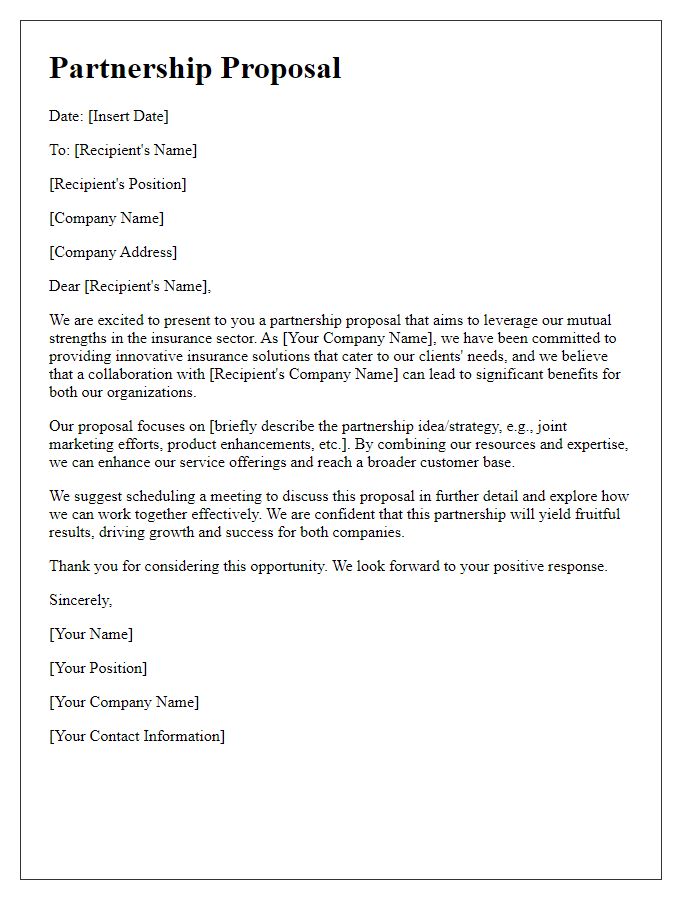

Are you considering taking your insurance business to the next level? Partnering with the right company can unlock new opportunities and enhance your service offerings. In this article, we'll explore the key components of a successful insurance partnership proposal and share tips for crafting a compelling letter that captures attention. So, if you're ready to transform your business through strategic collaboration, let's dive in and discover how you can create an impactful proposal!

Clear Introduction and Purpose

Building a solid insurance partnership can enhance customer satisfaction and expand market reach. Potential partners should understand the purpose and benefits of collaboration, including risk sharing, customer base diversification, and enhanced product offerings. Each participating company brings unique strengths, such as underwriting expertise, technological capabilities, or niche market access. Engaging in a partnership allows for pooled resources, joint marketing initiatives, and innovative solutions tailored to diverse client needs. By aligning mutual goals and leveraging industry knowledge, stakeholders can create a robust strategy to navigate changing market dynamics and improve overall service delivery.

Detailed Partnership Benefits

A strategic partnership between insurance companies can yield significant benefits, enhancing customer service and expanding market reach. Collaborative initiatives can lead to shared marketing campaigns, which can increase brand visibility and attract a broader customer base. Joint product offerings can combine various insurance types, such as life, automobile, home, or health insurance, creating comprehensive packages tailored for diverse client needs. Enhanced claim processing efficiency can result from integrated technology systems, allowing for streamlined communication between partners, which ultimately improves customer satisfaction. By sharing data insights, companies can better understand market trends and customer behaviors, enabling them to develop targeted products and promotional strategies. Furthermore, co-hosting educational seminars and workshops can bolster community engagement, fostering trust and establishing both companies as industry leaders in their regions. Overall, these collaborative benefits can lead to increased revenue, reduced operational costs, and a stronger competitive advantage in the insurance marketplace.

Alignment with Business Objectives

A partnership proposal between two insurance companies, focusing on strategic alignment with business objectives, can enhance market reach and customer satisfaction. By collaborating, both entities can leverage shared resources, such as technology platforms (like cloud-based solutions) and distribution channels (including online sales networks), leading to increased efficiency and reduced operational costs. The shared data analytics capabilities can drive personalized product offerings, resulting in better customer engagement and retention rates. Additionally, joint marketing initiatives can effectively target niche markets (for example, rural homeowners in certain states) while adhering to compliance regulations established by the National Association of Insurance Commissioners (NAIC). Ultimately, this partnership can lead to better financial performance and long-term growth in a competitive landscape.

Structured Financial and Operational Information

A well-structured financial and operational proposal for an insurance partnership outlines critical metrics and strategies essential for collaboration. Financial projections, including expected revenue growth rates (e.g., 7% annual increase), operating costs (estimated at $500,000 per year), and profit margins (targeting 20% margins), provide clarity in financial expectations. Operational aspects cover service delivery metrics, such as average claim processing times (ideally under 30 days) and customer satisfaction rates (aiming for 90% satisfaction). Resource allocation, detailing personnel involved from underwriting to customer service, ensures all stakeholders understand roles and responsibilities. Comprehensive market analysis identifies key demographics (age group 30-50) and potential competition, enhancing the strategic value of the partnership. This structured information empowers both parties to make informed decisions, ensuring alignment in goals and fostering a successful collaboration.

Call to Action and Contact Information

A compelling insurance partnership proposal emphasizes the mutual benefits of collaboration. Engaging with potential partners could lead to increased customer reach, enhanced service offerings, and improved market competitiveness. Highlighting accurate statistics, such as a 20% increase in customer acquisition through partnerships, can capture attention. Firms must provide clear contact information, including phone numbers, email addresses, and office locations, to ensure seamless communication. Creating a sense of urgency for a response may encourage early engagement, reinforcing the proposal's importance and potential impact on both parties' growth strategies.

Comments