Are you feeling frustrated after a denied health coverage claim? You're not alone, as many individuals face the challenge of navigating insurance battles when they believe their claims should be honored. In this article, we'll walk you through a helpful letter template designed to effectively contest denied claims and reclaim your rights to necessary medical treatment. Ready to take charge of your health coverage? Let's dive in!

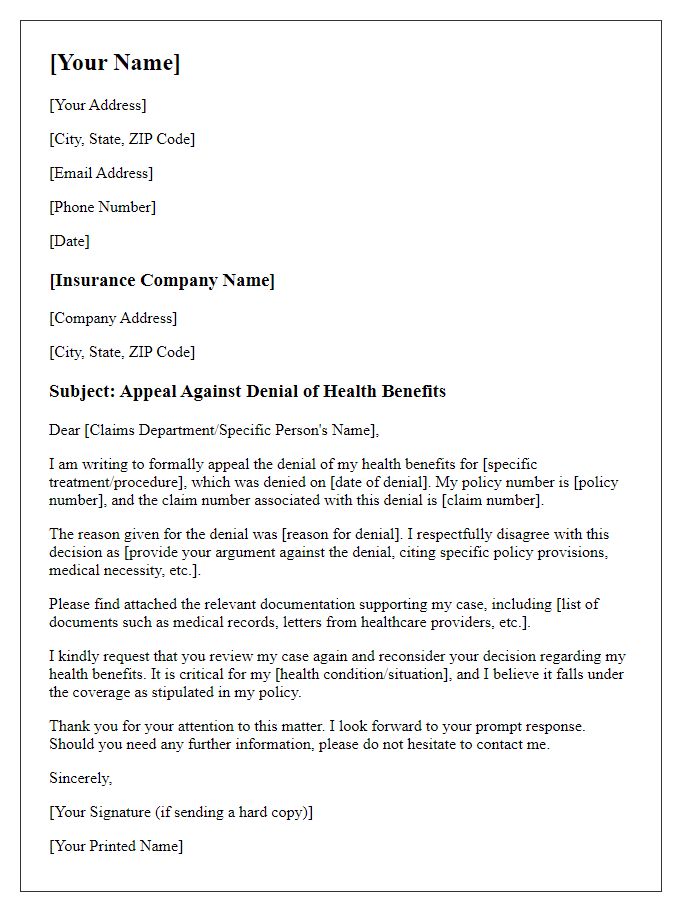

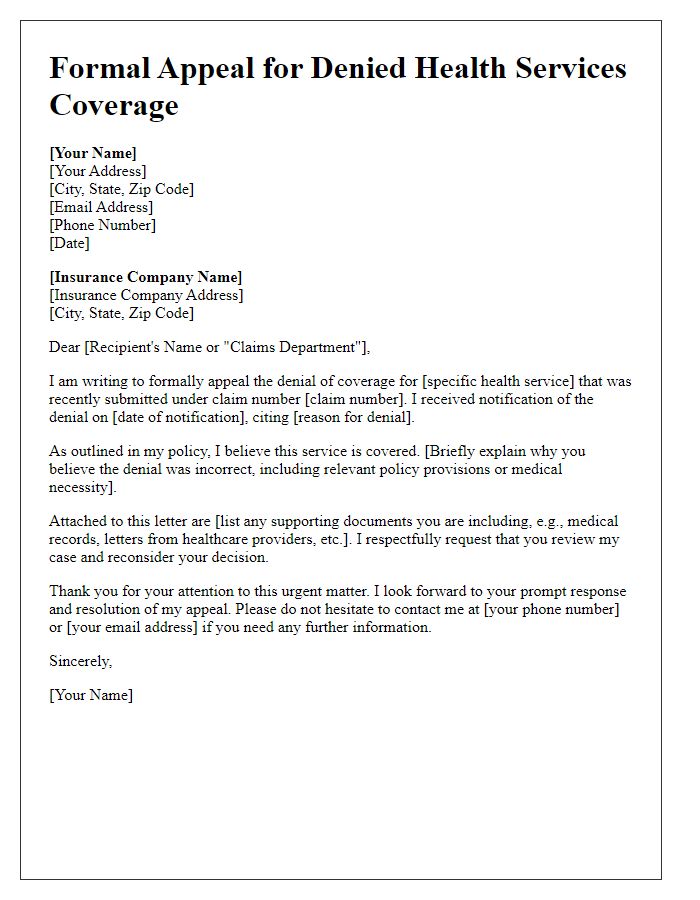

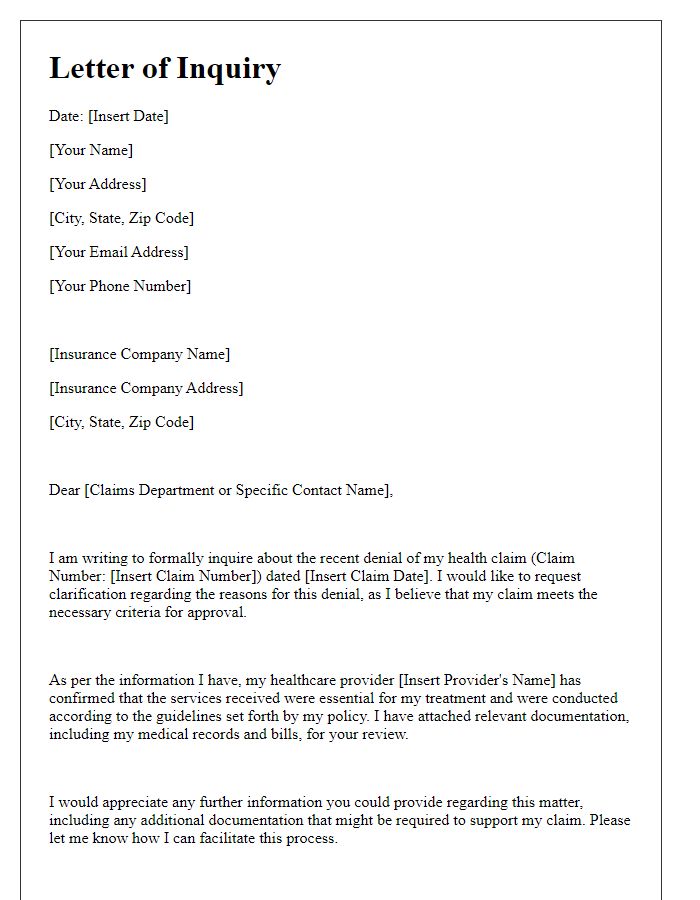

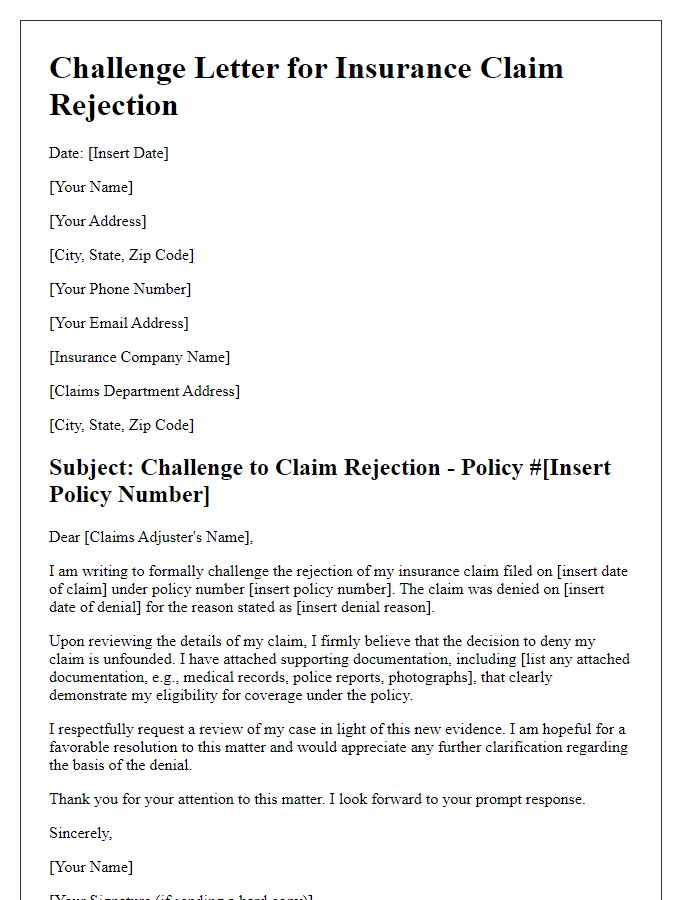

