When it comes to navigating the sometimes rocky waters of an insurance claim dispute, having the right approach can make all the difference. Addressing the nuances in your claim clearly and effectively can help pave the way towards a successful resolution. In this article, we'll explore a helpful letter template designed to streamline your communication with your insurance provider, ensuring that all your concerns are addressed. So, let's dive in and equip you with the tools you need to tackle your insurance claim dispute with confidence!

Clarity and Specificity

Insurance claim disputes often arise during the resolution process, leading to potential misunderstandings regarding coverage and compensation. A well-crafted communication is essential to address these issues effectively. Detailed documentation, including claim numbers, dates of incidents, policy provisions, and specific reasons for disagreement, should be included. Clear descriptions of the events leading to the claim, supported by photographic evidence, estimates, or receipts can strengthen the position. It is crucial to outline the desired outcome, whether it is a reassessment of the claim amount or consideration of additional damages not previously acknowledged, to ensure a transparent dialogue with the insurance provider.

Relevant Policy Details

In the realm of insurance claims, relevant policy details encompass crucial components such as policy numbers, coverage limits, deductible amounts, and specific exclusions that apply to the insurance agreement. The policy number, typically a unique identifier, facilitates tracking and managing claims related to specific agreements. Coverage limits define the maximum payout an insurer will provide for a covered loss, which varies significantly among different types of insurance, such as home, auto, or health insurance. Deductible amounts represent the out-of-pocket expenses policyholders must pay before the insurer covers remaining costs, often impacting claim processing. Specific exclusions delineate circumstances or events not covered by the policy, such as natural disasters or pre-existing conditions, directly influencing claim approvals and denials. Accurate documentation of these elements is vital for effective dispute resolution in the claims process, ensuring both parties understand their rights and responsibilities.

Supporting Evidence Documentation

To resolve an insurance claim dispute effectively, compiling a comprehensive set of supporting evidence documentation is essential. This may include photographs showcasing damage to property, such as a roof or vehicle, taken immediately after the incident, including timestamps. Detailed itemized invoices reflecting repair costs or medical bills must accompany any claims related to health issues or property damage, highlighting specific expenses incurred. Statements from witnesses, containing full names, contact information, and firsthand accounts of the incident, can strengthen the case. Additionally, policy documents, including the insurance agreement's coverage terms and conditions, should be reviewed and submitted, ensuring alignment with the claim filed. Correspondence with insurance adjusters, detailing all communications, can provide a clear timeline of events. Collectively, this substantive evidence creates a compelling narrative supporting the claim and facilitating a smoother resolution process with the insurance company.

Clear Resolution Request

In insurance claim disputes, effective communication with the insurance provider is crucial. A clear resolution request delineates the specific issues, such as denied claims, inadequate compensation, or delays in processing claim forms. Including pertinent claim details, such as policy number and claim reference number, streamlines the resolution process. Stating the desired outcome, whether it is a re-evaluation of the claim or a prompt response, enhances clarity. Supporting documents, including receipts, photographs, and previous correspondence, bolster the argument for resolution. Timely follow-up to ensure the insurance company acknowledges the request is essential for maintaining momentum in the dispute process.

Contact Information and Follow-Up Plan

Contact information is crucial for effective communication regarding insurance claim disputes. Relevant details include the policyholder's full name, address, phone number, and email address, ensuring all parties can be easily reached. The insurance company should provide their customer service hotline, claims department contact, and any specific representatives handling the dispute, including direct lines or email contacts. A follow-up plan is essential to establish a timeline for communication, specifying dates for sending documents, anticipated responses, and follow-up calls. Outline necessary documentation such as claim summaries, policy documents, and evidence supporting the dispute, along with clear deadlines to ensure accountability and progress tracking throughout the resolution process.

