Are you feeling overwhelmed by unexpected out-of-network service charges? You're not aloneâmany individuals find themselves in a complicated landscape of medical billing and insurance nuances. Navigating these charges can be daunting, but understanding your rights and options is key to contesting them effectively. Ready to learn how to challenge those charges and potentially save yourself some money? Let's dive deeper into the steps you can take!

Contact Information

Out-of-network service charges often result in unexpected financial burdens for patients seeking medical care. Patients may face significant fees if services from non-participating providers are used, which can reach thousands of dollars. This typically occurs in emergency situations where individuals have limited options or in specialized care facilities that do not accept the patient's insurance plan. Some insurance providers may offer partial reimbursements, but patients are often left grappling with the high out-of-pocket costs and complicated billing processes. Maintaining transparency in coverage options and understanding provider networks is crucial for patients to avoid such financial pitfalls.

Service Details

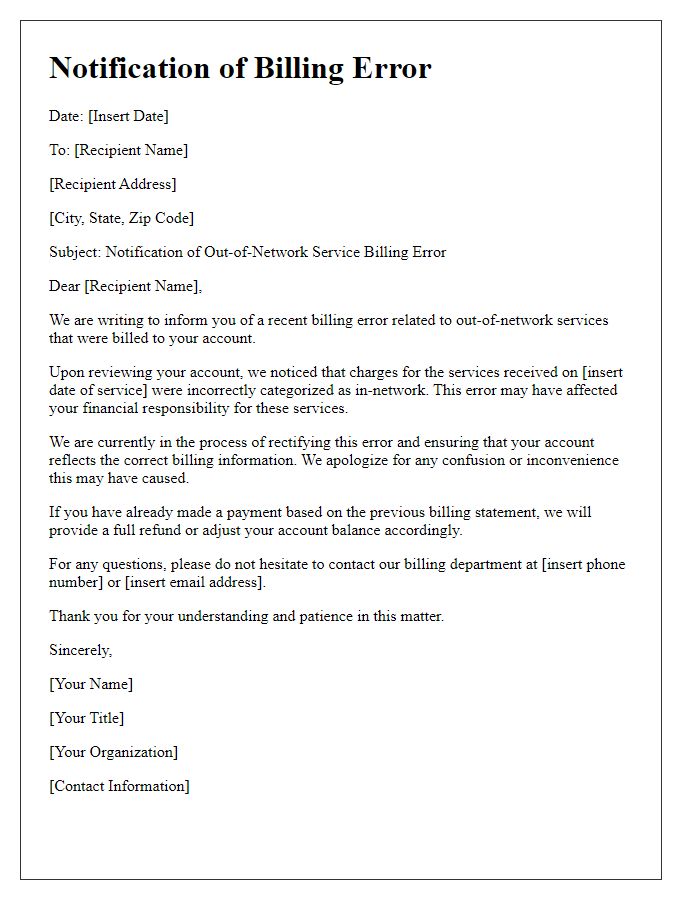

Contesting out-of-network service charges can involve several critical components. The date of service (specific day/month/year) is necessary to verify the instance in question, and the service provider's name (such as a healthcare facility or specialist) must be clearly identified. Details regarding the out-of-network status of the provider (e.g., not listed under the patient's insurance plan) are essential for context. Charging amounts (e.g., $250 for evaluation, $150 for consultations) should be included, along with an explanation for why these charges were unexpected, such as having followed in-network recommendations. Reference the policy number for the insurance plan and patient identification details, which might include a member ID, to streamline the resolution process. Clear articulation of instances of miscommunication or lack of adequate prior notification could support the argument against the service charges.

Explanation of Dispute

Out-of-network service charges can lead to unexpected financial burdens for patients receiving medical care. For example, a recent incident involved a patient whose emergency treatment in a facility located in Seattle, Washington resulted in a bill exceeding $5,000 due to out-of-network status of the provider. Insurance plans often fail to adequately inform patients about potential out-of-network charges, leading to confusion and frustration. Moreover, patients may not have a choice regarding facility or provider, especially in emergency situations, which complicates accountability for the financial implications of such care. Documentation from insurance providers indicates the facility was not verified as in-network, further exacerbating the dispute over the legality and fairness of these charges. It is essential to review the specifics of coverage, including any applicable exceptions that address patient rights in emergency medical situations.