Personal Information & Contact Details

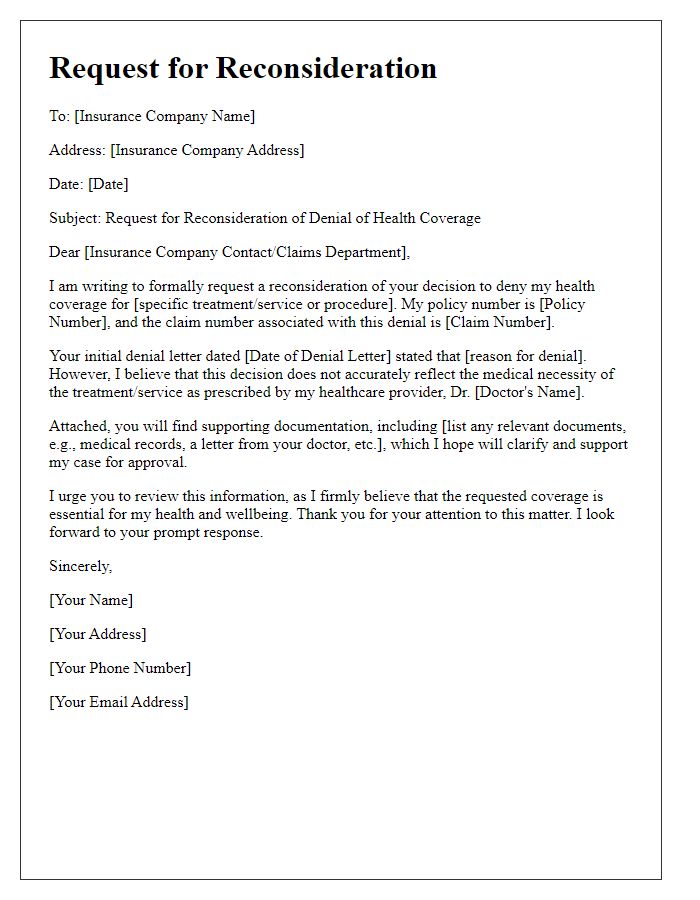

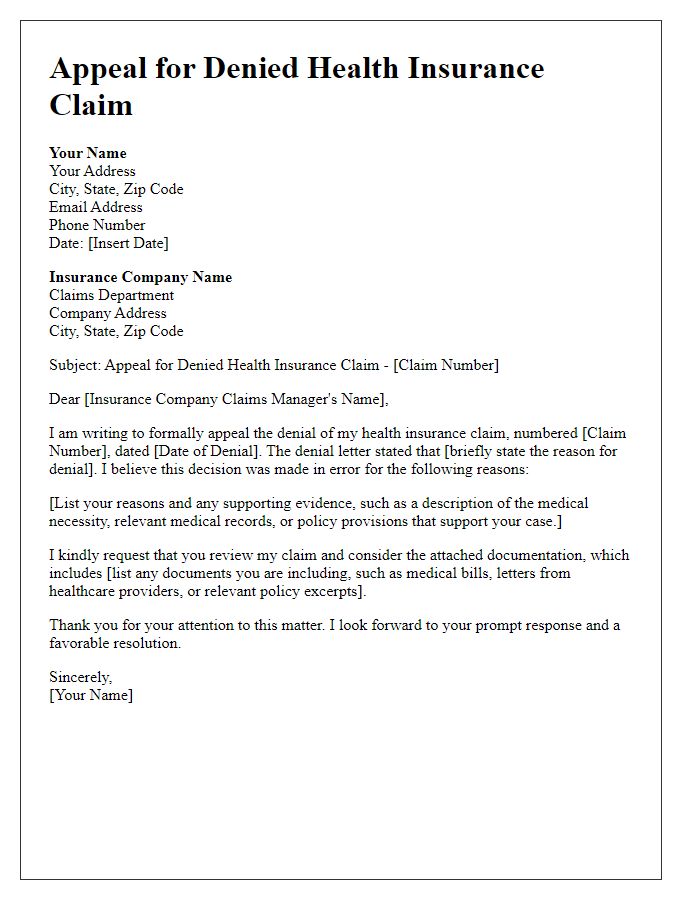

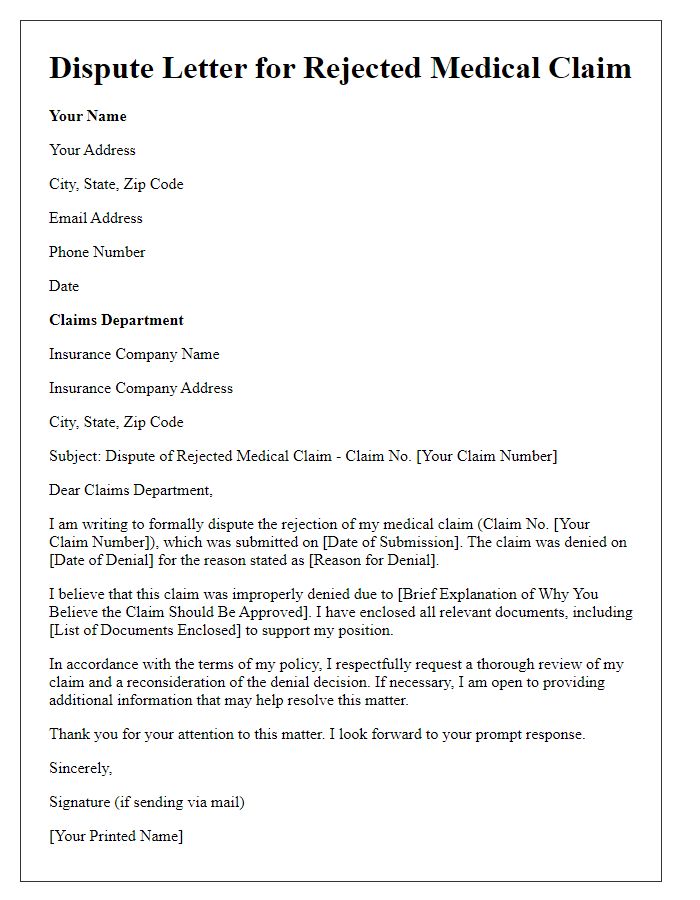

Health insurance claims can be denied for various reasons, often causing frustration and financial strain. Identification details such as policy number, full name, and contact details must be included for clarity. Consider referencing the specific denial date alongside claim numbers to facilitate efficient review. Document any communication with the insurance provider, including names and dates, to support your position. Emphasize the medical necessity of the treatment or service in question, providing relevant documentation from healthcare providers, including treatment plans or referral letters. Highlight coverage inconsistencies based on the policy's terms to reinforce your argument for reconsideration.

Policy & Claim Details

Health coverage claims can be denied for various reasons, impacting patients' access to necessary medical services. Insurance policy documentation provides crucial details, such as policy number (typically an alphanumeric code), coverage limits, and specific stipulations regarding treatment eligibility. Claim details encompass the claim number, the date of service, and associated procedure codes (like Current Procedural Terminology, or CPT codes) that delineate the services rendered. Denial letters from insurance companies typically cite reasons, including lack of medical necessity or failure to obtain prior authorization, requiring a thorough review of policy terms and medical records to construct a strong appeal. Timely filing of appeals within designated periods (often 30 days) is essential to ensure reconsideration of the claim.

