Are you feeling puzzled by unexpected charges on your latest bill? You're not aloneâbilling discrepancies can often leave us scratching our heads and wondering where things went awry. In this article, we'll guide you through writing an effective letter to clarify any confusing charges and ensure your concerns are addressed promptly. So, let's dive in and empower you to get the clarity you deserve!

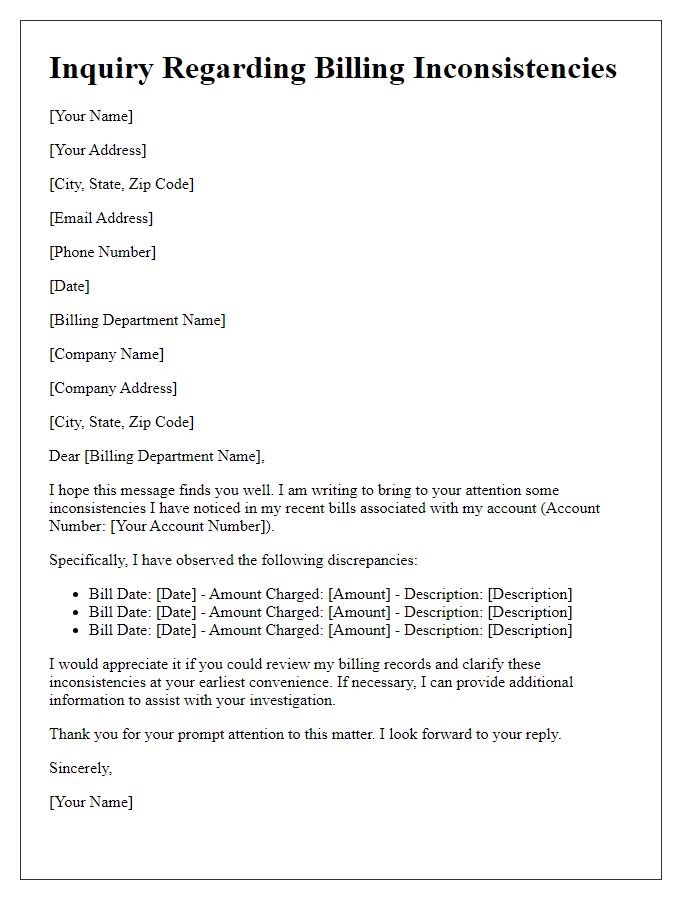

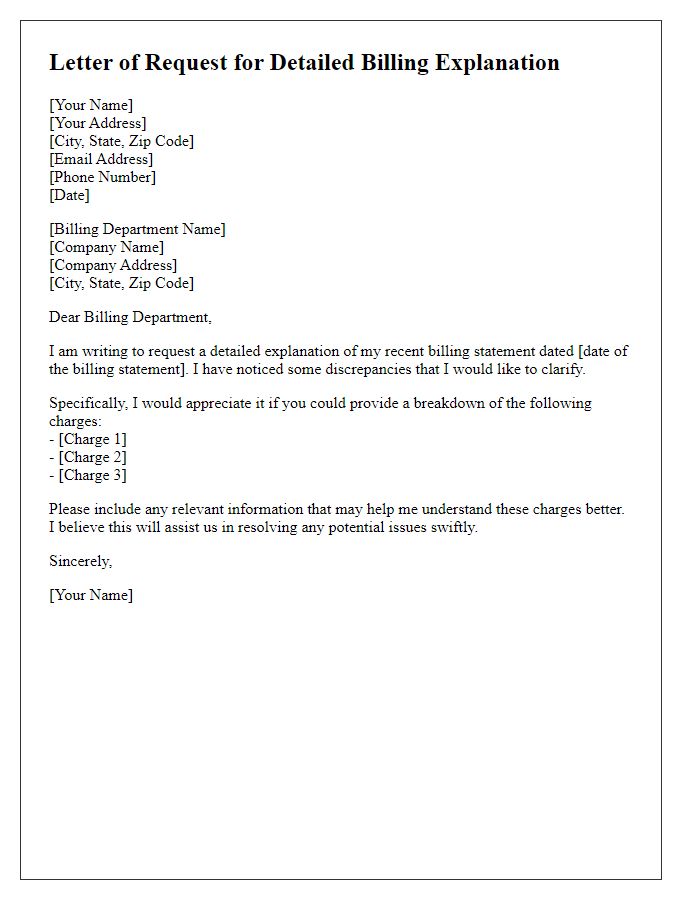

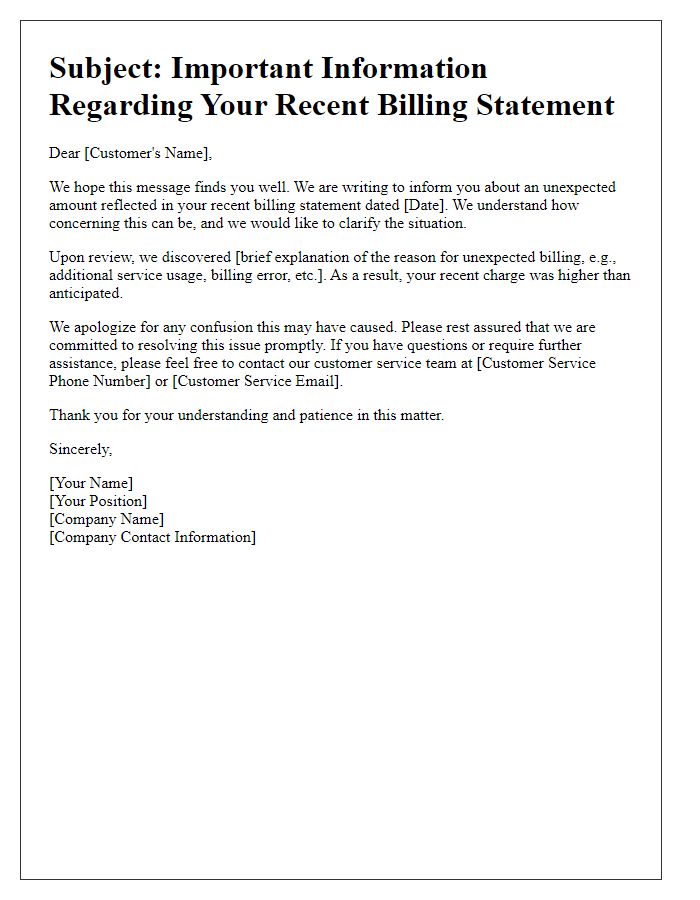

Clear subject line

Billing discrepancies can arise in monthly statements, especially in utility services like electricity or water. A clear breakdown of charges can reveal inconsistencies, such as higher-than-expected usage or errors in billing cycles. For instance, a customer might receive a $150 bill instead of the anticipated $100 due to an unaccounted increase in usage or a miscalculation in rates. Details from previous months' bills, such as meter readings or rate changes, can aid in identifying the source of the discrepancy. Contacting customer service promptly ensures timely resolution, often referencing account numbers or service addresses for efficient communication.

