Are you ready to take control of your financial future? In today's fast-paced world, understanding personal finance is more important than ever, yet many of us feel overwhelmed by the numbers. This letter serves as a stepping stone to help you navigate the complexities of budgeting, saving, and investing. Join us on this journey to financial empowerment and discover the tools you need to make informed decisions by reading more about our latest campaign!

Clear and concise language

The financial literacy campaign targets individuals seeking to enhance their understanding of money management. Workshops offer expertise on budgeting techniques, investment strategies, and debt reduction methods. Educational resources include interactive online courses and informative webinars led by financial advisors with industry experience. Participants gain practical skills in managing personal finances effectively. The campaign emphasizes building a solid foundation for future financial stability, encouraging informed decision-making regarding savings, retirement planning, and responsible spending habits. Partnerships with local organizations enhance outreach efforts, ensuring diverse populations can access these crucial learning opportunities.

Audience-specific content

A financial literacy campaign aims to educate individuals about managing their finances, understanding concepts like budgeting, saving, investing, and credit scores. The target audience includes young adults aged 18-30, particularly students and recent graduates looking to manage student loans totaling over $30,000. Workshops scheduled for September 2023 in major cities like New York, San Francisco, and Chicago will feature industry professionals from organizations such as the National Endowment for Financial Education (NEFE). Engaging activities will focus on practical skills, such as creating a budgeting plan to achieve financial goals, and utilizing digital tools like budgeting apps and savings calculators. Participants will also learn to navigate credit reports and understand interest rates from lenders, which can exceed 20% for credit cards. This initiative aims to empower and equip the younger generation with essential financial knowledge for a stable economic future.

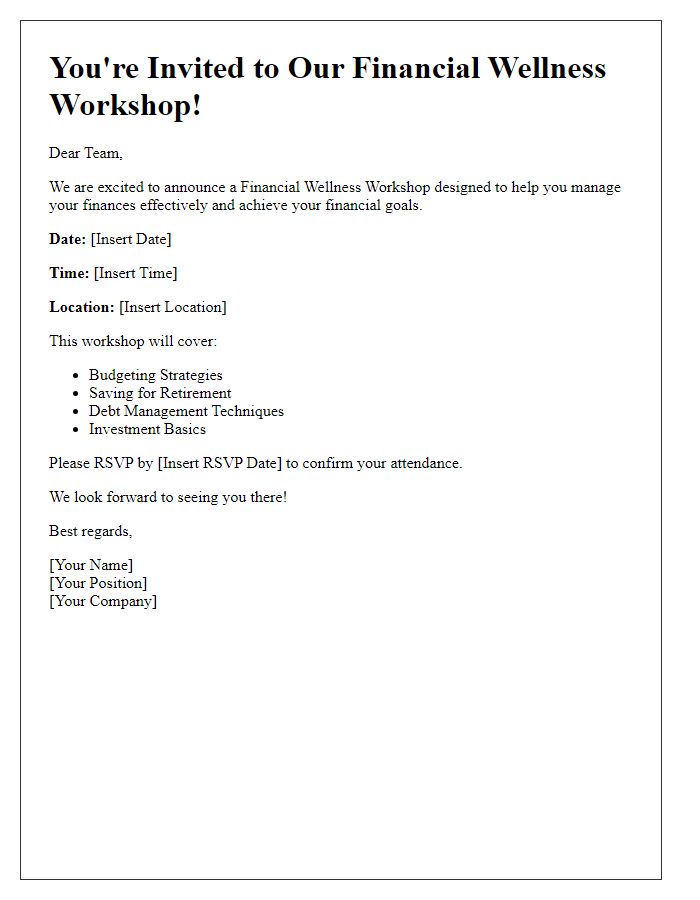

Engaging subject line

Financial literacy is crucial in today's economy, where an estimated 66% of adults in the United States report feeling stressed about their financial situation. Understanding core concepts such as budgeting, saving, and investing can empower individuals to make informed decisions. Events like National Financial Literacy Month, observed every April, highlight the importance of improving financial knowledge. Various organizations, including the National Endowment for Financial Education, offer resources to help communities understand the significance of financial well-being. Accessible tools, such as mobile budgeting apps and online courses, can aid in developing essential skills. Enhanced financial literacy can lead to reduced debt levels and improved overall quality of life.

Call-to-action (CTA)

Financial literacy programs provide essential skills for managing personal finances effectively. These workshops, often hosted in community centers or online platforms, aim to equip participants with budgeting techniques, investment strategies, and debt management skills. Engaging with certified financial advisors during these sessions enhances understanding of complex financial concepts. Students, young professionals, and families benefit significantly from these educational resources, which promote long-term financial stability. By joining local initiatives or online courses, individuals can take proactive steps toward achieving financial independence while fostering a culture of informed decision-making.

Accessibility and readability

Financial literacy campaigns aim to enhance individuals' understanding of financial concepts, helping them make informed decisions about budgeting, saving, and investing. Accessibility (the ease with which information can be obtained and utilized) is crucial, as it ensures that diverse audiences, regardless of socioeconomic status or educational background, can engage with the content effectively. Readability (the ease of reading and comprehension of written text) plays an important role, as materials should use clear language and straightforward formatting to cater to varying literacy levels. Tools such as infographics, interactive workshops, and digital platforms can facilitate these goals, enabling broader participation and ensuring that participants leave with essential skills for managing personal finances effectively.

Comments