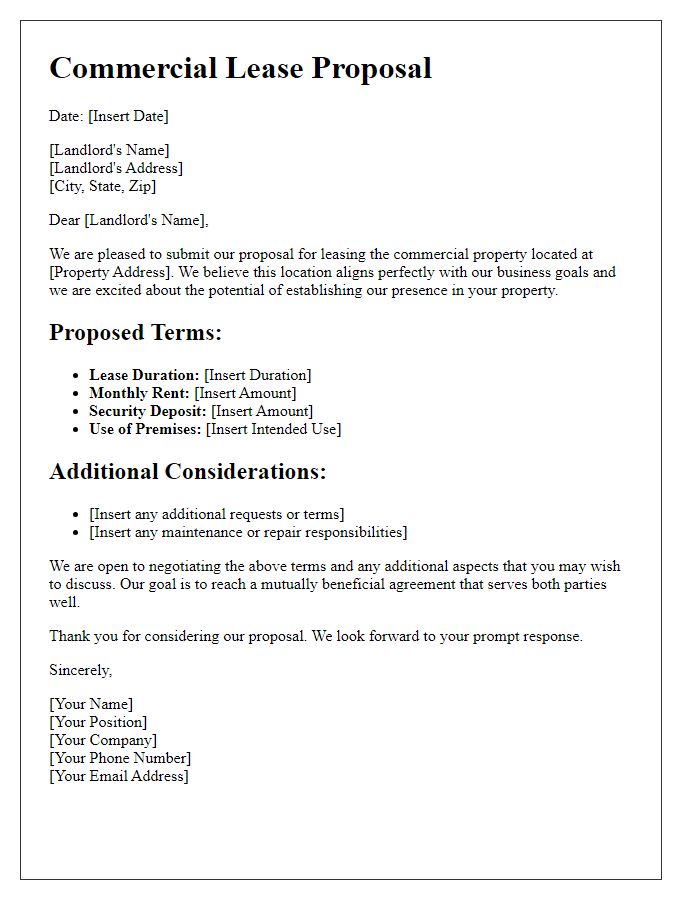

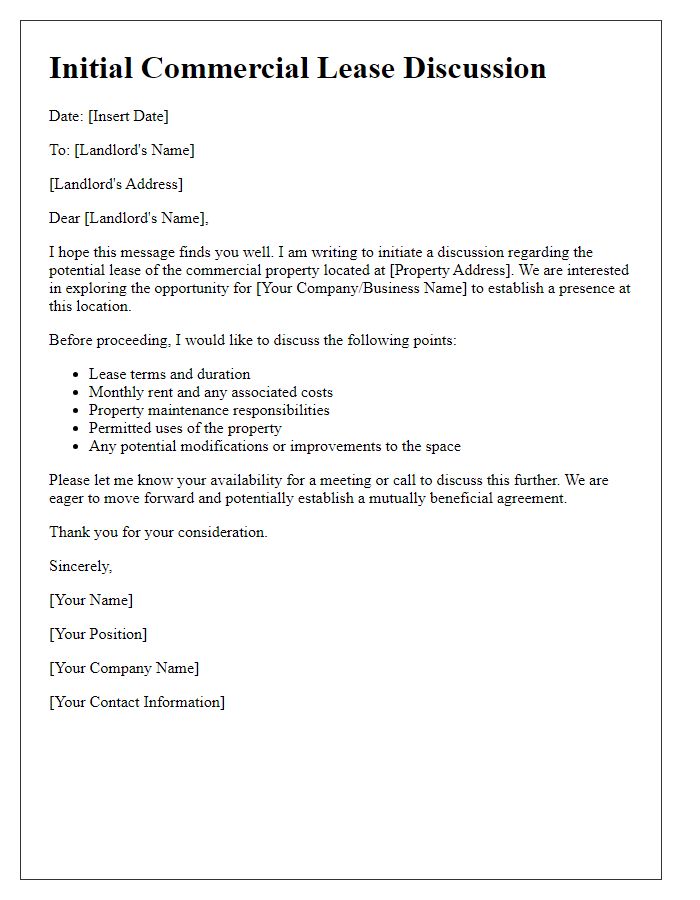

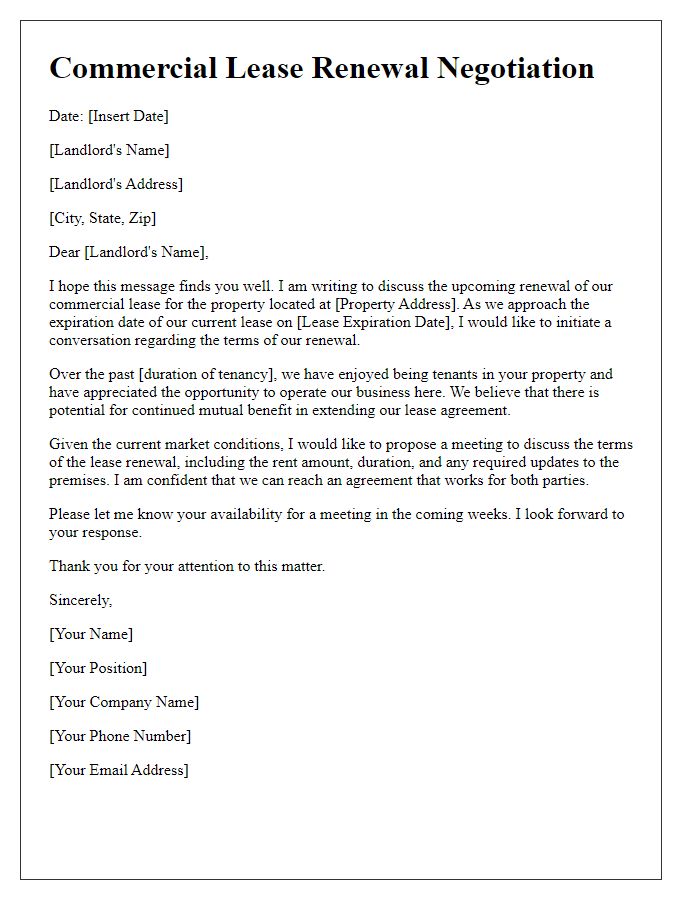

Navigating the complexities of commercial lease negotiations can feel overwhelming, but it's essential for securing a space that fulfills your business needs. Whether you're a seasoned entrepreneur or just starting out, understanding the key terms and tactics can make a significant difference. This guide aims to simplify the negotiation process, equipping you with strategies to advocate effectively for your interests. Ready to dive in and empower yourself in your next lease negotiation? Read on!

