Have you ever faced the frustration of having your health insurance claim denied? It can feel overwhelming, especially when you're in need of medical care and help. However, understanding how to contest these denials can pave the way for getting the coverage you deserve. In this article, we'll explore effective strategies and provide a comprehensive letter template to guide you through the processâso keep reading to take charge of your health insurance journey!

Policyholder Information

Policyholders who face denial of health insurance claims often feel a sense of frustration and confusion. Insurance policies, such as PPO (Preferred Provider Organization) or HMO (Health Maintenance Organization), typically detail coverage limits and exclusions, which often leads to misunderstandings regarding the scope of benefits. For instance, a claim for an MRI at a facility in Los Angeles might be denied if it's deemed out-of-network, leading to potential out-of-pocket costs. Gathering necessary documents like medical records, bills, and the initial denial letter from the insurer is crucial for contesting the decision. Nearby regulations in California, influenced by the Affordable Care Act, emphasize the importance of comprehensive coverage, making it essential to highlight any violations during the appeal process. Engaging with an experienced advocate can also provide valuable insights for navigating such disputes effectively.

Denial Details

Health insurance denial can disrupt access to necessary medical treatments and medications. Common reasons for denial include pre-existing condition exclusions, lack of medical necessity, or claim errors. Policyholders may face denials from insurers like Blue Cross Blue Shield or UnitedHealthcare, which can significantly impact financial stability and health wellness. Denial letters often contain specific codes, such as code 50 for non-covered services, that require clarification from the insurer. It is essential to gather relevant documentation, such as medical records or bills from healthcare providers, to substantiate the claim and contest the denial effectively. Legal rights may also be affected by state regulations, influencing the appeals process.

Medical Justification

Denial of health insurance claims can create significant barriers for patients seeking necessary medical care, particularly in cases involving procedures like MRI scans. Insurance providers often cite reasons such as lack of medical necessity or insufficient documentation. For instance, denials may occur if a provider fails to demonstrate that an MRI, costing approximately $2,000, is essential for diagnosing conditions such as tumors or herniated discs, particularly in patients experiencing chronic pain or neurological symptoms. Medical professionals must provide thorough patient records, including past treatments, diagnostic imaging results, and peer-reviewed studies supporting the need for the procedure. Expedited appeals may involve referencing patient-cited clinical guidelines or expert opinions to strengthen the case against the denial.

Supporting Documentation

Health insurance denial can present significant challenges for individuals seeking necessary medical services. A denial letter from an insurance company--often citing reasons such as lack of medical necessity, improper coding, or out-of-network status--requires a well-structured response. Essential supporting documentation must include a copy of the original claim, relevant medical records, and a detailed explanation of the medical procedure or treatment's necessity. Gathering statements from healthcare providers can also strengthen the appeal. Specific evidence, like diagnostic test results or referral letters from specialists, can underline the urgency and importance of the needed services. Additionally, familiarity with insurance policies and relevant state regulations can enhance the effectiveness of the appeal, ensuring that all aspects of the case are presented clearly and persuasively.

Appeal Request and Contact Information

Health insurance denial can have significant implications for individuals seeking necessary medical care. Denial letters often contain coding errors representing medical procedures under healthcare plans such as the Affordable Care Act (ACA) or Medicare. Such discrepancies may arise from incorrect diagnosis codes that fail to align with covered services. Additionally, policies can differ across states, like New York or California, affecting the approval process. It's crucial to thoroughly review the explanation of benefits (EOB) provided by insurers like UnitedHealth Group or Anthem Blue Cross to understand the specific reasons for denial. By gathering supporting documents such as medical records, letters from healthcare providers, and relevant policy statements, individuals can construct a compelling appeal argument, detailing the necessity of the treatments denied.

