Are you a busy insurance agent juggling countless tasks while trying to stay compliant with licensing requirements? If so, renewing your insurance agent license can often feel overwhelming, but it doesn't have to be! By understanding the renewal process and following the right steps, you can streamline the experience and focus on what you do bestâserving your clients. Join us as we explore a simple letter template to make your insurance agent license renewal a breeze!

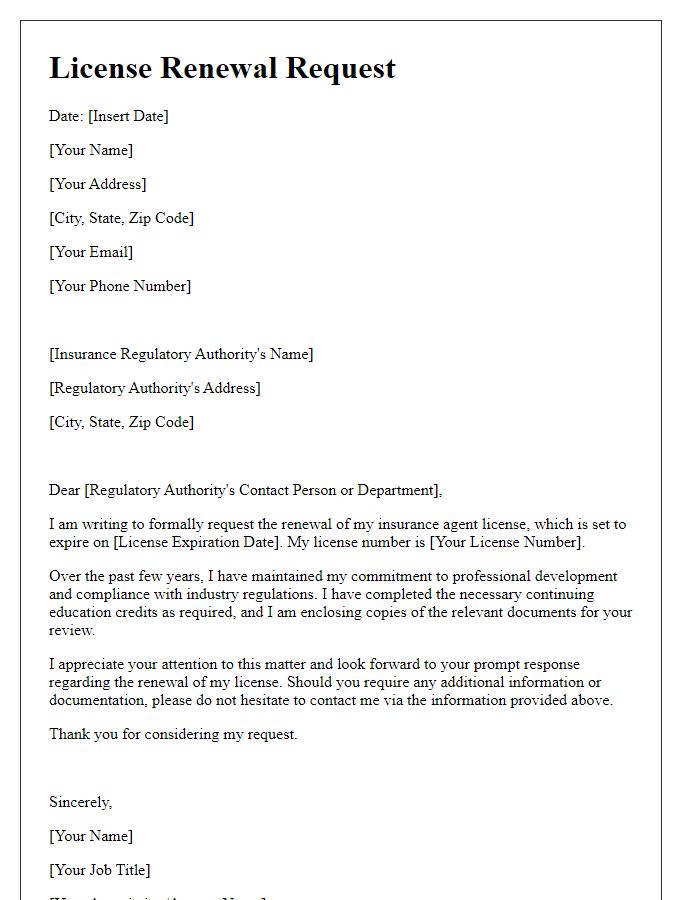

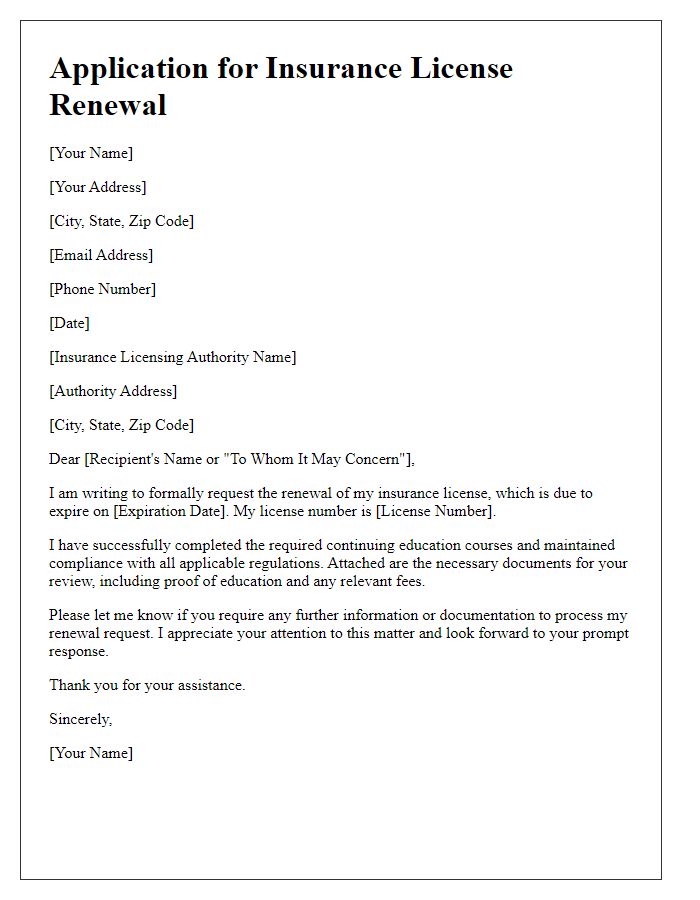

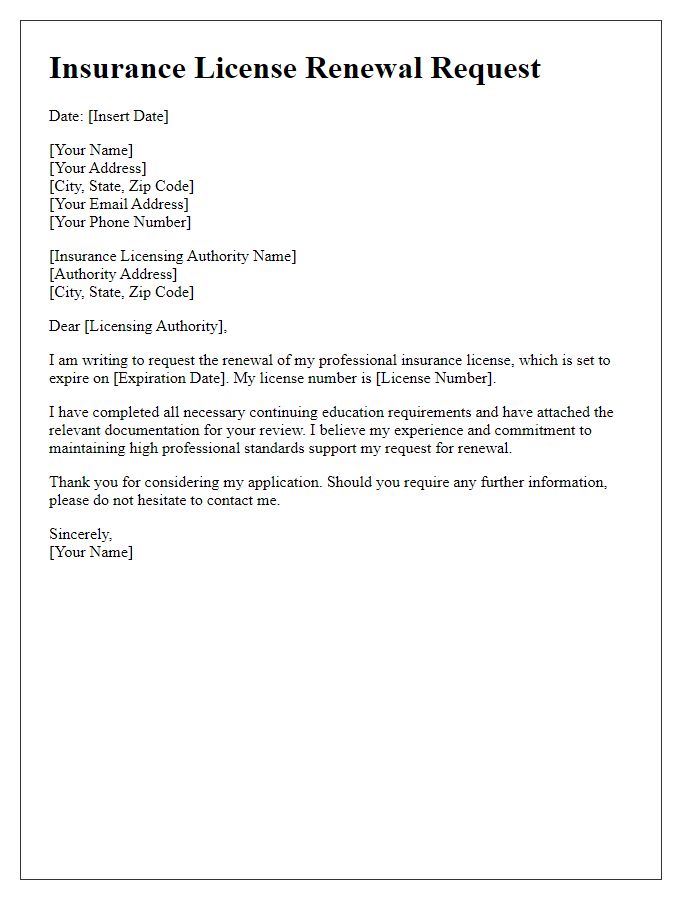

Personal Identification Information

The process of insurance agent license renewal involves significant personal identification information, which is crucial for maintaining valid credentials. Essential details include full name (first, middle, last), date of birth (essential for age verification), social security number (for identity confirmation), and current address (to ensure correct record-keeping). Additionally, it's important to provide the license number (specific to the state of operation) and any previous addresses (for background checks). Furthermore, contact information, such as phone numbers and email addresses, enhances communication regarding the renewal status. Accurate representation of this personal identification information ensures a smooth renewal process, adhering to regulations set forth by entities like the National Association of Insurance Commissioners (NAIC).

License Details and Expiration

The insurance agent license, a crucial element for operating within the financial services sector, has a specific expiration date, often every two years, depending on regional regulations, such as those set forth by the National Association of Insurance Commissioners (NAIC). Agents must ensure compliance by submitting renewal applications typically 30-60 days before expiration. License numbers serve as unique identifiers and must be referenced during the renewal process, ensuring accurate tracking through state databases, such as those maintained by the Department of Insurance in various states like California or New York. Regulatory fees accompany the renewal, varying by state, potentially ranging from $75 to $200, and sometimes require proof of continuing education credits, which ensures agents remain informed on industry changes and best practices.

