In today's fast-paced business world, managing costs effectively has become more crucial than ever. With budgets tightening and the need for continuous improvement, companies must adopt innovative strategies to reduce expenses without compromising quality. This article explores practical tips and insightful approaches to create a solid budget cost reduction plan that aligns with your organization's goals. So, if you're ready to take control of your financial future, read on to discover actionable steps for success!

Objective and Purpose

Objective and purpose statements are crucial for outlining the goals and intentions behind budget cost reduction plans within organizations. Budget cost reduction plans aim to identify expenditures that can be minimized without compromising essential operations or quality of service. The primary objective is to enhance financial efficiency, mitigate unnecessary expenses, and allocate resources more effectively. This ensures sustainability, especially during economic downturns, by maintaining operational integrity. Furthermore, the purpose includes fostering a culture of cost-conscious decision-making among employees, encouraging innovative approaches to reduce costs, and ultimately improving overall profitability while maintaining or enhancing the value delivered to stakeholders.

Current Financial Overview

Current financial overview indicates a need for strategic cost reduction measures across various departments. Recent budget analysis highlights a 15% increase in operational expenses over the past fiscal year. Key areas contributing to this rise include utility expenses in office buildings located in major metropolitan areas, employee benefits that have surged due to market trends, and supply chain disruptions increasing logistics costs significantly. In response, the finance team recommends implementing a comprehensive review of all discretionary spending, optimizing vendor contracts to ensure competitive pricing, and exploring alternative suppliers to reduce material costs. Additionally, investing in energy-efficient technologies may yield long-term savings on utilities. The goal is to achieve at least a 10% reduction in overall expenditures by the end of the upcoming financial quarter.

Cost-Saving Strategies

Implementing cost-saving strategies can significantly enhance the financial health of an organization, particularly during challenging economic periods. Analyzing operational expenses may reveal opportunities for reductions, such as renegotiating contracts with suppliers or reducing energy consumption in facilities. Employee training programs emphasizing efficiency can lead to decreased waste, impacting both resources and time. Utilizing technology, such as cloud computing services, can diminish overhead costs associated with maintaining physical servers. Regular audits of budget allocations, identifying underperforming areas, can ensure funds are directed towards priority initiatives. Furthermore, adopting a flexible remote work policy (as implemented by numerous firms in 2020) can lower real estate expenses and enhance employee satisfaction. By combining these strategies, organizations can achieve long-term sustainability while navigating complex market dynamics.

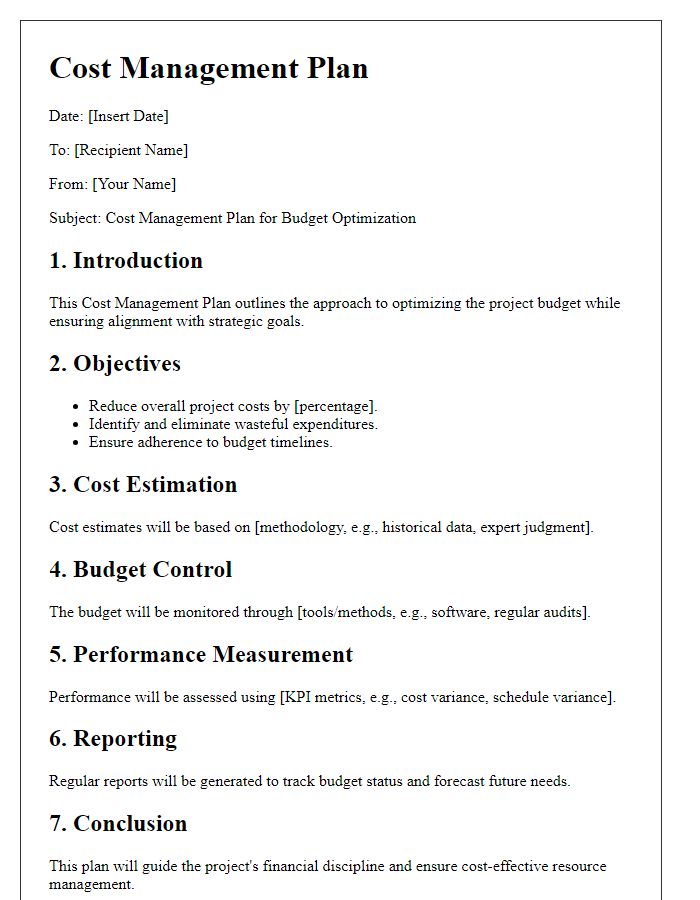

Implementation Timeline

The budget cost reduction plan for 2023 will unfold across three key phases over a six-month timeline. Initial planning and assessment will occur from January to February, involving stakeholder meetings and financial analysis to identify potential areas for savings within departments such as Marketing and Operations. During March and April, implementation of cost-saving measures, including renegotiating vendor contracts and optimizing resource allocation, will be prioritized. Finally, from May to June, monitoring and evaluation will take place to assess the effectiveness of the strategies, with progress reports generated for executives. Metrics such as percentage savings and impact on operational efficiency will guide future adjustments to ensure sustainable financial performance.

Monitoring and Evaluation

A comprehensive budget cost reduction plan requires diligent Monitoring and Evaluation (M&E) processes to measure effectiveness. Clear metrics, such as ROI (Return on Investment) and KPIs (Key Performance Indicators), must be established to assess progress. Regular assessments at predetermined intervals, such as quarterly reviews, provide insights into financial performance and efficiency gains. Data collection tools, including surveys and performance dashboards, facilitate effective tracking of expenditures and outcomes. Stakeholders, including department heads and financial analysts, must collaborate during evaluation meetings to identify trends and areas for improvement. A robust, adaptive framework allows for adjustment strategies based on real-time feedback, ensuring the organization meets financial objectives while maintaining operational integrity.

Comments