Are you navigating the often confusing world of health insurance claims? Submitting your claim forms can feel like a daunting task, but it doesn't have to be. In this article, we'll break down the essential steps and provide you with a helpful letter template to streamline the process. Ready to simplify your health insurance claims? Let's dive in!

Personal Identification Information

Submitting health insurance claim forms requires accurate personal identification information to ensure proper processing and reimbursement. Essential details include full name, typically formatted as first name, middle initial, and last name. Date of birth, usually presented in the format of month, day, and year, needs to be clearly listed for verification purposes. Social Security Number (SSN), a unique identifier issued by the Social Security Administration, must be included to facilitate claims processing. Policy number assigned by the insurance provider, which acts as a reference for the specific coverage plan, should also be noted. In addition, including contact information such as current address, phone number, and email enhances communication with the insurance company. Accurate personal identification information is crucial for timely claim approval and reimbursement.

Policy Number and Insurance Details

When submitting health insurance claim forms, it is essential to include accurate policy numbers along with comprehensive insurance details. The policy number, a unique identifier for each subscriber, typically consists of alphanumeric characters that confirm coverage. Insurance details should encompass provider information such as the insurer's name, contact number, and specific terms of the policy including coverage limits and deductibles. Including claimant information, like the insured's name, date of birth, and any related medical event dates further streamlines processing. Proper documentation, including itemized bills from healthcare providers, enhances the clarity of the submitted claim. Prompt submission of these forms--often within 30 days of receiving medical services--ensures adherence to claim timelines stipulated by insurers, helping expedite reimbursement.

Description of Services and Dates

Submitting health insurance claim forms requires detailed documentation of services and dates. It is essential to include specific treatment types, such as physical therapy sessions or surgical procedures, along with the exact dates these services were provided. For instance, a patient who underwent knee surgery on April 15, 2023, must document this service accurately. Additionally, including the healthcare provider's information, such as the name of the hospital (e.g., St. Mary's Medical Center) and provider's National Provider Identifier (NPI) number, enhances the claim's validity. Properly itemizing services received, like lab tests or consultations, can streamline the reimbursement process. Accurate documentation prevents delays, ensuring timely responses from the health insurance company.

Itemized Bills and Receipts

Submitting health insurance claim forms requires careful organization of itemized bills and receipts to ensure timely reimbursement. Itemized bills, detailing medical services, can originate from hospitals or clinics, showcasing dates and charges for consultations, treatments, and diagnostic procedures. Receipts, often issued by pharmacies or healthcare providers, typically include prescription medications and over-the-counter drugs purchased, each accompanied by individual costs. The claim submission may need to reference specific policy numbers from health insurance providers such as Blue Cross Blue Shield or UnitedHealthcare, facilitating the approval process. Accurate documentation, including the date of service and total expenses, is vital to avoid delays in reimbursement, often taking 30 days for processing. Each piece of information enhances the clarity of the claim, promoting a smoother interaction with the insurance bureaucracy.

Doctor's Report and Medical Records

Submitting health insurance claim forms requires accurate documentation and attention to detail. The doctor's report, essential for validating your medical treatment, should include specific diagnoses, dates of service, and detailed treatment notes. Medical records, which may consist of lab results, imaging studies, and notes from follow-up visits, play a critical role in providing comprehensive evidence to support the claim. Insurance policies often have stipulated timeframes for submission, typically within 30 days of treatment, to ensure timely processing. Including contact information and policy numbers on the claim forms is crucial to avoid delays. Incomplete documentation can result in claim denials, so thoroughness is vital to facilitate a smooth reimbursement process.