Explanation of Medical Necessity

Medical necessity is a critical factor in determining the approval of health coverage claims. Insurers often require detailed documentation to assess whether a treatment, procedure, or service is essential for a patient's health status. For example, in cases involving chronic conditions such as diabetes or heart disease, specialized treatments like insulin therapy or cardiac rehabilitation programs must be justified with evidence from credible medical sources, including peer-reviewed studies and clinical guidelines. Thorough explanations from healthcare providers are crucial, providing specific patient circumstances, previous treatment responses, and potential health risks associated with denying coverage. In states like California, local regulations may further impact coverage criteria. Properly articulated medical necessity ensures that patients receive vital healthcare services without unnecessary barriers.

Reference to Policy Terms & Supporting Documentation

Inaccurate health coverage claim denials can lead to significant financial stress for insured individuals. For example, a patient with a chronic condition may face overwhelming medical expenses after a claim rejection under their employer-sponsored health insurance plan. Key policy terms outlined in the coverage document, such as "medical necessity" and "pre-existing conditions," offer critical insight into why certain treatments may be eligible or excluded. Supporting documentation, including medical records, physician letters, and treatment plans, plays a vital role in appealing denied claims. Stakeholders, such as insurance adjusters and healthcare providers, must carefully review these elements to ensure a comprehensive understanding of the situation, aiding in the recovery of rightful benefits.

Request for Re-evaluation & Response Deadline

A denied health coverage claim can significantly impact access to necessary medical care, creating financial strain on individuals. In 2022, over 160 million Americans faced similar denial scenarios, prompting a surge in requests for re-evaluation. The claim, often linked to specific treatments (like chemotherapy for cancer or surgery for orthopedic conditions), must include detailed medical records from healthcare providers. Data from the U.S. Department of Health and Human Services indicate that timely follow-up on such denials is crucial, with most insurance companies allocating a 30-day response window. This period allows for the submission of additional documentation supporting the necessity of the treatment, including peer-reviewed studies, physician letters, and patient testimonials that underscore medical urgency and effectiveness.