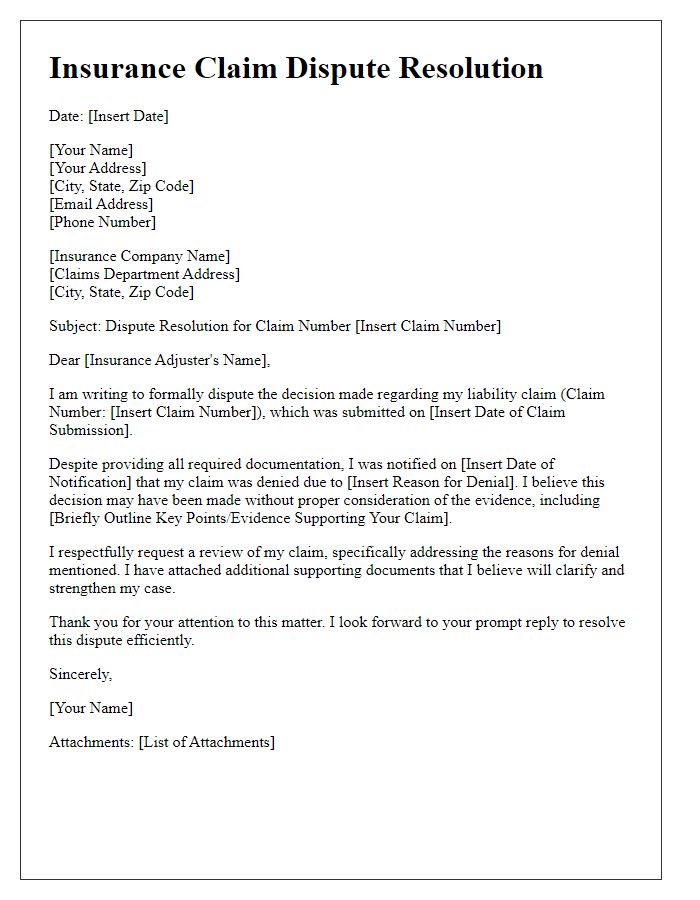

Letter Template For Insurance Claim Dispute Resolution Samples

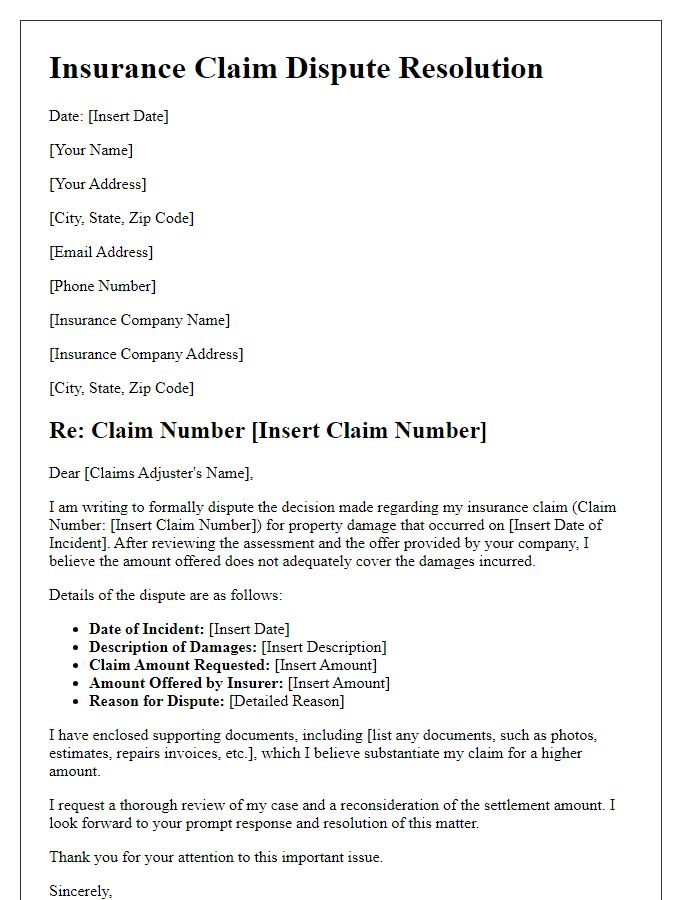

Letter template of insurance claim dispute resolution for property damage.