Letter Template For Submitting Health Insurance Claim Forms Samples

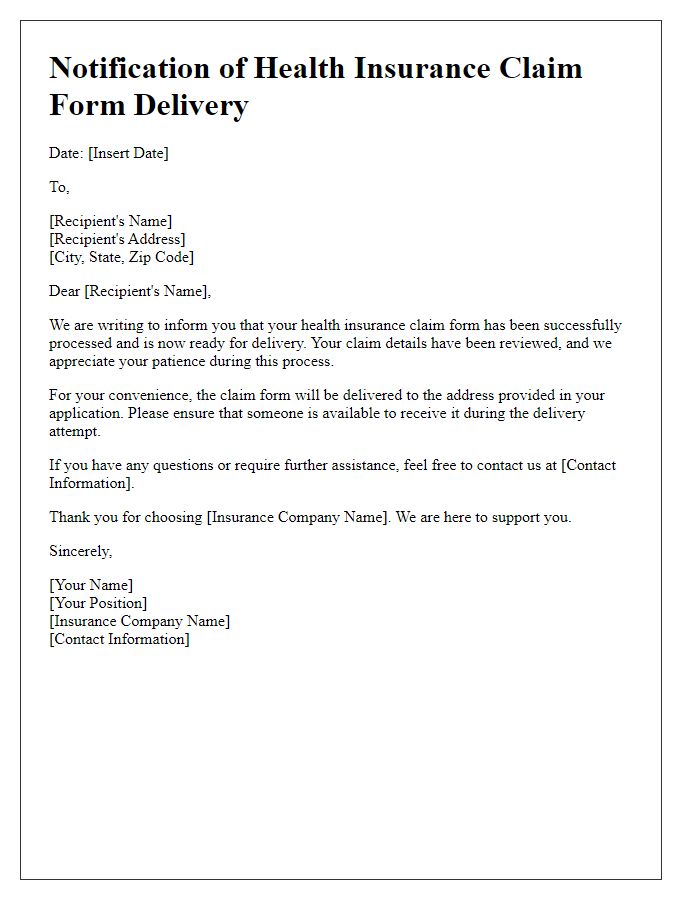

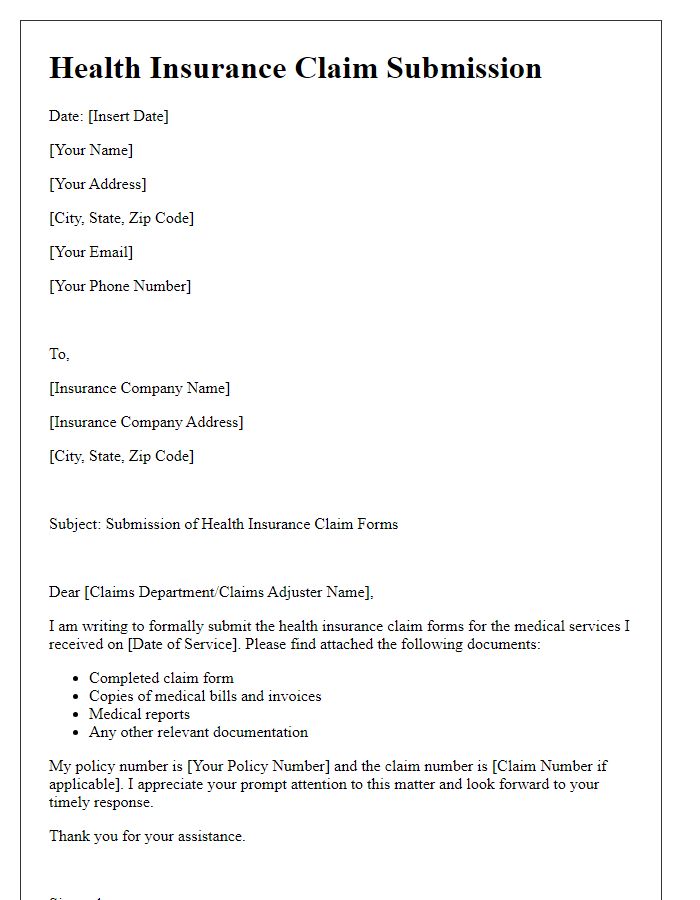

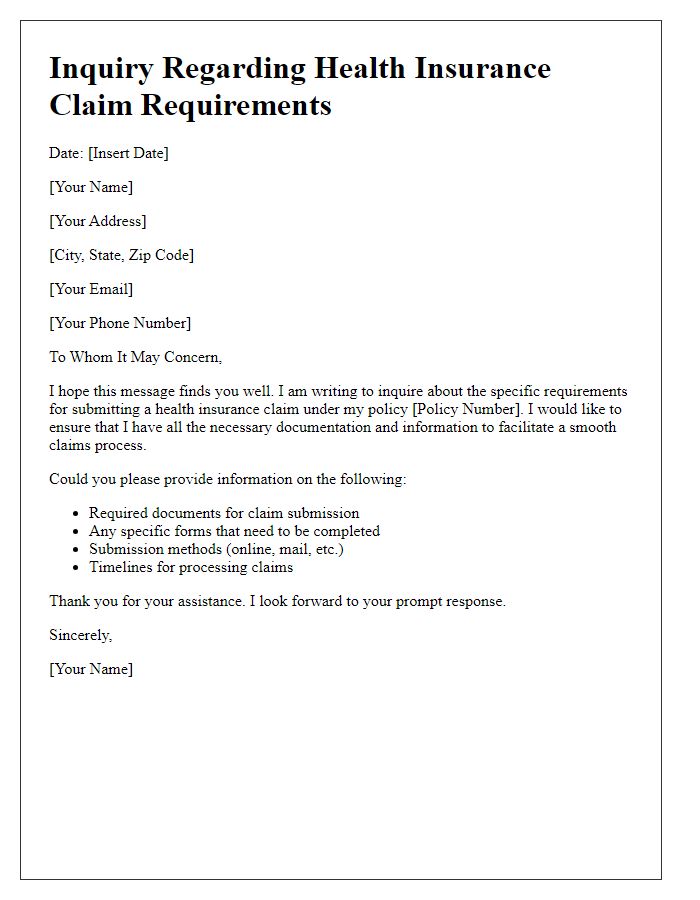

