Hey there! Following up on payments can sometimes feel a bit uncomfortable, but it's an essential part of keeping your business thriving. It's important to maintain clear communication with clients to ensure that invoices are settled in a timely manner. This article will provide you with simple strategies and a letter template to make the process smoother. Let's dive in and explore how to effectively write a follow-up letter for payments!

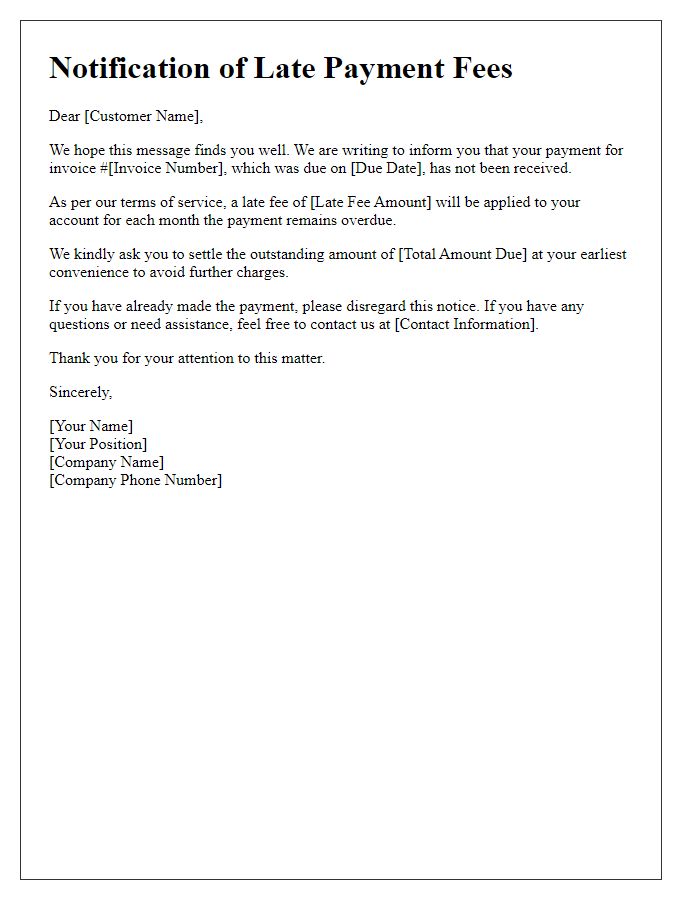

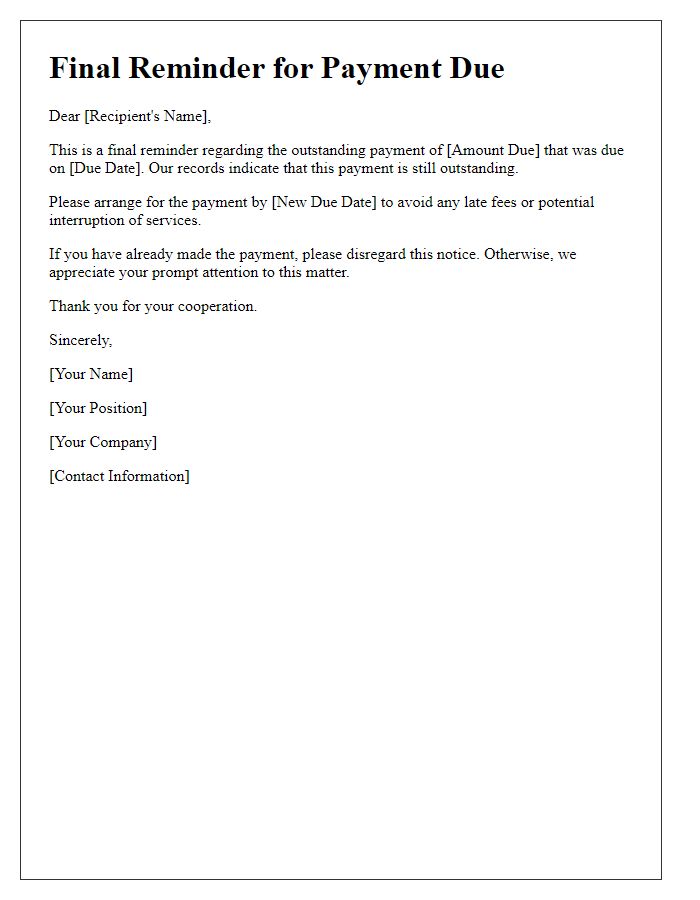

Clear subject line

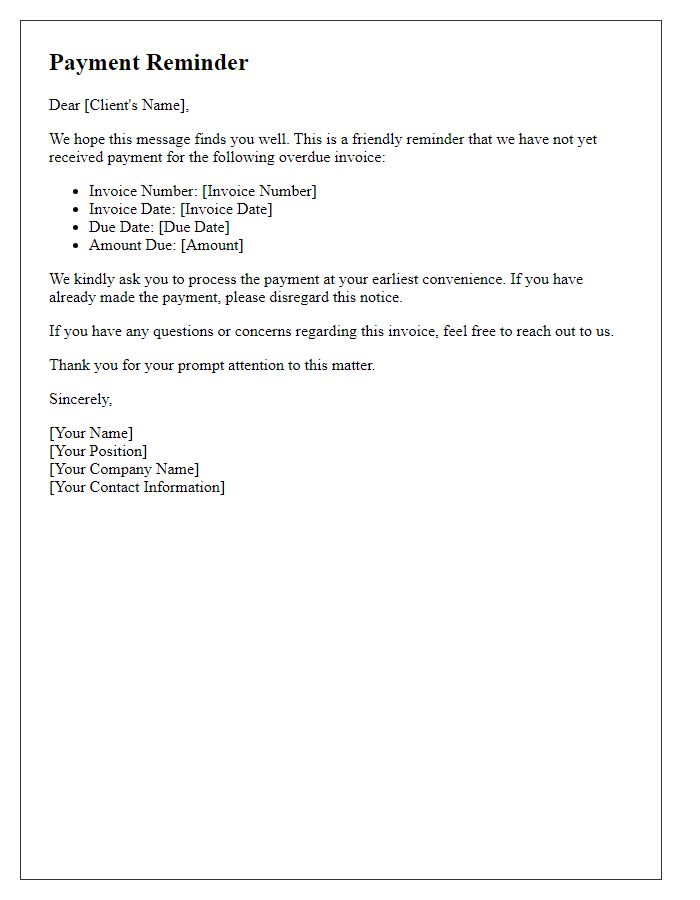

Following up on overdue payment can be critical for maintaining healthy cash flow in any business. An overdue payment reminder, which can be sent via email, should include specific details such as the amount owed, invoice number (for tracking purposes), and original due date. Clear communication helps avoid any misunderstandings regarding payment expectations. Ensure the message maintains a professional tone, while emphasizing the importance of prompt payment to support ongoing business operations. Effective follow-up can significantly improve payment rates, particularly for freelancers and small businesses.