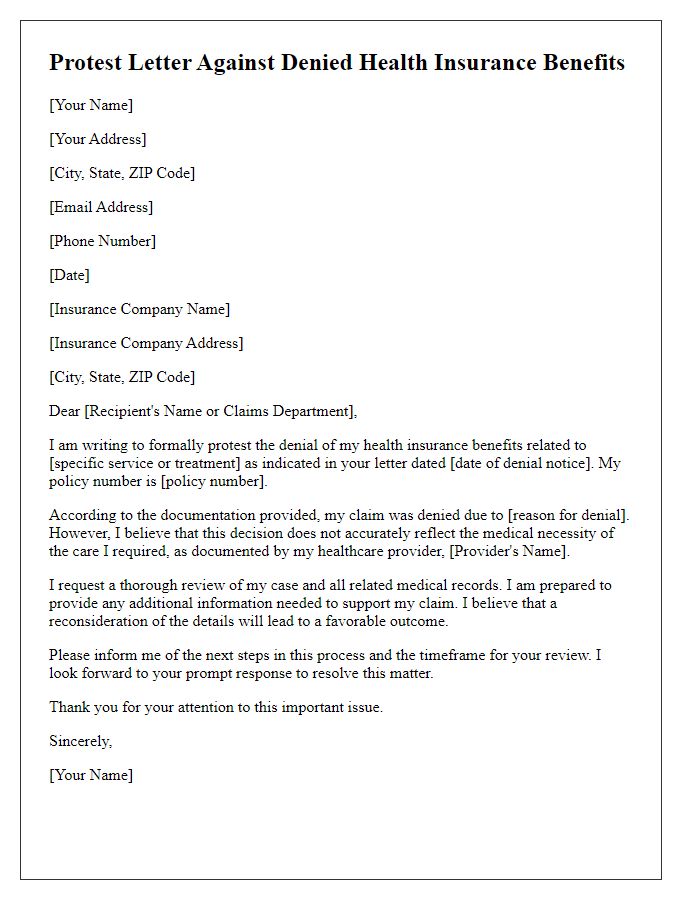

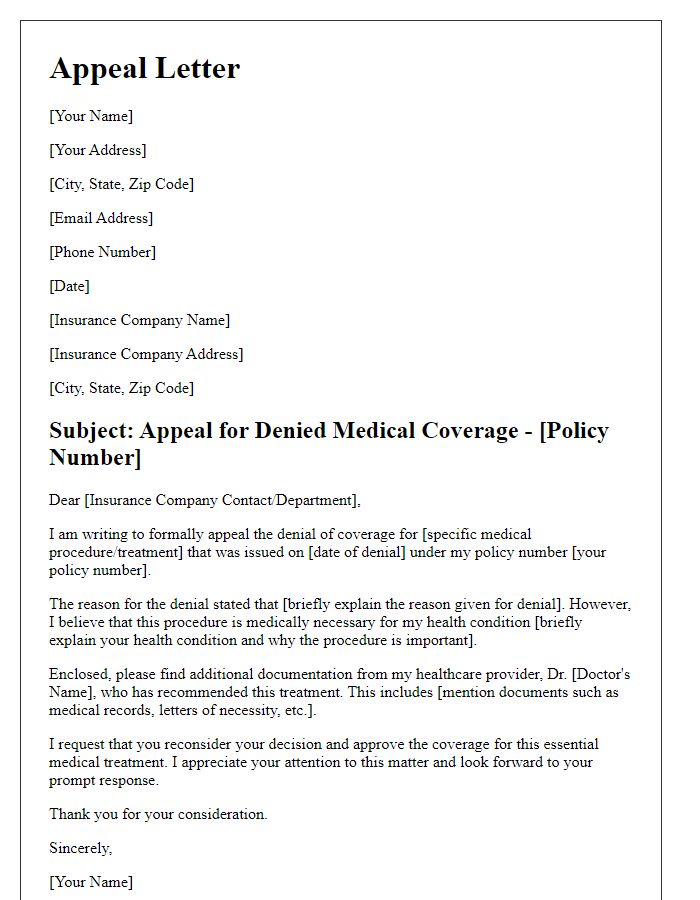

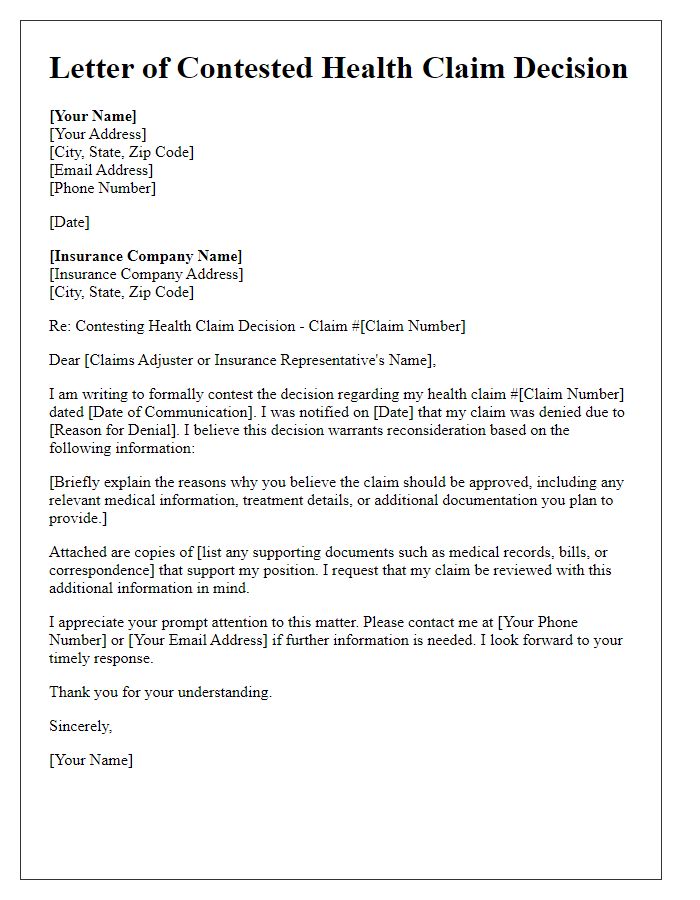

Letter Template For Contesting Denied Health Coverage Claim Samples

Letter template of request for reconsideration of health coverage denial

Comments