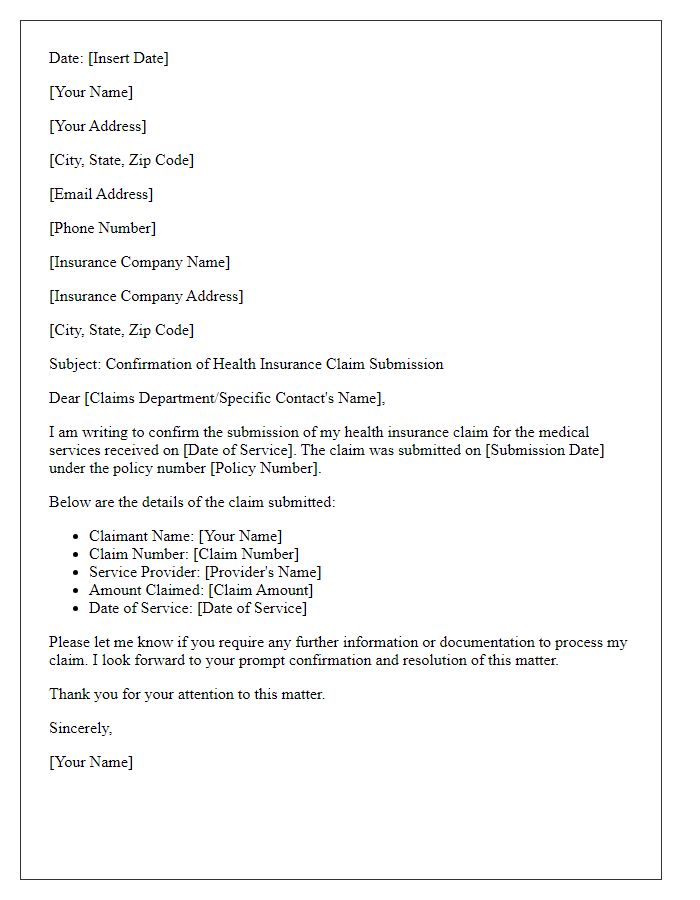

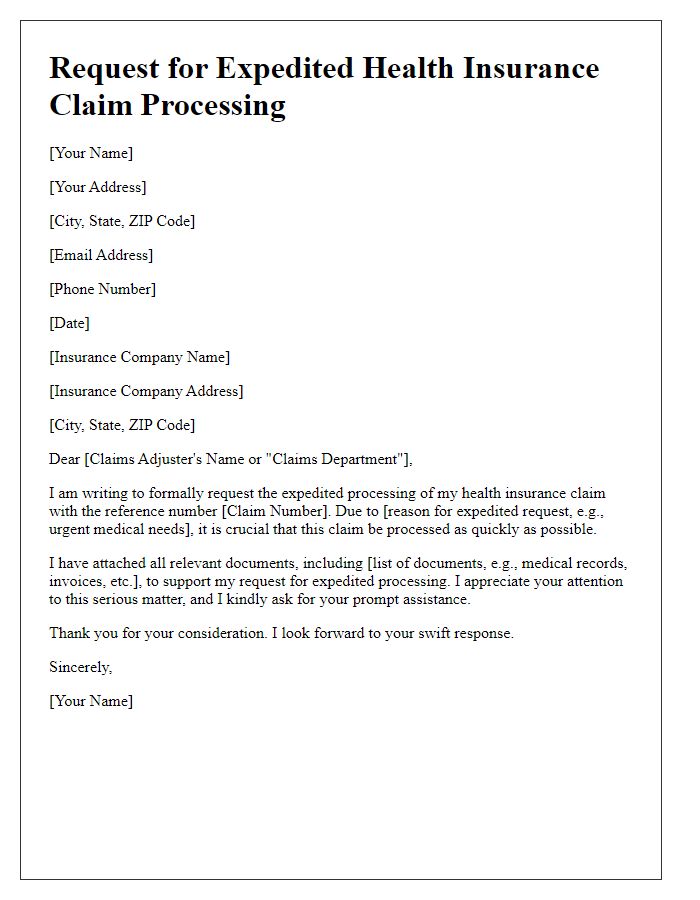

Letter template of notification for health insurance claim form delivery.

