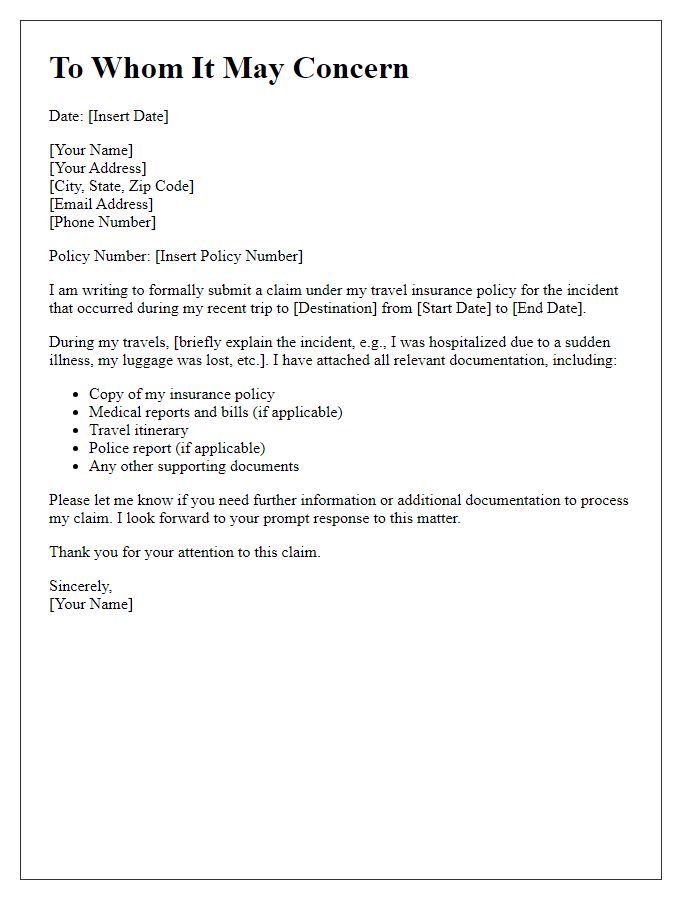

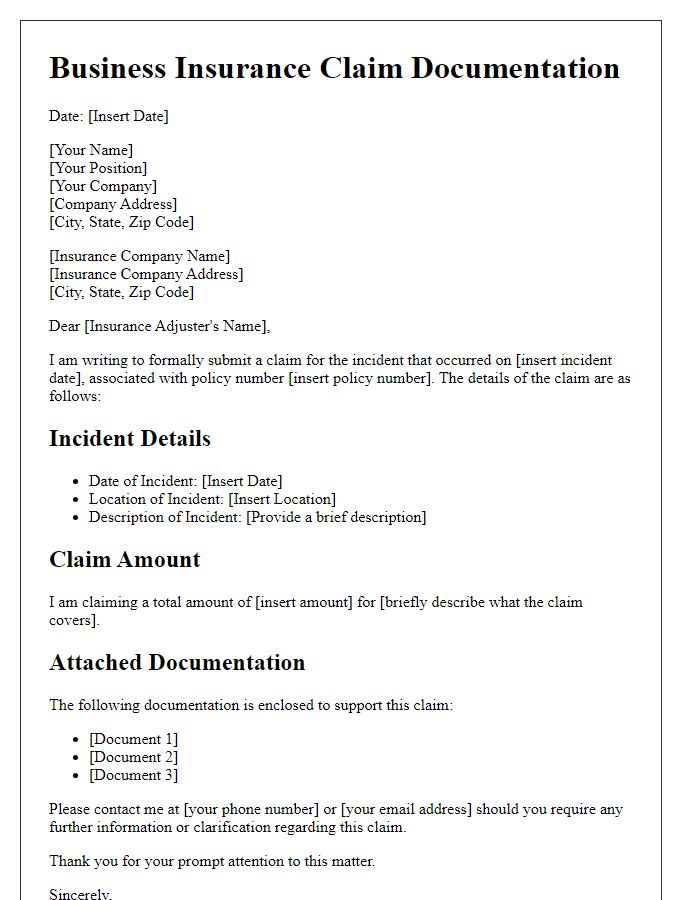

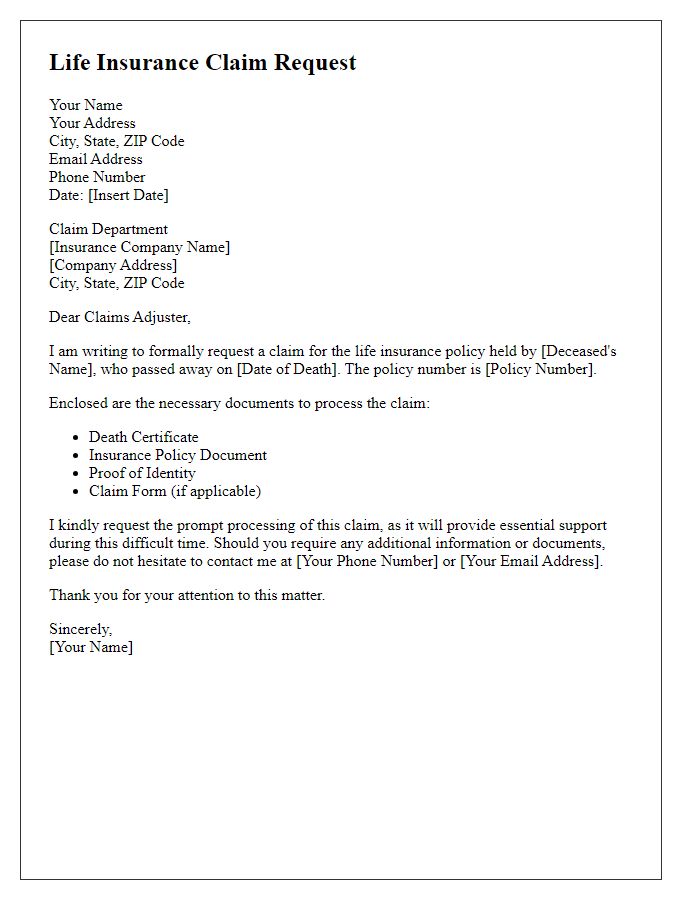

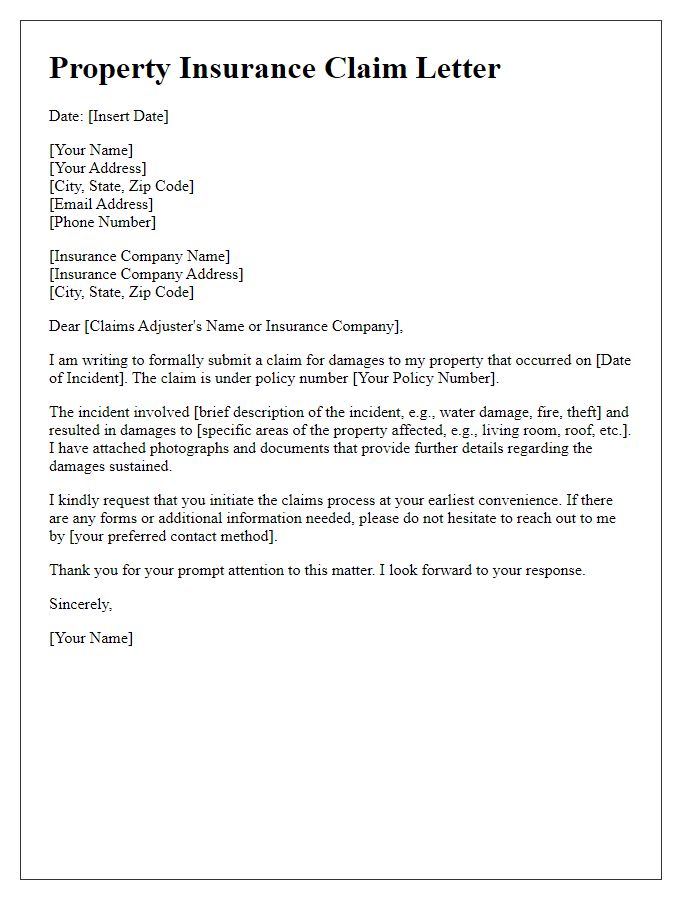

Filing an insurance claim can often feel overwhelming, but it doesn't have to be. A well-structured letter can make all the difference in ensuring your claim is processed smoothly and efficiently. In this article, we'll walk you through a straightforward letter template, emphasizing the crucial details insurance companies need to expedite your claim. So, grab your pen and paper, and let's get started on making this process easier for you!

