If you're considering closing your bank account, it's crucial to navigate the process smoothly to avoid any unnecessary hassles. Writing a formal closure request can seem daunting, but it's quite straightforward once you know what to include. In this article, we'll guide you through a simple letter template that ensures your request is clear and direct. So, grab a pen and paper, and let's get started on drafting your closure letter!

Account Holder's Full Name and Contact Information

To close a bank account, account holders must typically provide specific information, including their full name, contact details, and the account number. For instance, John Smith, residing at 123 Main Street, Springfield, with a contact number of (555) 123-4567, must formally request the closure of his savings account, numbered 987654321. Account closure may involve potential outcomes such as the final transaction summary reflecting any outstanding balance, and a confirmation document sent to the contact address to finalize the process. Banks often have specific procedures for account closure to ensure compliance with regulatory requirements.

Bank's Name and Branch Address

To close a bank account effectively, ensure to address the specific bank's name and branch location correctly, emphasizing the importance of secure and identifiable information. Include the account holder's details, such as full name, account number, and contact information, to facilitate the closure process. Specify the request for closure clearly, along with any reasons for the closure, like moving to a different bank or dissatisfaction with services. Request written confirmation of the account closure to maintain a record of the transaction. Additionally, inquire about the final balance withdrawal procedure and any potential fees associated with account closure to avoid unexpected charges.

Account Number(s) and Type of Account(s)

A bank account closure request requires precision and clarity. The account number, a unique identifier assigned to an individual's banking account, holds significance in processing the request efficiently. The type of account, such as a savings account or a checking account, defines the specific service relationship between the customer and the bank. Effective communication with the bank branch involves stating the reason for closure, whether due to relocating to a different state, dissatisfaction with services, or simply consolidating finances. Providing personal identification, such as a driver's license number or social security number, ensures verification of identity and prevents unauthorized access. Timing matters; initiating this process before the next billing cycle can help avoid fees. Lastly, ensuring that any outstanding transactions are settled before closure can prevent complications, making the process smoother for all parties involved.

Reason for Account Closure

To close a bank account, customers often cite reasons such as switching to a different financial institution that offers better interest rates, lower fees, or improved online banking services. Another common reason involves dissatisfaction with customer service or recent changes in account terms, such as increased monthly maintenance fees or reduced accessibility to local branches. Some may opt for closure due to a lack of regular use, particularly if they transition to utilizing digital wallets or other fintech solutions for everyday transactions. Specific financial goals, gained from personal budgeting adjustments or life changes like moving to a new city, might also contribute to the decision to close an account.

Signature and Date

To close a bank account, individuals must submit a formal request to their financial institution, ensuring proper identification and account details are included. The request typically requires personal information such as the account holder's name, address, and the specific account number, ensuring accuracy in processing. Written communication should confirm the request date, and preferences for any remaining funds, whether to transfer to another account or issue a check. Incorporating a signature serves to authenticate the request, while the date indicates when the closure is requested, aiding in the bank's processing timeline.

