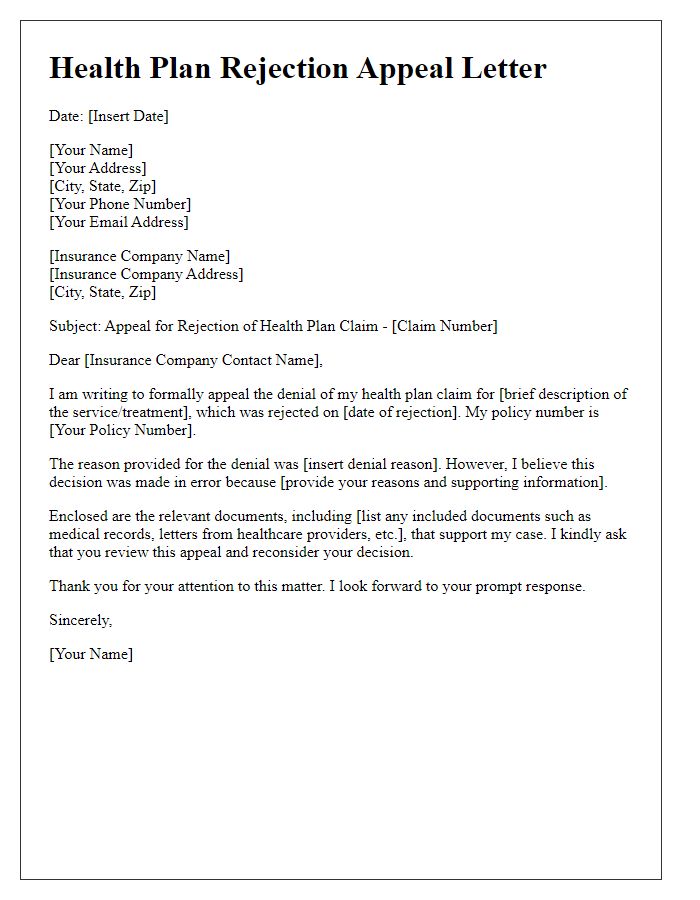

Navigating the world of medical insurance can sometimes feel like a daunting challenge, especially when you face a claim denial. Writing an effective appeal letter is crucial in ensuring that you receive the coverage you deserve for necessary medical treatments. It's all about clearly stating your case and providing the right documentation to support your request. If you're looking for guidance on crafting a persuasive appeal letter for your medical insurance, keep reading for some valuable tips and templates to help you through the process!

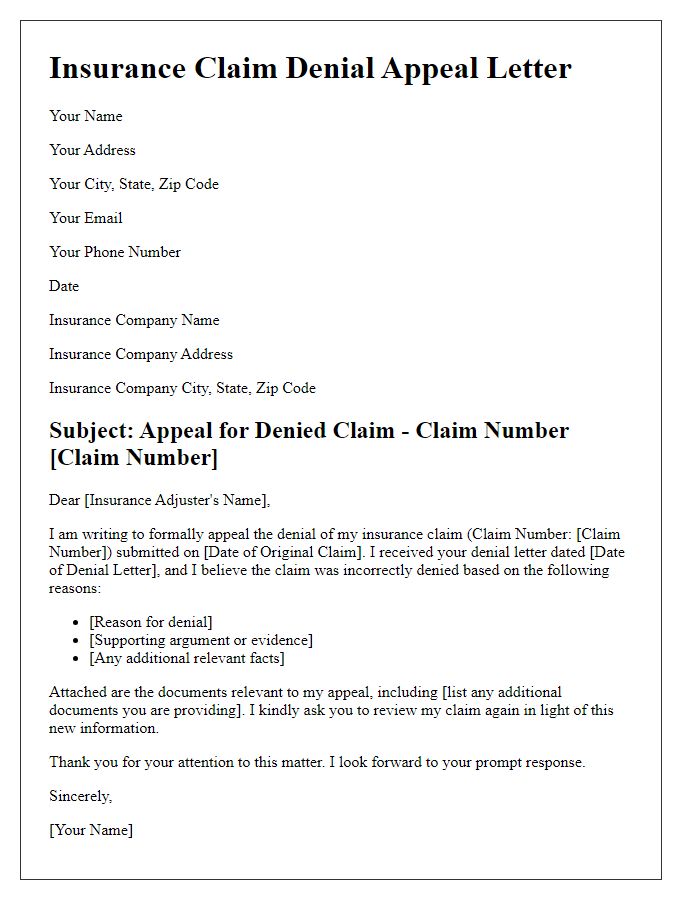

Patient Information

Medical insurance appeals require clear and detailed patient information to facilitate the review process. Essential details include the full name of the patient, which aligns with the records of the insurance provider, and the date of birth (DOB) for accurate identification, as well as the patient's insurance policy number--typically a combination of letters and numbers specific to the individual. Important contacts include the address of the patient for correspondence and potentially a phone number for direct communication. Additionally, including the name of the healthcare provider and the specific date of the medical service in question enhances clarity and allows for a focused review of the appeal related to the denied claim by the insurance company.

