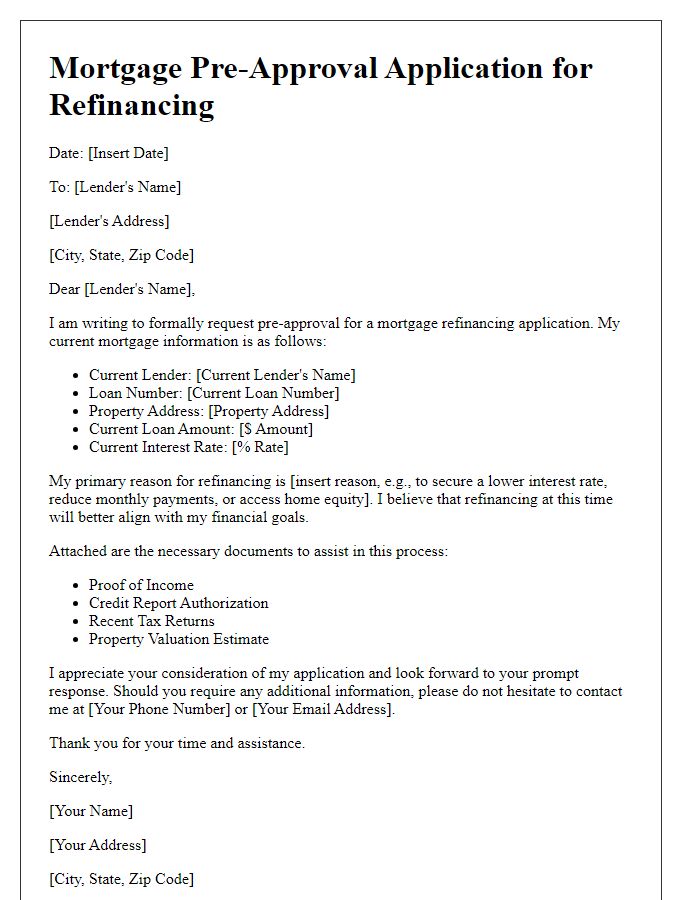

Mortgage pre-approval is a crucial step in the home-buying process, ensuring potential homeowners secure financing before making an offer on a property. Financial documentation requirements typically include recent pay stubs, verifying income from employment, W-2 forms from the last two years, demonstrating taxable income, bank statements from checking and savings accounts, illustrating available funds for down payment and closing costs, and tax returns for the previous two years, providing insight into overall financial health. Additional items may include divorce decrees or child support agreements if applicable, showcasing financial obligations, and proof of additional income sources, such as bonuses or rental income, crucial for accurately assessing borrowing capacity. Collecting and organizing these documents facilitates a smoother pre-approval process, paving the way for successful homeownership journeys in competitive real estate markets, like those found in cities such as San Francisco or New York.

Expiry Date of Pre-approval

A mortgage pre-approval serves as a crucial step for homebuyers seeking financial backing when navigating the competitive real estate market. Typically, lenders will issue a pre-approval letter that includes an expiration date, often ranging between 60 to 90 days, which indicates the validity period of the loan offer. This time frame is essential for buyers, especially in high-demand areas like San Francisco or New York City, where properties may be quickly sold. Potential homebuyers must act within the specified duration to lock in favorable interest rates and take advantage of current market conditions. Once expired, applicants may need to reapply, potentially encountering changes in their financial situation or market interest rates. It's important to keep track of the pre-approval's expiration date to ensure a smooth home-buying process and maintain competitive standing against other buyers.