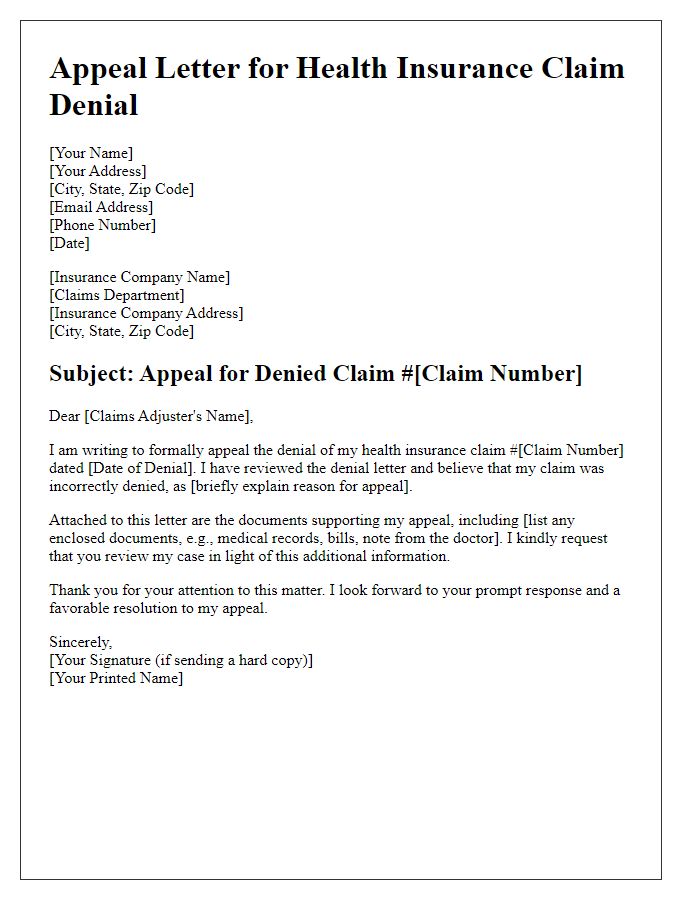

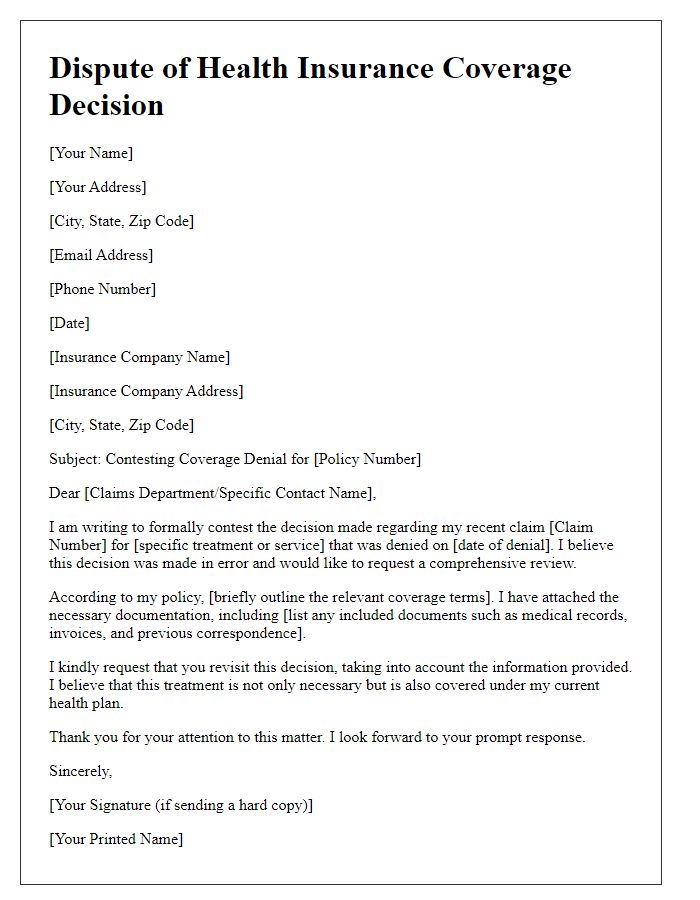

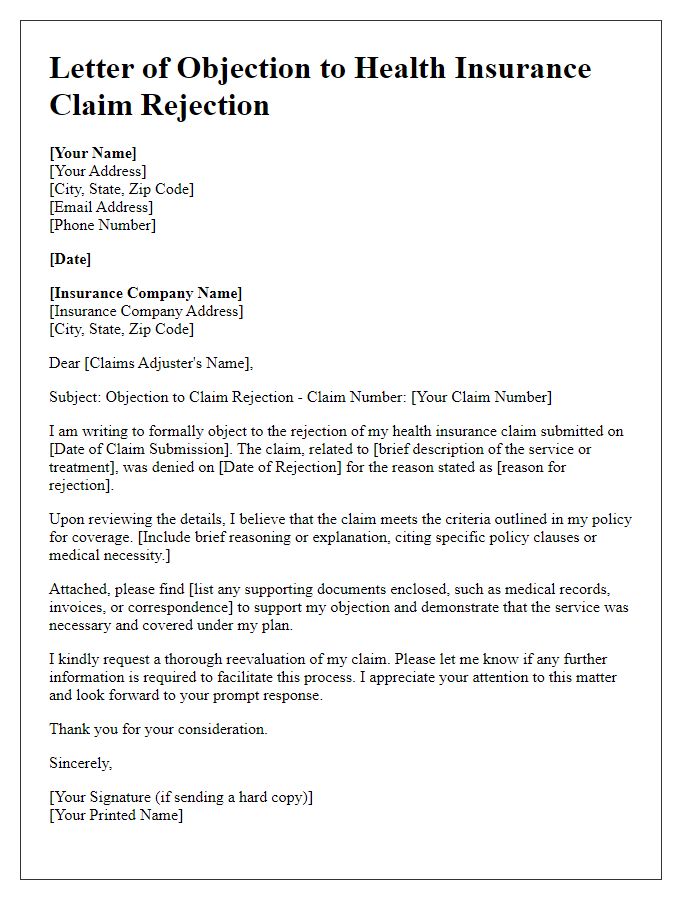

