Hey there! We all know that keeping track of bills can sometimes get a bit tricky, right? That's why we're here to make it easy for you with our straightforward billing reminder template. Whether you need a simple nudge for an upcoming payment or a more detailed notice for a past due balance, we've got you covered â so let's dive in and explore how to make your billing reminders effective and engaging!

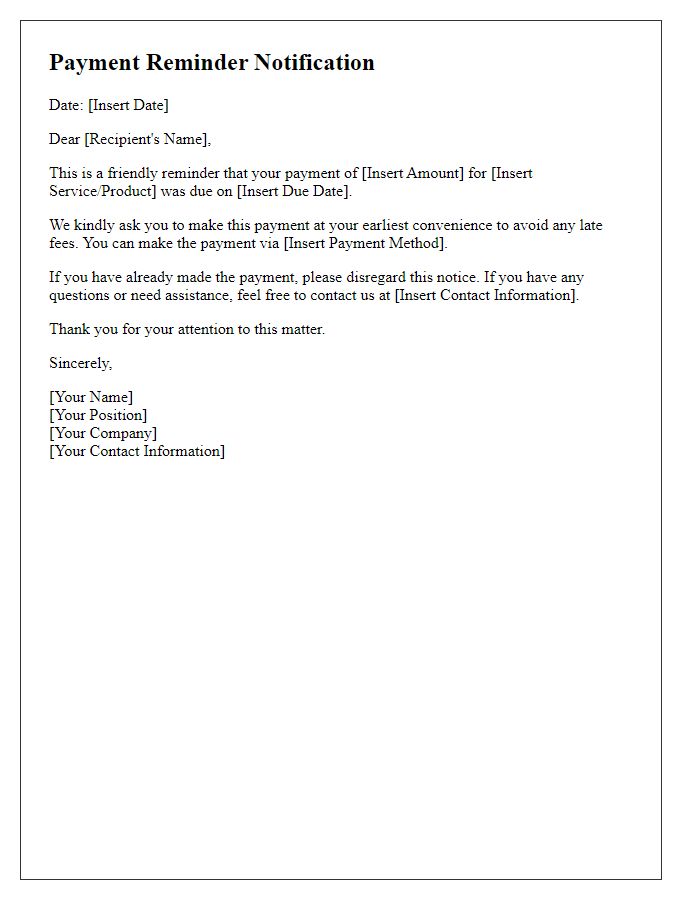

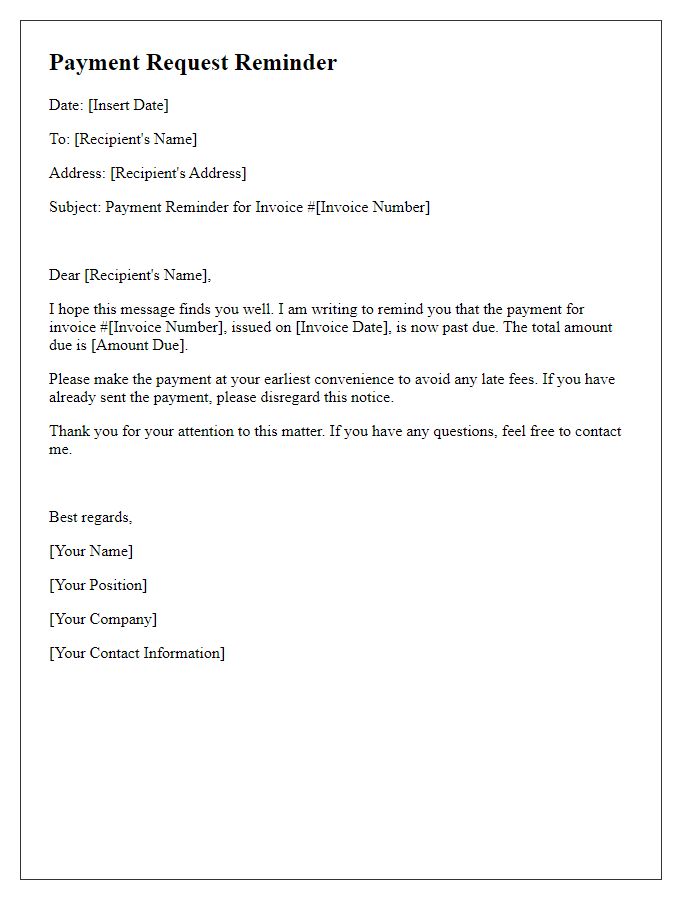

Subject line and header.

Billing reminders serve as crucial notifications for maintaining timely payments from clients or customers. An effective billing reminder notice may contain a subject line such as "Friendly Reminder: Invoice Payment Due Date Approaching." The header could feature the company's logo prominently at the top, followed by contact details, such as the business name, address, phone number, and email, to enhance brand recognition and facilitate easy customer communication. Incorporating elements like the invoice number and due date in bold can further underscore the urgency of the message.