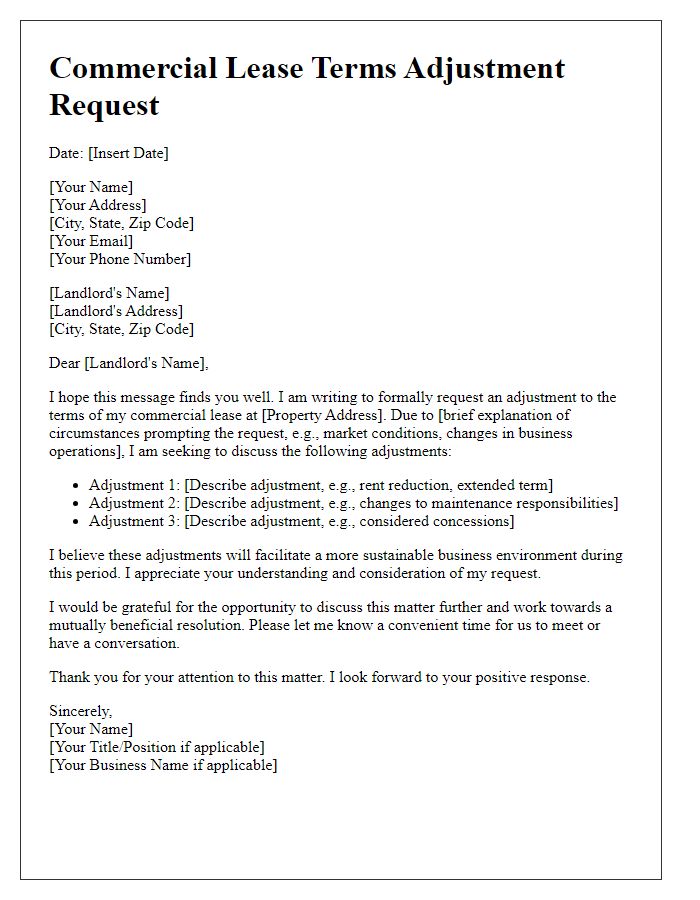

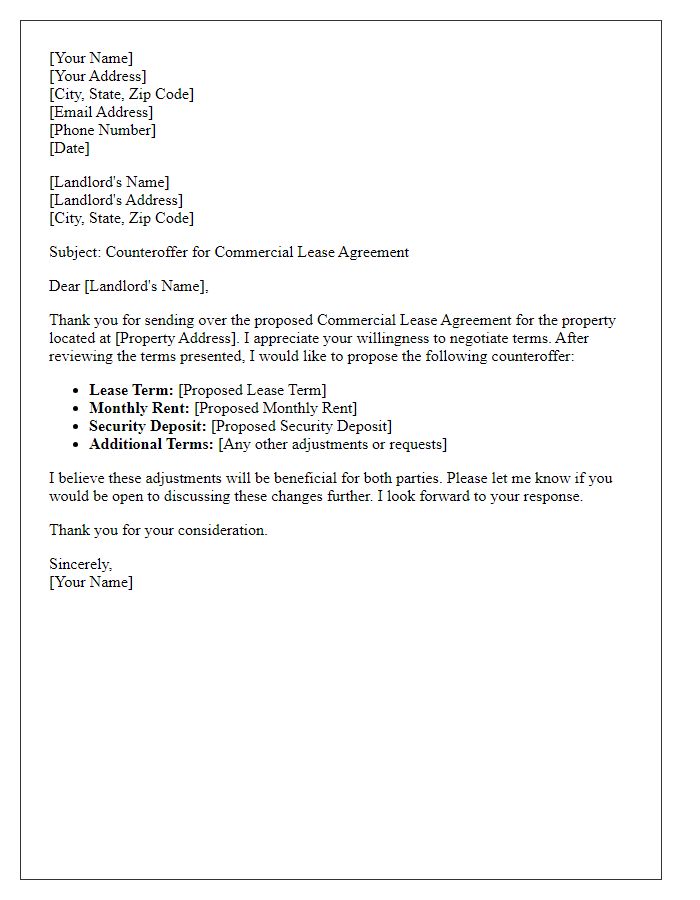

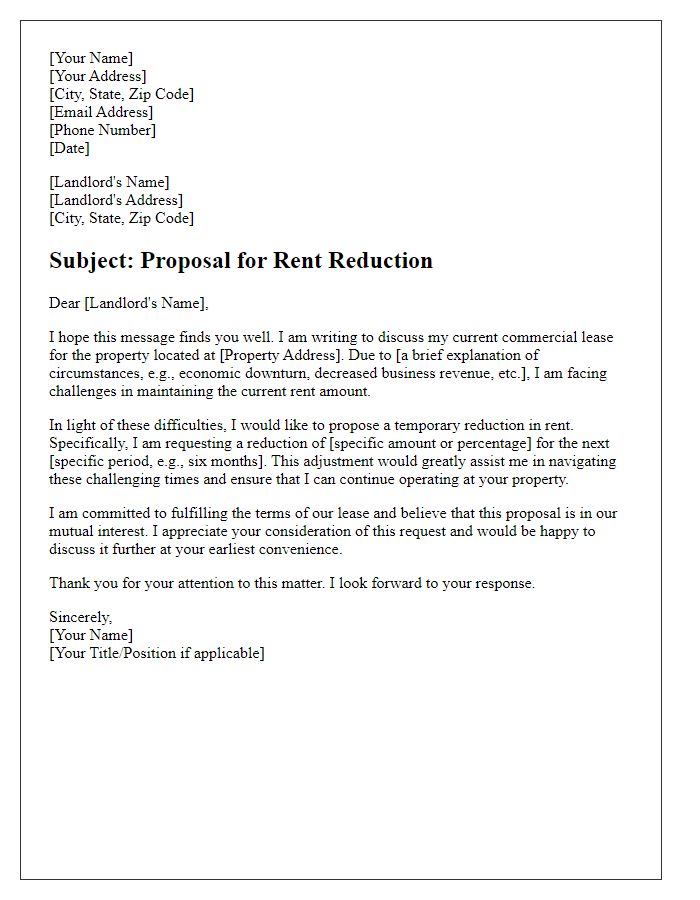

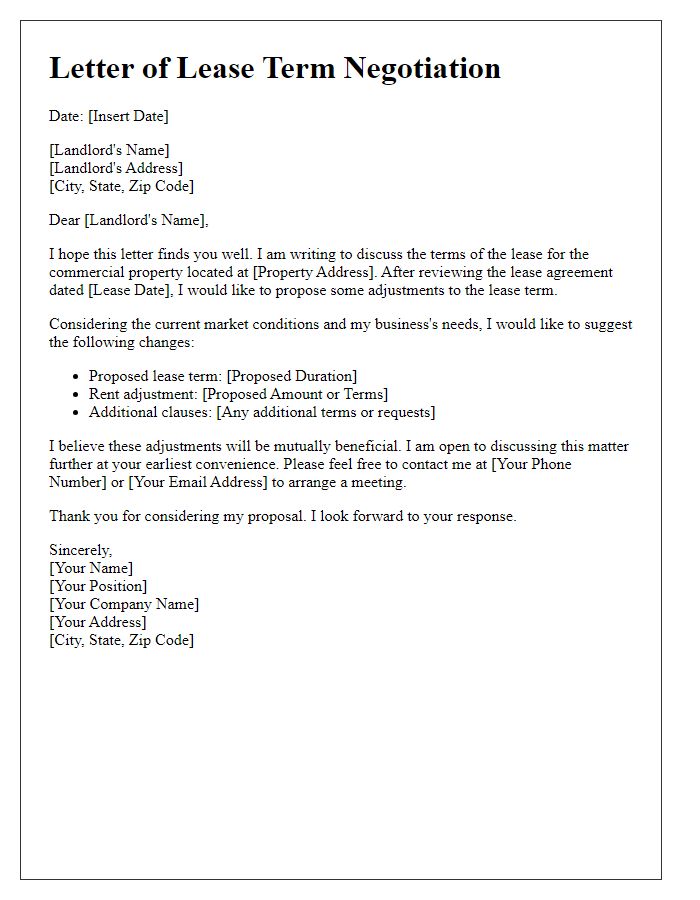

Rent and Lease Term Adjustments

Negotiating commercial lease adjustments involves addressing key terms regarding rent and lease duration. A notable example is adjusting monthly rent, often set per square foot, which may be influenced by market trends viewed in areas like Silicon Valley, known for its fluctuating real estate prices. Additionally, lease terms typically range from three to ten years, with variations based on location, business type, and market demand. Early termination clauses, renewal options, and escalations tied to inflation rates can also play significant roles in restructuring agreements. Overall, addressing these elements can ensure a mutually beneficial arrangement between tenants and landlords while maintaining financial viability.

Maintenance and Repair Responsibilities

The maintenance and repair responsibilities outlined in a commercial lease agreement play a crucial role in ensuring the longevity and functionality of the leased property. This includes provisions concerning the upkeep of structural elements (like roofs, walls, and foundations) essential for the overall integrity of the building located at 123 Main Street, and the ongoing maintenance of systems such as electrical, plumbing, and HVAC (heating, ventilation, and air conditioning), which are critical for tenant operations. Responsibility for routine repairs (defined as minor fixes typically addressed within 48 hours) versus major repairs (which may be required less frequently but are often more expensive) must be clearly delineated. Additionally, stipulations regarding prompt notification of maintenance needs and the timelines for resolution can prevent disputes and ensure a cooperative relationship between landlord and tenant. Clearly specifying which party is liable for damages resulting from negligence or failure to maintain helps protect both interests in scenarios involving unforeseen incidents or natural disasters, such as those that could arise from severe weather conditions.