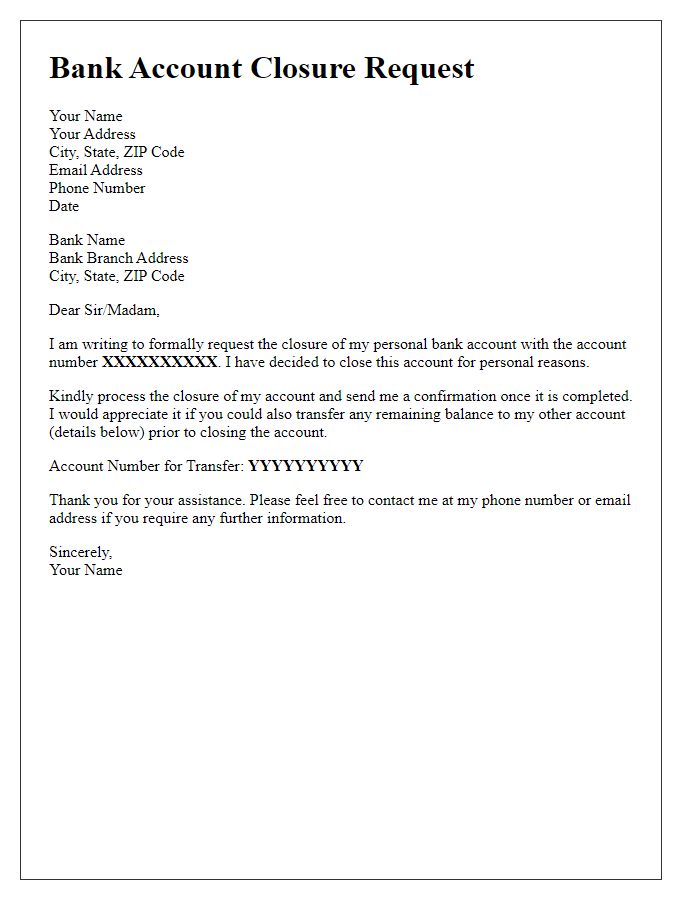

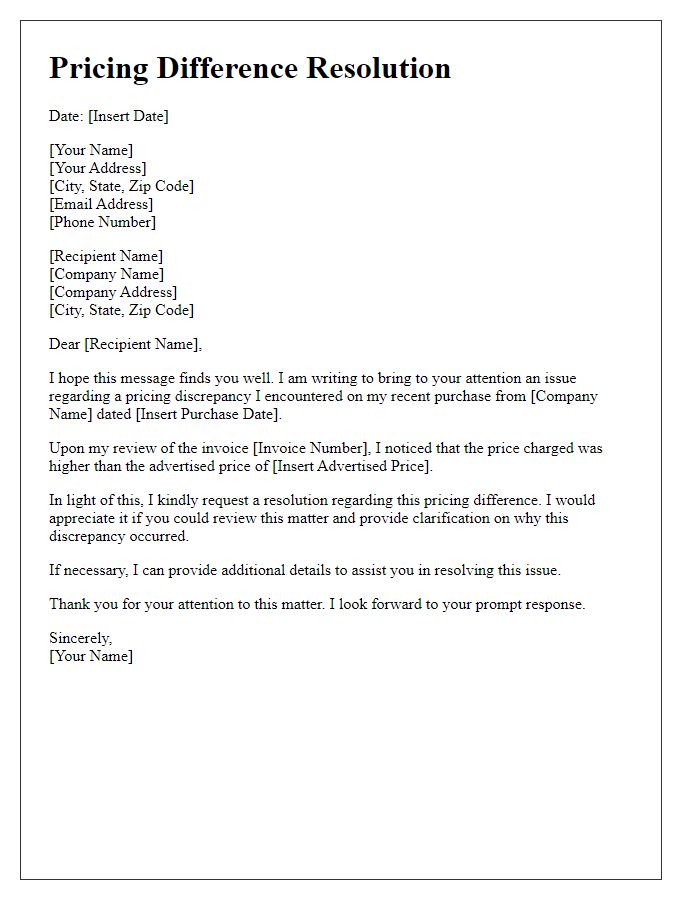

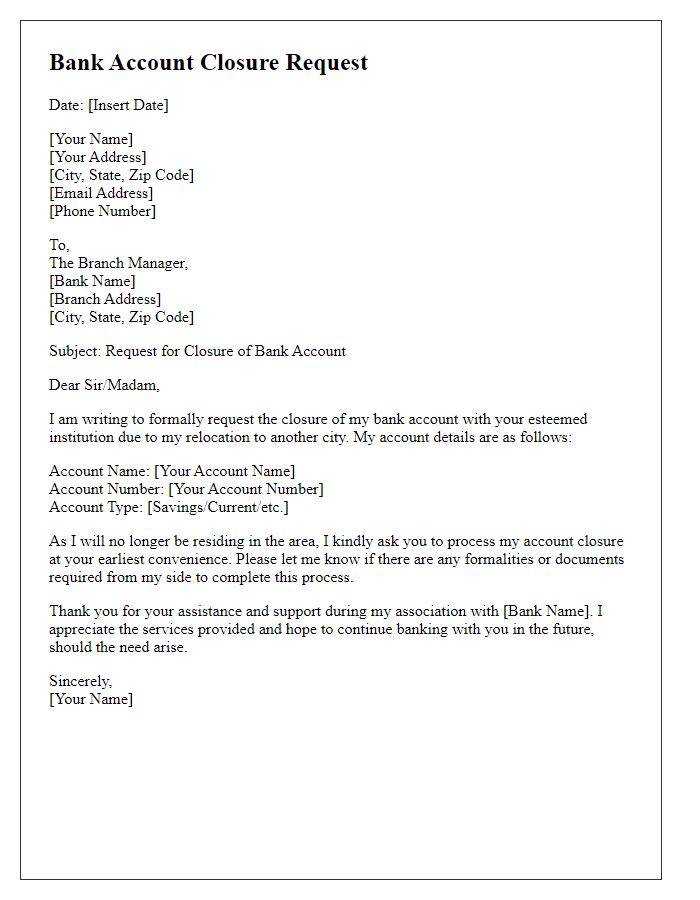