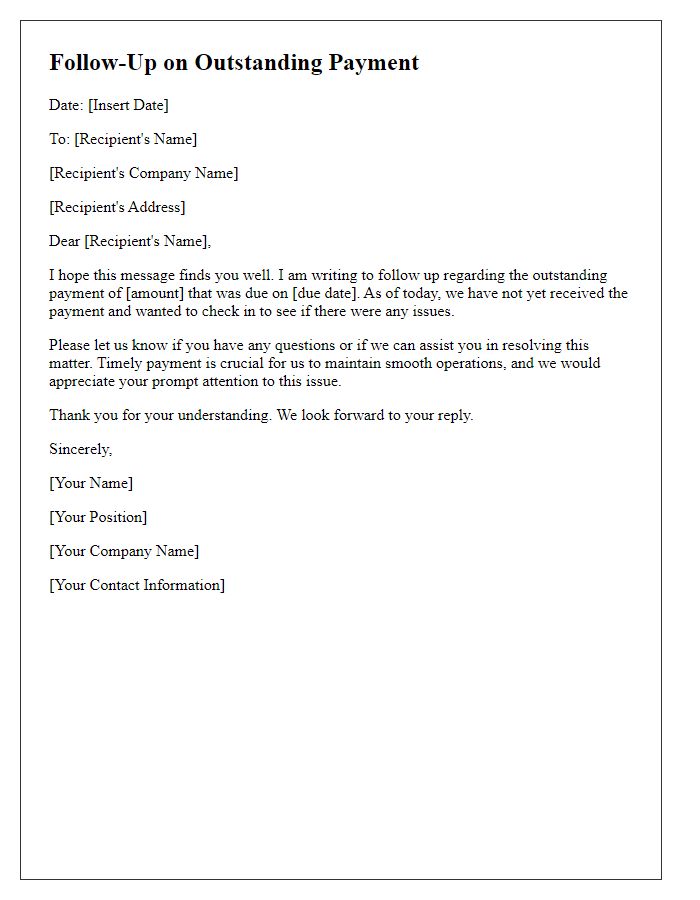

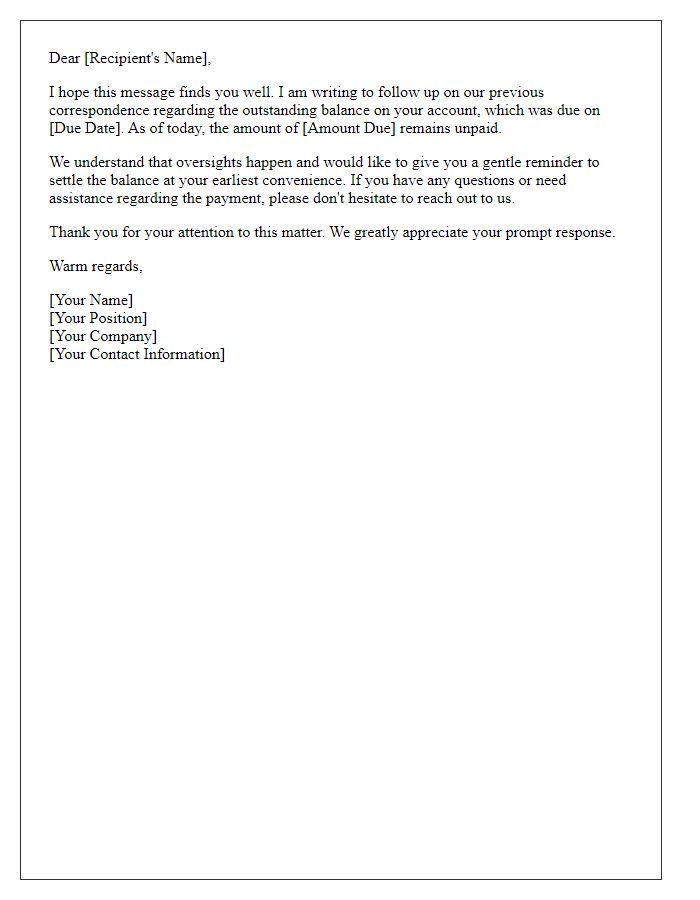

Polite and professional tone

A polite and professional follow-up on outstanding payment can convey the necessary information without being confrontational. For instance, businesses often experience delays in payment due to various factors, including administrative oversight, cash flow issues, or organizational changes. Sending a follow-up email or letter referencing the original invoice number, the amount due, and the due date can help clarify the situation. Including contact information for inquiries makes it easier for the recipient to address the issue promptly. Maintaining a courteous tone, acknowledging the possibility of inadvertent oversight, and expressing appreciation for the relationship fosters goodwill while encouraging timely resolution.