Claimant Information

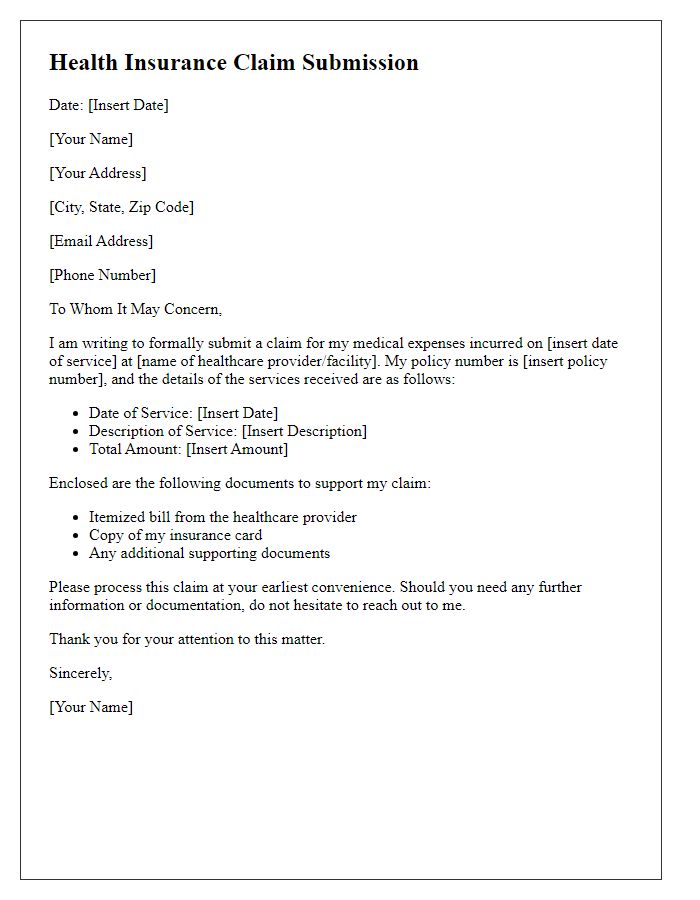

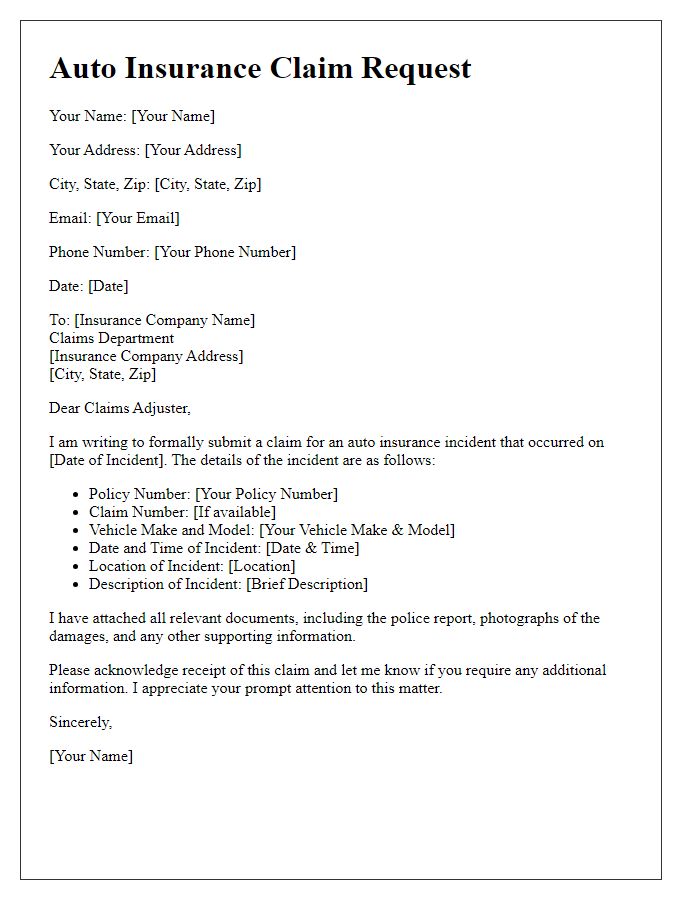

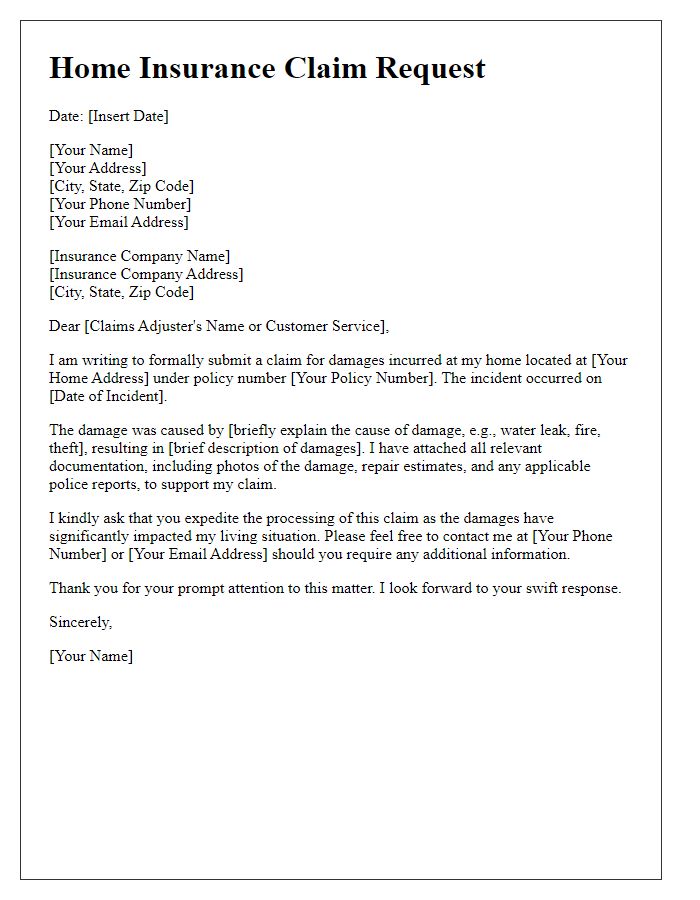

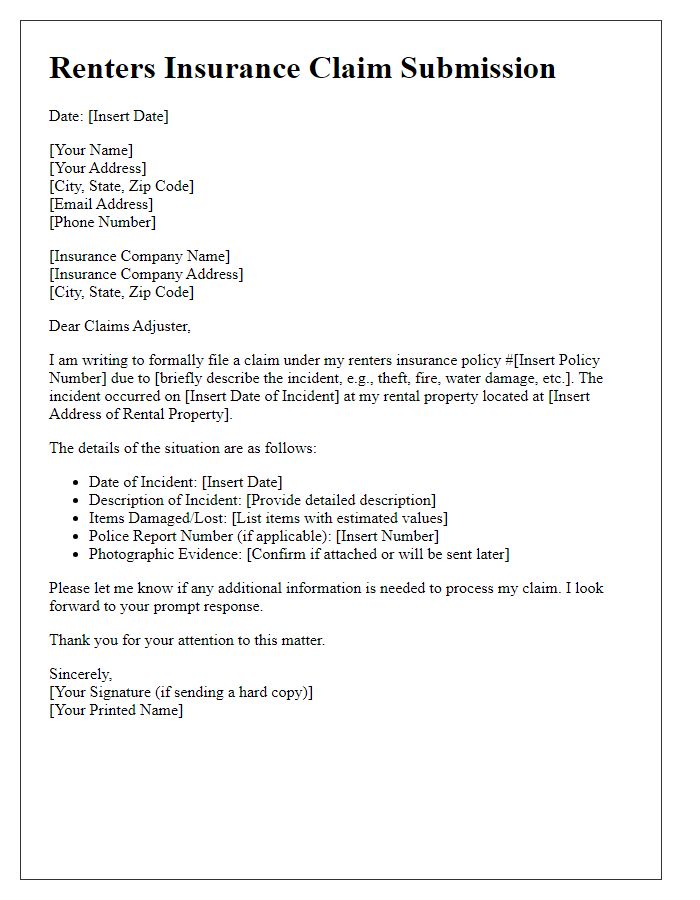

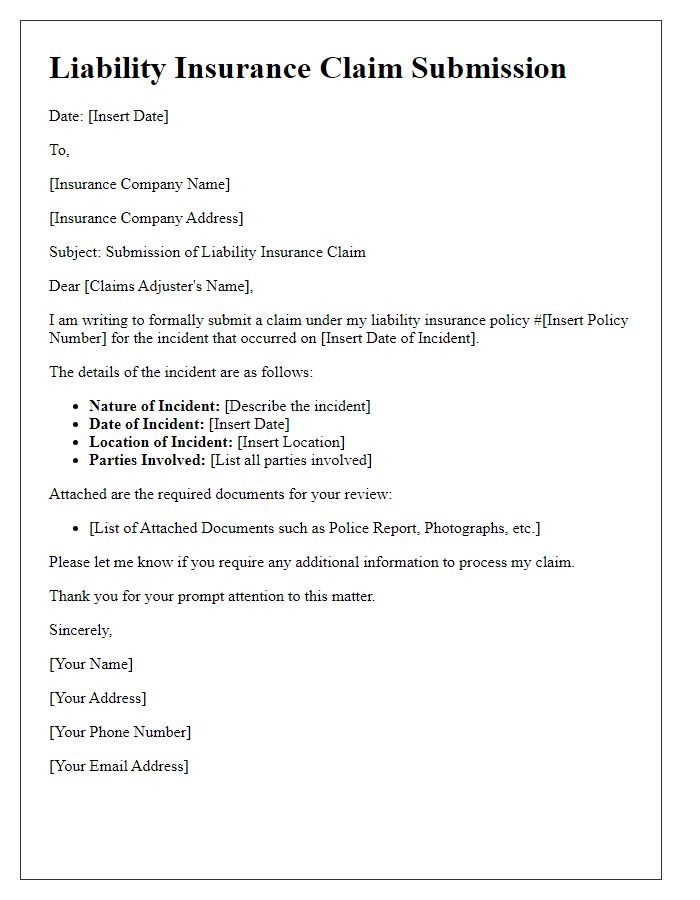

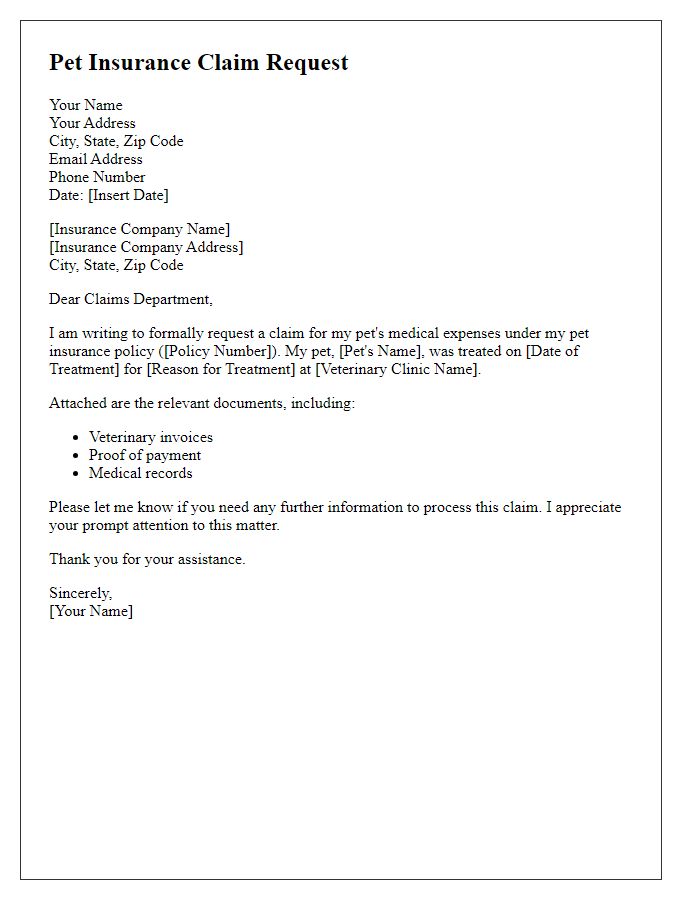

Filing an insurance claim requires meticulous attention to claimant information, including personal details and policy specifics. The claimant's full name (e.g., John Doe), address (e.g., 123 Main Street, Springfield, IL 62701), and contact number (e.g., +1-555-123-4567) are essential for identification. Policy details encompass the policy number (e.g., P123456789) and type of coverage (e.g., auto, home, health) to ensure correct processing. The date of the incident (e.g., September 15, 2023) and location (e.g., 456 Elm Street, Springfield, IL 62701) play a crucial role in establishing the context of the claim. Associated documentation such as police reports, previous correspondence, and medical records should be compiled to support the claim. Accurate and complete information expedites the evaluation process, ensuring timely compensation for the claimant.