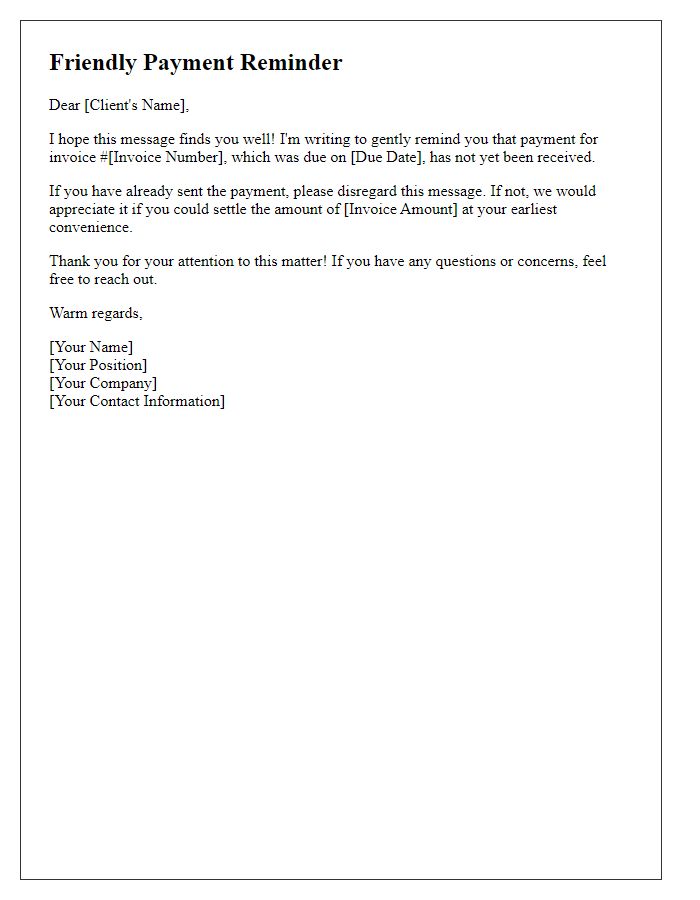

Personalized recipient details.

In September 2023, many businesses, especially in urban centers like New York City, faced challenges with timely payments from clients. Xyz Corp, a fictional consulting company, implemented a series of billing reminder notices to address overdue invoices exceeding 30 days. These notices contained personalized recipient details, including name, service description (marketing analysis), and invoice number. The reminders emphasized the due amount ($1,500) and provided various payment methods, such as direct bank transfers or online payment portals. Additionally, the notices mentioned a grace period of 10 days before late fees were applied, highlighting the importance of maintaining good relationships with clients while ensuring prompt payments.

