When preparing for an external audit, clear communication is key to ensuring a smooth process. This letter serves as an essential notification to inform you about the upcoming audit and what to expect. Understanding the timeline and requirements can ease any concerns and foster a collaborative atmosphere. So, let's dive in and explore everything you need to know about this important step for your organization!

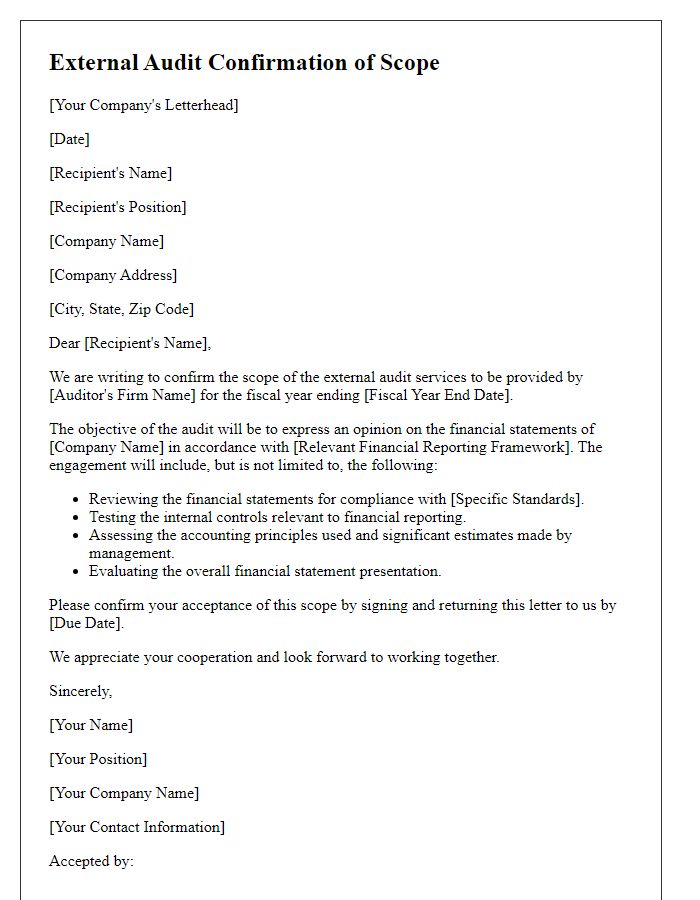

Purpose and Scope of Audit

The purpose of external audits is to provide an independent evaluation of financial statements, ensuring accuracy and compliance with accounting standards such as GAAP or IFRS. These audits often encompass various financial documents including balance sheets, income statements, and cash flow statements, scrutinizing them for consistency and transparency. The scope typically includes a thorough examination of accounting records, internal control systems, and financial transactions from the previous fiscal year, often spanning January through December. Additionally, auditors may assess risk management practices and operational performance, providing insights into areas needing improvement and verifying adherence to regulatory requirements noted by organizations such as the SEC or IRS.

