Are you considering diving into the exciting world of gaming business? Securing a gaming license is a crucial step that can open up numerous opportunities for your venture. In this article, we'll guide you through the essential elements of a compelling letter template for your gaming license application. So, grab your controller and let's level up your application processâread on to discover more!

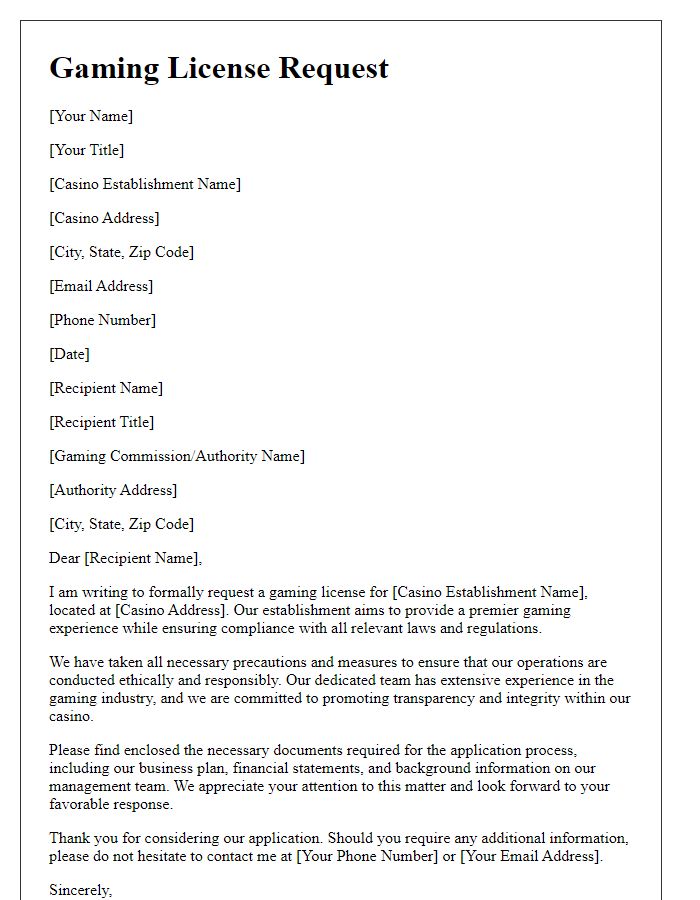

Applicant Information

The gaming license application process requires detailed applicant information to ensure compliance and transparency within the gaming industry. Key details must include full legal name (which may include any aliases used in gaming or business), date of birth (confirming age eligibility, typically 21 years old for gambling activities), and current residential address (including city, state, and zip code for location verification). Contact information such as phone numbers and email addresses (valid for communication purposes) is essential. Furthermore, the applicant should provide a comprehensive background history, including previous gaming-related licenses held (such as state or federal licenses), and any past gaming violations or criminal activity (to ensure integrity in gaming operations). Financial information, including bank statements and source of funds (to assess financial stability), is crucial as well. Identification documents (like a passport or driver's license) must be submitted for verification, often requiring certified copies to prevent fraud.

