Are you considering a credit limit increase? Understanding the ins and outs of this process can empower you to make informed decisions about your financial future. With the right strategy, a higher credit limit can benefit your credit score and offer you greater purchasing power. So, let's dive into the details and explore how you can successfully request a credit limit increase!

Personal Information

Personal information is crucial for the credit limit increase process. This includes your name, address, and Social Security number for identification verification. Financial details such as annual income, employment status, and existing debts are also necessary to assess your creditworthiness. Additionally, credit score data from agencies like FICO or VantageScore provides insight into your credit history. Correct and up-to-date information ensures a smoother application process for obtaining higher credit limits with financial institutions. Accurate records of previous payment behaviors can significantly influence the decision on the credit limit increase.

Reason for Request

A credit limit increase request may be prompted by various factors. Increased income levels, such as securing a higher-paying job or receiving a promotion, can signify enhanced financial stability. Additionally, a growing credit score, potentially surpassing 700, indicates responsible credit management, including timely payments and low credit utilization. Major life events, such as marriage or the birth of a child, often lead individuals to reassess financial needs and goals. Moreover, larger purchases, including home renovations in areas like California or tuition fees for esteemed universities, may necessitate higher credit limits to accommodate unforeseen expenses or to maintain cash flow.

Current Credit Standing

Current credit standing reflects an individual's creditworthiness, typically indicated by a three-digit credit score ranging from 300 to 850. Factors influencing this score include payment history, credit utilization ratio, and length of credit history. Organizations such as FICO and VantageScore provide calculations based on data from major credit bureaus, including Equifax, Experian, and TransUnion. A high score, often above 700, suggests responsible credit management, whereas a lower score may indicate missed payments or high debt levels. Analyzing current credit standing is essential before requesting a credit limit increase, as lenders evaluate this metric alongside income and existing debt obligations.

