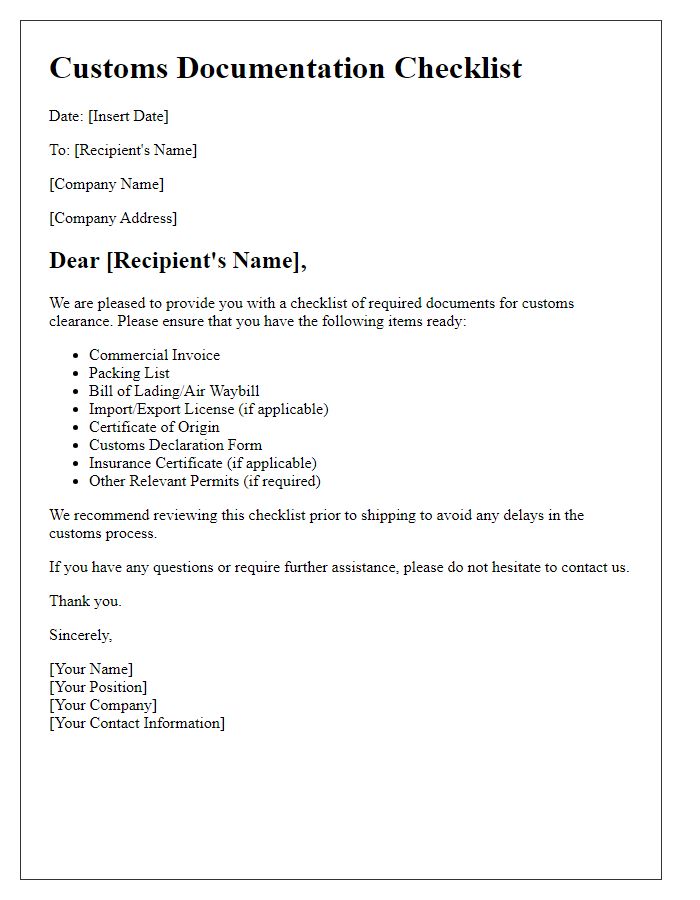

Are you ready to streamline your customs documentation process? In today's world, navigating the complexities of international shipping can be challenging, but having the right letter template can make all the difference. With clear guidelines and essential information at your fingertips, you'll find it easier than ever to prepare your customs documents accurately. Dive into the details and discover how to simplify your workflowâread on for more insights!

Accurate Description of Goods

Accurate description of goods is crucial for customs documentation preparation, impacting processing time and duty assessment. Detailed specifications (such as material composition, size, and weight) ensure compliance with regulations set by agencies like the U.S. Customs and Border Protection (CBP). For example, an import of electronics must include information about brand names (like Apple, Samsung), model numbers (iPhone 13, Galaxy S21), and specific technical features (storage capacity, processor type) to avoid delays. Additionally, the declared value must reflect the market price, typically determined by invoices or contracts, as inaccurate valuations can lead to fines or penalties. Proper categorization using Harmonized System (HS) codes is also essential, aiding in tariff classification and providing a standardized method for identifying products across different countries.

Harmonized System Code (HS Code)

The Harmonized System Code (HS Code) is a standardized numerical method of classifying traded products, essential for customs documentation and international shipping. This six-digit code, developed by the World Customs Organization, enables countries to identify specific goods for tariff and trade purposes. For instance, the HS Code for electronics often begins with 85, while textiles start with 50 to 60. Accurate classification ensures compliance with regulations and helps prevent delays during customs clearance at international ports like the Port of Los Angeles or the Port of Rotterdam. Additionally, incorrect HS Codes can result in costly penalties or misclassification of goods, emphasizing the importance of thorough research and precise documentation to facilitate global trade.