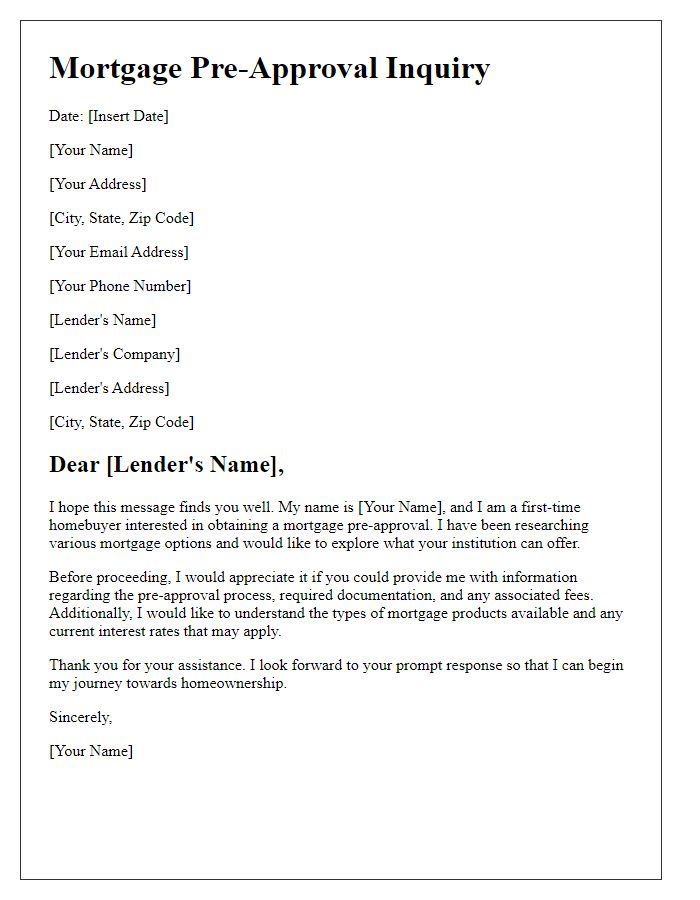

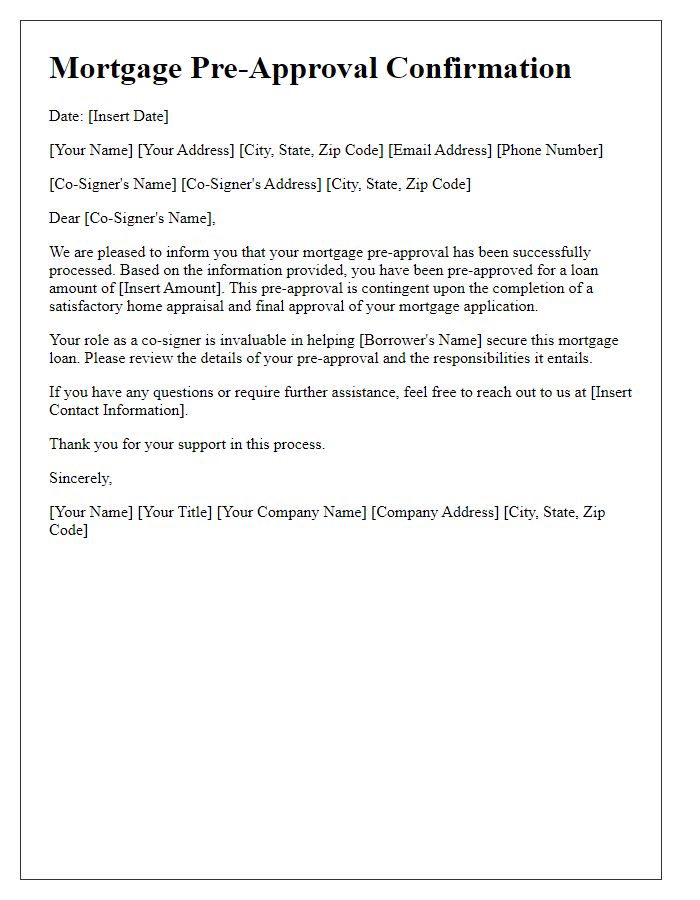

Letter Template For Mortgage Pre-Approval Introduction Samples

Letter template of mortgage pre-approval for investment property financing.

Letter template of mortgage pre-approval notification for multiple offers.

Letter template of mortgage pre-approval introduction for self-employed applicants.

Letter template of mortgage pre-approval follow-up for pending documents.

Comments