Hey there! It's always a bit uncomfortable to discuss finances, but we wanted to gently remind you about the unpaid invoice from last month. Keeping everything on track is important for both of us, and we understand that these things can sometimes slip through the cracks. If you're curious about how to gracefully approach this situation, stick around to read more tips and templates!

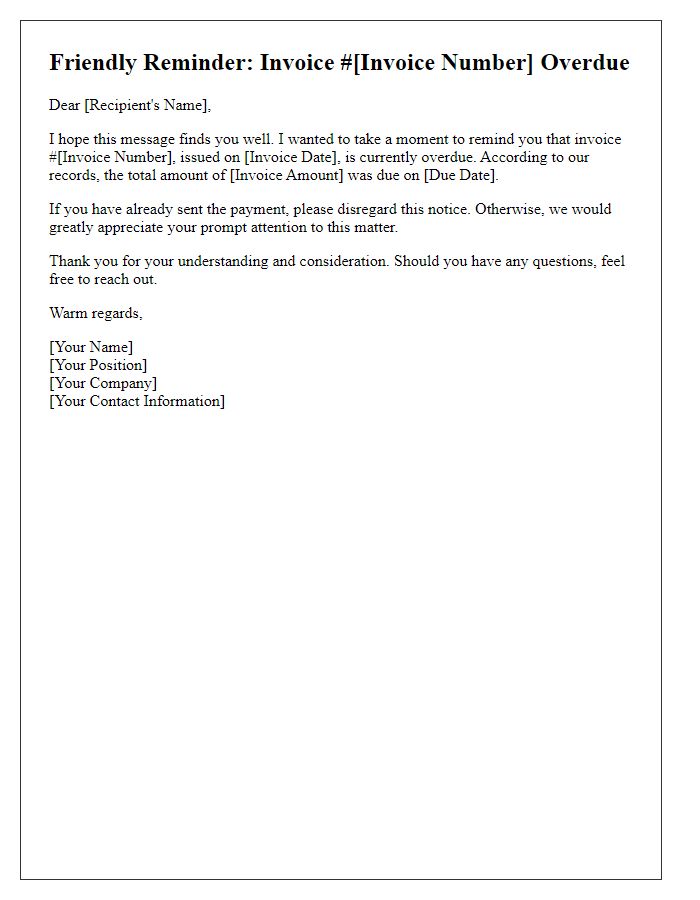

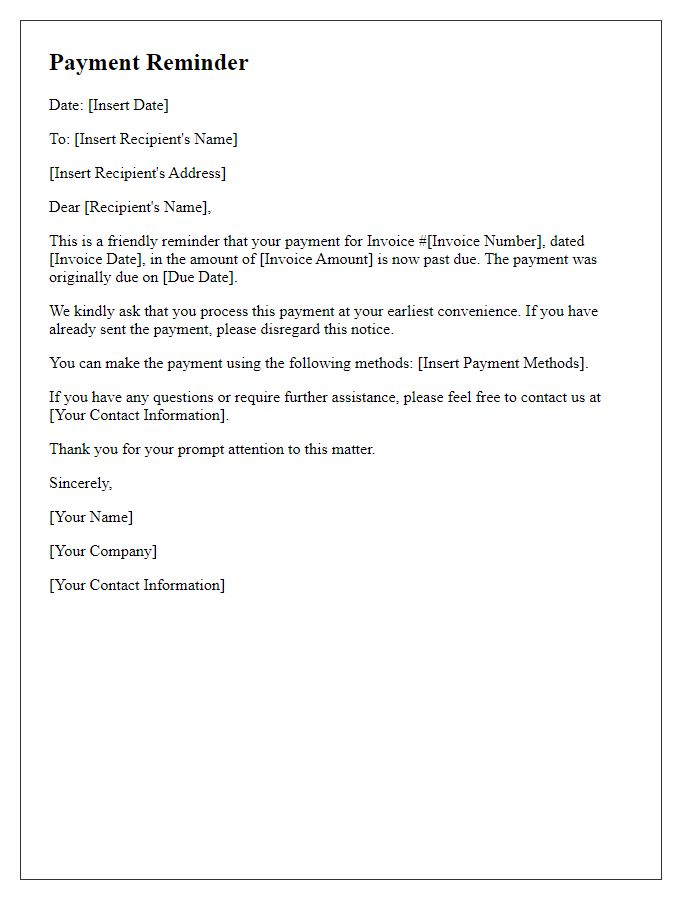

