Are you looking to make your money work harder for you? Our new savings scheme is designed to help you achieve your financial goals with attractive interest rates and flexible terms. Whether you're saving for a rainy day, a dream vacation, or your future home, we have options tailored just for you. Join us as we explore the benefits of this exciting opportunity and discover how you can maximize your savingsâread on to learn more!

Key benefits and features

Introducing a new savings scheme designed to enhance your financial security and growth, featuring competitive interest rates up to 4.5% annually for deposits. Flexible deposit terms ranging from 6 months to 5 years cater to a variety of financial goals. Monthly compounding ensures that your earnings grow faster in comparison to traditional savings accounts. Additional benefits include no maintenance fees, allowing for uninterrupted savings accumulation. A minimum initial deposit of just $100 makes it accessible for all individuals, promoting better financial habits. Furthermore, the scheme is backed by robust insurance up to $250,000 provided by the Federal Deposit Insurance Corporation (FDIC), ensuring peace of mind with your savings investment.

Eligibility and participation criteria

The new savings scheme, named the "Smart Saver Initiative," targets individuals aged 18 and above, residing in urban and rural areas across the United States. Eligibility requires participants to have a valid Social Security Number and an active bank account. Applicants must demonstrate a minimum monthly income of $1,500, ensuring financial capability to engage consistently in the scheme. Participation involves committing to a minimum deposit of $200 monthly over a specified period of 12 months. Furthermore, participants will gain access to personalized financial planning sessions, enhancing their savings strategies and overall financial literacy. This initiative aims to encourage better financial habits and empower individuals to achieve their savings goals efficiently.

Schedule and timings

A new savings scheme will be launched at Community Bank, accessible to local residents beginning April 1, 2024. The scheme will offer a competitive interest rate of 4% annually, allowing individuals to secure their financial future through disciplined savings. Enrollment will take place at the bank's main branch located at 123 Main Street during business hours, from 9 AM to 5 PM, Monday through Friday, with extended hours on Saturdays from 10 AM to 2 PM. Information sessions will be scheduled every Wednesday at 6 PM in the bank's community room to explain the benefits and features of the savings scheme, helping participants understand how to maximize their savings effectively.

Terms and conditions

The newly launched savings scheme presents attractive features designed to enhance financial stability, including interest rates of up to 5% per annum (as of October 2023) for participating members. Minimum deposits required are $500 (USD) to initiate the account, while the maximum limit stands at $50,000 (USD) for individual accounts. Members can withdraw funds quarterly, adhering to a 30-day notice period to avoid penalties. The scheme is governed by regulatory guidelines established by the Federal Deposit Insurance Corporation (FDIC), ensuring account security up to $250,000 (USD). Additional benefits, such as online banking access, allow seamless management of accounts from anywhere, including comprehensive customer support during business hours. Terms and conditions are subject to periodic review and members will be notified of any changes via email or physical mail as needed.

Contact information for inquiries

The recent launch of the new savings scheme, known as "Future Builder," offers an interest rate of 5% annually, allowing individuals to grow their savings steadily. This scheme, initiated by the National Bank of Finance, aims to promote financial literacy and encourage long-term investment among citizens. Participants can enroll online through the official bank website or visit one of the 150 local branches available nationwide. For further inquiries, customers may reach out to the dedicated customer service team at the hotline number, 1-800-555-0199, operational from 8 AM to 8 PM. This initiative represents a significant step towards empowering individuals to secure their financial future, fostering a culture of saving and investment across communities.