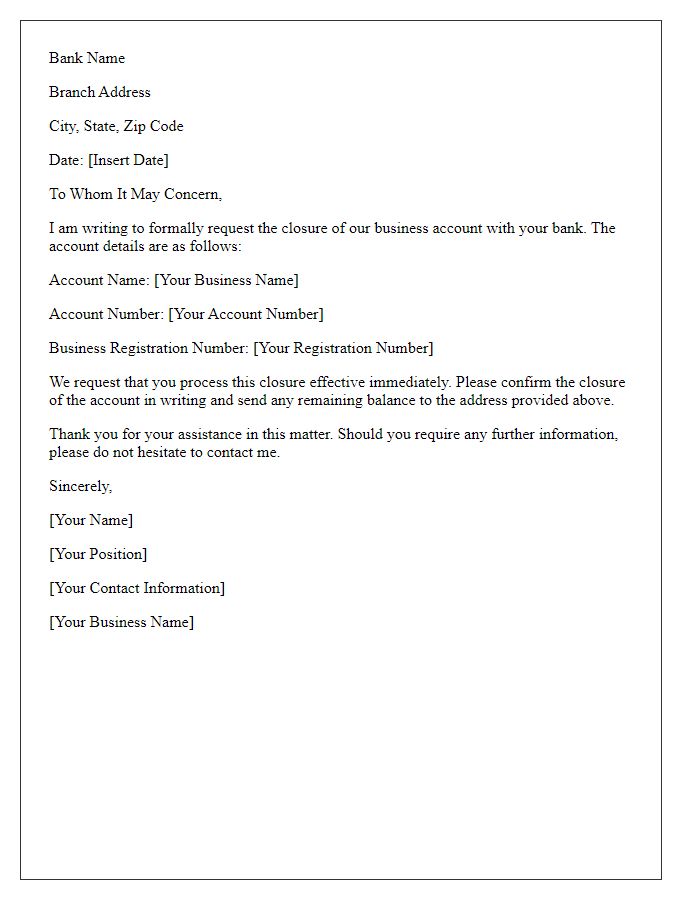

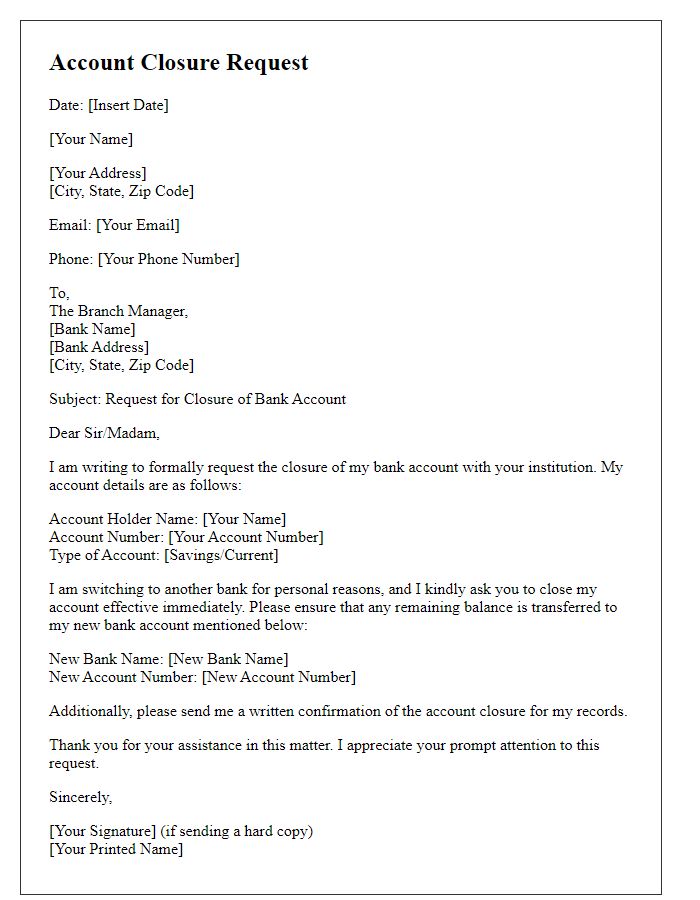

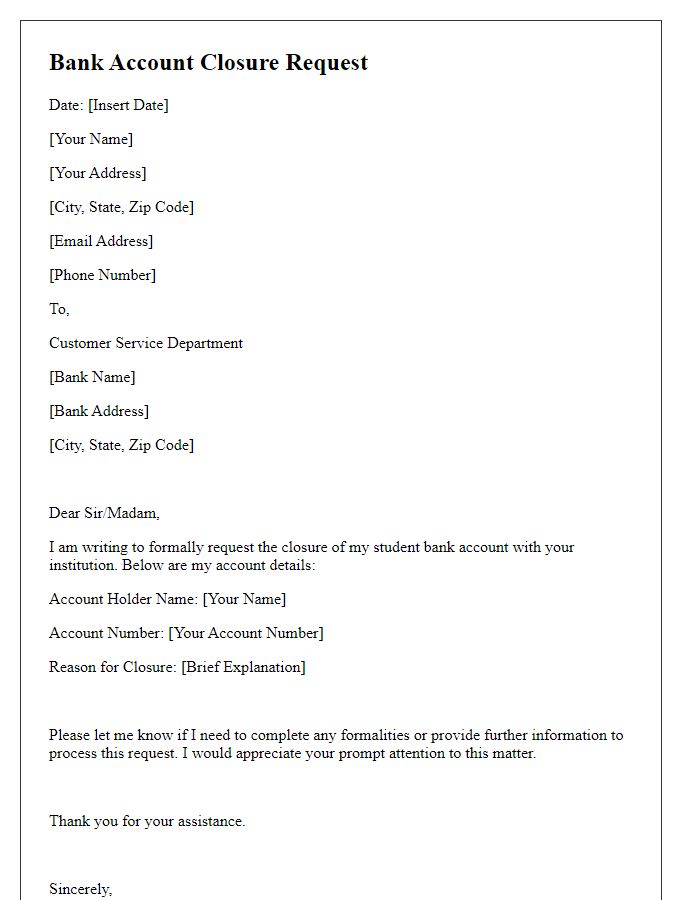

Letter Template For Bank