Insurance Policy Details

The appeal for medical insurance regarding the policy details often involves the specific coverage plan, including the policy number (a unique identifier for the insurance coverage), the claimant's name (the individual who holds the insurance), and the service date (the date on which the medical service was provided). It's crucial to detail specific benefits outlined in the policy, such as maximum coverage limits, copayment amounts, and exclusions (services not covered by the insurance). Providing documentation, such as medical bills and treatment summaries, supports the appeal, validating the necessity of the treatment and demonstrating that it falls within the prescribed insurance benefits. Furthermore, citing relevant medical guidelines or precedents can strengthen the case for reconsideration of the denied claim.

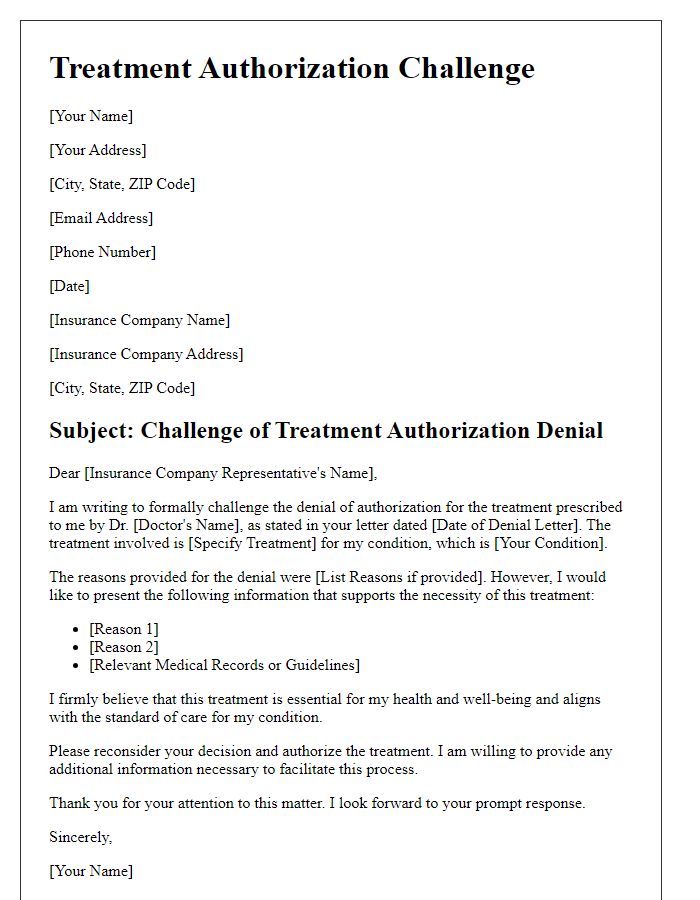

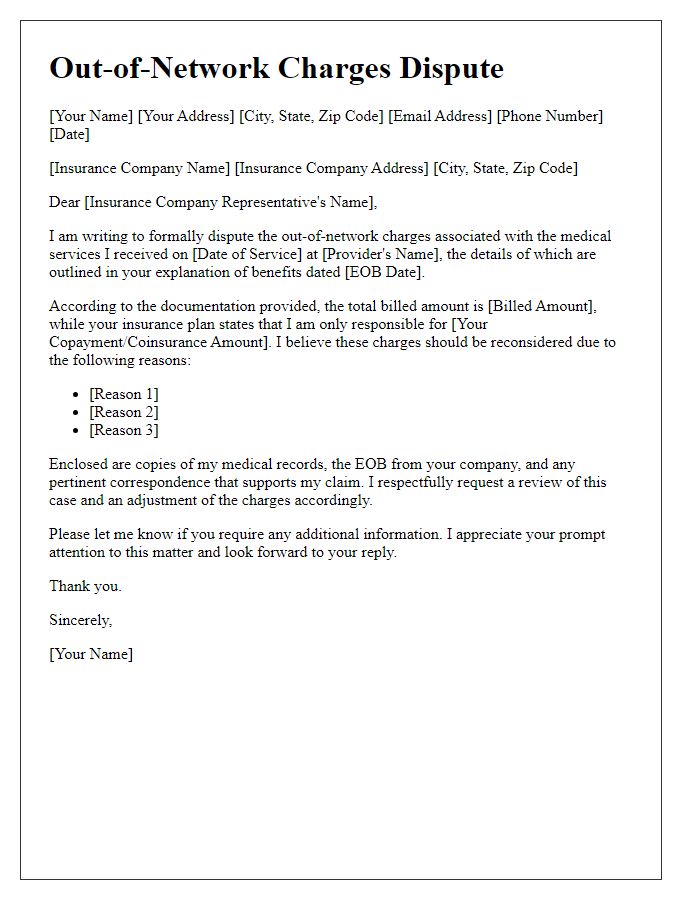

Clear Description of Denied Claim

A denied medical insurance claim presents a significant challenge for patients seeking necessary healthcare services, often due to complex policy guidelines. For instance, a claim submitted for a diagnostic imaging procedure, such as an MRI (Magnetic Resonance Imaging), may be denied under the rationale that it was not deemed "medically necessary" according to the insurer's criteria. It's crucial to provide