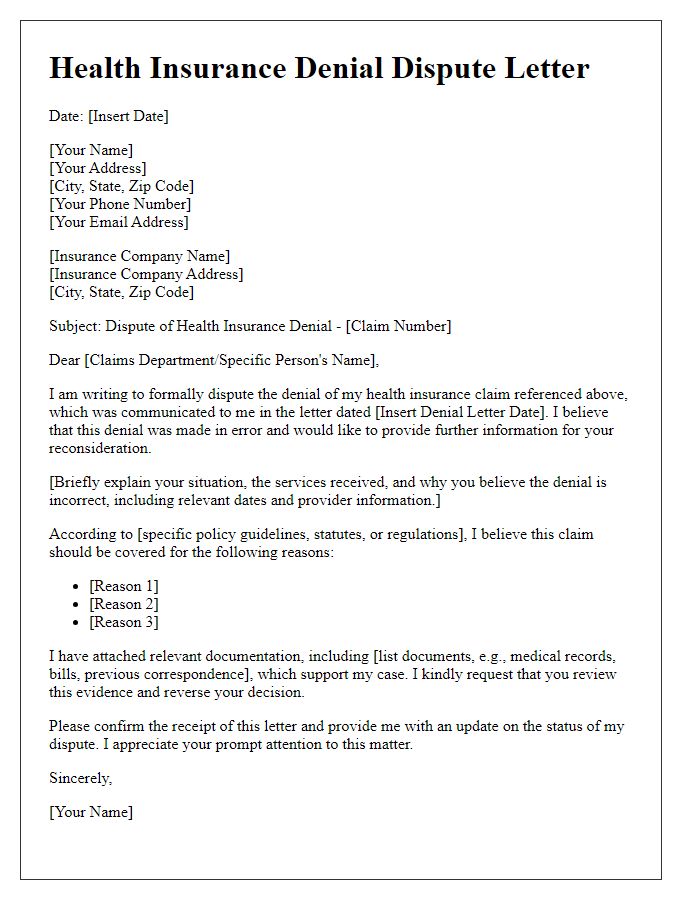

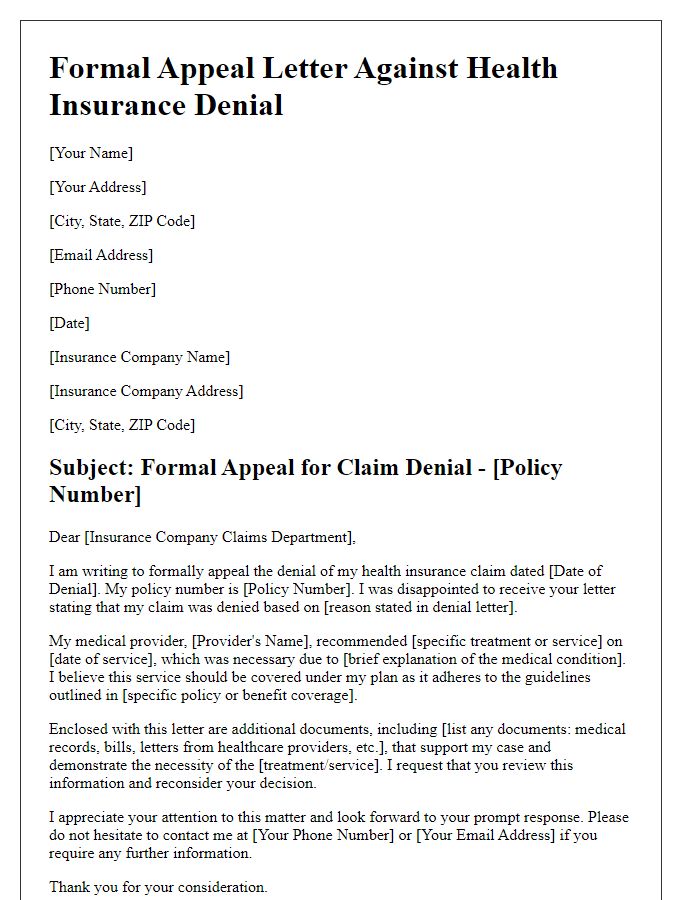

