Are you on the lookout for exciting investment opportunities that could elevate your portfolio? In today's dynamic market, finding the right avenues for growth is crucial, and we have some enticing options to share with you. We'll delve into emerging sectors, innovative startups, and sustainable ventures that promise substantial returns. So, if you're ready to explore these potential game-changers, keep reading!

Company Background and Vision

XYZ Innovations, established in 2020, is a groundbreaking technology firm headquartered in San Francisco, California. Focused on developing sustainable energy solutions, our mission emphasizes reducing carbon footprints through innovative products such as solar energy systems and energy-efficient smart home technology. With a talented team of over 50 engineers and sustainability experts, we aim to lead the transition towards a greener future, targeting a market of $2 trillion by 2030. Our vision includes creating a world where clean energy is accessible to all, addressing climate change challenges while improving quality of life for communities across the globe. By collaborating with industry leaders and leveraging cutting-edge research, we strive to revolutionize the energy landscape, ensuring our commitment to environmental stewardship aligns with profitable growth strategies.

Market Analysis and Opportunity

Market analysis reveals significant growth potential in the renewable energy sector, particularly solar power. In 2023, the global solar energy market size reached approximately $200 billion, with a projected compound annual growth rate (CAGR) of 20% through 2026. Key players include companies like First Solar and SunPower, operating in regions such as North America and Europe, where governmental support and incentives are robust. The recent climate agreements, such as the Paris Accord, underscore a global shift towards sustainable energy solutions. Additionally, advancements in photovoltaic technology have reduced costs by nearly 90% over the last decade, increasing adoption rates for residential and commercial users alike. Recognizing these trends presents a unique investment opportunity that aligns with both economic growth and environmental sustainability.

Value Proposition and Unique Selling Points

The investment opportunity in the renewable energy sector, specifically solar energy projects, presents a compelling value proposition. The global solar market is projected to reach $223 billion by 2026, driven by increased demand for sustainable energy sources and government incentives. With solar panel efficiency rates improving to over 20% in leading technologies, potential investors can leverage advancements in photovoltaic innovation. Unique selling points include an established partnership with SunPower, a leader in high-efficiency solar solutions, and access to key markets in California and Texas, which represent over 50% of the U.S. solar capacity. Furthermore, attractive tax credits, such as the Investment Tax Credit (ITC), offer advantages that can enhance return on investment significantly. This opportunity aligns with the escalating emphasis on reducing carbon footprints and achieving energy independence, positioning it as a forward-thinking, responsible investment choice.

Financial Projections and ROI Expectations

Investment opportunities often include detailed financial projections and return on investment (ROI) expectations to help potential investors understand the potential profitability of the venture. Financial projections typically outline expected revenues, expenses, and profit margins over a specific timeframe, often broken down into quarterly or annual increments. For instance, a tech startup may forecast revenues of $500,000 in the first year, growing to $2 million by the third year, requiring a comprehensive analysis of market trends and demand in the technology sector. ROI expectations provide an important metric for investors, usually expressed as a percentage, indicating the anticipated profit relative to their investment. For example, a typical ROI of 20% may be projected over five years, showcasing a clear timeline for when the investor can expect a return. Furthermore, scenario analysis may illustrate best-case and worst-case outcomes, assisting investors in assessing risks associated with the anticipated figures.

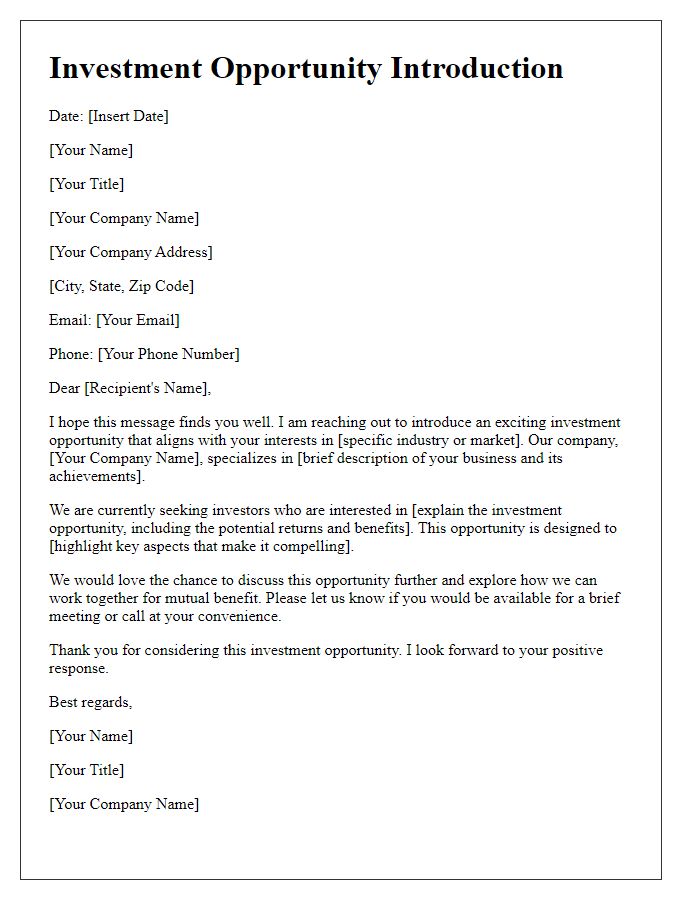

Call to Action and Contact Information

An investment opportunity presentation requires clarity and urgency in its call to action. Interested investors should be encouraged to evaluate the potential benefits of investing in a high-growth sector, such as renewable energy, which has seen a staggering increase in funding, over $500 billion globally in 2020 alone. Clear contact information, including a dedicated email address and phone number for immediate dialogue, is essential. A follow-up timeline can be proposed, emphasizing the urgency of investment engagement to capitalize on forthcoming milestones in product development or market expansion. Highlighting personal availability for meetings, whether virtual or in person, through platforms like Zoom or at industry conferences can facilitate swift communication.

Comments