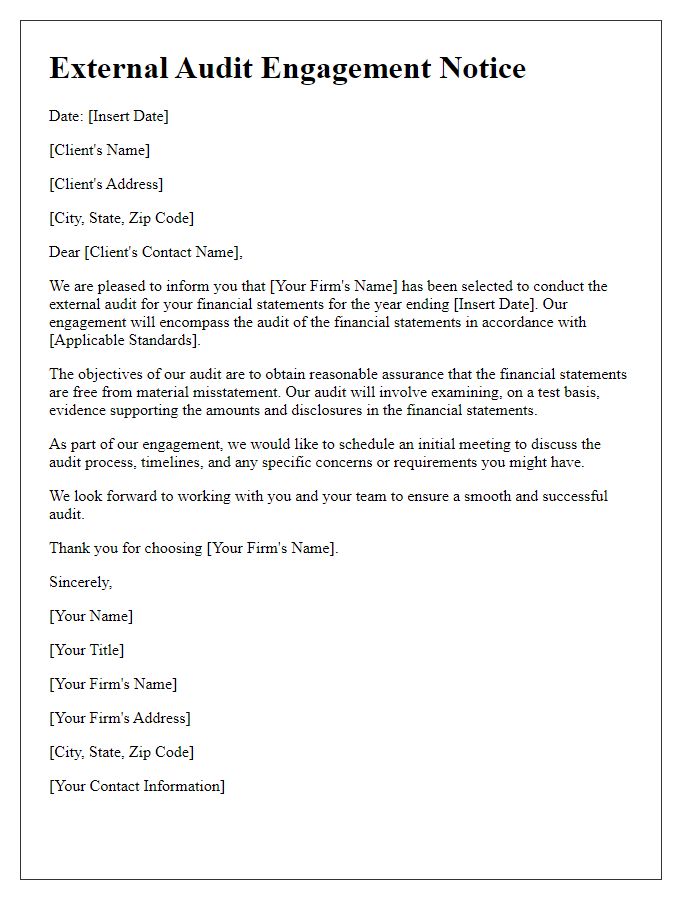

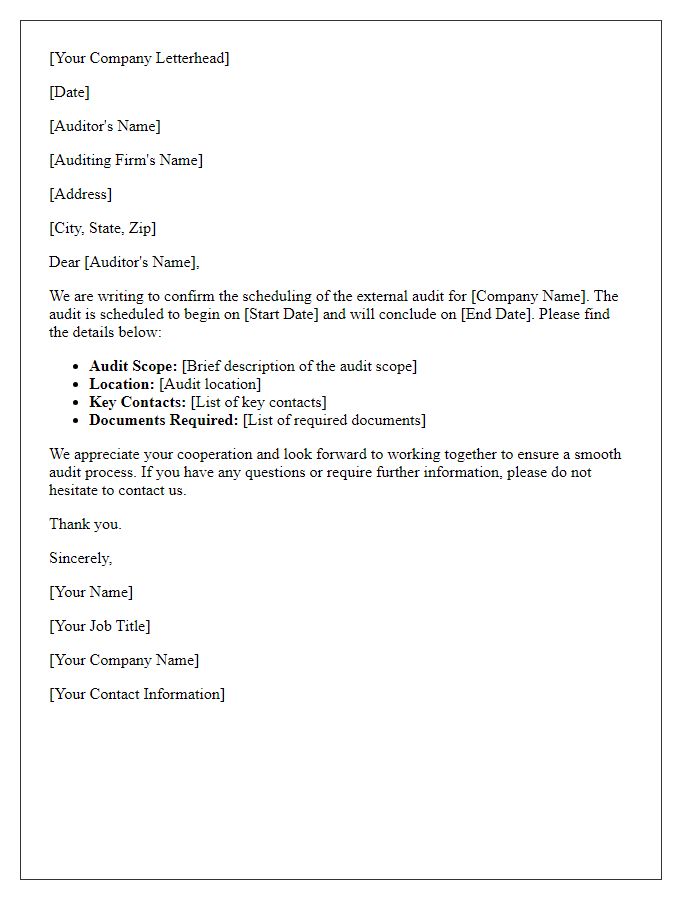

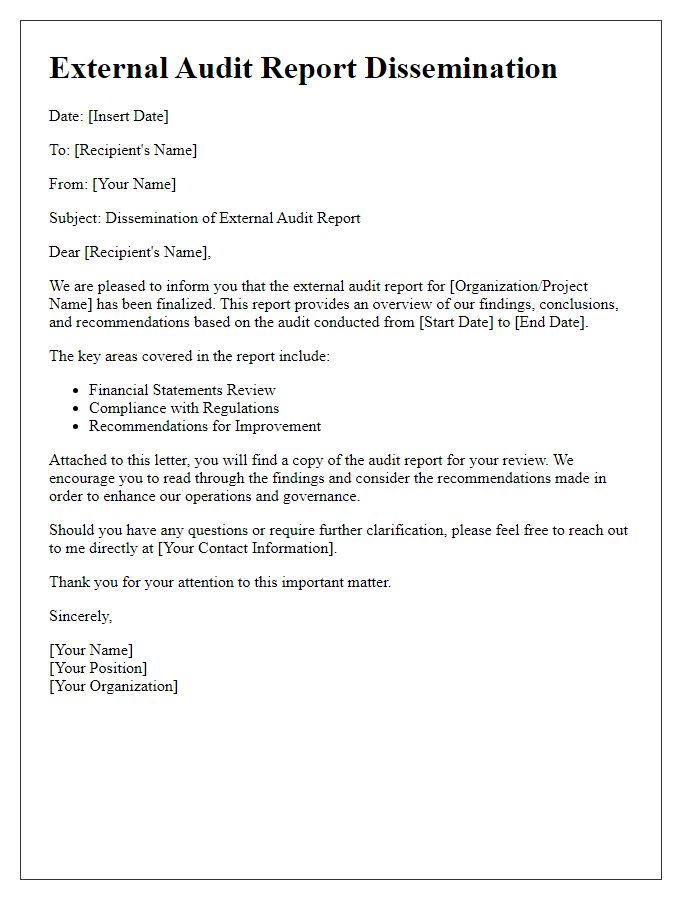

Audit Schedule and Timeline

The external audit process is essential for ensuring financial transparency and compliance within organizations. An audit schedule is typically set to outline specific dates for each stage of the audit, from the initial kickoff meeting (usually held at least one month prior to the audit dates) to the final reporting (which may occur several weeks after the fieldwork concludes). Key milestones include the planning phase, where auditors review financial documents and internal controls, followed by the fieldwork phase, where auditors conduct on-site evaluations and interviews (often lasting 1-2 weeks). The final report, detailing findings and recommendations, may be presented to the board of directors or stakeholders during a formal meeting, often scheduled within two months after fieldwork. Timely communication throughout this process is vital for all parties involved to address any concerns or discrepancies identified during the audit.