specific details from the insurance policy, including page numbers and sections, which outline the coverage for such services. Additionally, including dates of service, the total amount billed, and the reason for denial, as stated in the official communication from the insurer, adds clarity. Furthermore, referencing relevant medical recommendations from healthcare providers, along with supporting documentation, can strengthen the appeal.

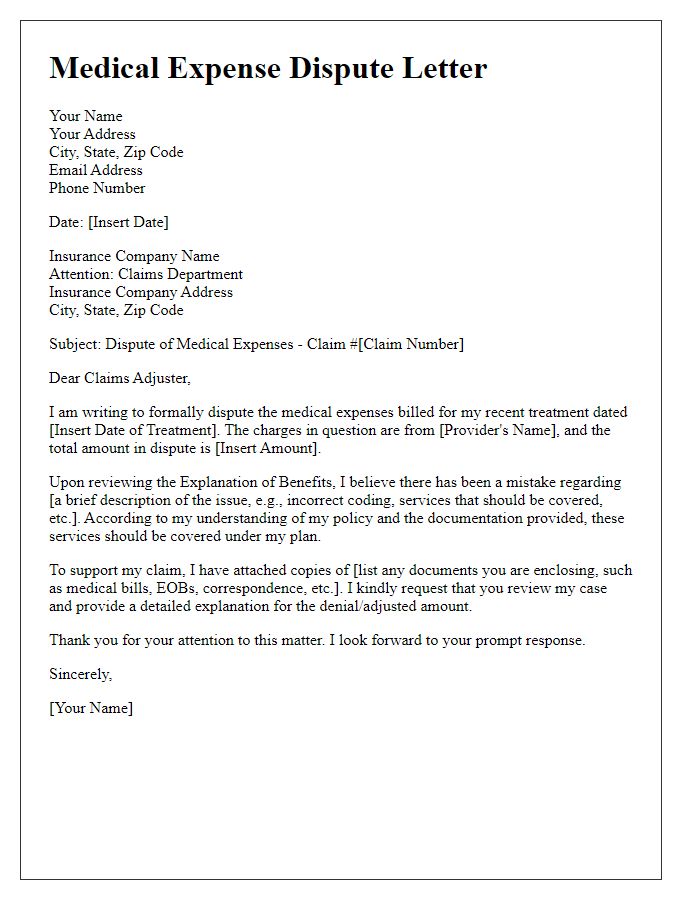

Supporting Medical Documentation

Medical insurance appeals often require thorough supporting medical documentation to justify the need for specific treatments or procedures. Essential documents include comprehensive medical records, such as diagnostic imaging reports (e.g., MRI, CT scans), physician's notes detailing patient history and treatment rationale, and treatment plans outlining proposed interventions. Additionally, any letters of medical necessity from healthcare providers, showing the alignment of care with established treatment guidelines, can be pivotal. Detailed prescription records, including medication history, demonstrate attempted lesser interventions prior to the requested services. All records should include patient demographics (name, date of birth, insurance information) and be organized chronologically to provide a clear narrative of the patient's medical journey.

