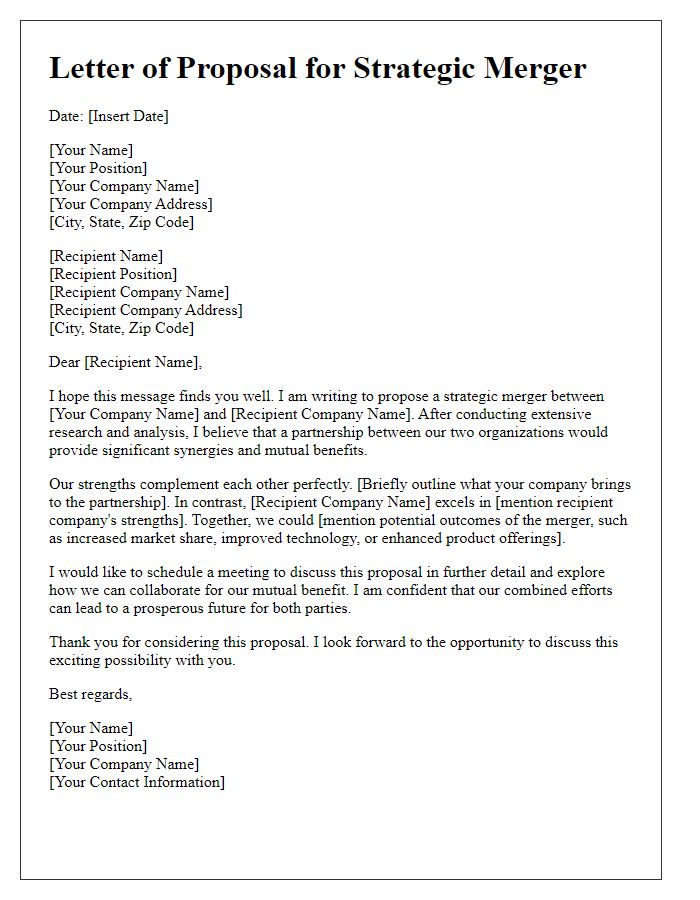

Are you considering a merger partnership but unsure how to present your proposal effectively? Crafting a compelling letter can set the stage for a successful collaboration, capturing the essence of your vision while addressing potential concerns. This guide will provide you with a structured template that emphasizes transparency, mutual benefits, and strategic alignment. Curious to learn more about how to create a persuasive merger partnership proposal?

Introduction and Purpose of the Merger

A merger partnership proposal outlines a strategic alliance between two companies aimed at enhancing market position, operational efficiency, and profitability. The primary purpose of this merger is to leverage the strengths of each partner, combining resources, technologies, and expertise to create a more competitive entity in the industry. In competitive markets such as technology or healthcare, merging can lead to significant cost reductions, increased market share, and the ability to innovate more effectively. By pooling financial resources, both companies can invest in research and development projects that may have been too costly individually, positioning the new entity for sustainable growth in a challenging economic landscape. Ultimately, the merger aims to deliver greater value to stakeholders while maintaining a commitment to quality and service excellence.