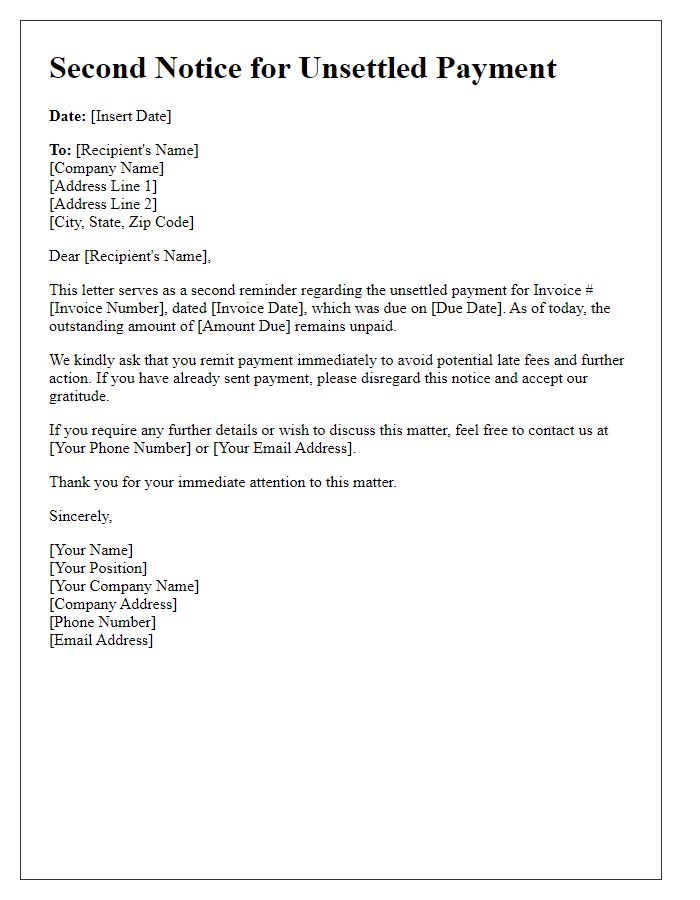

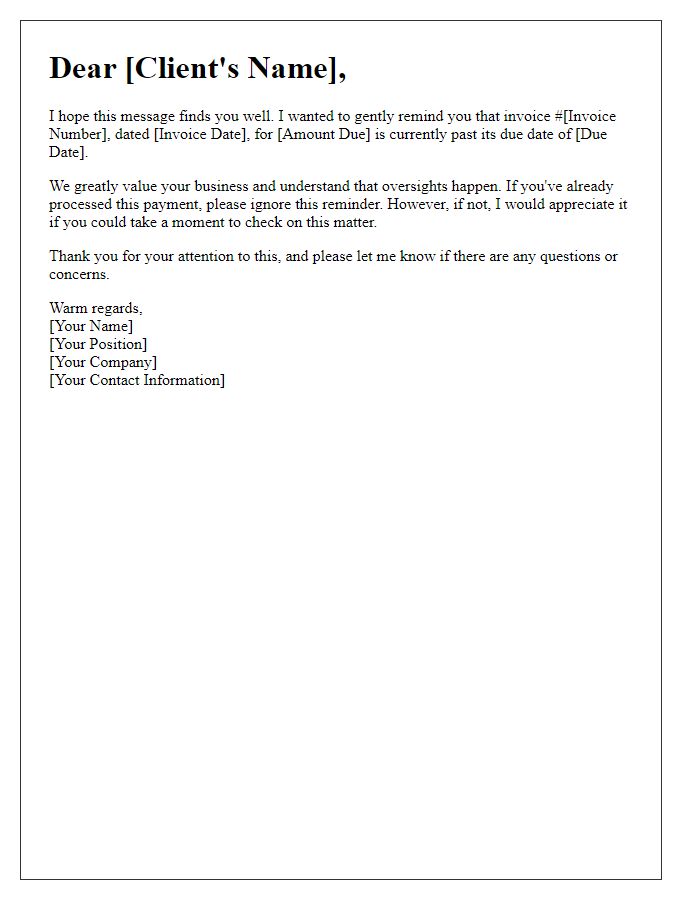

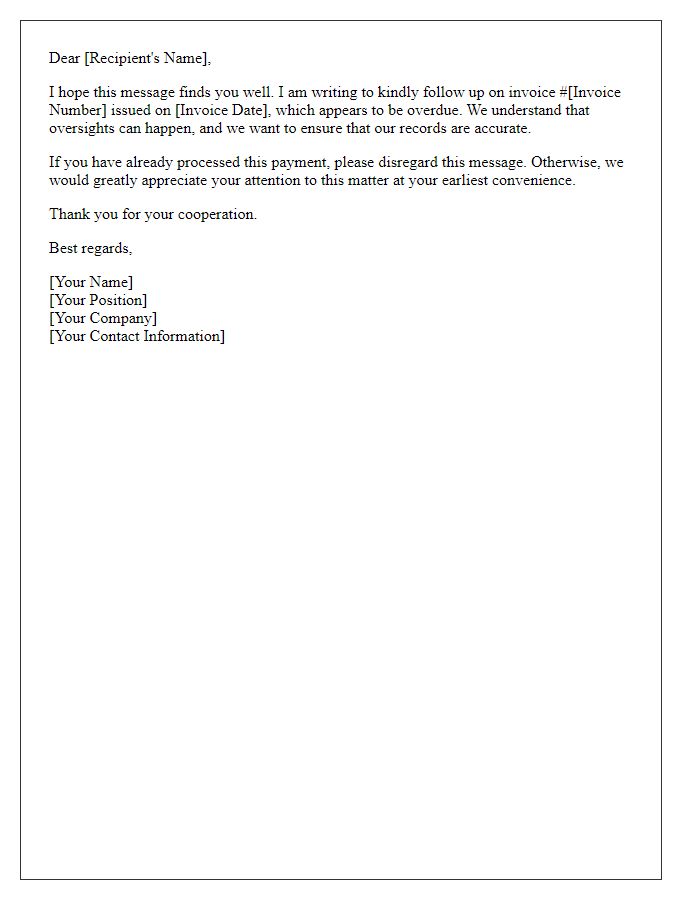

Clear subject line

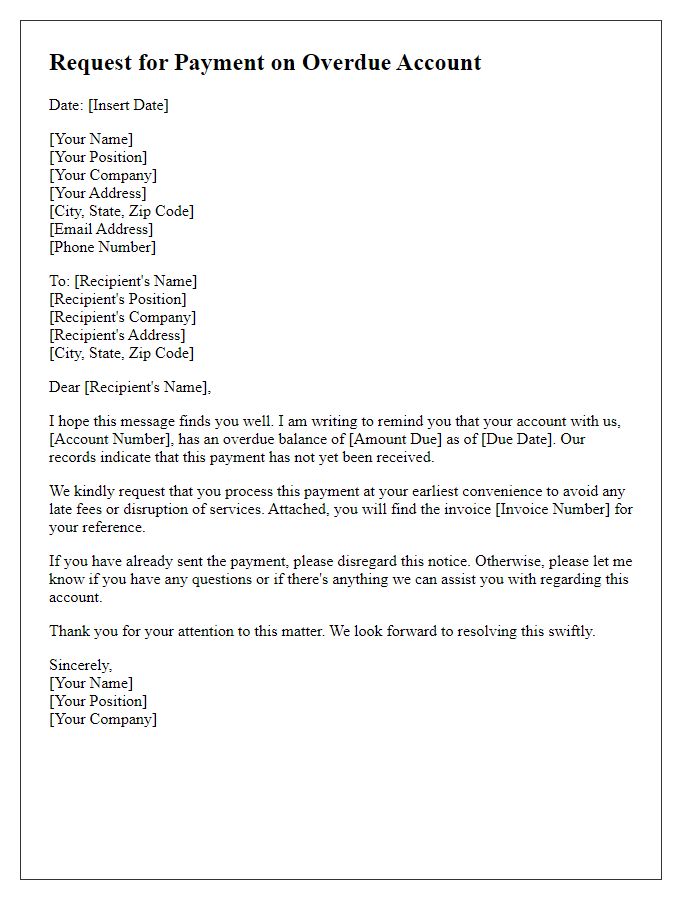

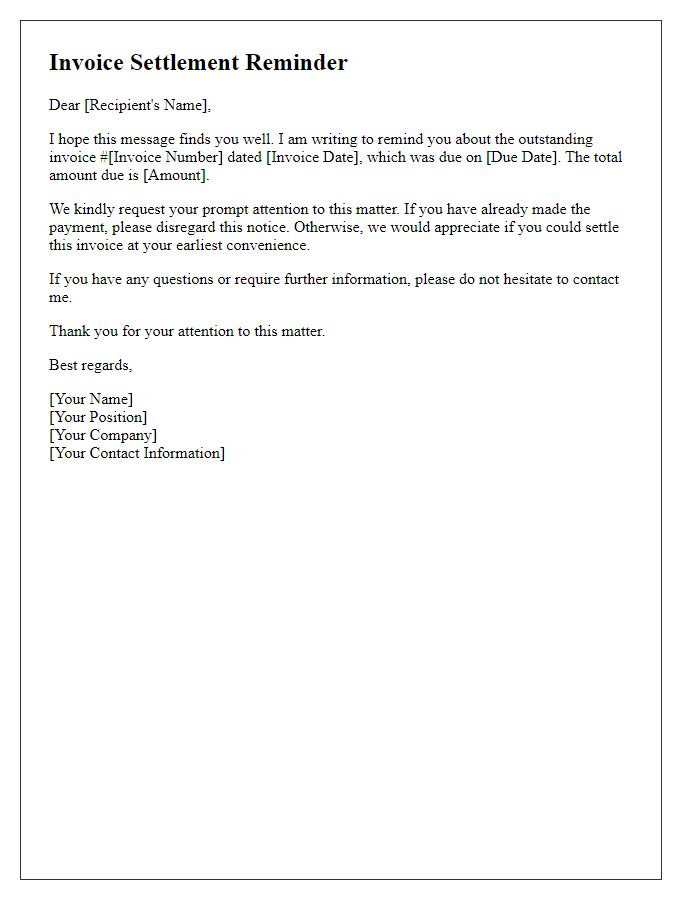

Unpaid Invoice Reminder involves a follow-up communication regarding financial obligations owed by a client. Standard practice includes detailing the invoice number, date of issue, and total amount due. Clear subject line such as "Friendly Reminder: Invoice #12345 Due" helps capture attention. The communication may mention payment methods accepted, deadline for payment, and possible late fees for past-due accounts. Timely reminders assist businesses in maintaining cash flow and fostering professional relationships with clients.

Professional and polite tone

Unpaid invoices can create significant issues for businesses, affecting cash flow and financial stability. A reminder should include essential details, such as invoice number (e.g., INV-123456), due date (e.g., September 30, 2023), and total amount owed (e.g., $500). Mentioning payment methods (e.g., bank transfer, credit card) can facilitate the process. Providing contact information for any questions or concerns enhances communication and professionalism. It's crucial to maintain a respectful tone while emphasizing the importance of timely payment to ensure ongoing business relations.

