Are you looking to expand your financial horizons through a strategic partnership? Creating a compelling partnership proposal can be a game-changer for both your organization and potential collaborators. In this article, we'll guide you through crafting a persuasive letter that highlights mutual benefits and aligns your financial goals. So, grab a cup of coffee and let's dive in to enhance your financial partnership prospects!

Introduction

A financial partnership proposal serves as a strategic initiative designed to foster collaborative growth between two entities. This partnership may involve businesses across various sectors, including technology startups in Silicon Valley or established manufacturing firms in the Midwest. The purpose is to combine resources, expertise, and market reach to increase overall profitability and enhance operational efficiency. Detailed financial forecasts, market analysis, and partnership structures are often included, showcasing projections for increasing revenues to potentially millions of dollars annually. Geographic considerations, such as urban demographics in New York City or rural hubs in Texas, can significantly influence the proposal's framework and anticipated success rates.

Partnership Objectives

In a financial partnership proposal, clear objectives establish the foundation for collaboration, guiding both parties toward mutual success. These objectives may include enhancing market reach by tapping into combined customer bases; increasing revenue streams through joint ventures or shared resources; and minimizing financial risks by diversifying investments in sectors such as technology or renewable energy. Additionally, fostering innovation may be a primary goal, encouraging the development of cutting-edge products or services that leverage each partner's expertise. Aligning objectives also encompasses establishing transparent communication channels and regular performance assessments to ensure accountability and continuous improvement in the partnership dynamics.

Value Proposition

In a financial partnership proposal, a compelling value proposition is essential for demonstrating mutual benefits and potential growth. Financial institutions (such as banks or investment firms) seek partnerships that enhance their portfolio diversification while providing access to innovative products. The incorporation of technology-driven solutions can streamline operations, resulting in reduced costs and increased efficiency in various processes. Collaborating with established entities in emerging markets, like renewable energy firms in Southeast Asia, can provide unique investment opportunities that align with sustainability goals. Additionally, pooled resources can lead to shared expertise, enhancing risk management capabilities and ultimately generating greater returns on investment for all parties involved.

Financial Projections

Financial projections for a proposed partnership often include detailed forecasts of revenue, expenses, and profitability over a set period, typically three to five years. These projections utilize historical data from similar ventures or industry benchmarks to establish realistic performance expectations. Key figures include anticipated sales growth rates, which may range from 10% to 25% annually, depending on market conditions and business strategies. Cost structures encompass fixed expenses such as rent and salaries as well as variable expenses like materials and marketing. Net profit margins, commonly between 15% and 30%, indicate the expected profitability from operations. Cash flow forecasts ensure sufficient liquidity, mapping out inflows and outflows monthly to avoid cash shortfalls. Sensitivity analyses assess the impact of different scenarios, adjusting for potential market fluctuations, regulatory changes, or economic downturns. Overall, comprehensive financial projections serve as a roadmap for anticipated success, guiding strategic decision-making within the financial partnership.

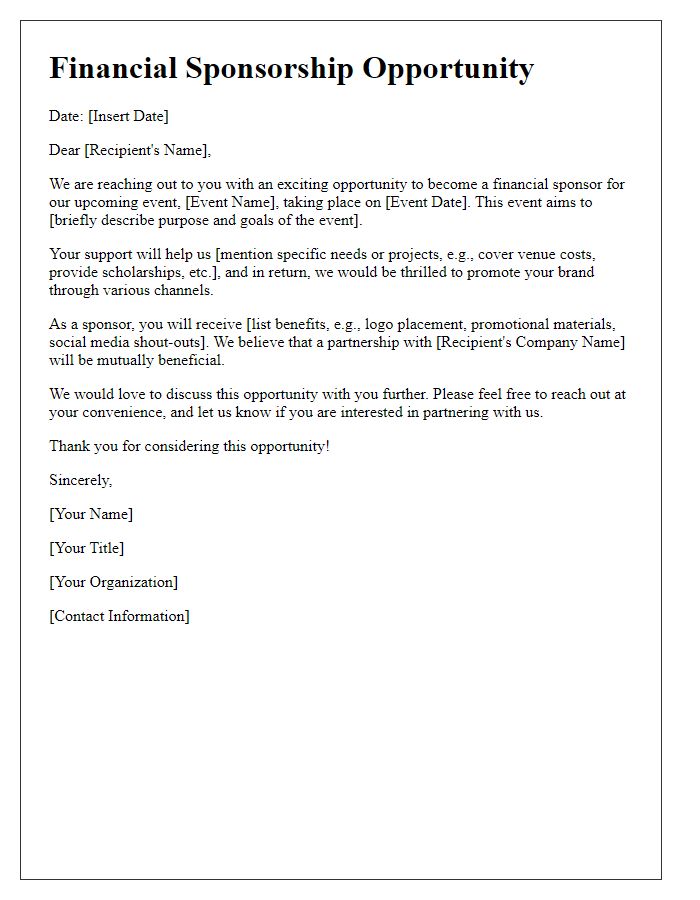

Contact Information

Creating a financial partnership proposal requires presenting essential details clearly. The contact information segment must include key components. Name(s) of individuals or organizations involved should be listed prominently. Address details should encompass complete street address, city, state, and zip code for easy reference. Email addresses must be professional, ensuring prompt communication. Phone numbers should feature area codes for national partners. Additionally, including social media handles can enhance visibility and trust. Executives' titles add authority, indicating the significance of the proposal. Comprehensive details facilitate seamless interaction between potential partners.

Comments