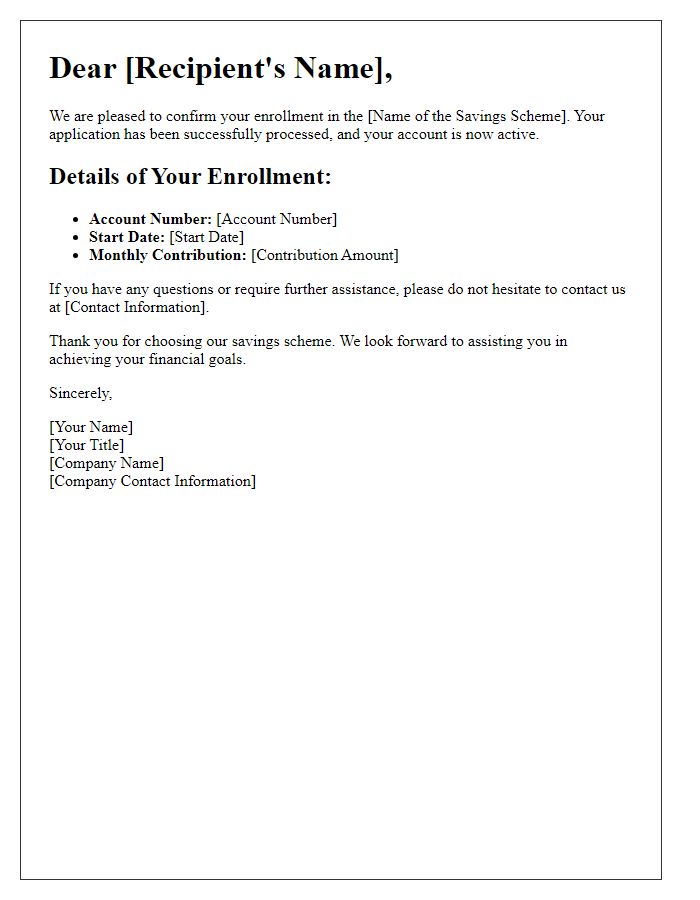

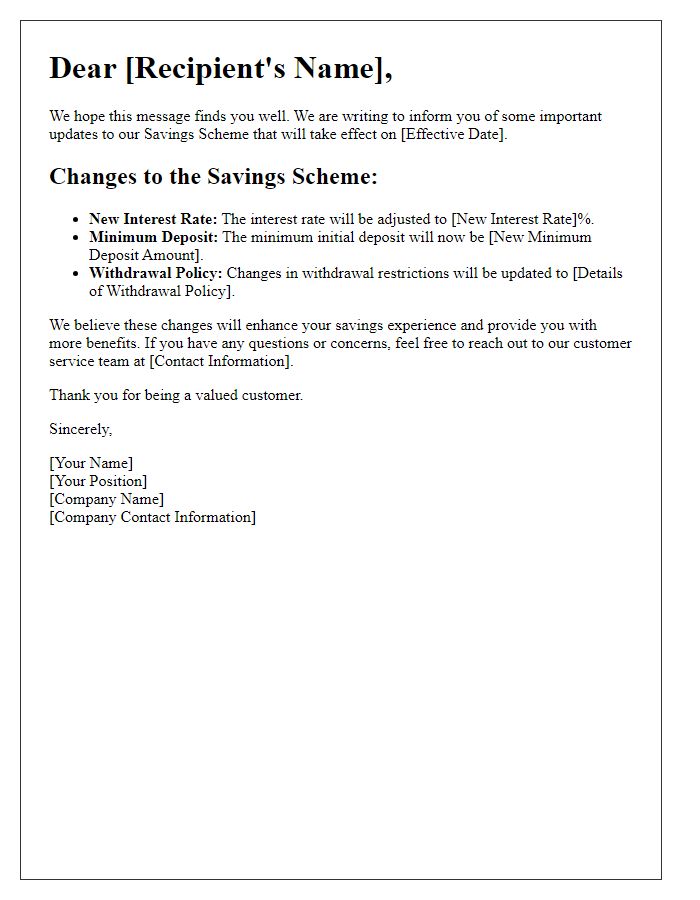

Letter Template For Savings Scheme Announcement Samples

Letter template of exclusive savings scheme invitation for existing clients

Comments