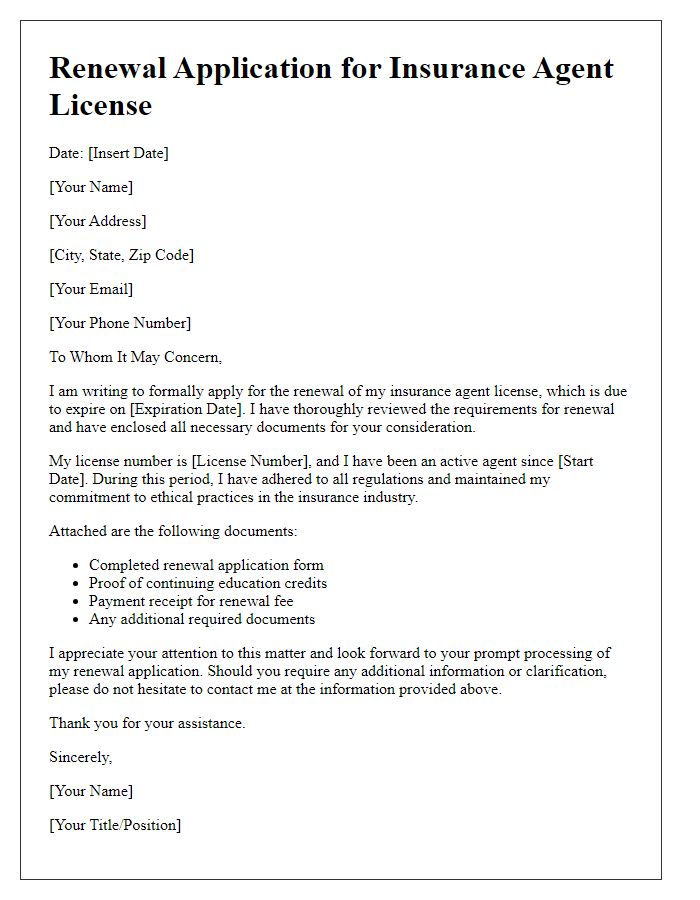

Continuing Education Compliance

Continuing education compliance is essential for insurance agents to maintain their licenses in various U.S. states, including Texas and California. Each state mandates a specific number of hours (often 24 hours every two years) of continuing education, particularly in important areas such as ethics, consumer protection, and policy updates. Failure to complete these requirements can lead to penalties, including fines or loss of licensure. Insurance agents are encouraged to enroll in accredited programs or courses offered through approved associations, like the National Association of Insurance Commissioners (NAIC), to ensure they meet the necessary criteria for renewal. Additionally, maintaining proper documentation, such as course completion certificates, is crucial during the renewal process.

Payment Method for Renewal Fee

Insurance agents must submit a payment method for the renewal fee, which varies by state and provider. Renewal fees can range from $50 to $300 based on the license type, with some additional charges for late renewals. Accepted payment methods typically include credit cards, electronic checks, or money orders payable to the state insurance department. Agents must ensure their payment is processed by the renewal deadline, which often falls annually on the agent's licensing anniversary. Failure to renew on time could result in a lapse of the license, requiring additional reinstatement fees or retesting in some jurisdictions. Properly documenting payment submissions is crucial for maintaining clear records for future reference and compliance with state regulations.