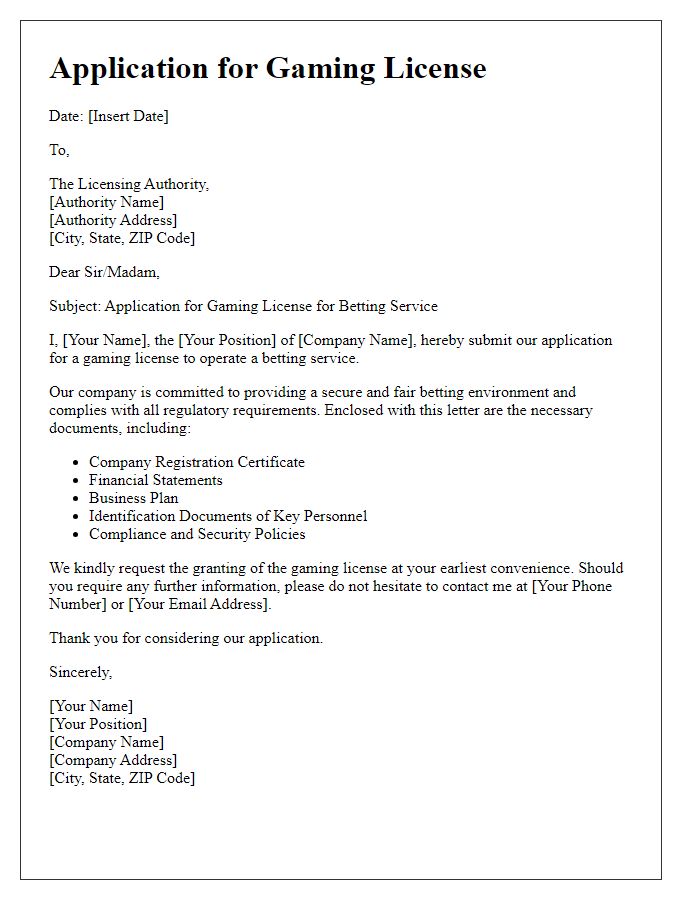

Business Details

In the competitive landscape of the gaming industry, accurate business details are vital for securing a gaming license. The application generally requires information such as the business name, which may reflect a unique gaming concept or brand identity, and the registered address, essential for legal correspondence in jurisdictions like Nevada or Malta, known for their favorable regulations. Ownership details, including the names of key stakeholders, highlight the leadership's experience in gaming or related sectors. Financial statements, demonstrating sufficient capital reserves typically over $100,000, reassure regulatory bodies of the business's stability. Additionally, describing the planned gaming offerings, like online casinos or esports betting, provides insight into market positioning and target demographics, essential for licensing authorities assessing compliance and potential market impact.

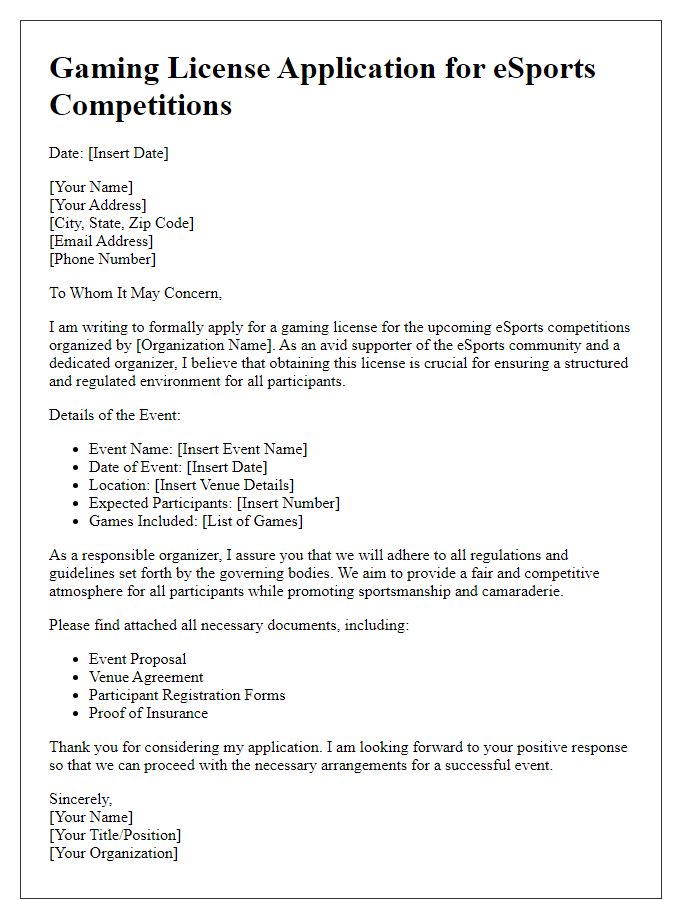

Licensing Type Requested

The gaming license application process in jurisdictions like New Jersey or Nevada requires specific details. Applicants need to specify the licensing type requested, such as a casino license or an online gaming license. Requirements may include a comprehensive background check, financial disclosures, and adherence to gaming regulations established by the New Jersey Division of Gaming Enforcement or Nevada Gaming Control Board. Providing detailed information about the gaming operation, including estimated revenue projections and types of games offered, is crucial for approval. Each state may have different timelines, typically ranging from a few months to over a year for the evaluation process.

Compliance with Regulations

Gaming licenses, essential for legal operation, adhere to strict regulations set by governing bodies such as the United Kingdom Gambling Commission (UKGC) and the Malta Gaming Authority (MGA). These licenses require companies to follow rules regarding fair play, responsible gambling, and anti-money laundering measures. Applicants must submit extensive documentation, including detailed reports on game fairness algorithms, player protections, and financial transparency. Compliance assessments often involve rigorous audits conducted by independent testing laboratories like eCOGRA or iTech Labs. Furthermore, regulatory compliance includes maintaining minimum liquidity levels and implementing player verification processes to ensure age restrictions are respected, typically set at 18 years or older.

Financial Information

The financial information section of a gaming license application requires detailed disclosure of the applicant's monetary resources, including assets, liabilities, and cash flow. Comprehensive financial statements, such as balance sheets and income statements, should present the fiscal health of the business over the past three years. Quantified projections for future revenue, ideally analyzed by market research data revealing potential customer bases, must accompany these documents. Sufficient evidence of funding sources, including bank statements for accounts at institutions like Citibank or JPMorgan Chase, is crucial to validate financial stability. Additionally, applicants must provide information regarding any outstanding debts or loans, detailing accrued interest, repayment terms, and creditor details, ensuring transparency and trustworthiness to regulatory bodies like the Gaming Control Board.

Comments