Are you exploring financing options for your upcoming projects? Understanding the right financial approach can make all the difference in turning your vision into reality. Whether you're a seasoned entrepreneur or just starting out, there are various pathways you can consider that cater to your unique needs. Join me as we delve deeper into these financing alternatives and discover the best fit for you!

Greeting and Introduction

A comprehensive financing option presentation requires a thoughtful approach to greeting and introducing the relevant topics. Begin with a warm welcome to all participants, establishing a positive atmosphere. Introduce yourself by providing your name, position, and organization, such as "John Smith, Senior Financial Consultant at ABC Finance Group." Highlight the purpose of the presentation, emphasizing key aspects like innovative financing strategies, potential investment opportunities, and expected outcomes. Briefly outline the agenda, mentioning specific sections like risk assessment and financing alternatives, ensuring all participants understand the structure and significance of the discussion. This establishes clarity and prepares the audience for an engaging and informative session.

Purpose and Benefits

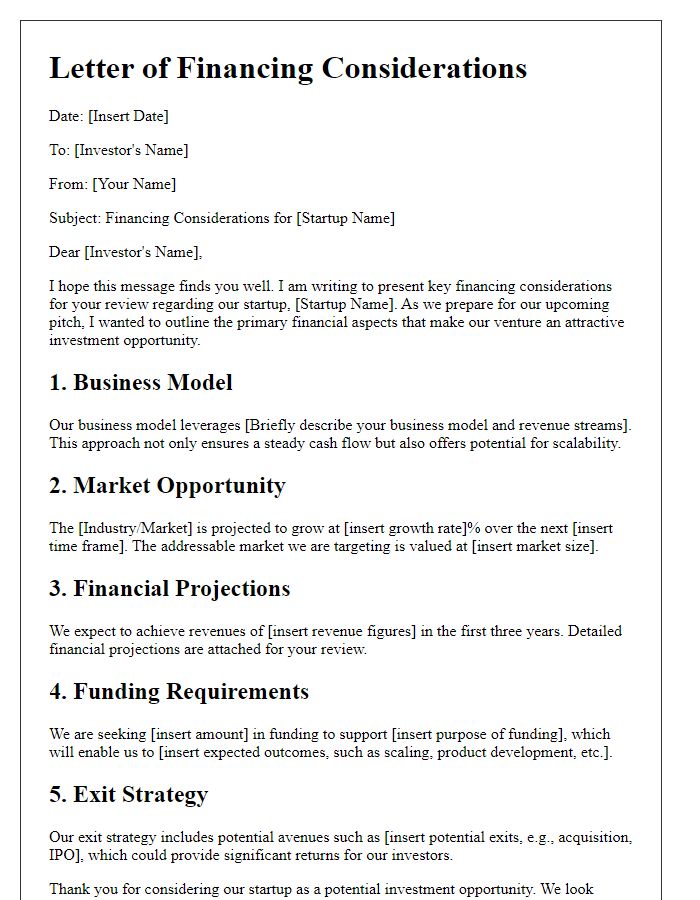

Presenting financing options for new projects or products allows organizations to explore various funding sources to meet financial goals. Diverse financing methods, such as bank loans, crowdfunding, or venture capital, provide unique advantages, including increased liquidity and reduced cash flow pressure. With the right financing structure, businesses can invest in growth initiatives, enhancing market reach and competitive positioning. Furthermore, effective financing strategies can lead to more favorable terms for repayment, establishing long-term financial stability and fostering innovation. Understanding these financing options is essential for informed decision-making and achieving overall business objectives.