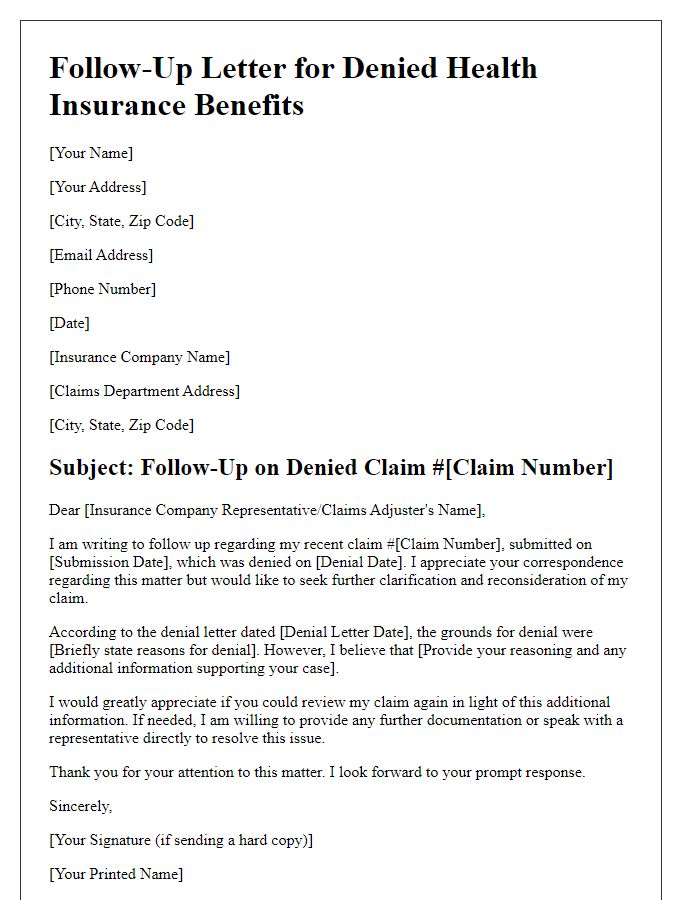

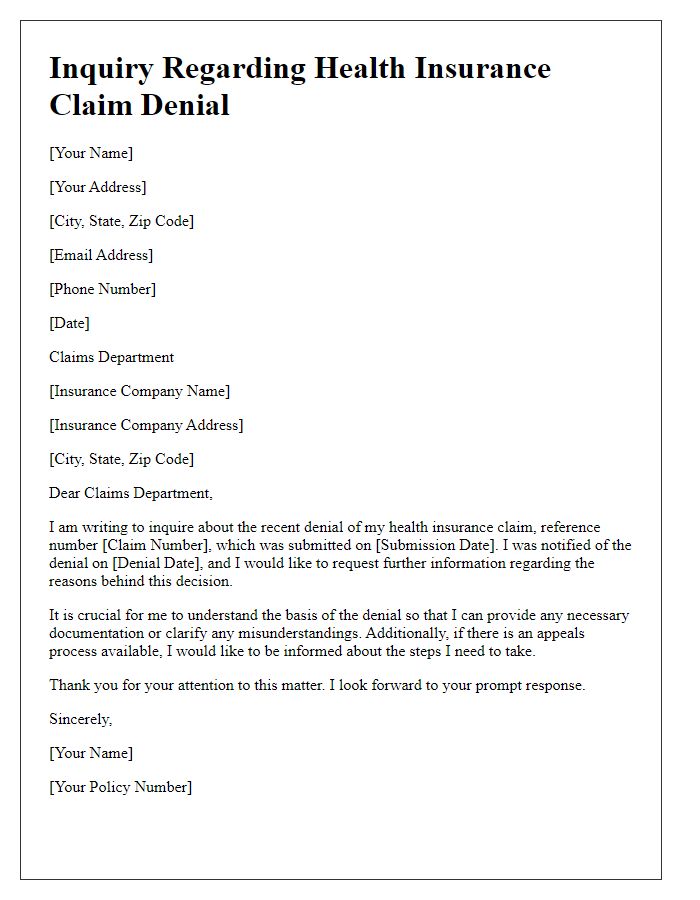

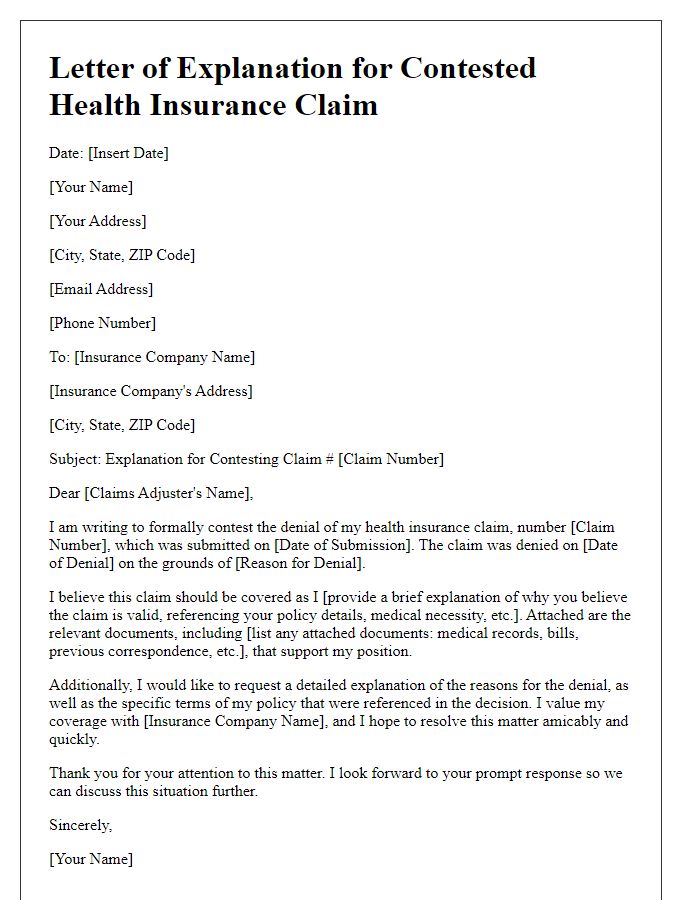

