Are you involved with an NGO and wondering how to ensure your organization meets legal compliance standards? Navigating the complex world of regulations can be daunting, but securing your legal compliance certification is a crucial step toward building trust and credibility. By understanding the requirements and taking action, you can safeguard your mission and support your community effectively. Ready to dive deeper into the process? Keep reading to learn more!

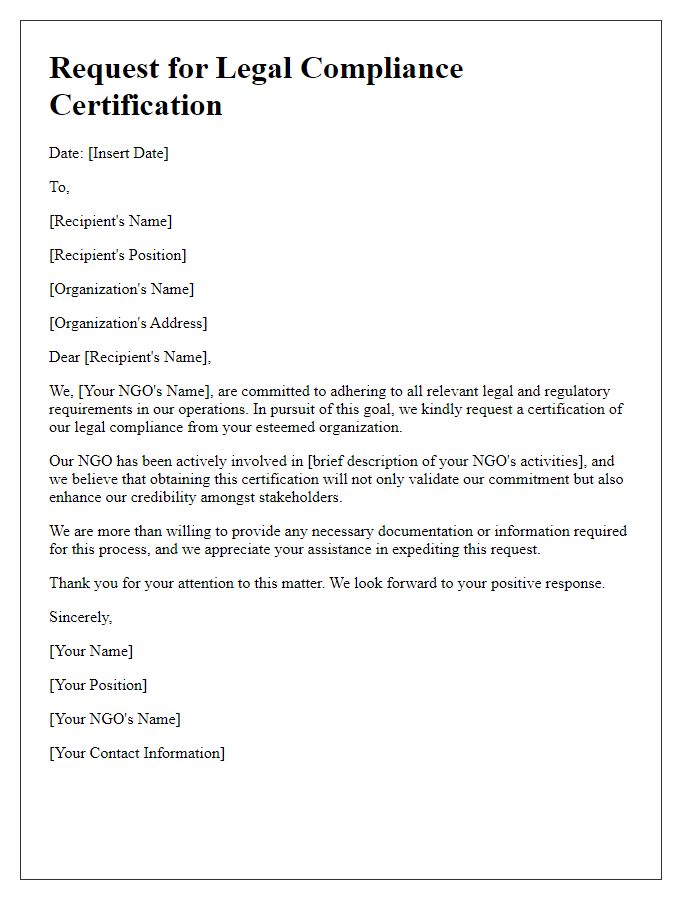

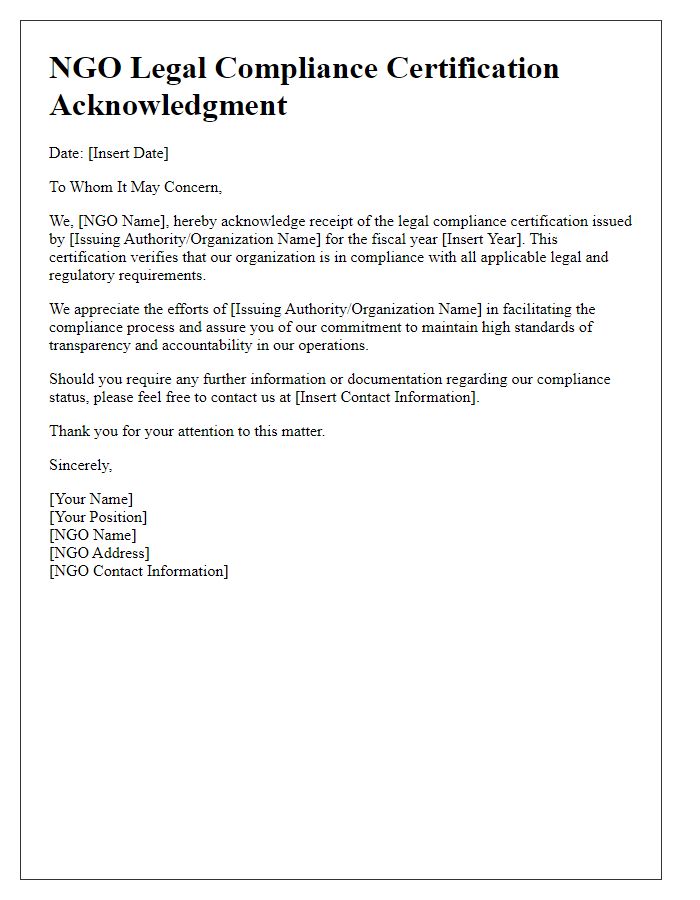

Organizational Name and Contact Information

The organizational name, such as "Global Welfare Initiative" (GWI), represents a non-governmental organization focused on social justice, health, and education. Contact information, including a designated email address (info@gwi.org) and phone number (+1-202-555-0123), facilitates communication with stakeholders and regulatory bodies. Address details, like 123 Humanitarian Lane, Washington, DC 20001, help verify the legitimacy of operations within legal frameworks. This organization participates in programs that align with local and international compliance standards, ensuring transparency and accountability in its mission. Legal compliance certification confirms that GWI adheres to the stipulations set forth by authorities like the Internal Revenue Service (IRS) and local governing bodies, enabling eligibility for grants and partnership opportunities.