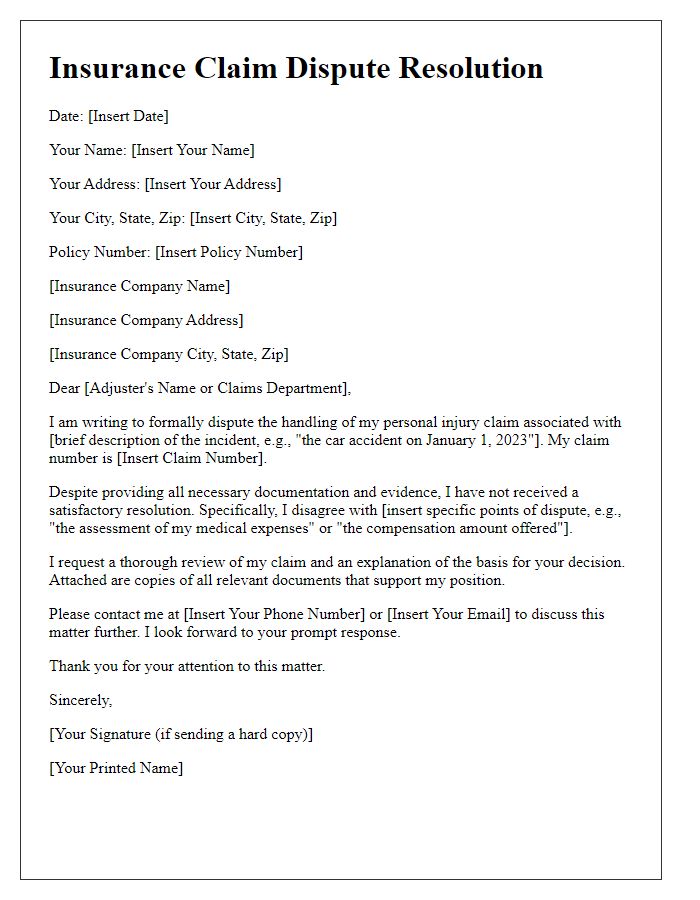

Letter template of insurance claim dispute resolution for personal injury.

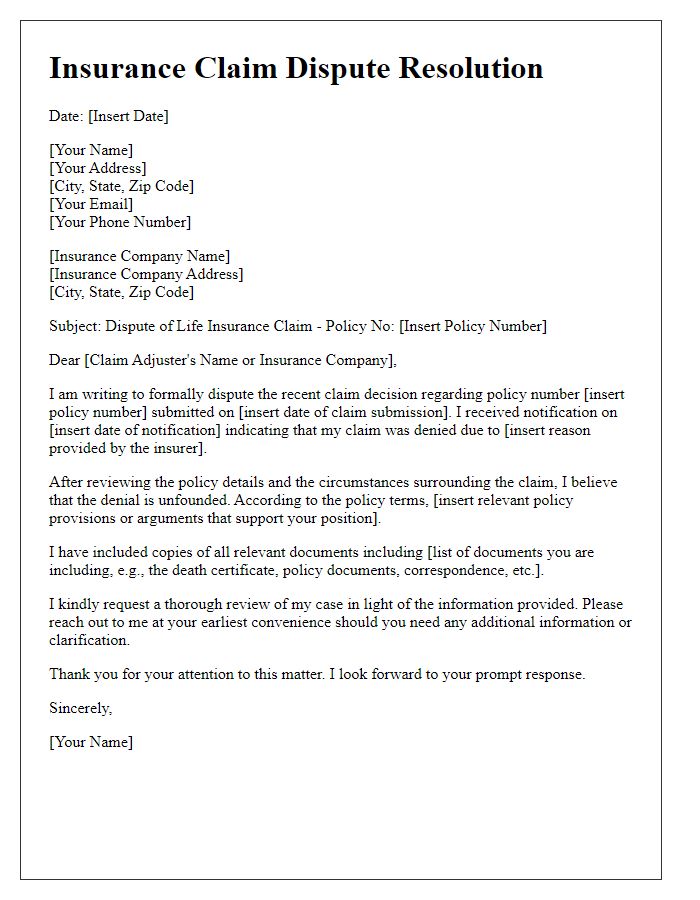

Letter template of insurance claim dispute resolution for life insurance.