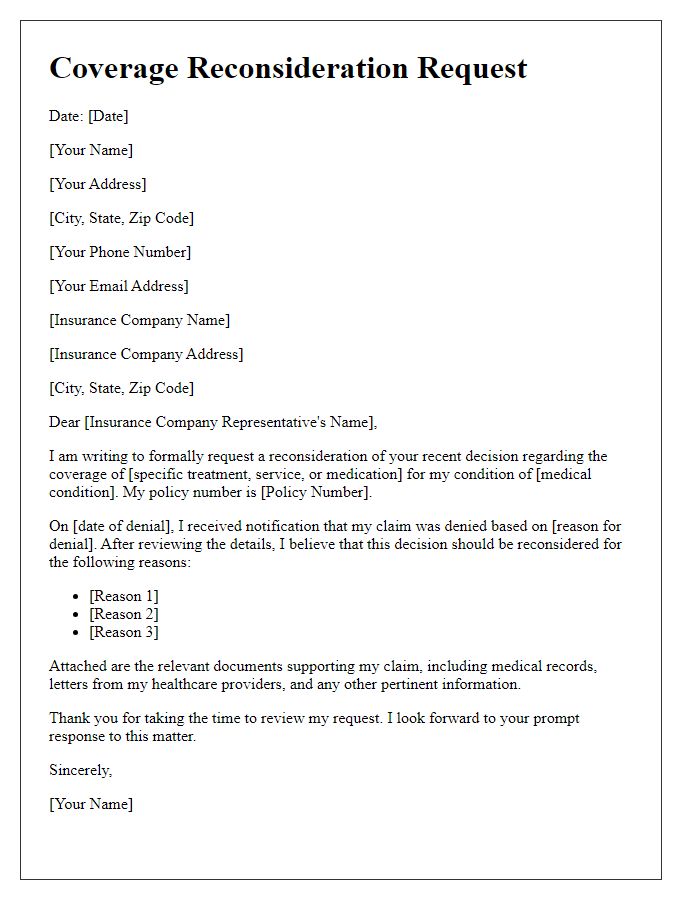

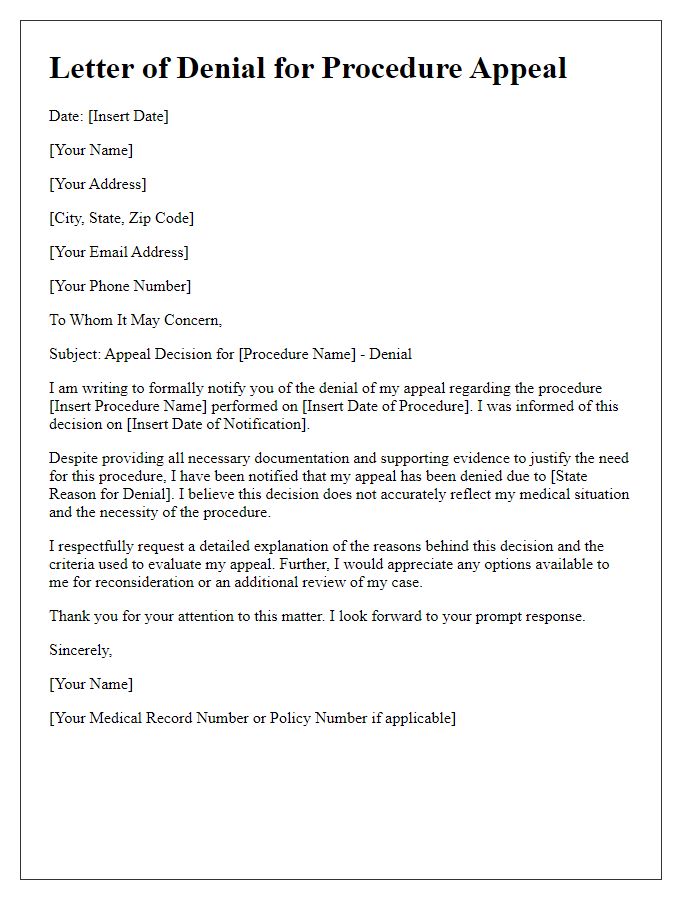

Reason for Reconsideration

Insufficient coverage details in the initial medical claim submission identified as a reason for denial. The treatment of chronic conditions like diabetes requires comprehensive management, including necessary medications and regular monitoring. The claim related to insulin therapy and glucose monitoring supplies, totaling $1,200, was deemed non-essential by the insurance provider, despite these items being critical for maintaining health and preventing complications. Relevant guidelines from the American Diabetes Association specify that regular glucose checks and insulin administration are vital for preventing severe health risks. Additionally, the review highlighted that previous claims for similar treatments had been approved, indicating inconsistency in case handling. Timely access to appropriate care plays a significant role in patient outcomes, underscoring the urgency for a reconsideration of the original denial.

Comments