Desired Credit Limit

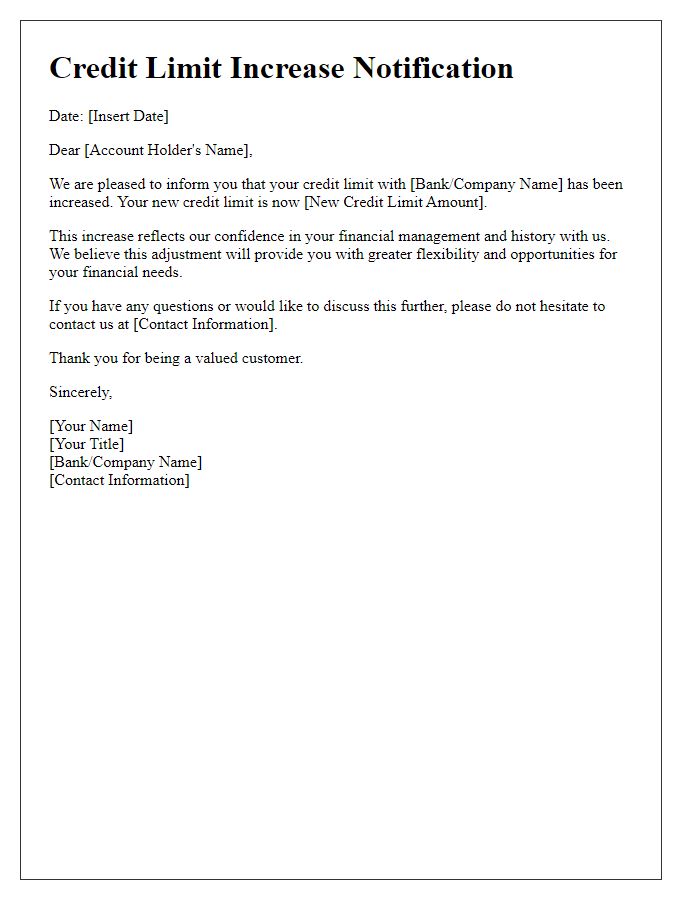

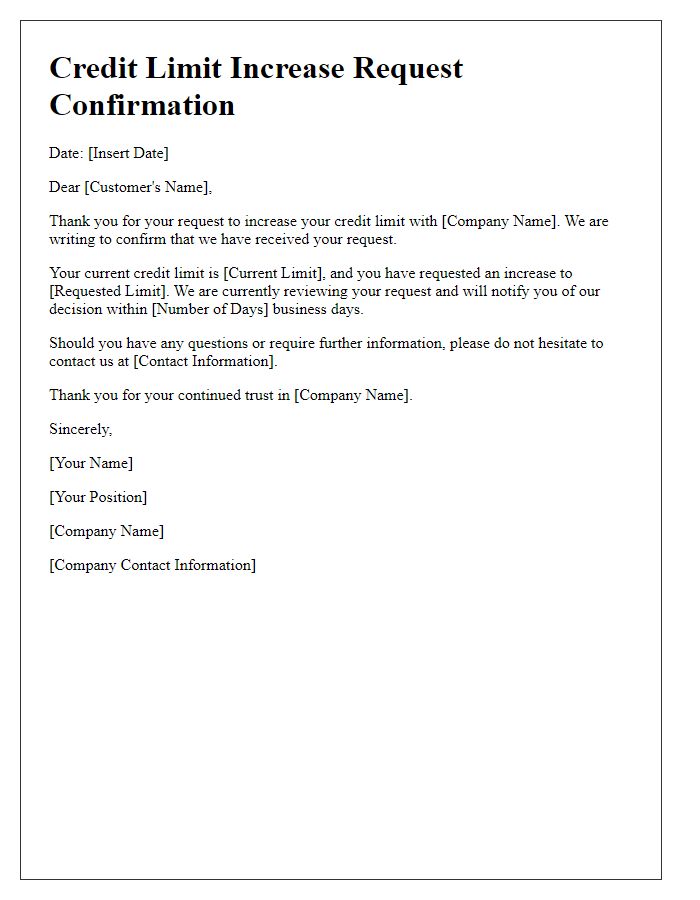

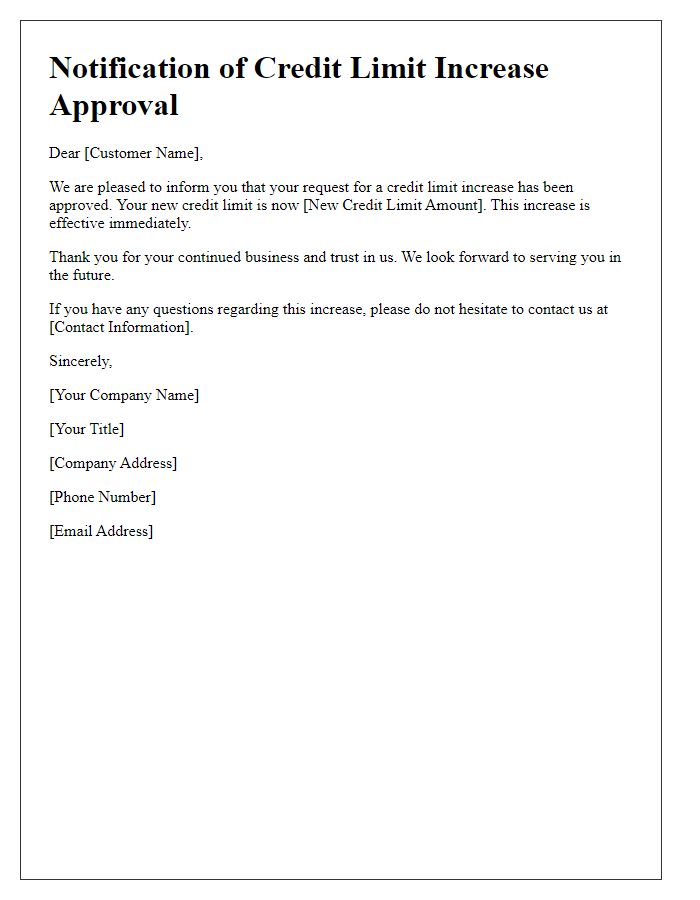

A credit limit increase request often involves careful consideration of various financial factors that affect an individual's creditworthiness. Applications typically include desired credit limit amounts, such as $5,000 or $10,000, depending on the applicant's financial history and income level. Credit agencies assess factors like payment history, credit utilization ratio (ideally below 30%), and outstanding debts to determine eligibility. Institutions may use a computer algorithm that evaluates the applicant's debt-to-income ratio (DTI), ideally kept below 36%, before approving the request. An increase can positively impact an individual's credit score (FICO scoring model ranges from 300 to 850) by improving their credit utilization rate, providing greater flexibility for expenses, emergencies, or larger purchases. Financial institutions usually communicate decisions via official letters and notifications, ensuring transparency in the process and maintaining a customer-friendly experience.

Supporting Financial Documentation

A credit limit increase notice often requires supporting financial documentation to verify the borrower's ability to manage increased credit responsibly. This documentation can include recent pay stubs, bank statements from institutions such as Chase or Bank of America, tax returns from the previous two years, and proof of other income sources such as rental properties or investment dividends. Creditors may also consider credit reports from agencies like Experian or TransUnion to assess the borrower's creditworthiness, ensuring their debt-to-income ratio remains within acceptable limits, typically below 36%. Additionally, including evidence of consistent payment history on existing credit accounts reinforces the argument for a higher limit while mitigating lender risk.