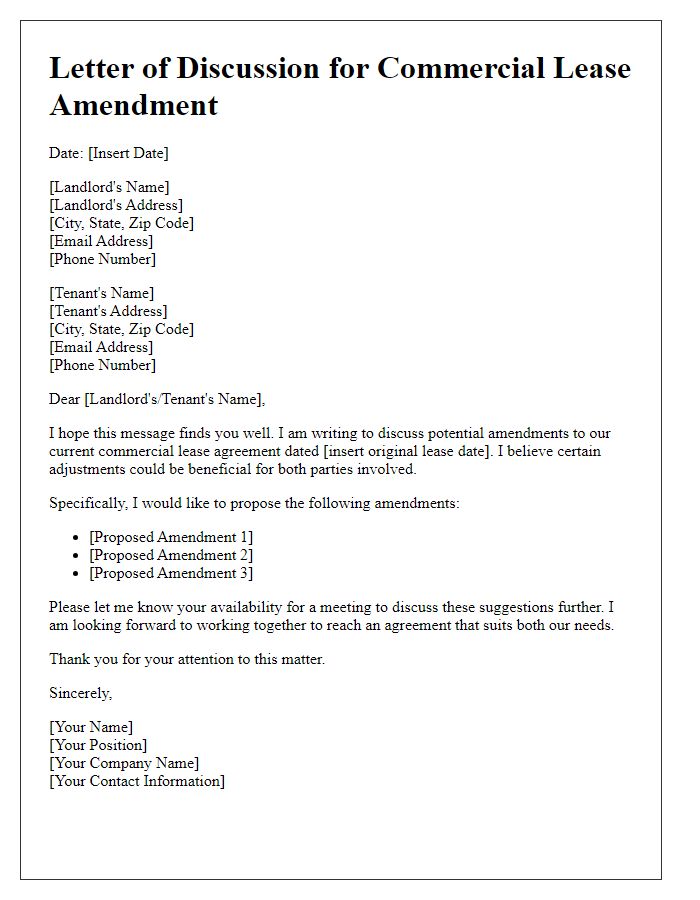

Sublease and Assignment Clauses

Subleasing arrangements in commercial real estate transactions often carry specific conditions that are crucial for tenants and landlords alike. The sublease clause typically dictates the rights of the original tenant to lease the premises, located at addresses such as 123 Main Street, to another party, ensuring compliance with the primary lease agreement established on January 1, 2023. Precise language in this clause can include restrictions on the type of businesses allowed to occupy the space, which must align with local zoning laws. The assignment clause provides guidelines for the tenant's ability to transfer their lease obligations to another entity, requiring written consent from the landlord, such as ABC Property Management. These clauses can also outline necessary documentation, including financial statements or credit checks, ensuring the assignee meets the financial criteria set forth in the lease. Clear stipulations regarding subleases and assignments are vital for maintaining tenant rights while safeguarding the landlord's interests, particularly in thriving commercial areas like downtown Manhattans or suburban business parks.

Security Deposit and Guarantees

In commercial lease negotiations, the security deposit is a critical financial component, typically amounting to one to three months' rent, depending on the property's location and market conditions. This sum serves as protection for landlords against damages and unpaid rent, ensuring lease compliance. Guarantees, often required from tenants, may involve personal or corporate guarantees, securing the lease obligations in cases of default. Such guarantees can bolster a landlord's confidence in the tenant's financial stability, especially in high-stakes markets like New York City or San Francisco. The negotiation of these terms must clearly outline the conditions under which the security deposit may be retained, along with the time frame for its return following the lease's expiration, often stipulated as 30 to 60 days.