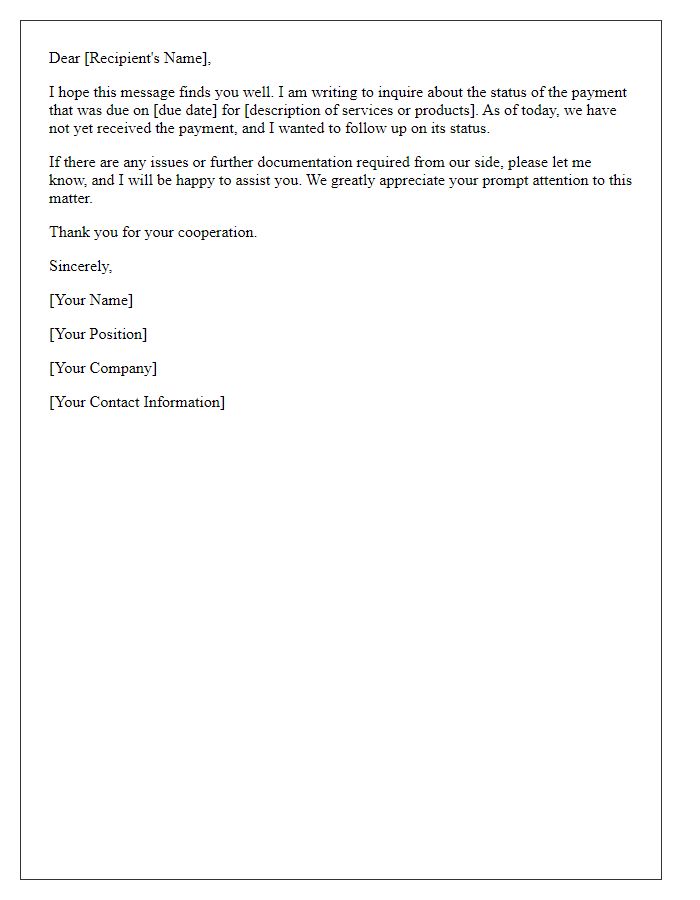

Specific payment details

In the realm of business transactions, following up on payment is crucial for maintaining cash flow and ensuring financial stability. A common scenario involves an invoice due from a client, with a total amount of $5,000 outstanding since the due date of September 15, 2023. The follow-up might reference the invoice number (INV-12345) and include a polite reminder of the agreed payment terms, such as net 30 days. Additionally, it can mention accepted payment methods, which may include bank transfers, credit card payments, or digital payment platforms like PayPal or Stripe. Businesses often provide their banking information for ease of payment and inquire about any potential issues that may have led to the delay.

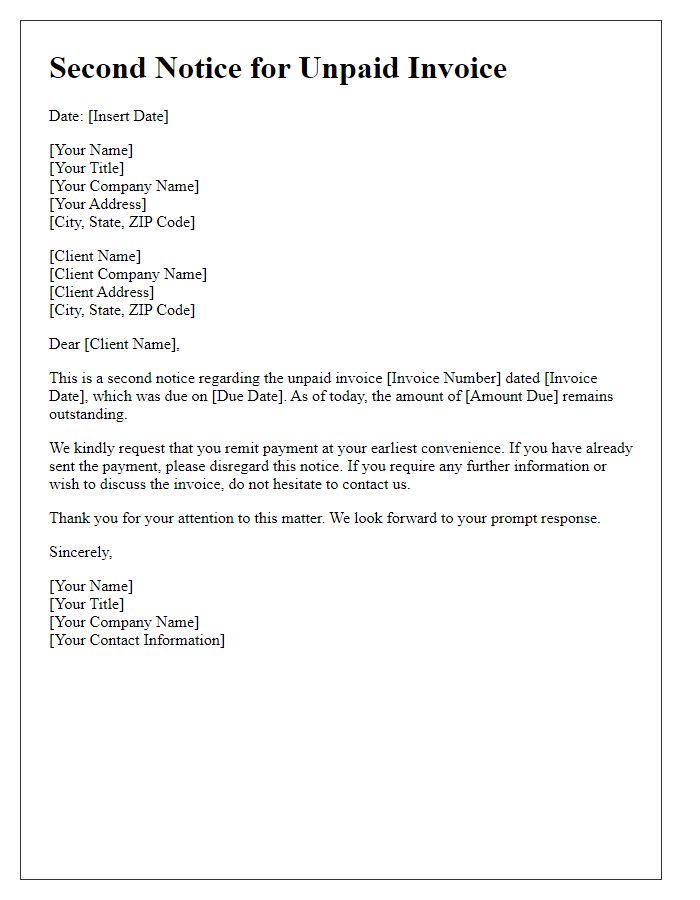

Reminder of previous communication

Timely payment reminders are essential for maintaining healthy business relationships. Persistent follow-ups can improve cash flow significantly. Invoices typically include a due date, often 30 days from the invoice date. An effective payment reminder should reference the original invoice number for clarity. Encouraging payment methods can include electronic transfers via bank accounts or payment platforms like PayPal. Communication should be professional yet courteous, reflecting the importance of mutual respect. Many companies use customer relationship management (CRM) systems to track overdue payments and streamline follow-up processes.