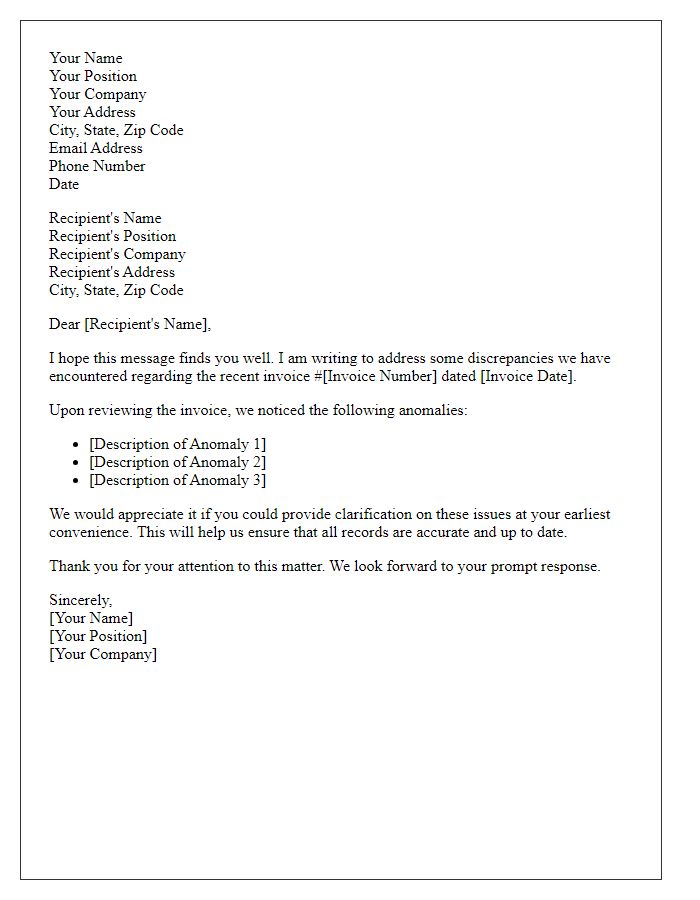

Detailed description of discrepancy

Billing discrepancies frequently arise in various payment statements, particularly in financial services like insurance or utilities, resulting in confusion among customers. Common issues include incorrect charges, such as unexpected fees or duplicate billing, which can total hundreds of dollars. For example, discrepancies may occur due to human error in data entry or system malfunctions dating back to the previous month's bill. These billing errors can lead to misunderstandings about service usage or subscription details for products and services, like cell phone plans or internet packages. Accurate billing is critical for maintaining trust with customers and ensuring satisfactory service continues in locations such as local offices and call centers. Prompt clarification of these discrepancies is essential for resolution and customer satisfaction.