Account Closure Request Samples

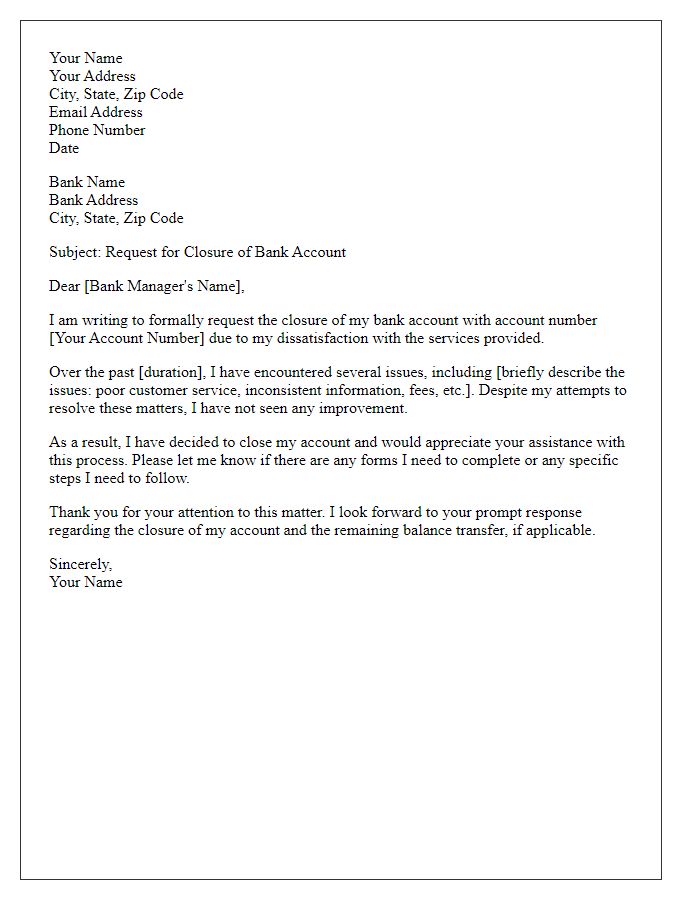

Letter template of bank account closure request for dissatisfaction