Are you feeling overwhelmed by medical debt? It's a common struggle that many individuals face, and navigating the world of debt settlement can seem daunting. Fortunately, understanding how to negotiate and settle your medical bills can lead to financial relief and peace of mind. If you're interested in learning more about effective strategies for tackling medical debt, read on!

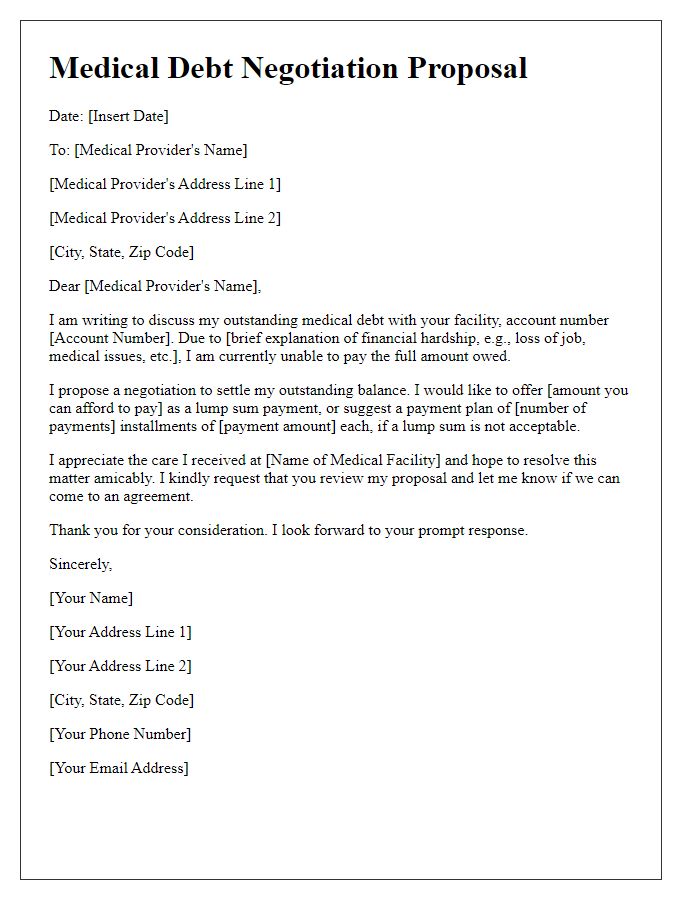

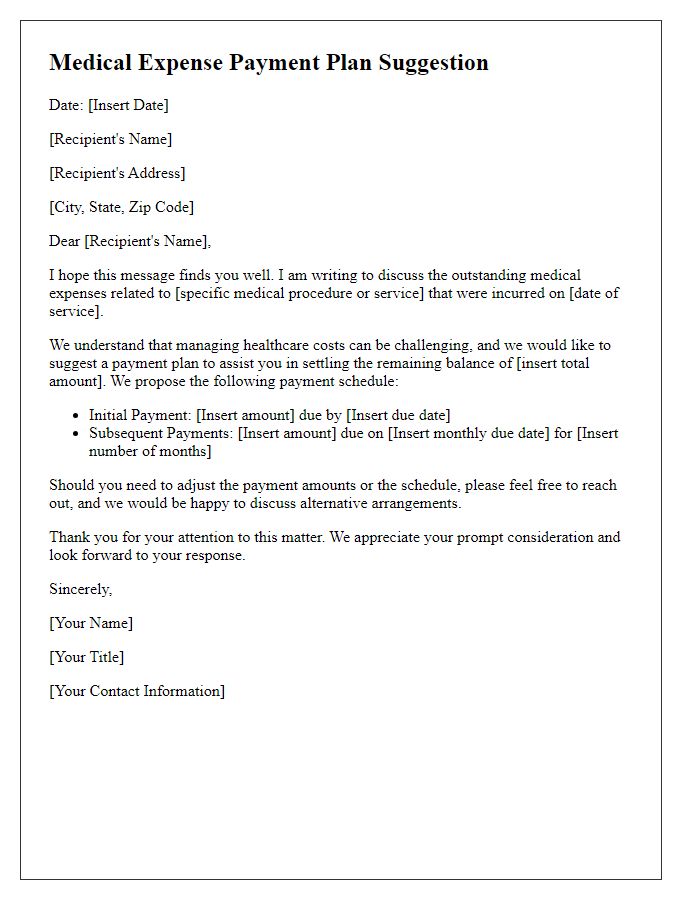

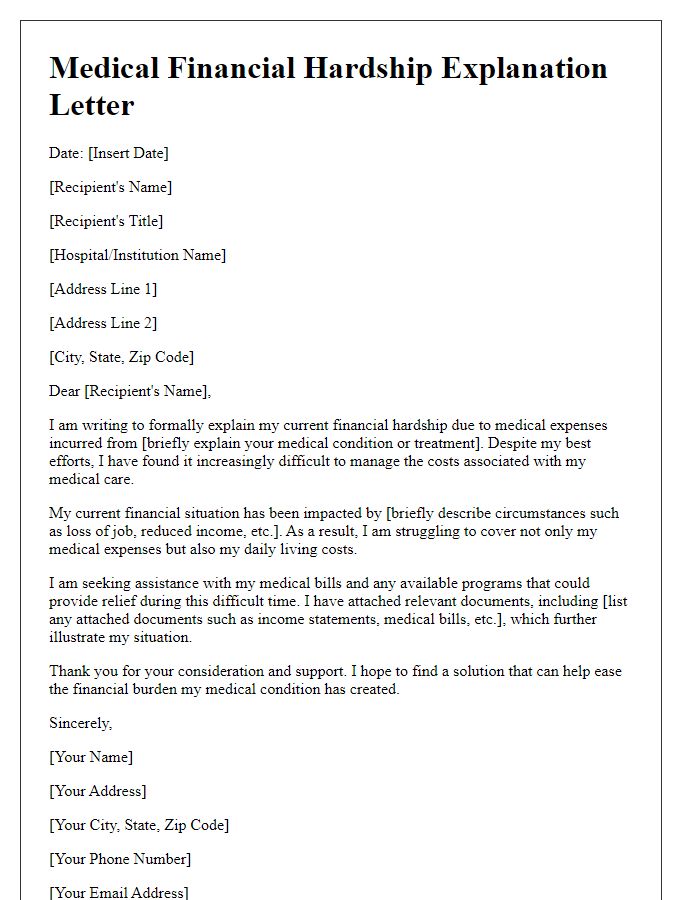

Debtor's personal information

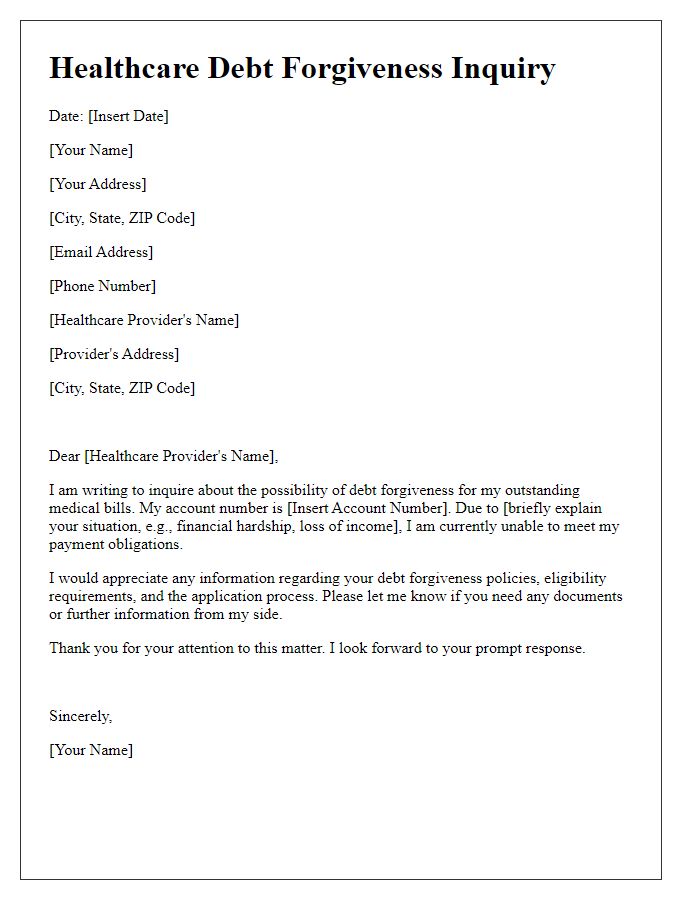

Medical debt settlement involves negotiating the amount owed to healthcare providers or collection agencies for services rendered. Patients, often facing financial distress, seek to reduce their outstanding balances. Essential personal information may include full name, address, contact number, and date of birth. Additionally, details about the medical services received, including dates of service, hospital or clinic name, and account numbers, play a critical role. Financial hardship documentation, such as income statements or unemployment letters, helps demonstrate the inability to pay the full amount. Engaging a professional negotiator or credit counselor can enhance the chances of a favorable settlement.