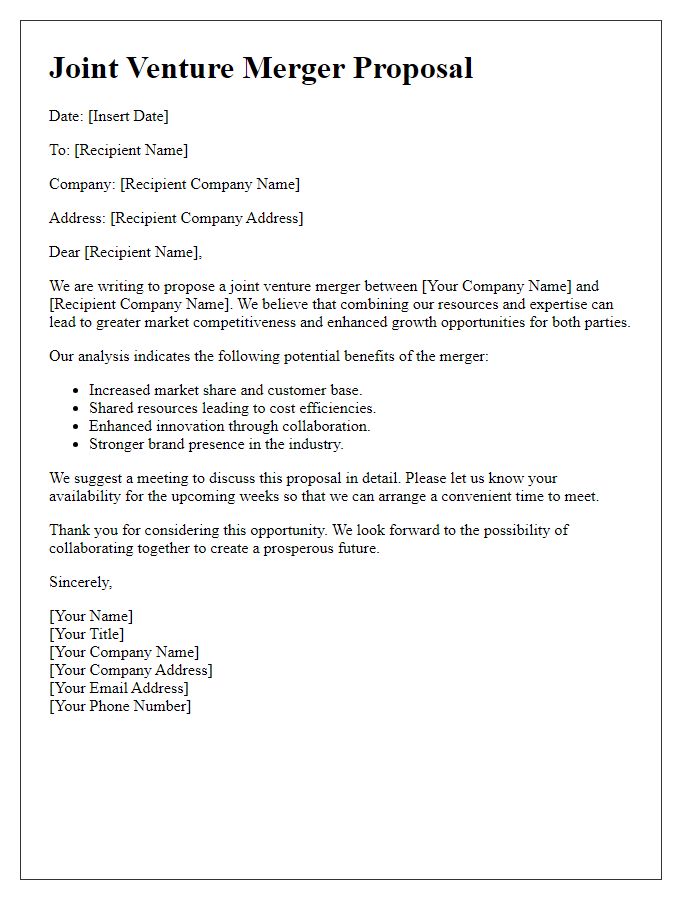

Strategic Benefits and Synergies

A merger partnership proposal can significantly enhance the strategic positioning of the involved companies, leading to amplified market reach, operational efficiencies, and shared expertise. Combining resources can create a consolidated entity capable of optimizing economies of scale. Enhanced product offerings may arise through the integration of complementary technology platforms, facilitating improved customer experiences across diverse sectors. Collaborative efforts in research and development can also yield innovative solutions that meet evolving consumer demands. Furthermore, leveraging shared distribution networks can reduce logistical costs and streamline supply chain processes. By aligning strategic goals, such a partnership promises increased competitiveness and sustained growth in a rapidly changing market landscape.

Financial Overview and Projections

A well-structured financial overview of the merger partnership should incorporate key metrics, revenues, and future projections to provide a comprehensive understanding of the financial landscape. The revenue for Company A, estimated at $10 million annually, combined with Company B's $7 million, illustrates a potential market share increase of approximately 30%. Cost synergies projected to reach $1.5 million in the first year post-merger due to operational efficiencies highlight significant financial benefits. The combined EBITDA margin is expected to improve from 15% to 20% over the next three years, suggesting enhanced profitability. Furthermore, the projected revenue growth rate of 10% annually indicates robust market positioning, supported by shared resources and customer bases in the technology sector.

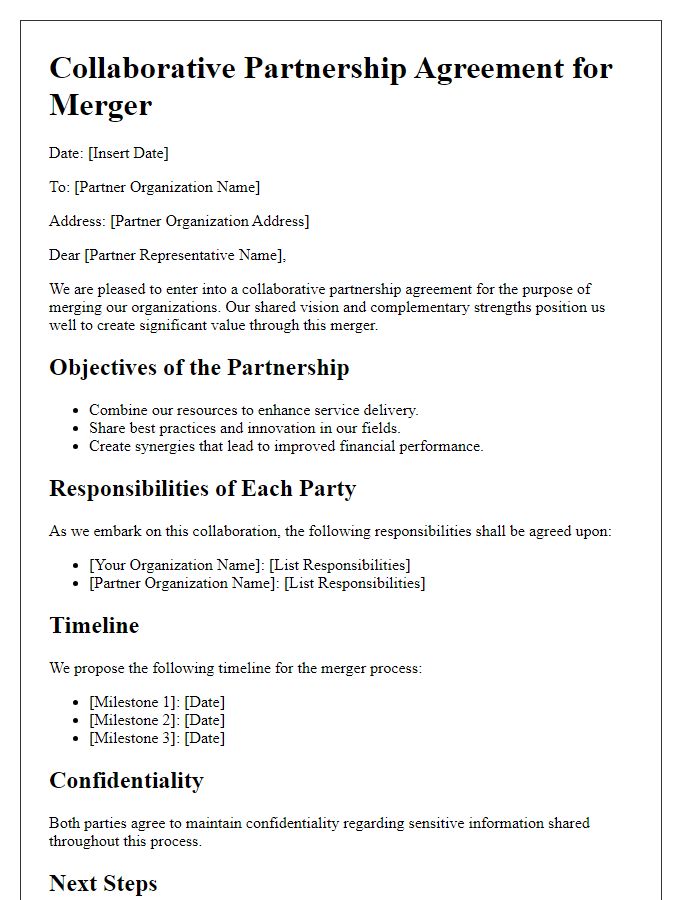

Proposed Timeline and Milestones

The proposed timeline for the merger partnership initiative outlines critical milestones aimed at ensuring a smooth transition and operational integration. Initial discussions are scheduled for the first quarter of 2024, facilitating stakeholder engagement and collaborative deliberations. By the end of March 2024, both entities will finalize due diligence processes, analyzing financial statements and operational capabilities. Subsequently, mid-April 2024 is earmarked for the drafting of a binding letter of intent, outlining shared objectives and expectations. In June 2024, a comprehensive integration plan will be developed, addressing cultural alignment and resource allocation. Key performance indicators will be identified by July 2024 to measure success post-merger, with the official consolidation targeted for August 2024. Regular progress reviews will occur each month, ensuring accountability and timely adjustments. The ultimate goal focuses on achieving a seamless merger experience that maximizes operational efficiency and stakeholder value.

Contact Information and Next Steps

Contact information is vital for establishing communication between merging entities, ensuring seamless dialogue throughout the partnership. Important details include names, phone numbers, email addresses, and physical addresses of the companies involved, typically located in corporate offices or headquarters. Next steps in the merger partnership proposal should outline timelines for initial discussions, financial assessments, and strategic planning meetings to facilitate a smooth transition. Designating key contacts for each organization can streamline the process, promoting collaboration while addressing potential concerns. This structured approach can lead to successful integrations, fostering growth, and enhancing competitive advantages in targeted markets.

Comments