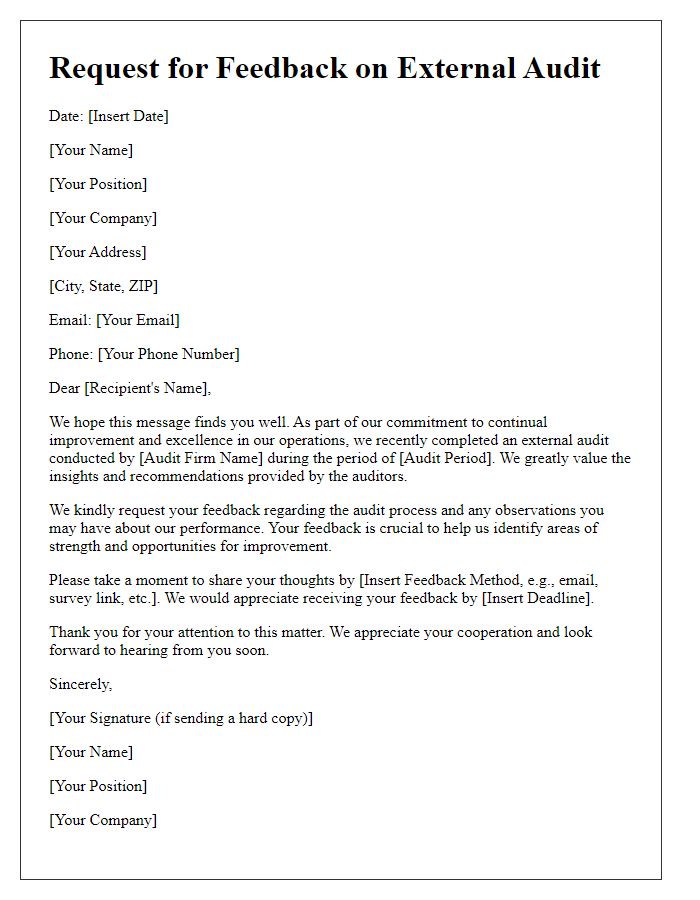

Contact Information for Audit Queries

External audit notifications are essential for maintaining transparency during financial assessments. Auditors require specific contact information to facilitate efficient communication regarding inquiries and document requests. Key contacts usually include the Chief Financial Officer (CFO), located at the headquarters in Springfield, who oversees all financial matters. The audit manager, responsible for coordinating the audit process, should also be included, sometimes based in a nearby office on Maple Street. Additionally, the accounting department may have designated personnel for handling invoice-related queries, ensuring timely responses. Providing direct phone numbers (with area codes) and email addresses for these key individuals enhances communication, paving the way for a smooth audit experience and accurate financial reporting.