Billing reference numbers

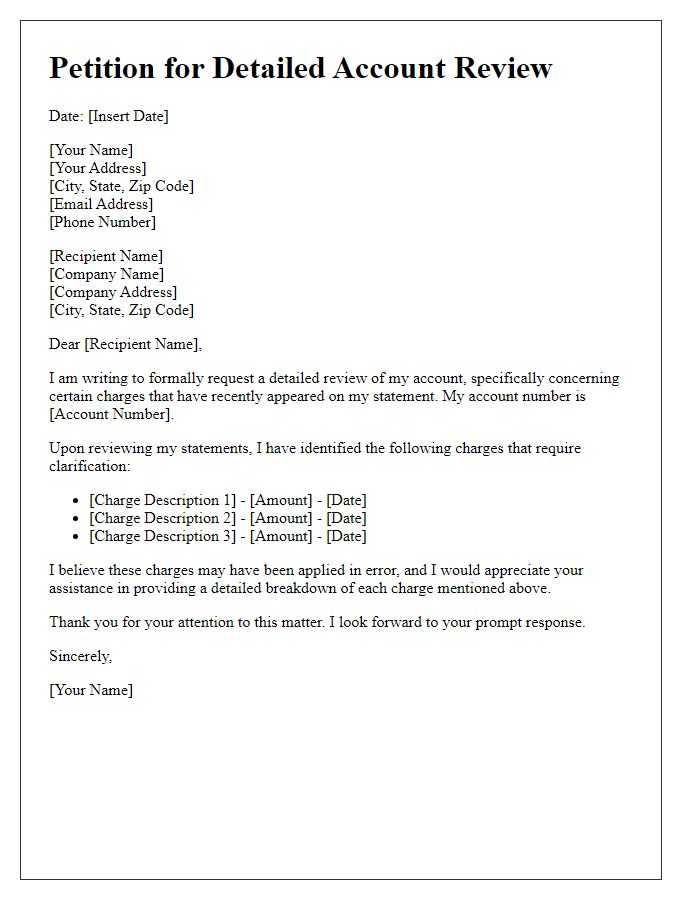

Billing discrepancies can arise in various services and products, often reflected in the paperwork sent by companies. Billing reference numbers serve as crucial identifiers for tracking specific transactions associated with a customer's account. Instances of inaccuracies can lead to confusion, resulting in the need for clarification on amounts due, payment dates, or even the services rendered. Such discrepancies might also involve examining charges for specific items or services, like late fees or promotional discounts which should have adjusted the overall balance. Accurate resolution often requires detailed documentation, including when the charges occurred and whom to contact for further assistance. In busy firms, addressing discrepancies promptly is vital to maintaining customer satisfaction and trust.

Request for specific clarification

Billing discrepancies can cause confusion and frustration, especially when unexpected charges appear on invoices. A detailed review of the account statements from January to March 2023 revealed inconsistencies in the charges for services rendered at [Service Provider Name], located in [City Name]. Specifically, charges for [Service Type] dated [Specific Date] amounted to [Specific Amount], which does not align with the agreed contract terms outlined in the service agreement dated [Contract Date]. Additionally, perceived duplicate charges for [Service Type or Item] on [Specific Date] require immediate clarification. Addressing these issues promptly is essential to maintain transparency and ensure accurate financial records.

Polite closing and contact information

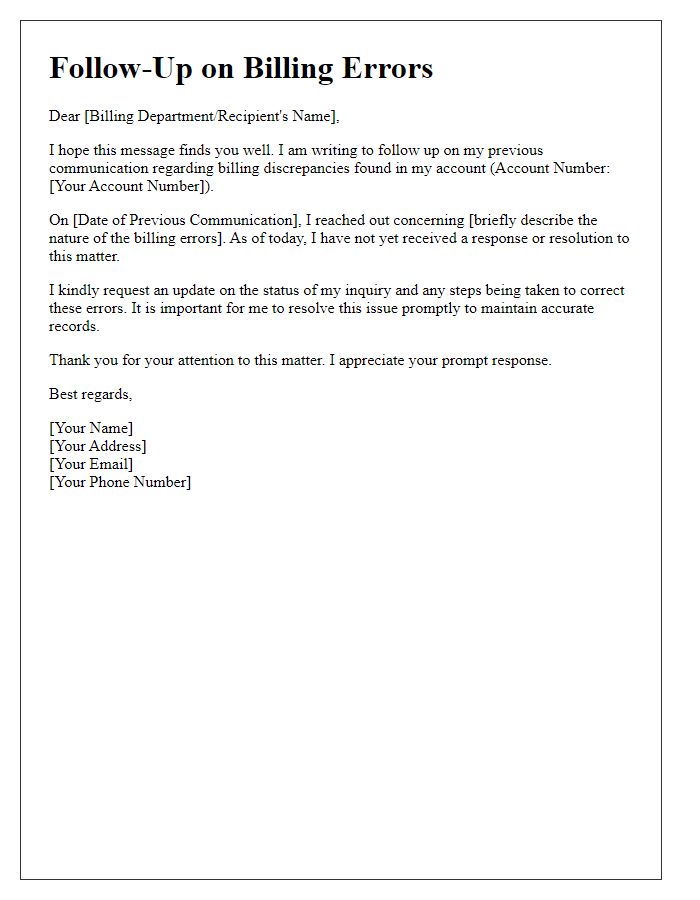

Billing discrepancies can lead to confusion in financial statements, especially in monthly invoices from service providers like telecommunications companies or utility services. Common issues include unexplained charges, duplicate billing for the same period, or incorrect amounts charged, which may vary greatly, sometimes exceeding expectations by 30% or more. Such inconsistencies can undermine trust and complicate personal budgeting. Engaging customer service representatives can often resolve these issues; however, it is essential to have detailed records, including dates of previous payments and reference numbers, to facilitate a swift resolution. Customers should also note the importance of following up in writing for a clearer audit trail.

Comments