Welcome to our quarterly financial performance review! In this article, we'll dive into the key insights and trends that have shaped our financial landscape over the past few months. We'll explore the successes, areas for improvement, and strategic adjustments we've made to enhance our overall performance. So, let's get started and uncover the details that matterâread on to learn more!

Executive Summary

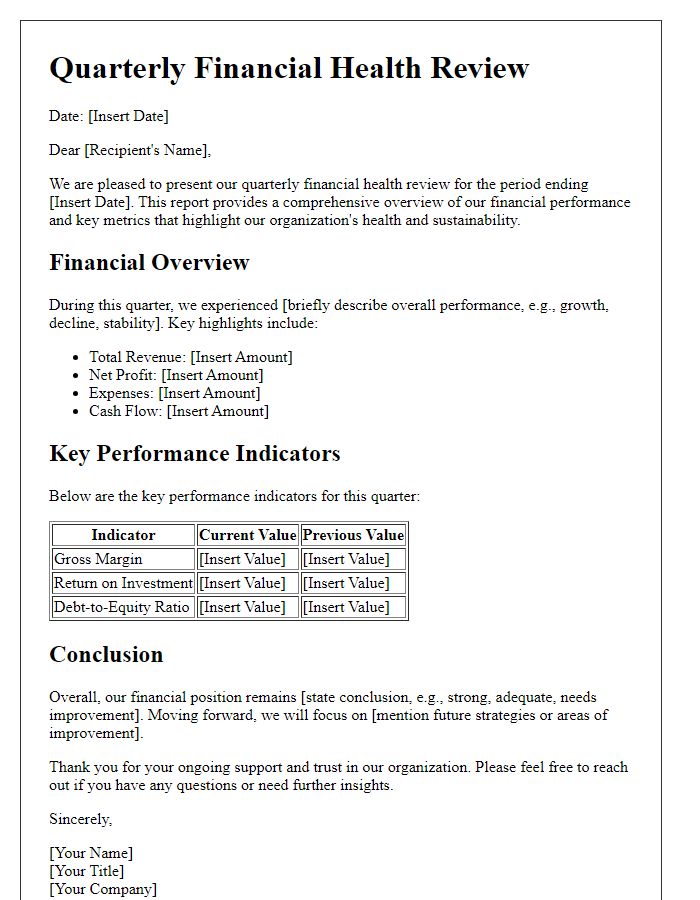

In the quarterly financial performance review, key metrics reveal a significant increase in revenue, totaling $2.5 million for Q3 2023, compared to $2.0 million in Q3 2022, signifying a growth rate of 25%. The gross profit margin improved to 45%, reflecting enhanced operational efficiency and cost management strategies implemented in the last quarter. Expenses were managed effectively, with a total operating cost of $1.375 million, which is a 10% decrease from the previous quarter. Net income reached $800,000, translating to an impressive net profit margin of 32%. Cash flow remained strong with an ending balance of $1.2 million, ensuring sufficient liquidity for upcoming projects and investments. Additionally, customer acquisition numbers increased by 15%, indicating robust market demand and successful marketing efforts. These performance indicators suggest a positive trajectory for the company's financial health and strategic positioning in the industry.