with services.

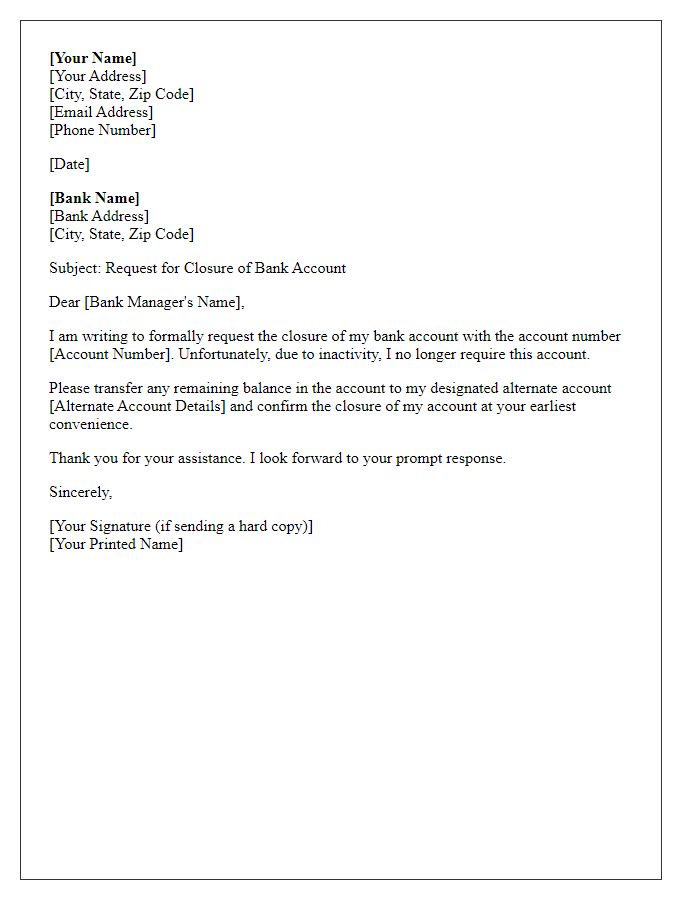

Letter template of bank account closure request after account inactivity.