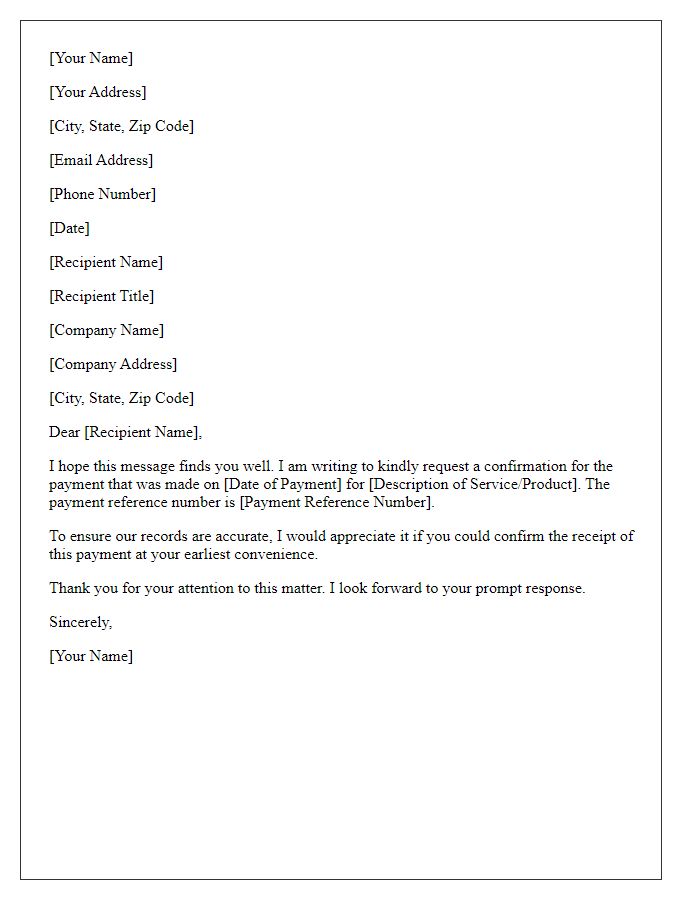

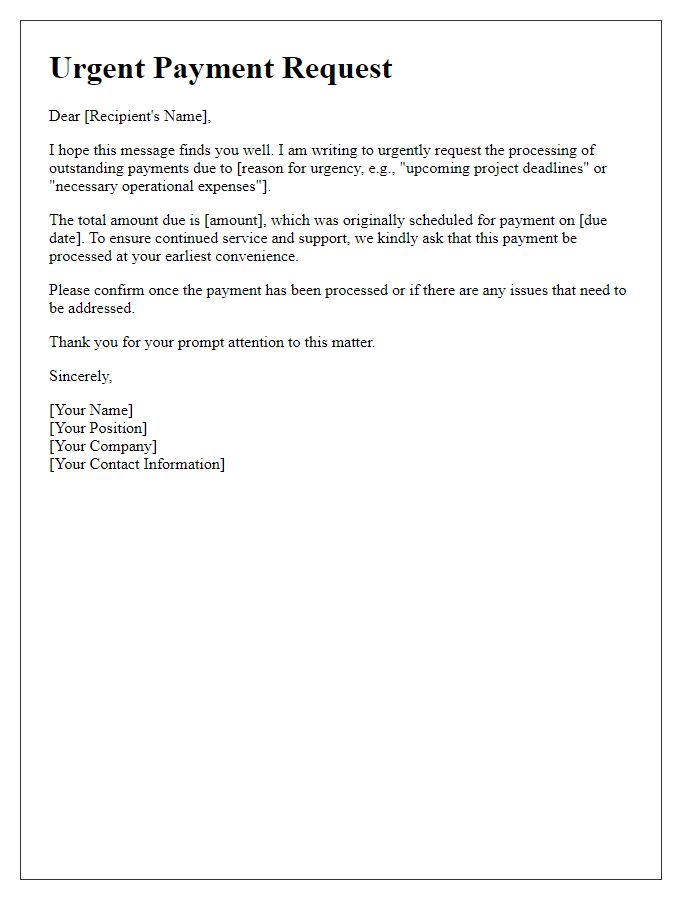

Contact information for further assistance

Payment follow-ups are crucial in maintaining cash flow and fostering business relationships. An overdue invoice can disrupt operations, particularly for small businesses. Clients may overlook payments due to oversight, so sending a friendly reminder is vital. For prompt responses, include direct contact information such as a phone number and email address, ensuring your client can easily reach the accounts department for clarification. Providing clear instructions on payment methods, referencing the specific invoice number (e.g., Invoice #12345), and including due dates will enhance clarity. Professionalism in tone while remaining courteous can help maintain a positive rapport, encouraging timely payments.

Comments