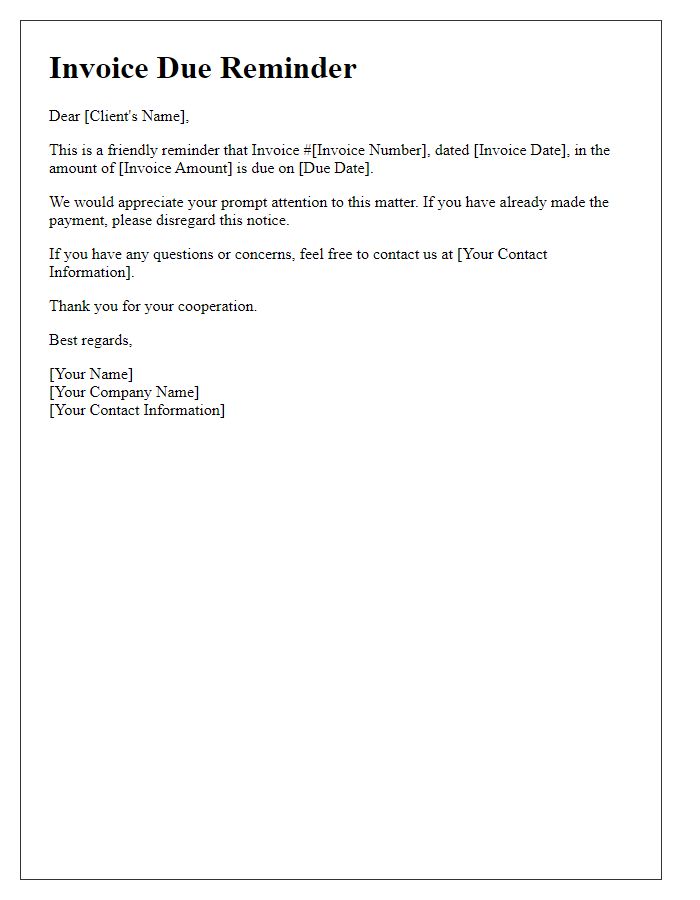

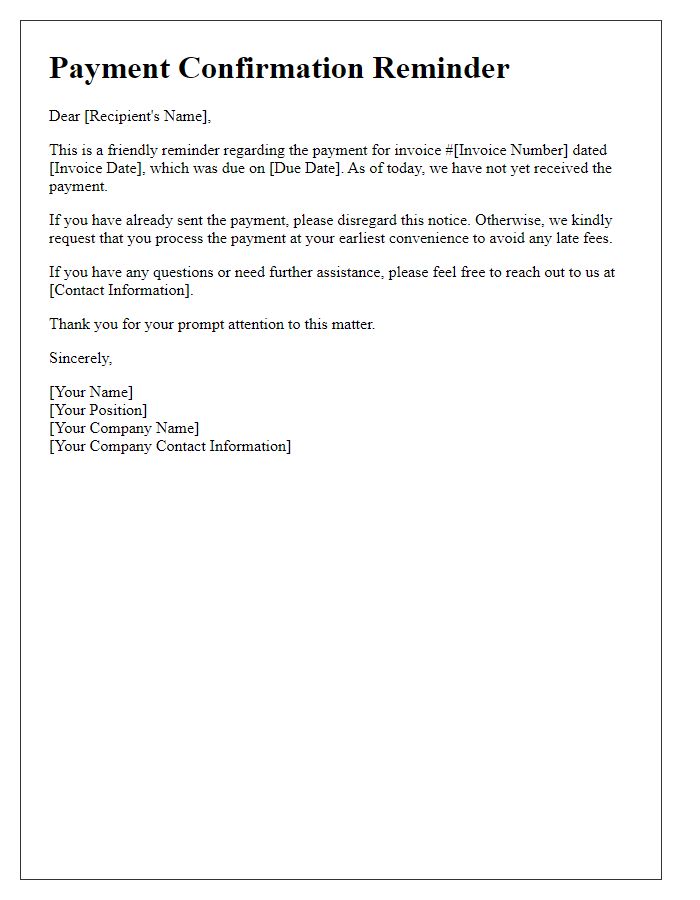

Clear statement of overdue payment.

An overdue payment notice serves as an essential reminder for clients regarding outstanding invoices. This document typically includes the payment amount, due date, and a clear statement indicating the duration of the delay, often exceeding 30 days. Legal entities like businesses, particularly in the finance and service sectors, rely on timely payments to maintain operations. Including account details, such as invoice numbers and payment methods, enhances clarity. Furthermore, a polite yet firm tone can encourage prompt resolution, fostering a professional relationship while ensuring financial obligations are met promptly.

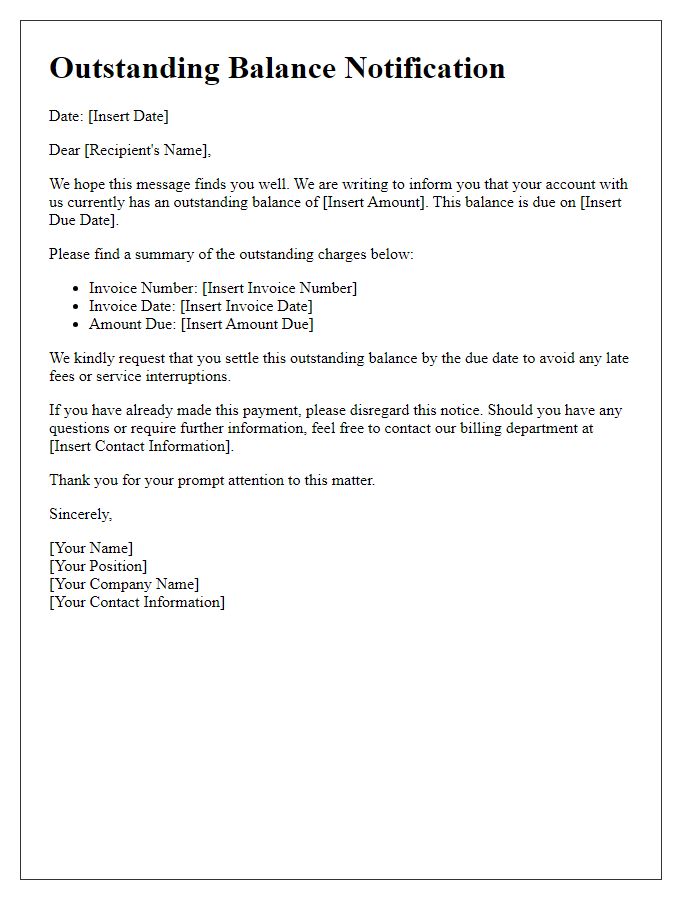

Payment options and deadline.

Timely payments are crucial for maintaining smooth business operations. The billing reminder notice (typically sent 30 days after the original invoice date) emphasizes payment options available to clients, such as credit card, bank transfer, or online payment portals, enhancing convenience. Clear deadlines, originating from specific invoice due dates, foster accountability. For instance, if the due date is December 1, clients must complete payments before December 15 to avoid late fees, which can reach up to 5% of the overdue amount. In addition, inclusion of contact details for support ensures customers can easily resolve any queries or concerns regarding their bills.

Contact information for queries.

Billing reminders serve as notifications for outstanding payments, often issued by service providers or financial institutions. Many companies include contact information, such as a dedicated customer service phone number (usually toll-free) and email addresses for queries related to billing concerns. Timely reminders enhance cash flow management and reduce late payment occurrences. Properly formatted billing notices include due dates, amounts owed, and a brief summary of services provided. This approach ensures that customers remain informed and motivated to settle their accounts promptly.

Comments