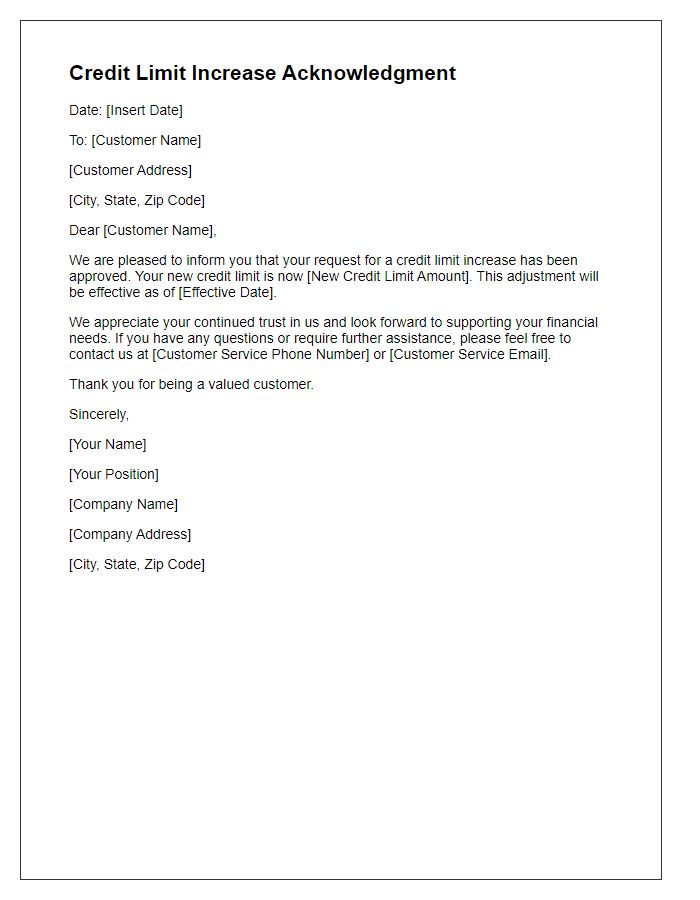

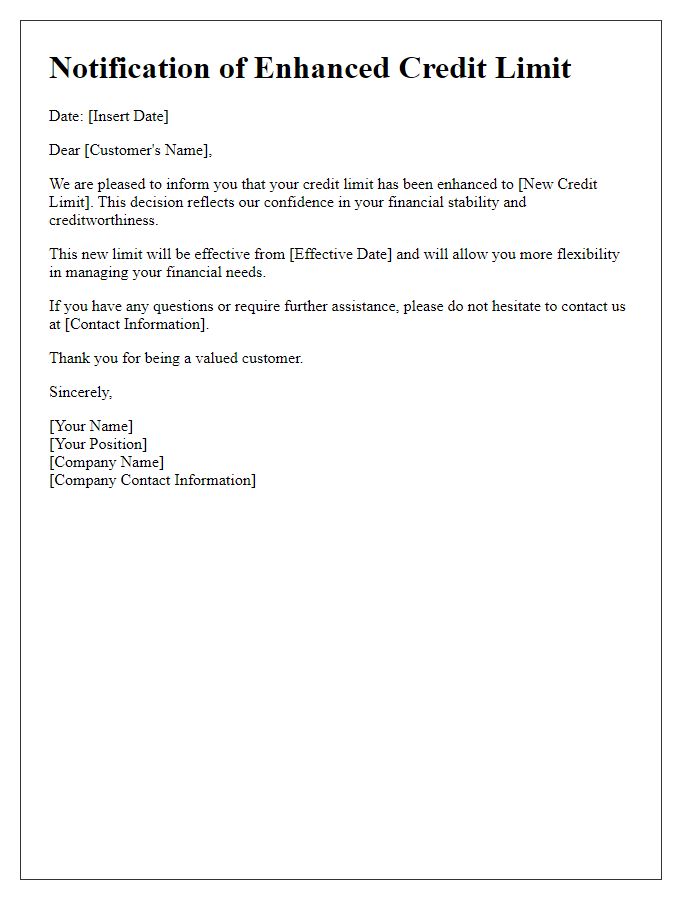

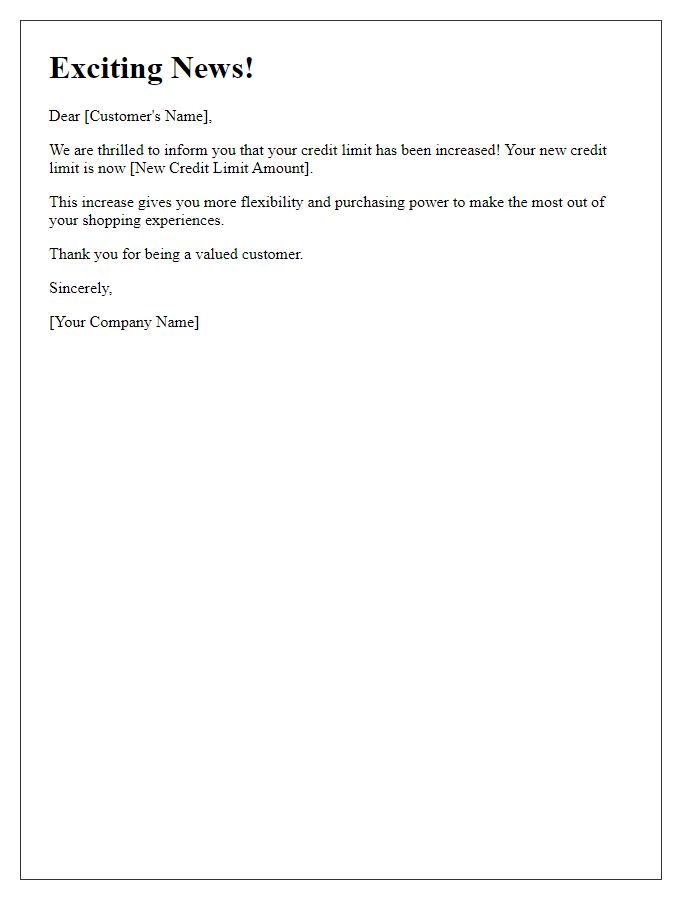

Letter Template For Credit Limit Increase Notice Samples

Letter template of Credit Limit Increase Notification for Account Holder

Comments