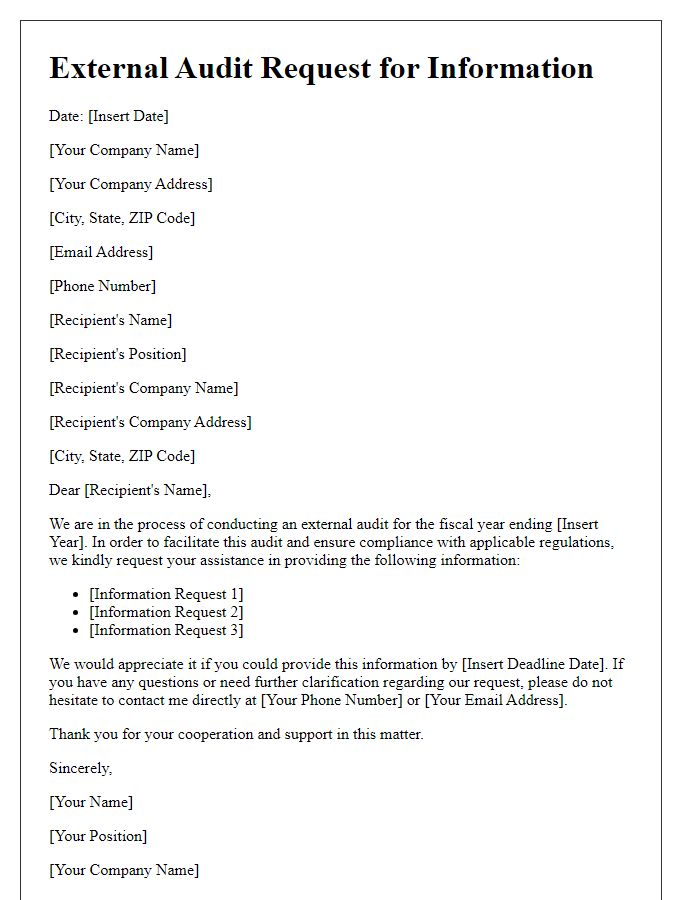

Required Documentation and Access

External audits are critical processes that ensure transparency and compliance within organizations. Auditors require specific documentation, such as financial statements, invoices, and contracts, typically spanning the fiscal year-end of December 31, as well as access to facilities, including corporate headquarters located at 123 Main Street, and branch offices across various states. Timely submission of requested documents prior to the audit commencement on April 15 can streamline the review process and enhance efficiency. Additionally, designated personnel, such as the Chief Financial Officer, should be available to facilitate information retrieval and provide clarity on any inquiries. Ensuring that all relevant records, including backup files and electronic databases, are organized and accessible can significantly aid auditors in their evaluations of compliance with accounting standards such as Generally Accepted Accounting Principles (GAAP).

Confidentiality and Compliance Guidelines

An external audit notification outlines critical confidentiality and compliance guidelines, ensuring stakeholders understand their roles during the audit process. The audit, conducted by a certified external firm, typically occurs annually, assessing financial records, operational efficiencies, and adherence to regulatory standards. Specific compliance requirements established under laws like the Sarbanes-Oxley Act mandate transparency, integrity, and accurate reporting. Key documents, including financial statements from the previous fiscal year, must be prepared for review. All personnel involved in the audit process should be aware of non-disclosure agreements (NDAs) to protect sensitive information. Additionally, the audit timeline generally spans several weeks, beginning with the planning phase in January and concluding with the final report released by March.

Comments