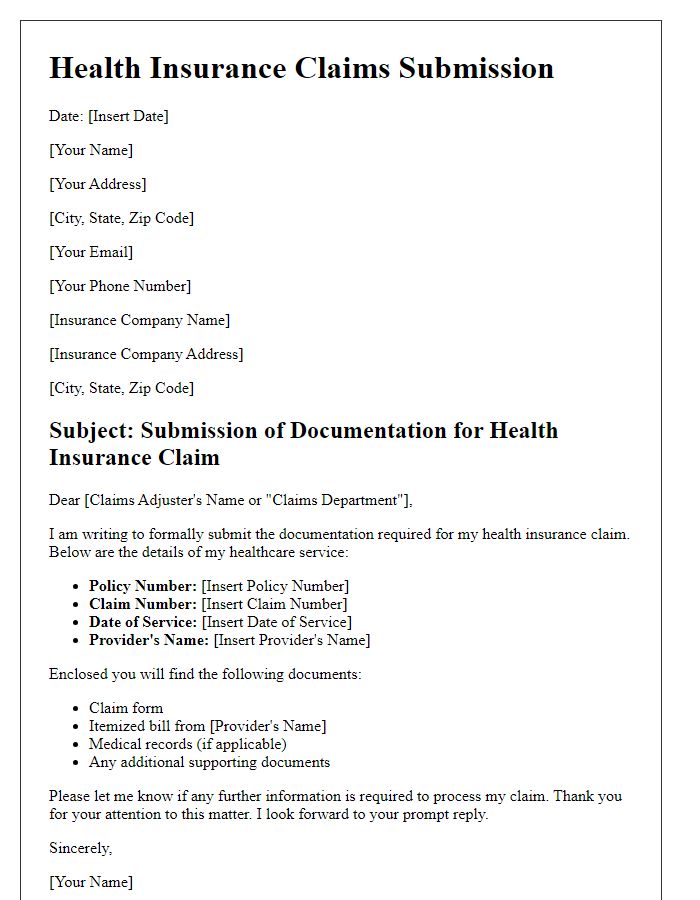

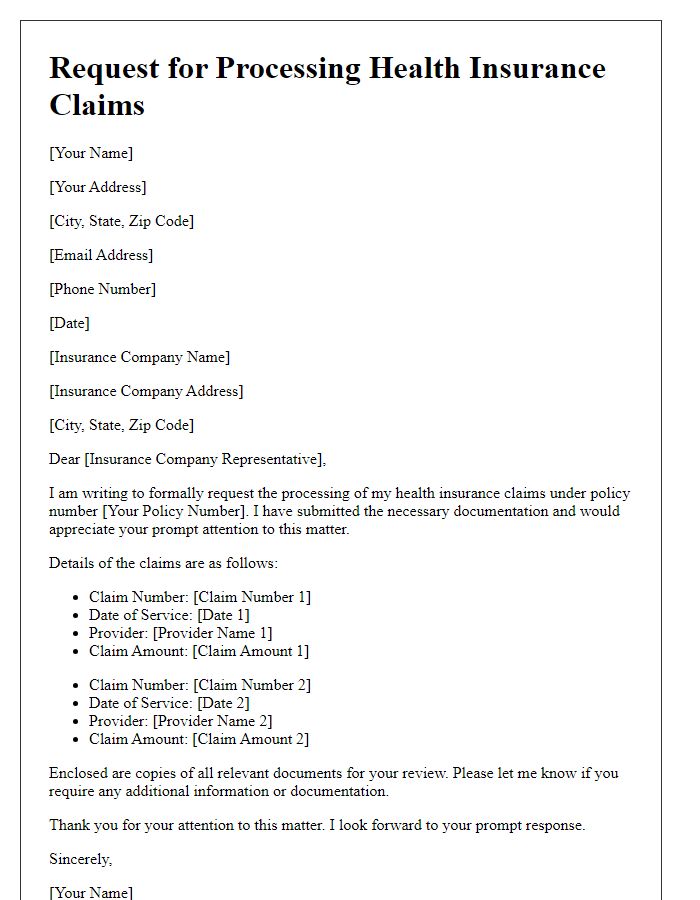

Letter template of documentation submission for health insurance claims.