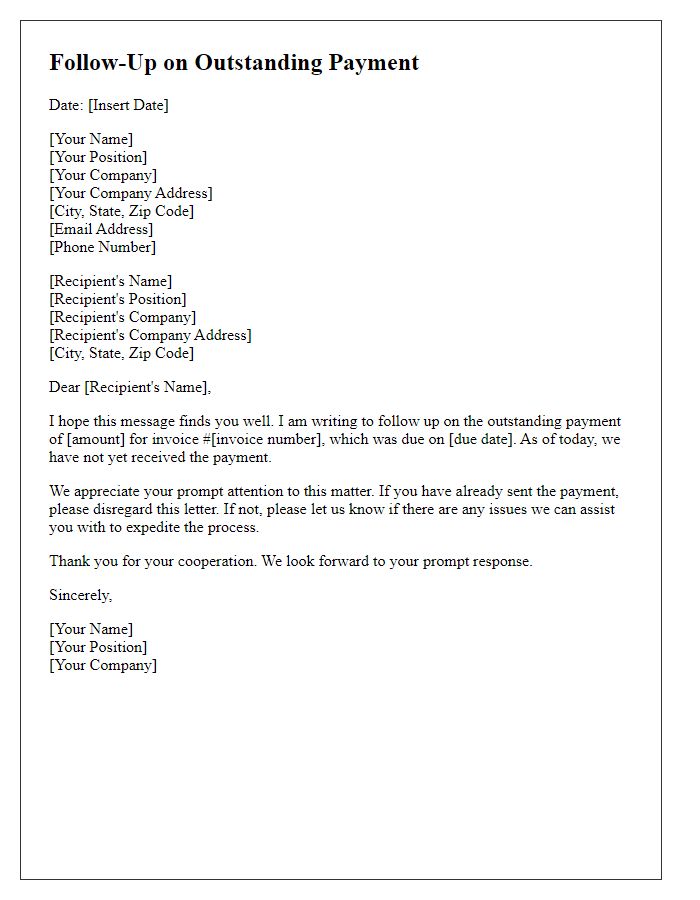

Specific invoice details

Unpaid invoices can significantly impact cash flow for businesses. An overdue notice should include specific invoice details to ensure clarity. Invoice number 12345 relates to services rendered on March 1, 2023, totaling $2,500, with a payment due date of March 31, 2023. The client, ABC Corp., located at 789 Business Rd, Cityville, has previously agreed to net 30 payment terms. It is essential to reference the original service agreement for confirmation of the payment schedule. Late fees may apply according to the agreed-upon terms, further complicating financial records. Prompt communication regarding the outstanding balance can aid in resolving the matter efficiently while maintaining a positive client relationship.

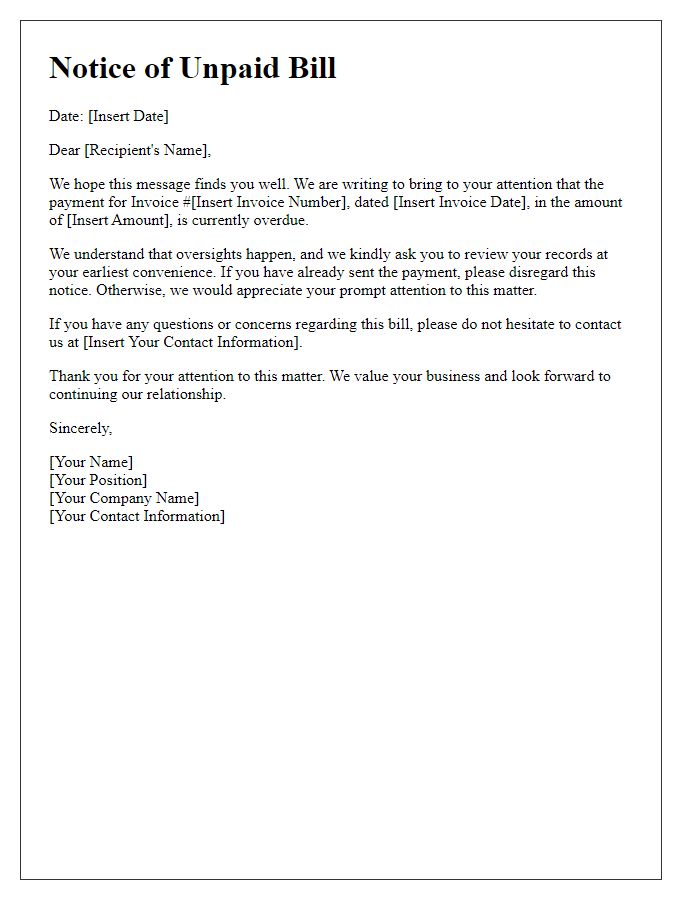

Consequences of non-payment

Unpaid invoices can lead to significant consequences for businesses, including financial strain and disrupted cash flow. Outstanding payments, especially those over 30 days, may incur late fees, typically ranging from 1% to 2% per month, as stipulated in contractual agreements. Businesses in the United States, for example, often resort to collections agencies after 90 days of non-payment, which can harm customer relationships and diminish brand reputation. Persistent non-payment might escalate to legal actions, resulting in additional costs and potential court judgments against the debtor. Furthermore, businesses may report delinquent accounts to credit bureaus, adversely affecting credit scores and future borrowing abilities.

Contact information for queries

Unpaid invoices can significantly impact cash flow for businesses. A reminder about overdue payments often includes specific details such as invoice numbers, due dates, and outstanding amounts. For instance, an invoice dated September 1, 2023, totaling $2,500 may remain unpaid after 30 days. Including contact information (like email and phone number) for inquiries ensures clients can easily reach out for clarification or resolution. This proactive communication can reduce confusion and foster better client relationships while positively influencing payment timelines.

Comments