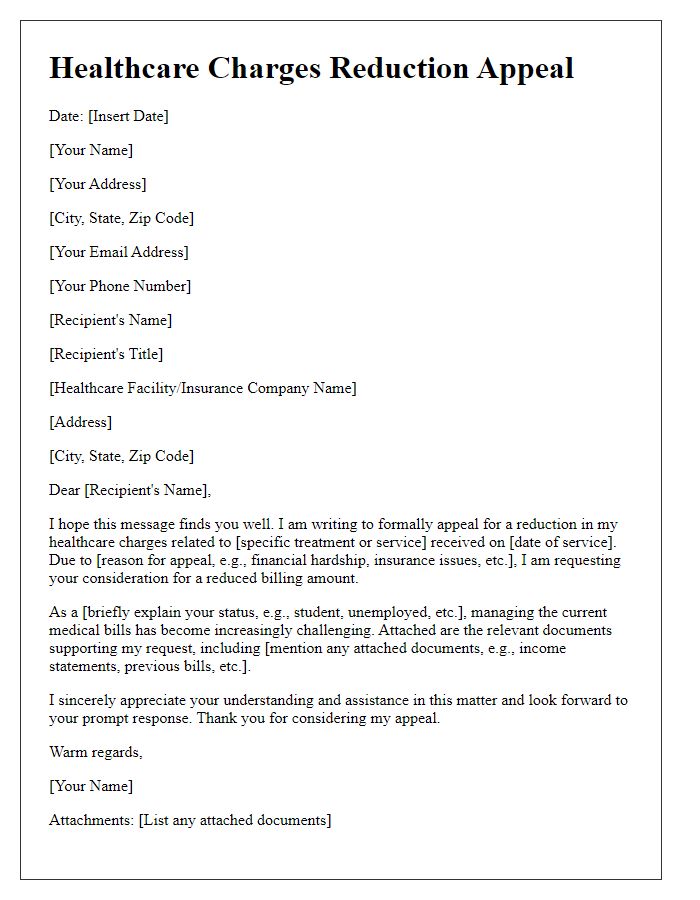

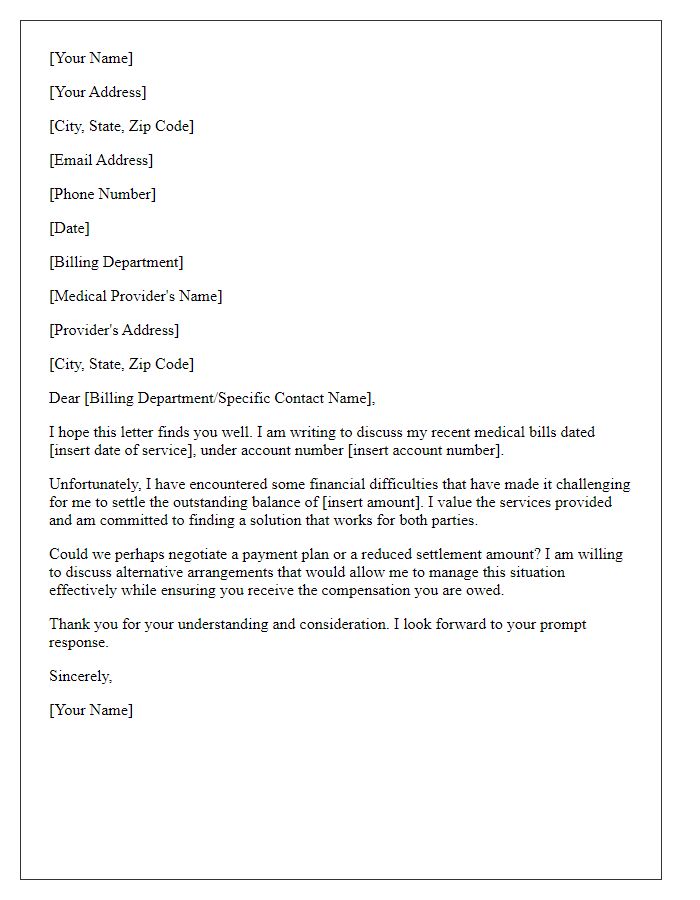

Creditor's details and account number

Medical debt can accumulate rapidly due to unexpected healthcare events, such as emergency surgeries, hospital stays, or ongoing treatments for chronic illnesses. When dealing with a creditor, it is crucial to reference specific details about the account, including the account number assigned to the debt (typically a series of digits unique to the individual account). The creditor's details, including the name of the healthcare provider or collection agency (such as a hospital, physician group, or specialized debt collector), also play a significant role in clarifying the context of the debt. Addressing the creditor directly can facilitate negotiations for a settlement, which often involves offering a reduced payment to clear the debt, particularly if hardships like job loss, high medical bills, or financial difficulties are cited.