Financial Highlights

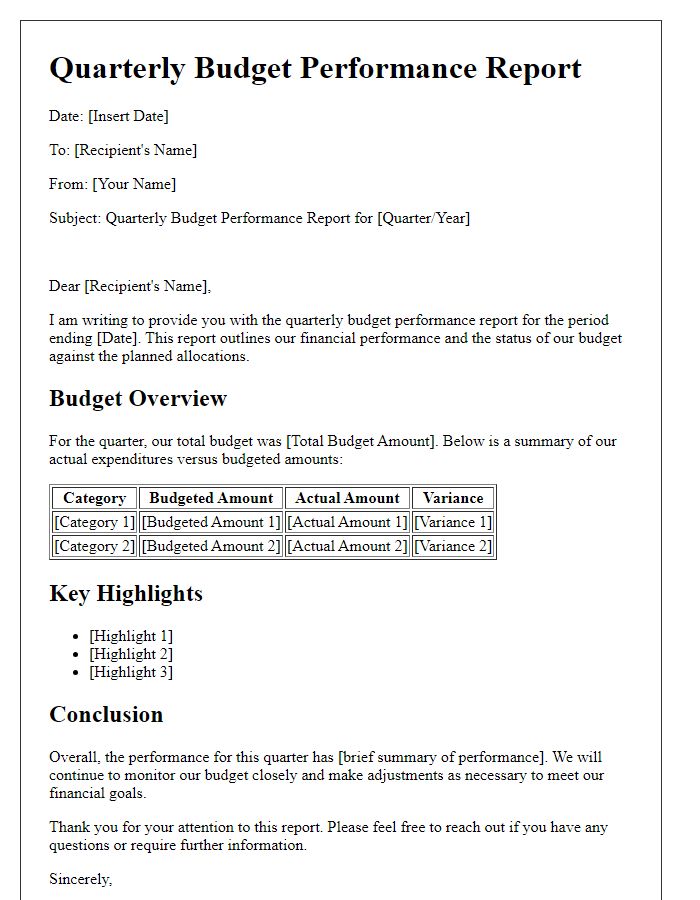

**Quarterly Financial Performance Review: Financial Highlights** This quarterly financial performance review delineates significant financial metrics and outcomes for the third quarter of 2023. Revenue growth reached an impressive 15% year-over-year, amounting to $5 million, compared to $4.35 million in Q3 2022. Operating expenses were effectively managed, totaling $3 million, reflecting a decrease of 5% due to streamlined operational efficiencies. Net profit margins also improved, now standing at 20%, up from 18% in the previous quarter. Key performance indicators (KPIs) such as return on investment (ROI) have shown positive traction, yielding a robust 12% this quarter. Additionally, customer acquisition costs decreased by 10%, enhancing overall profitability. Cash reserves reported are at $2 million, ensuring adequate liquidity for upcoming projects; indicating a strong financial position within the competitive landscape.

Revenue and Expense Analysis

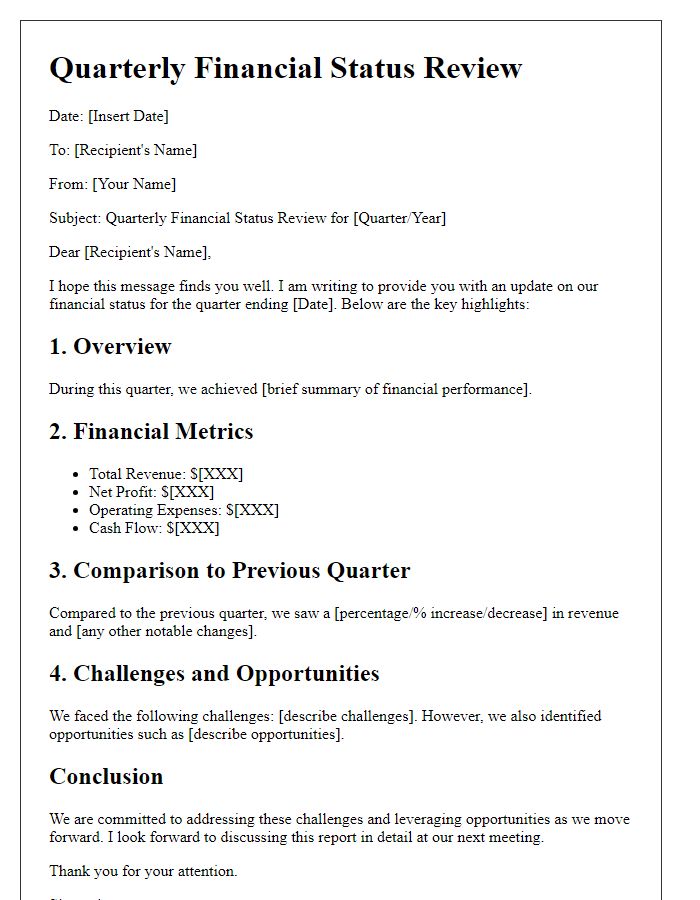

During the quarterly financial performance review, a detailed analysis of revenue and expenses for the fiscal period was conducted. The total revenue for Q3 2023, amounting to $2.5 million, displayed a notable increase of 15% compared to Q2 2023, driven largely by a rise in product sales from the flagship line of technology gadgets in markets such as North America and Europe. Conversely, total expenses reached $1.8 million, reflecting a 10% increase, largely attributed to higher operational costs and new marketing initiatives aimed at expanding brand visibility. Categories such as research and development incurred approximately $600,000, while administrative expenses stood at $500,000, indicating strategic investment into innovation and infrastructure. Overall, the net profit margin calculated at 28% showcases a robust financial standing moving into the next quarter.

Key Performance Indicators (KPIs)

The quarterly financial performance review highlights key performance indicators (KPIs) essential for assessing the organization's fiscal health. Revenue growth percentage, a vital metric, reflects the increase in sales compared to the previous quarter, with targets typically set at 10% for sustainable expansion. Profit margins, calculated as net income divided by total revenue, illustrate the efficiency of operations and currently average 15% across the industry. Additionally, return on investment (ROI) measures the profitability of investments in new projects, with benchmarks usually exceeding 20%. Cash flow statements provide insights into liquidity, ensuring the company can meet short-term obligations, with favorable cash flow ratios above 1.5. Tracking these KPIs enables effective decision-making and fosters alignment with long-term strategic objectives.

Forward-Looking Statements

Forward-looking statements in quarterly financial performance reviews involve projections regarding future earnings, revenues, and market conditions for businesses. These statements often reference fiscal quarters, such as Q1 or Q2, and estimate growth percentages based on current trends. Businesses may highlight anticipated changes in operating expenses, potential expansion into new markets, or the impact of economic factors like inflation rates. Moreover, companies may discuss strategies to enhance shareholder value and optimize resource allocation for the upcoming fiscal year. Such statements provide stakeholders with insight into management's expectations and caution against reliance on these projections due to uncertainties and market volatility.

Comments