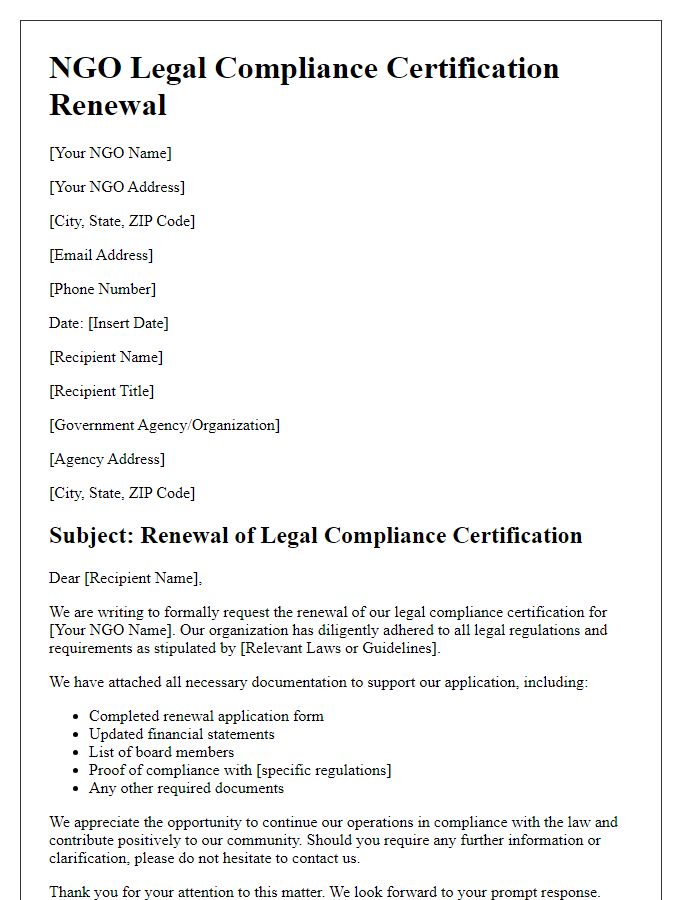

Legal Registration Details and Tax Identification

Legal registration of non-governmental organizations (NGOs) provides essential recognition and operational legitimacy in their respective countries, such as the United States or India. This often involves obtaining a unique registration number, reflecting the organization's legal status, which can be verified on government databases. An NGO's Tax Identification Number (TIN) is critical for compliance with tax regulations and allows the organization access to benefits such as tax-exempt status or eligibility for grants. In the United States, the IRS assigns a TIN for federal tax purposes, while in India, the Permanent Account Number (PAN) serves a similar role. Proper documentation and adherence to the guidelines set forth by local and national authorities are crucial for maintaining legal compliance and fostering trust within the community.

Statement of Compliance with Relevant Laws

Non-Governmental Organizations (NGOs) must adhere to specific legal frameworks to maintain their operational integrity, such as the Charitable Organizations Act 2006 in the United Kingdom or the Internal Revenue Code, particularly Section 501(c)(3) in the United States. Compliance entails rigorous adherence to regulations encompassing financial reporting, fundraising practices, and organizational governance. Documented evidence including annual financial statements, donor agreements, and board meeting minutes should be generated to support compliance claims. Failure to comply may result in penalties, including revocation of tax-exempt status or legal actions from regulatory bodies such as the IRS or the Charity Commission. Regular audits and legal consultations are advisable to ensure all operational practices align with the relevant laws and guidelines.

List of Attached Supporting Documents

The list of attached supporting documents for NGO legal compliance certification includes the following: Certificate of Incorporation (official registration from the government), By-Laws (the organization's governing document outlining its purpose and procedures), Tax Exemption Letter (confirmation from the Internal Revenue Service or local taxation authority), Board Meeting Minutes (detailed records showing decision-making processes within the NGO), Financial Statements (audited annual accounts, including balance sheets and income statements), Annual Reports (publications summarizing the activities and achievements over the past year), Project Proposals (detailed descriptions and objectives of past and upcoming projects), Memorandum of Understanding (agreements with other organizations or stakeholders), and Policymaking Documentation (records of adopted policies regarding governance, ethics, and compliance). Each document serves to validate the adherence to regulatory standards necessary for maintaining operational legitimacy in the nonprofit sector.

Contact Person for Further Inquiries

The contact person for further inquiries at the NGO concerning legal compliance certification is John Smith, the Compliance Officer. With over ten years of experience in non-profit sector regulations, John is located at the headquarters in Springfield, USA. He is responsible for overseeing adherence to federal and state laws, including the Internal Revenue Service regulations that govern non-profit organizations. Interested parties can reach John via email at john.smith@ngomail.org or by phone at (555) 123-4567 during office hours from 9 AM to 5 PM EST. He is well-versed in the application processes and documentation required for certification, making him a valuable resource for any compliance-related questions.

Comments