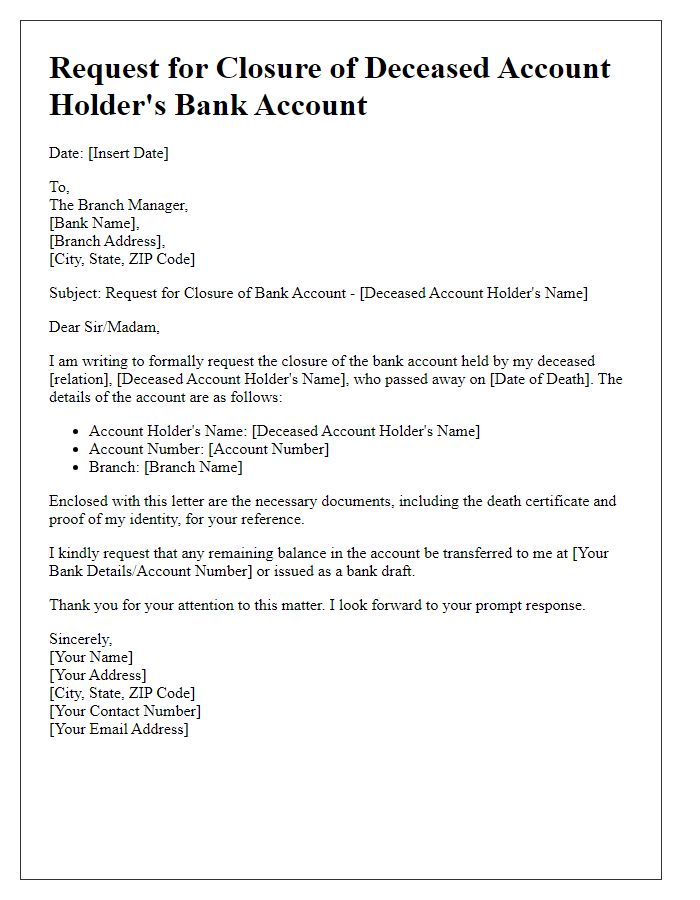

Letter template of bank account closure request from a deceased account holder.

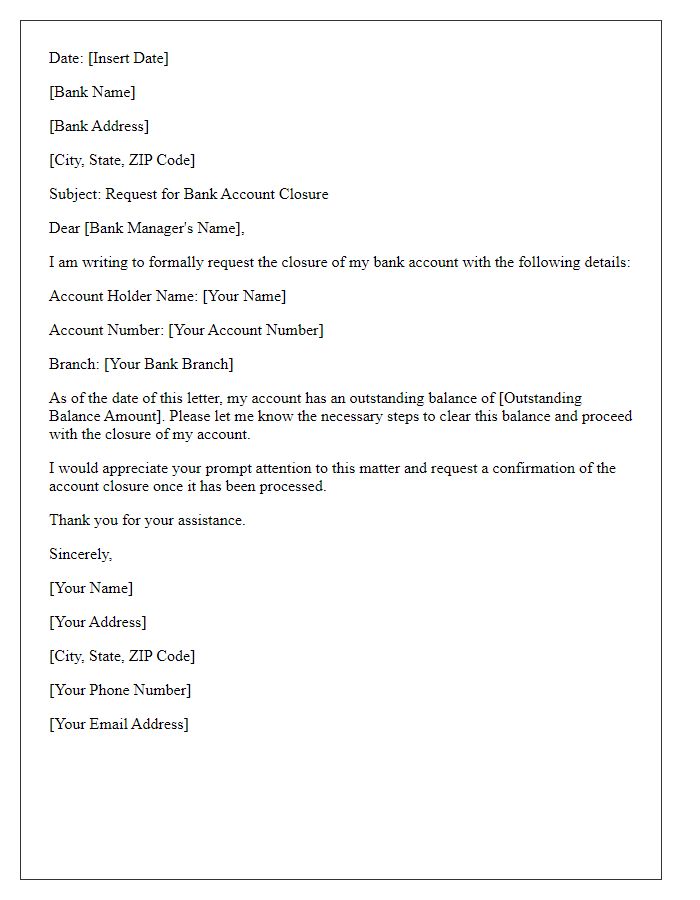

Letter template of bank account closure request accompanied by outstanding balance.

Comments