Policy Details

Insurance policy details include crucial information such as policy number, which uniquely identifies the coverage plan, and effective dates, indicating the start and end of the insurance coverage period, typically spanning one year. Premium amounts reflect the costs paid regularly for maintaining the policy, while the coverage limits define the maximum payout the insurer will provide for specific claims, such as property damage or medical expenses. In addition, deductibles represent the amounts policyholders must pay out-of-pocket before the insurance company covers the remaining costs, with higher deductibles often leading to lower premium costs. Understanding these details ensures a smoother claim filing process and aids in determining the extent of financial protection provided by the policy.

Incident Description

A severe hailstorm occurred on July 20, 2023, in Denver, Colorado, causing extensive damage to residential properties. The storm, which featured hailstones measuring up to 2 inches in diameter, battered rooftops and shattered windows across several neighborhoods. One homeowner reported significant damage to their asphalt shingle roof, exposing the underlying materials to rain, risking further complications such as leaks and mold growth. Additionally, the storm left a significant amount of debris, including broken branches and damaged siding, requiring professional cleanup and repair services. This incident highlights the importance of immediate action to mitigate further damage following such severe weather events.

Supporting Documentation

Submitting supporting documentation for an insurance claim is crucial to ensure a smooth and efficient claims process. Policyholders must gather essential documents such as the claim form, which outlines the details of the incident, photographs capturing the damage, and any police or incident reports, if applicable. Additionally, receipts for repairs or medical expenses, depending on the claim type, offer tangible proof of costs incurred. Correspondence with the insurance company, like acknowledgment letters or previous communications regarding the claim, should also be included to provide a comprehensive overview of the claim history. Collectively, this documentation substantiates the claim and assists in facilitating timely processing by the insurer.

Contact Information

Contact information is essential for effective communication during the insurance claim process. Typically, it includes the policyholder's full name, which identifies the individual associated with the insurance policy. The address, comprising street name, city, state, and ZIP code, ensures that correspondence reaches the correct location. The phone number, preferably a mobile contact for immediate response, facilitates quick discussions regarding the claim. An email address can serve as an alternative communication method, allowing for the exchange of documents and updates in a timely manner. Additionally, the policy number uniquely identifies the specific insurance plan under which the claim is being filed, streamlining the claims process with the insurance provider.

Comments