Supporting Documentation

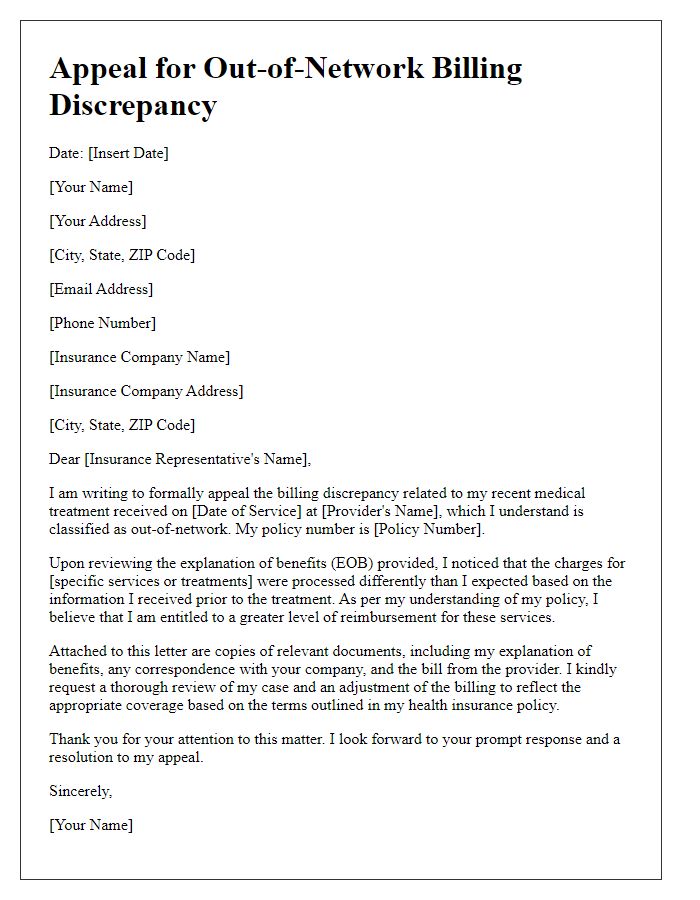

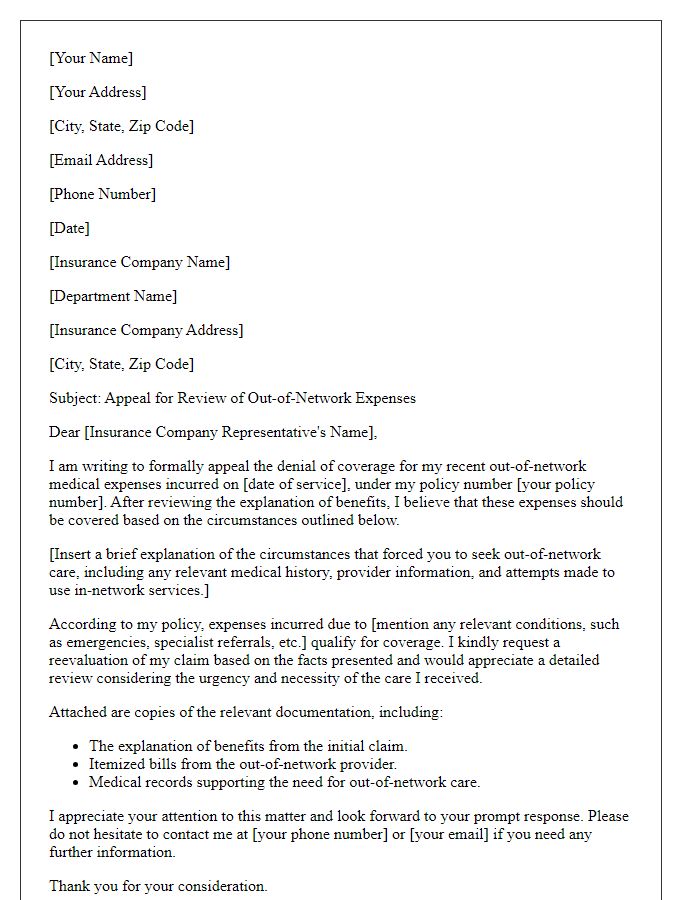

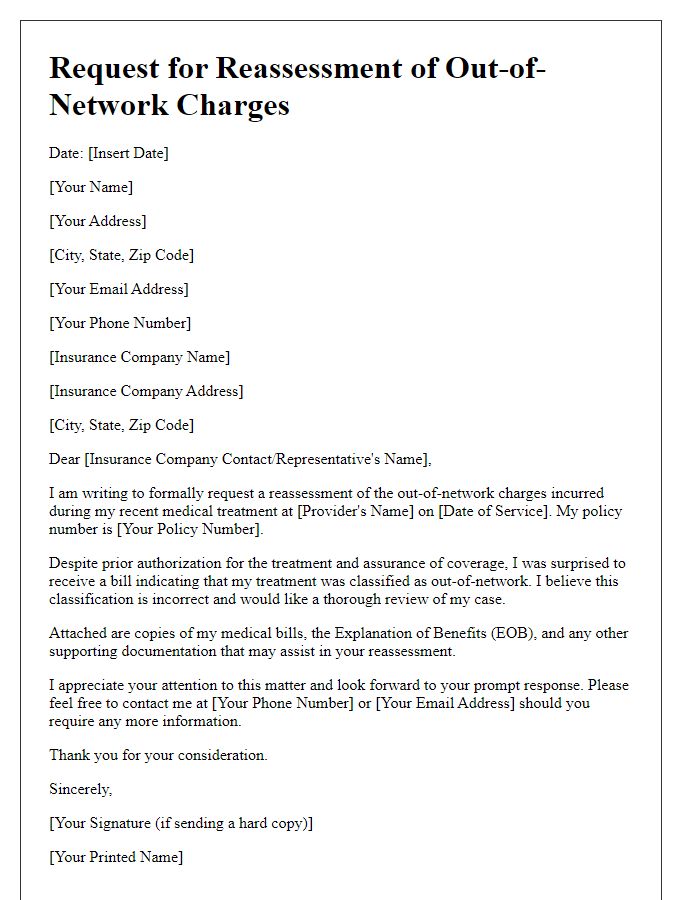

Out-of-network service charges frequently result from medical encounters with providers outside an individual's insurance network, often leading to unexpected financial burdens. Charges may stem from emergency services received at non-network hospitals or specialist consultations without prior authorization, potentially costing patients hundreds or thousands of dollars. Supporting documentation is crucial in contesting these charges, with evidence including itemized bills detailing services rendered, Explanation of Benefits (EOB) statements from insurance providers illustrating payment amounts, as well as records of prior authorizations that clarify coverage terms. Additionally, appealing letters should emphasize network inadequacies, detailing how the lack of available in-network providers led to the need for out-of-network care. Notably, state regulations regarding surprise billing can further strengthen arguments for reduced charges, reflecting consumer protection efforts in healthcare.

Requested Resolution

Out-of-network service charges can significantly impact financial planning, especially for individuals seeking medical services from providers outside their insurance network. Such charges (ranging from 20% to 80% of total costs depending on the procedure) can lead to unexpected bills that create additional stress. Various healthcare institutions, like hospitals or specialized clinics, may have different out-of-network rates affecting the overall expenditure. Patients often find themselves navigating complex billing systems, with insurers disputing certain expenses based on their coverage policies. Adequate documentation of services rendered, as well as clear communication with both the provider and insurance company, is crucial for contesting these charges effectively.