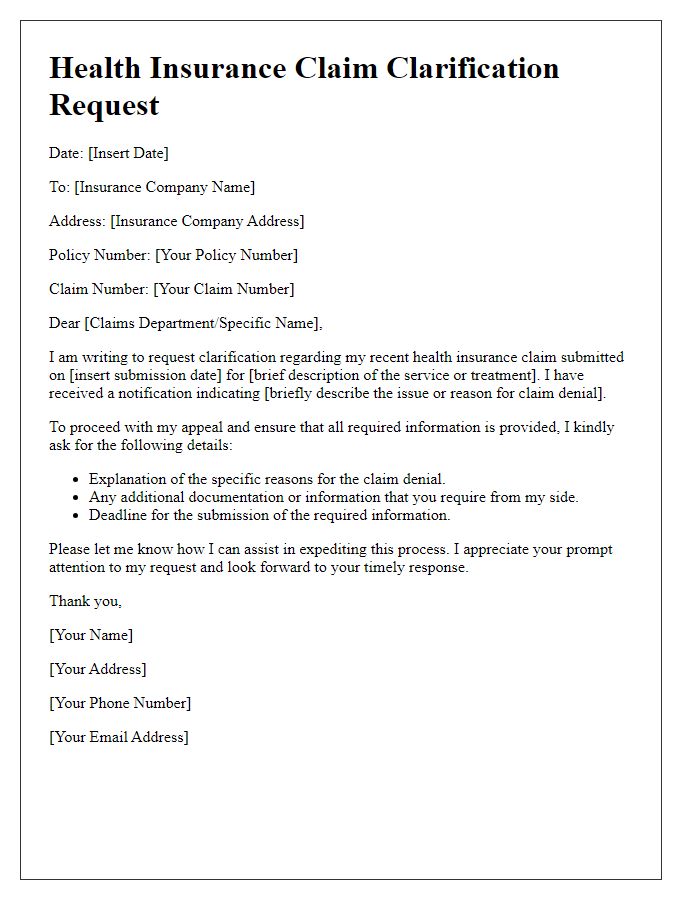

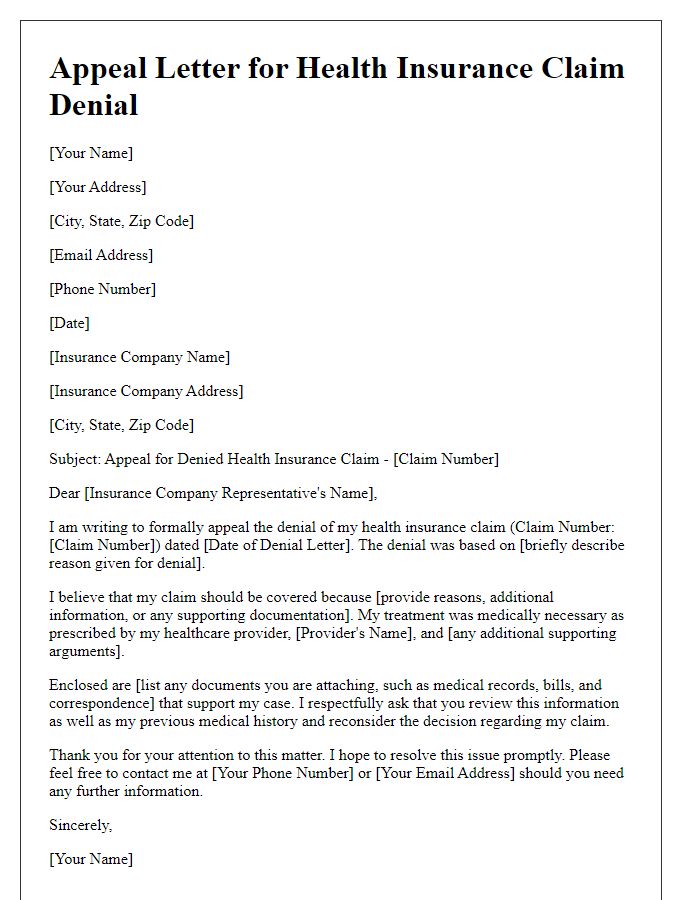

Letter template of details needed for health insurance claim clarification.

Comments