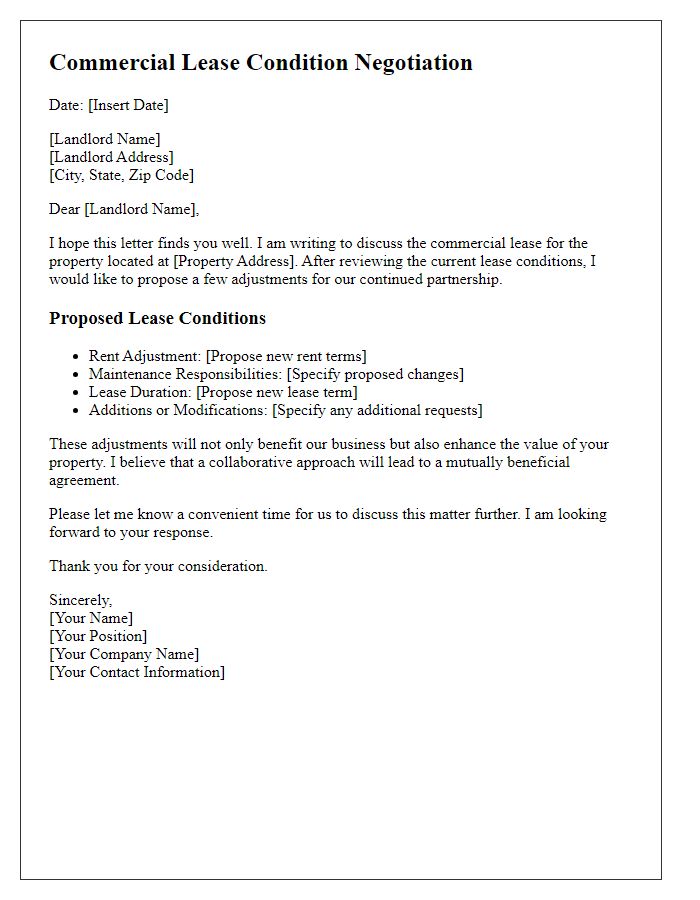

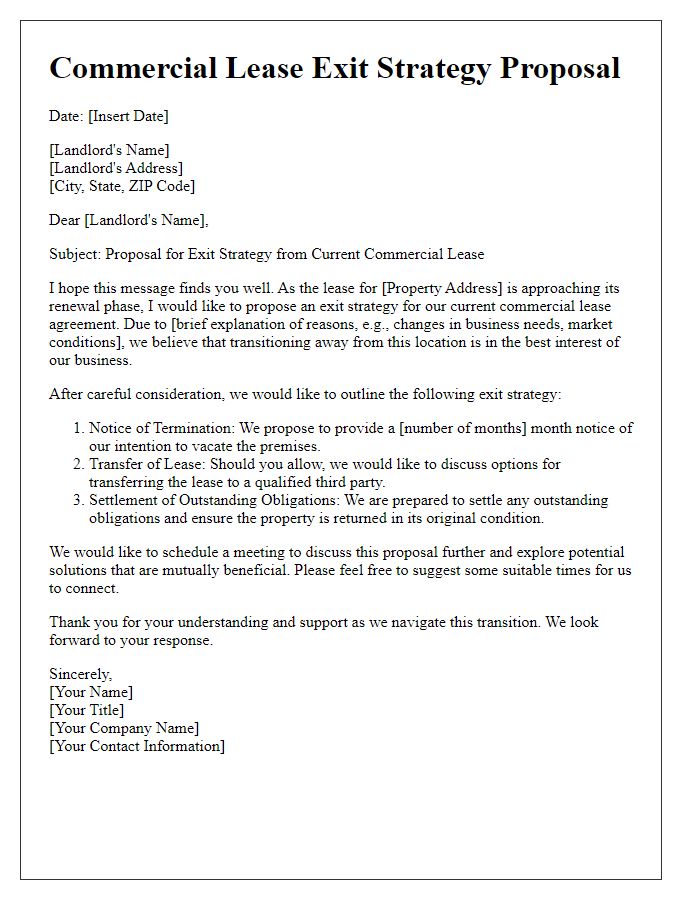

Termination and Renewal Options

Commercial lease agreements often include clauses for termination and renewal options, critical for both landlords and tenants. Termination options provide a clear exit strategy, typically outlined in sections of the lease detailing notice periods, conditions for ending the lease, and any associated penalties. For example, a five-year lease may have a termination clause allowing for a break at the three-year mark, requiring six months' notice. Renewal options grant tenants the ability to extend their lease under pre-negotiated terms, often reflecting current market conditions. This section might specify the duration of the renewal, such as an additional three to five years, and any adjustments to rental rates, possibly tied to the CPI (Consumer Price Index) to ensure fair pricing. Establishing these options benefits both parties by providing stability for tenants and retaining income for landlords.

Comments