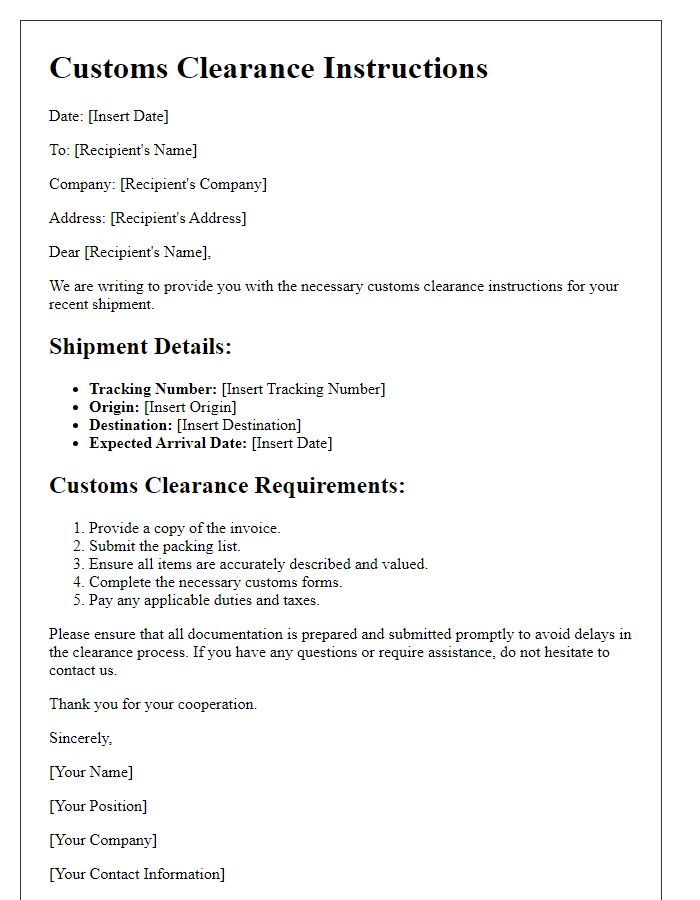

Declared Value and Currency

Customs documentation preparation requires accurate declaration of values and currencies for international shipments. The declared value denotes the worth of goods transported, impacting duties and taxes calculated by customs authorities. Each item, such as electronics or clothing, should have a specific declared value correlating with its market price, often requiring invoices or receipts for verification. Currency utilized must align with local regulations, typically denoted in USD or EUR, ensuring clear communication with customs officials. Precise completion of this section aids in expediting clearance processes at border control, facilitating smoother international trade operations.