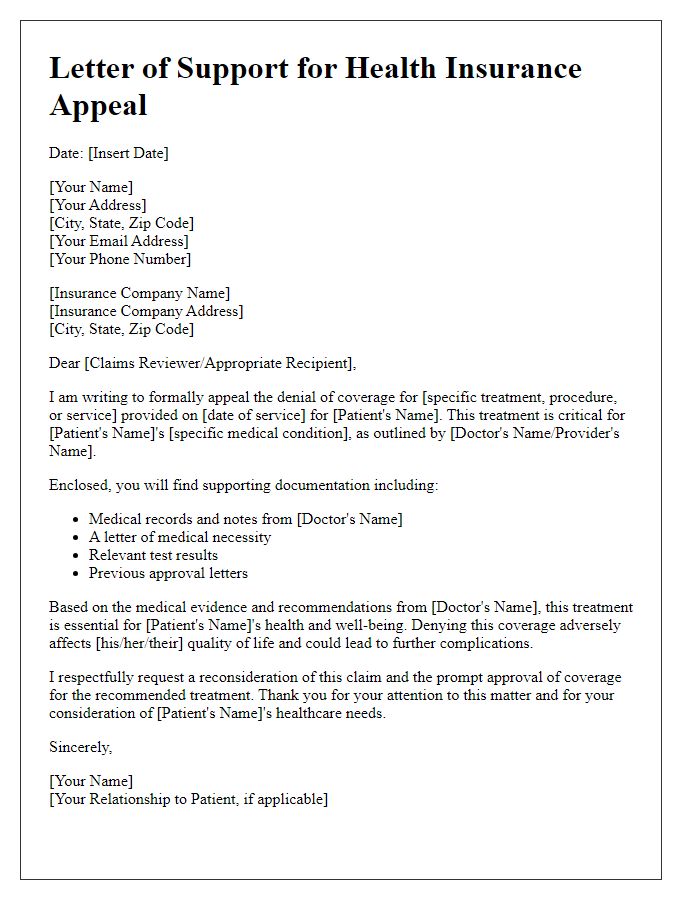

Letter Template For Contesting Health Insurance Denial Samples