Letter Template For Contesting Out-Of-Network Service Charges Samples

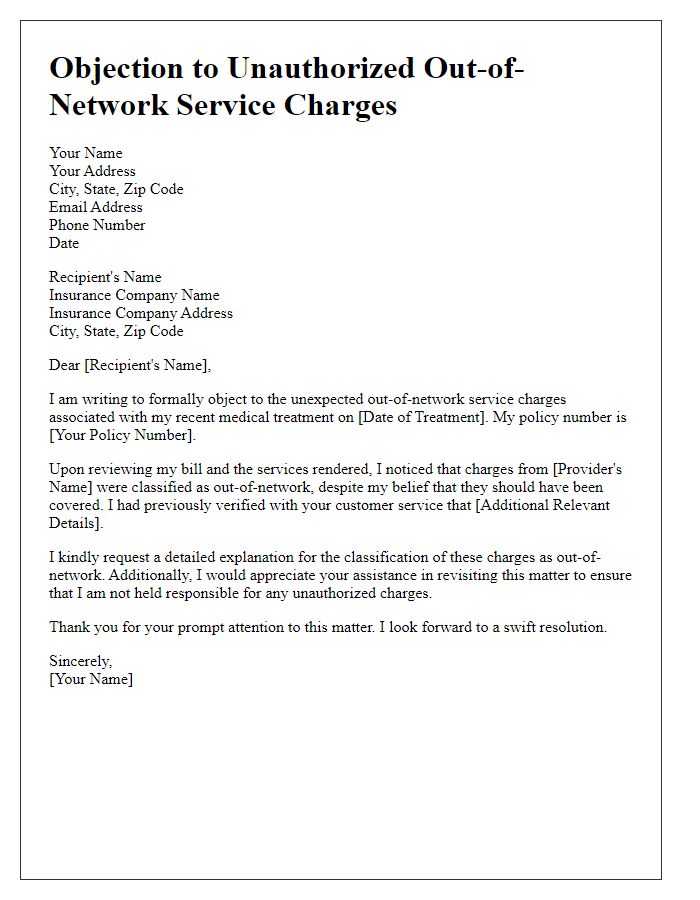

Letter template of objection to unauthorized out-of-network service charges

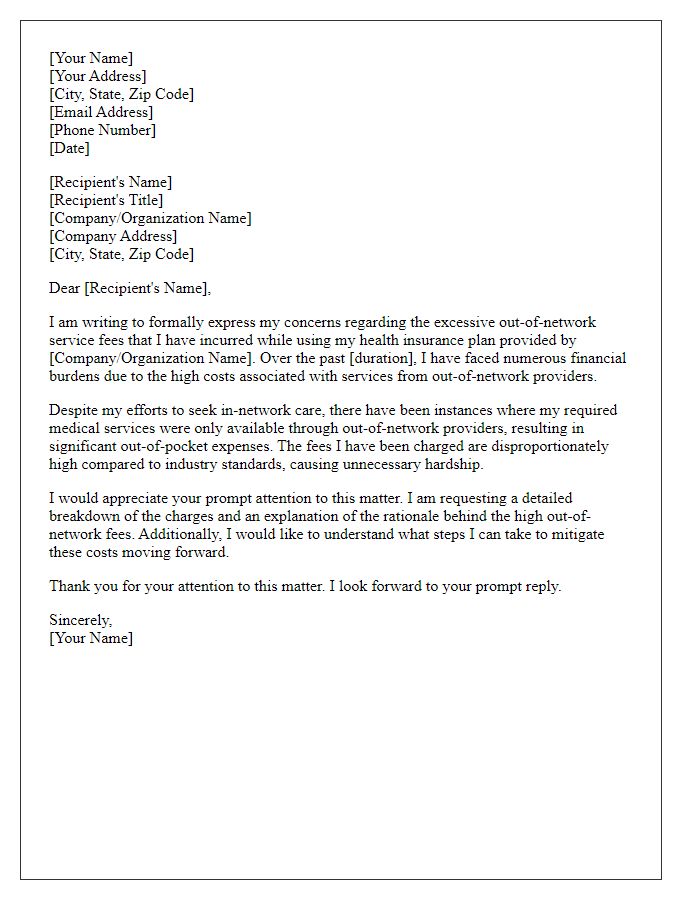

Letter template of formal complaint about excessive out-of-network service fees

Comments