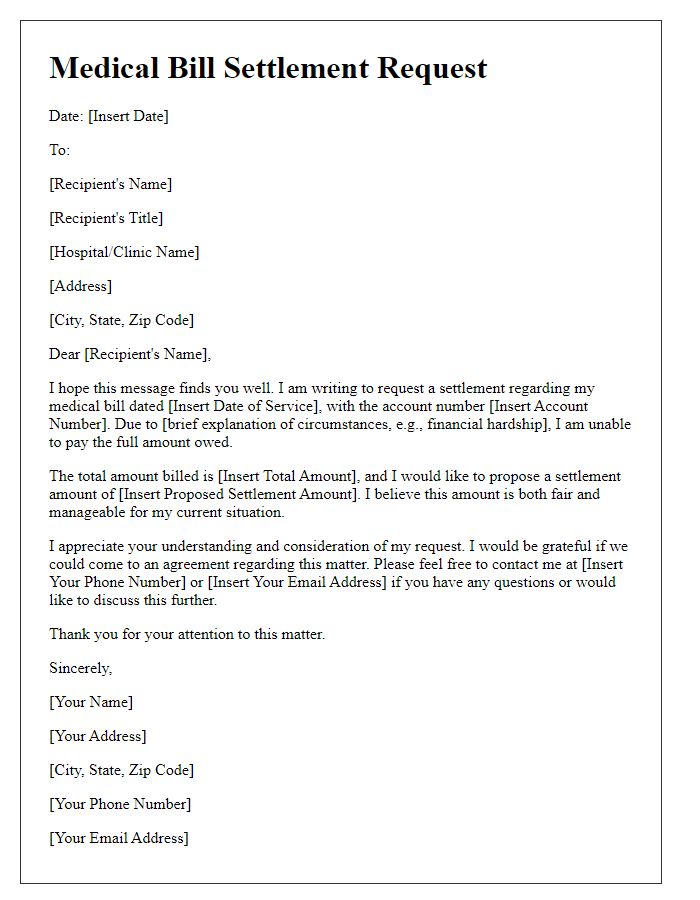

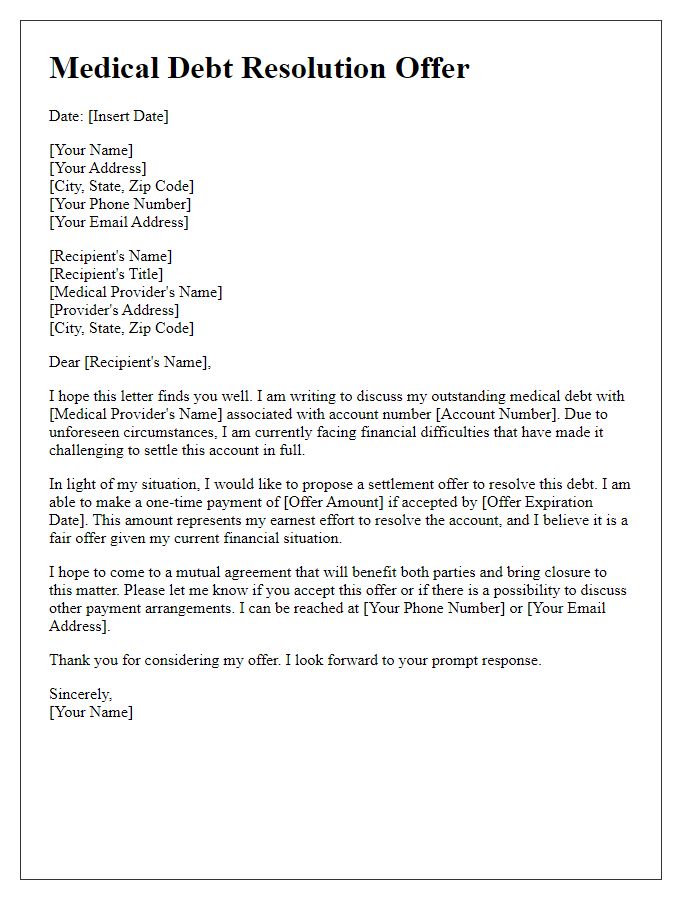

Reason for financial hardship

Patients experiencing significant financial hardship often cite various factors affecting their ability to manage medical debt effectively. Common reasons include abrupt job loss, which may reduce income by up to 100% due to unemployment; overwhelming medical expenses from chronic conditions, which can reach thousands of dollars annually; and unexpected emergencies leading to urgent care visits, often incurring costs exceeding $1,000. Additionally, the rising cost of living, particularly in urban areas such as New York City or Los Angeles, can strain budgets, making it difficult to prioritize medical bills. Furthermore, lack of health insurance coverage or high deductibles can exacerbate financial stress, resulting in mounting debt over time. Patients frequently express concerns regarding the impact of these circumstances on their overall well-being and financial stability.

Proposed settlement amount and terms

Medical debt can impact your financial health significantly. In situations regarding settlement negotiations, clear propositions become essential for resolution. A settlement amount usually falls between 30-50% of the original medical bill, depending on your financial circumstances and the creditor's willingness. For instance, a hospital bill of $10,000 might be negotiated down to a settlement of $3,000, paid in lump sum or installments. The terms of the agreement can include deadlines for payment, potential cancellation of further collection attempts, and impact on credit reporting. Key details like the name of the healthcare provider, account numbers, and any existing payment plans must be highlighted to ensure clarity and compliance from both parties. Proper documentation is vital, as it protects against unexpected future claims related to the settled debt.