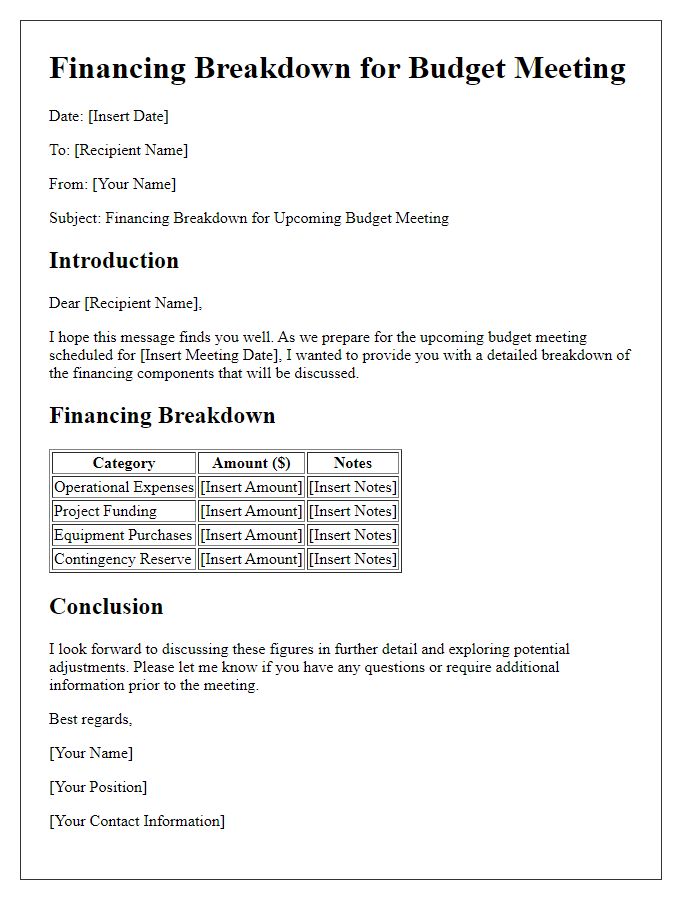

Financial Details and Options

In a financial presentation regarding funding opportunities, detailed breakdowns of options can significantly impact decision-making for stakeholders. Typical financing options include pathways such as secured loans, which often require collateral, and unsecured loans, offering flexibility but potentially higher interest rates. Leasing arrangements enable businesses to acquire equipment without heavy upfront costs, while venture capital funding introduces investors eager to support innovation in exchange for equity. Each financing route presents unique advantages and risks. For instance, Small Business Administration (SBA) loans offer lower interest rates but involve lengthy approval processes. Furthermore, angel investors can provide not only capital but also invaluable mentorship, particularly for startups based in technology hubs like Silicon Valley. Utilizing comprehensive financial modeling tools can assist in projecting potential return on investment (ROI) and cash flow implications under various scenarios, resulting in strategic financial planning.

Call to Action

Financing options provide essential support for businesses looking to expand and thrive in competitive markets. Innovative financial solutions such as Small Business Administration (SBA) loans and peer-to-peer lending platforms allow entrepreneurs to access necessary capital, often at lower interest rates than traditional bank loans. Business lines of credit enable flexible funding, providing immediate cash flow management for tackling unexpected expenses. Grants from organizations like the U.S. Economic Development Administration (EDA) can offer non-repayable funds specifically for startups in technology or renewable energy sectors. Exploring these financing avenues can empower businesses located in urban centers like New York City or San Francisco to execute growth strategies and increase market share. Engaging with financial advisors can help clarify options and facilitate a tailored approach that meets individual business needs. Actively pursuing these opportunities is crucial for sustainable success in today's economy.

Contact Information

Contact information serves as a crucial element in ensuring effective communication during the financing option presentation. Essential details include the name of the presenter, the title or position held within the organization, and the company's name for credibility. Furthermore, including a professional email address, such as john.doe@financingfirm.com, and a direct phone number, like (123) 456-7890, facilitates easy follow-up inquiries. It is also beneficial to list the physical address of the organization, including city, state, and zip code, ensuring transparency and trustworthiness in business dealings. Lastly, providing a company website URL, for example, www.financingfirm.com, allows potential clients to access further information, enhancing their understanding of available financing options.

Comments