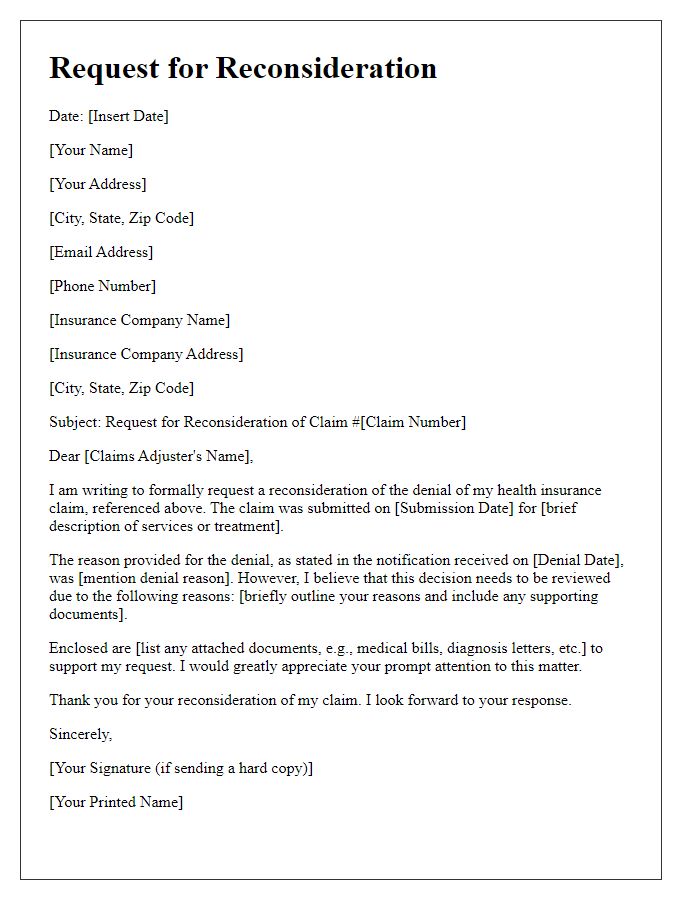

Letter template of request for reconsideration of health insurance claim

Comments