Hey there! We're excited to share some exciting updates regarding your investment property. Over the past few months, we've seen promising developments that enhance both the value and appeal of the property, thanks to strategic improvements and market trends. If you're curious to delve deeper into the specifics and learn how these changes can benefit your investment, we invite you to read more!

Property Overview

The property located at 220 Maple Street, Springfield, MA, encompasses a total area of 2,500 square feet, featuring both residential and commercial spaces. Recent renovations completed in March 2023 have enhanced the aesthetic appeal and efficiency of the building. The residential units, consisting of four apartments, each showcase modern amenities, including energy-efficient appliances and hardwood flooring. The commercial segment, occupied by a thriving cafe and an artisanal bakery, has reported a 20% increase in foot traffic since the start of the year, attributed to the local farmers' market that operates every Saturday nearby. Property management has implemented strategic marketing initiatives aimed at maximizing occupancy rates and fostering community engagement. Recent assessments indicate an estimated property value of $750,000, marking a 15% appreciation since the last evaluation in 2022.

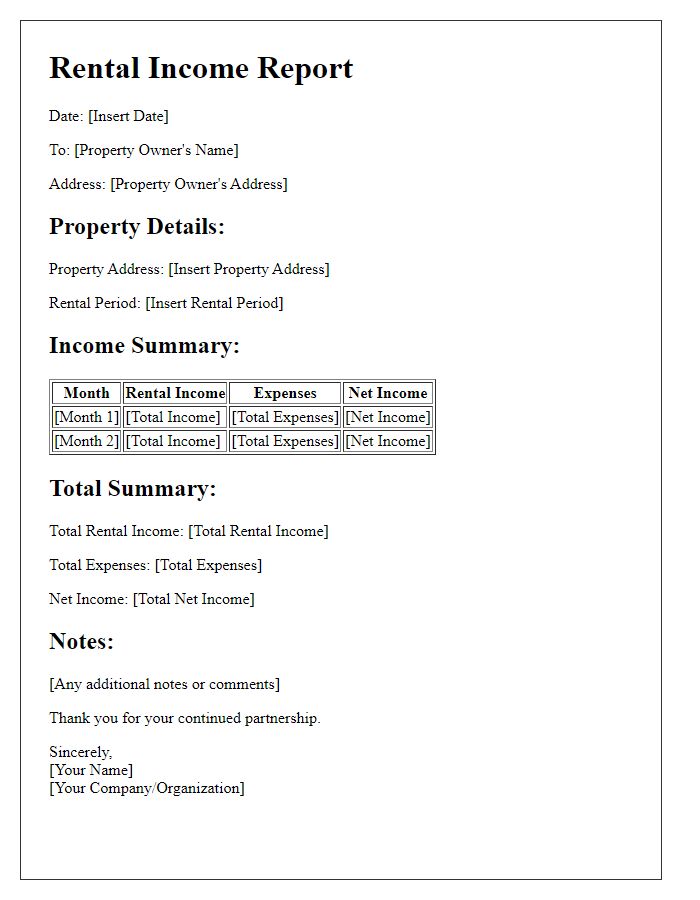

Financial Performance

In the latest financial quarter of 2023, the property's income has shown an impressive growth rate of 12% compared to the previous quarter, largely attributed to enhanced tenant retention strategies in the rapidly developing downtown area of Austin, Texas (notably a hub for technology firms). Operating expenses have remained stable, demonstrating a 3% increase primarily due to inflation-driven maintenance costs. Net operating income (NOI) reached approximately $150,000, reflecting an upward trajectory in the overall financial health of the investment property. Additionally, vacancy rates have decreased to 5%, signaling robust demand in the local rental market characterized by significant economic growth and an influx of new residents. The positive cash flow generated during this period has facilitated ongoing property improvements, which are expected to further increase market value and appeal.

Market Conditions

Current market conditions indicate a steady decline in property values within major metropolitan areas. Recent reports from the National Association of Realtors (NAR) highlight a 10% drop in median home prices in cities like San Francisco and New York over the past year. Inventory levels have surged to unprecedented heights, with over 1 million active listings nationwide, leading to increased competition among sellers. Interest rates, currently averaging around 7% for a 30-year fixed mortgage, further impact buyer affordability and demand. The rental market is also showing signs of strain, with a noticeable slowdown in rental price growth, particularly in urban centers. Investment strategies must now adapt to a more cautious approach in response to these evolving economic indicators.

Upcoming Developments

The upcoming developments in the urban landscape of downtown Austin, Texas, showcase a multifaceted expansion aimed at enhancing residential and commercial infrastructures. Projects include the construction of a twelve-story luxury condominium building featuring 150 units, with prices starting around $500,000, expected to be completed by December 2024. Additionally, a new mixed-use development, incorporating over 50,000 square feet of retail space, will debut in early 2025, boasting top-notch amenities such as a rooftop garden and community gathering areas. Local government incentives, including tax abatements, aim to encourage investment in sustainable practices, such as green construction materials and energy-efficient designs. The revitalization efforts signal a commitment to transforming the area into a vibrant hub, with an emphasis on attracting young professionals and families, thereby increasing property values and rental demand in the surrounding neighborhoods.

Contact Information

Investors often seek updates regarding property performance, thus regular communication enhances trust and transparency. The contact information section should include essential details such as the property address, which serves as the physical location identifier for the asset in question, and the property manager's name, which connects investors with the responsible party for day-to-day operations. Additionally, including an email address ensures direct communication for inquiries, while a phone number allows for immediate discussions regarding property status. Such organized contact information not only fosters relationships but also enhances the overall reporting process for any real estate investment.

Comments