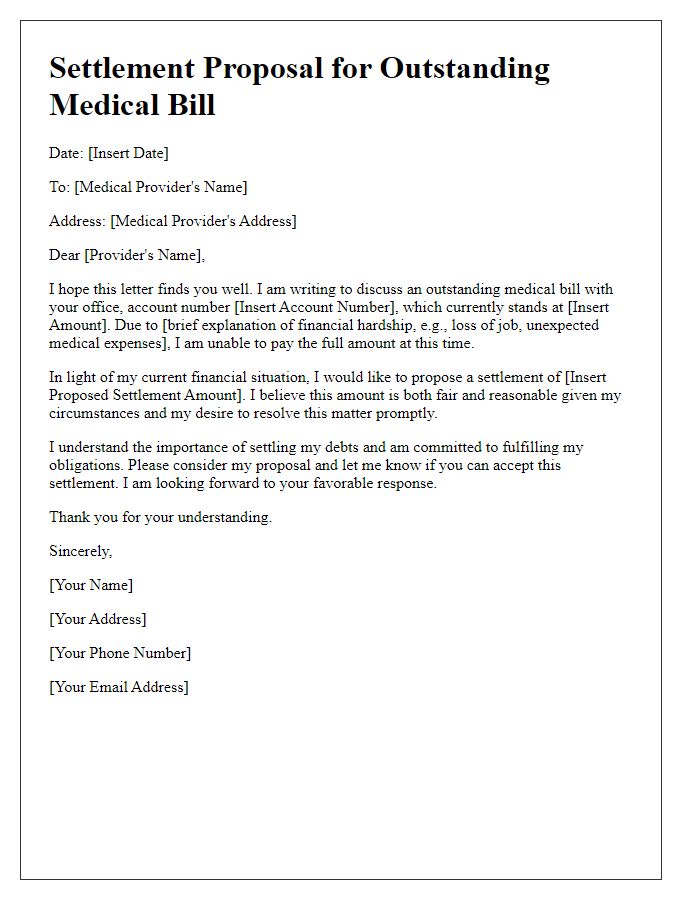

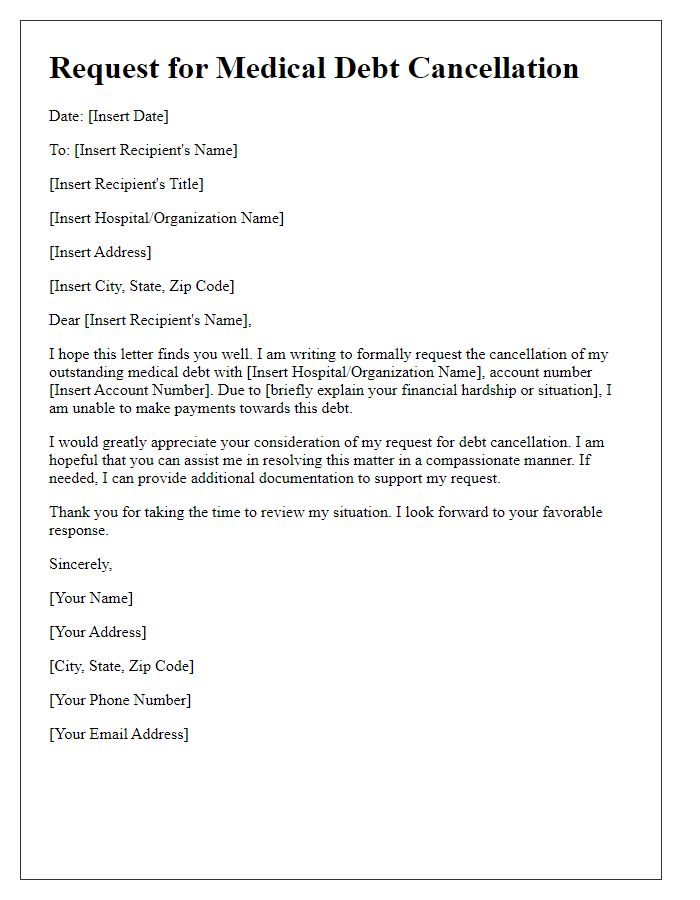

Request for written confirmation of agreement

Medical debt settlement agreements often involve delicate negotiations between patients and healthcare providers or collection agencies. After reaching an agreement, it is crucial to obtain formal confirmation. This written confirmation serves as a legally binding document that outlines the terms of the settlement, such as the reduced amount to be paid, the timeline for payment, and any conditions regarding future credit reporting. Ensuring that this confirmation is specified can help prevent misunderstandings and ensure compliance with the agreed terms, which may include a specific payment plan over several months or a lump sum payment. Retaining this documentation is essential for protecting consumer rights and providing evidence in case of future disputes.

Comments