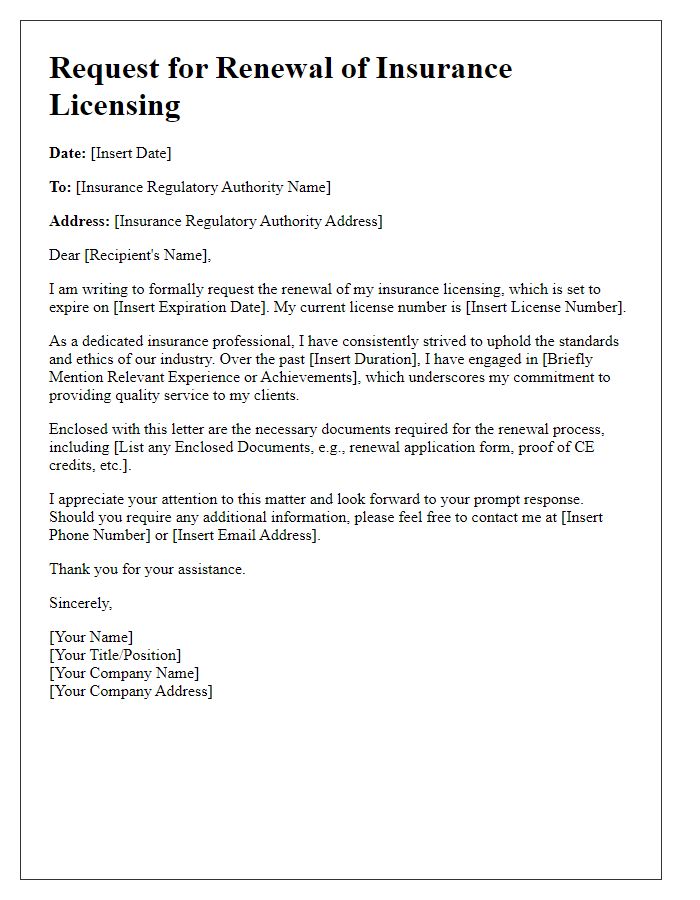

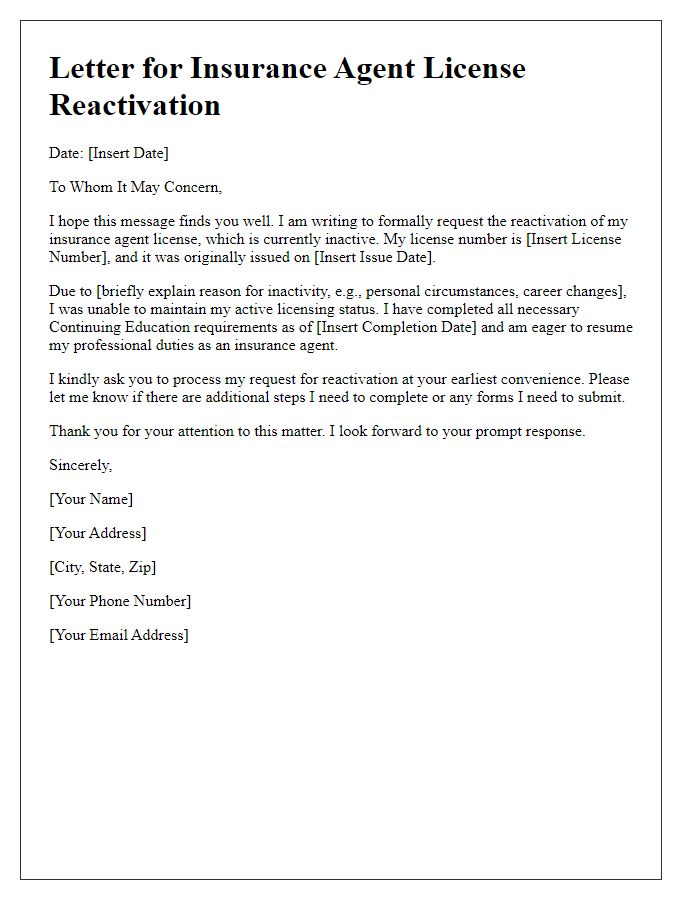

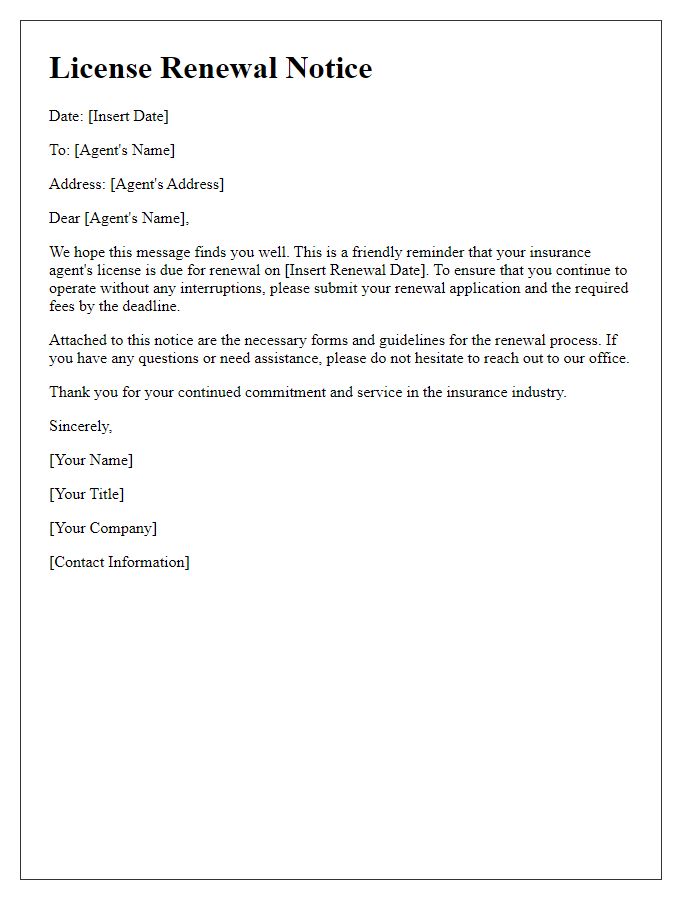

Renewal Request Statement

Insurance agent license renewal ensures compliance with regulatory standards and allows professionals to continue providing services in the insurance industry. Each state, such as California (where agents must renew every two years), has specific requirements including continuing education credits (often 24 hours) and submission of application fees ranging from $50 to $800, depending on the license type. It's essential for agents to submit their renewal request before the expiration date to avoid penalties or lapse in licensure, ensuring uninterrupted service to clients seeking policies covering life, property, and health. Tracking deadlines and maintaining records of completed courses is crucial for a successful renewal process.

Comments