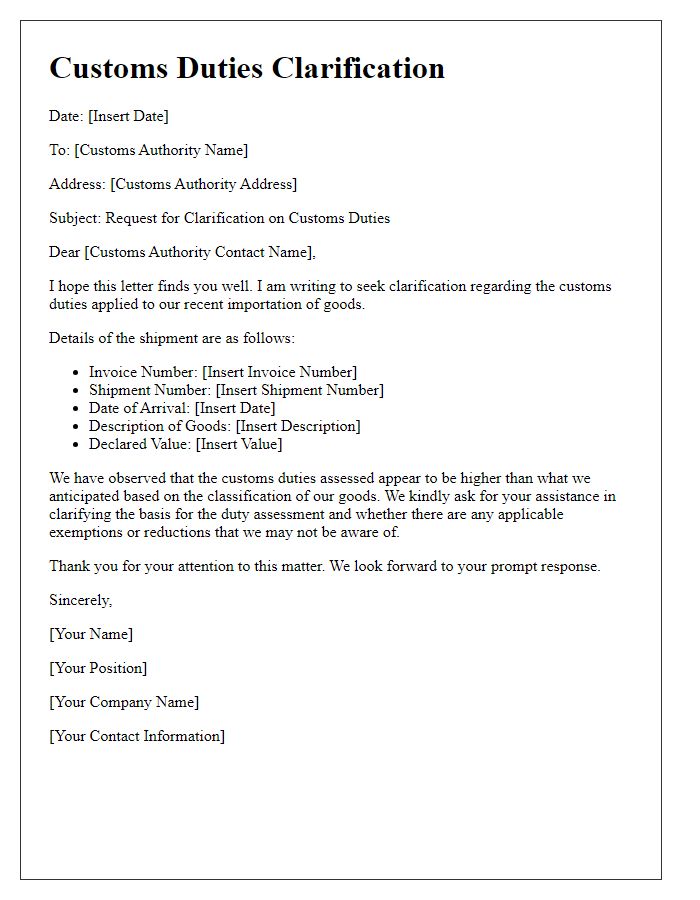

Country of Origin or Manufacturer

When preparing customs documentation, the country of origin or manufacturer plays a crucial role in international trade compliance. For instance, products manufactured in China, including electronic devices or textiles, must indicate this origin on the customs declaration forms. Accurate labeling enhances transparency and hinges on trade agreements like the North American Free Trade Agreement (NAFTA). This requirement ensures compliance with tariffs and import duties determined by the destination country, such as the United States. Additionally, products from EU member states benefit from lower tariffs due to established trade relations. Misrepresentation of country of origin can result in penalties or delays in customs clearance, impacting supply chains and logistics.

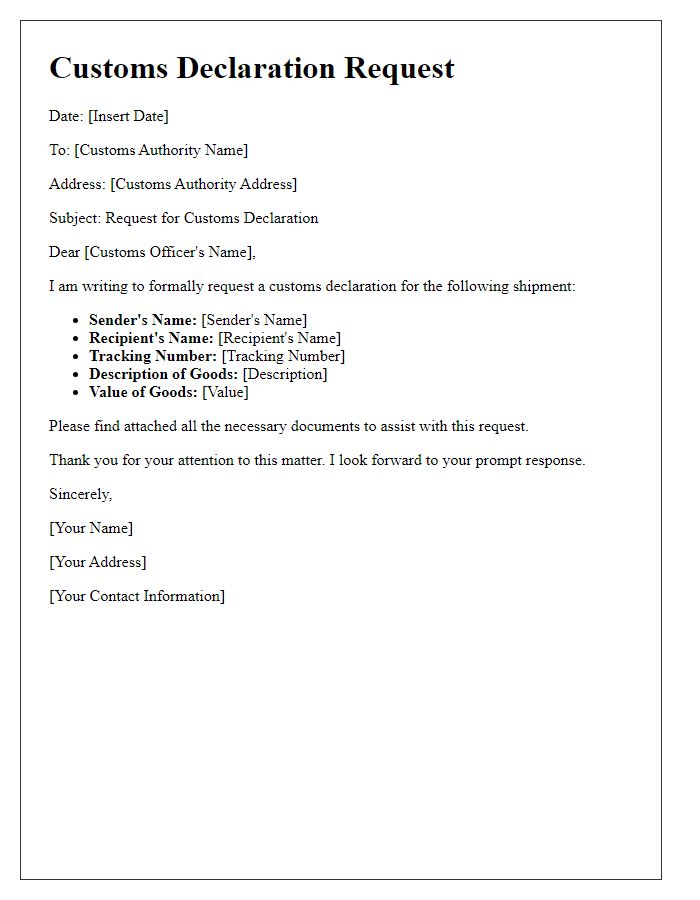

Consignee and Consignor Details

Consignee details encompass the receiving party in a shipping transaction, including name, address, and contact information. Proper documentation requires specific data, such as the consignee's business registration number for verification, which is particularly significant in international shipments. Consignor details identify the sending party, also requiring name, address, and contact information. A unique identifier, like the VAT (Value Added Tax) number, may be necessary for assessing duties, especially within the European Union. Accurate detailing of both consignee and consignor plays a crucial role in facilitating customs clearance and ensuring compliance with regulations imposed by agencies such as the U.S. Customs and Border Protection or the World Customs Organization.

Comments