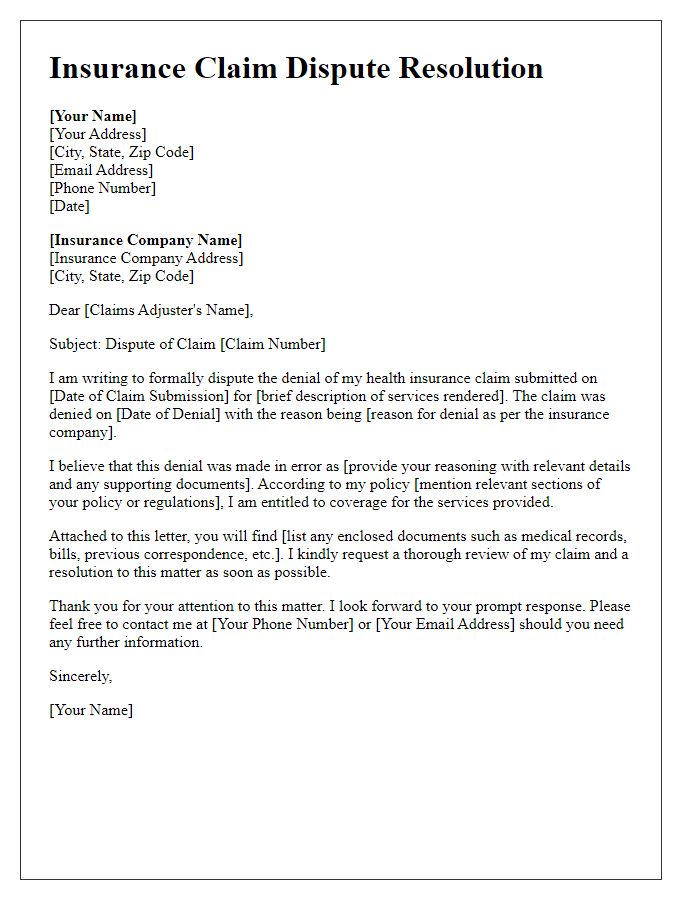

Letter template of insurance claim dispute resolution for health insurance.

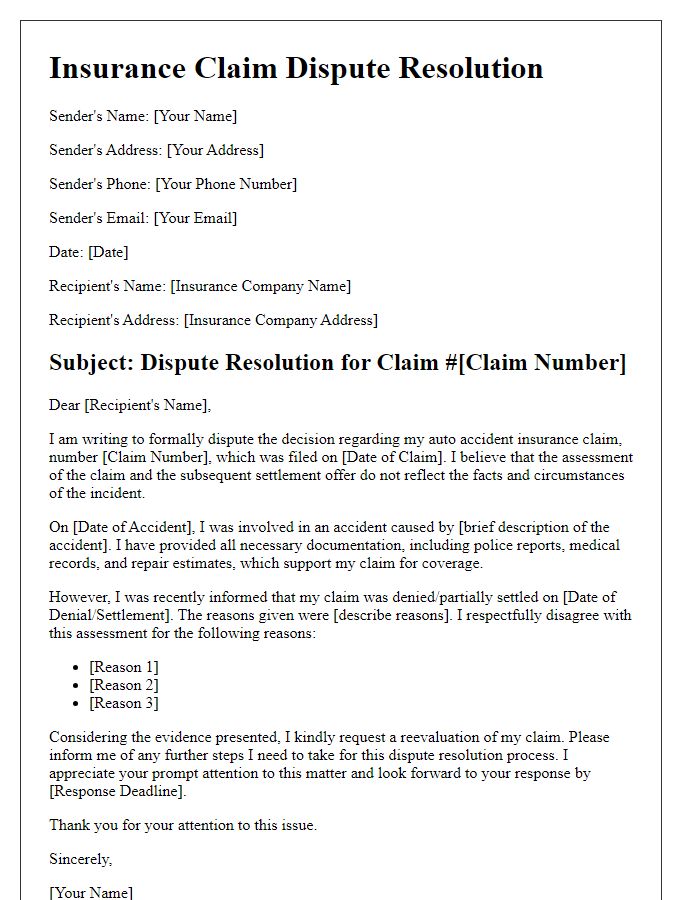

Letter template of insurance claim dispute resolution for auto accident claims.

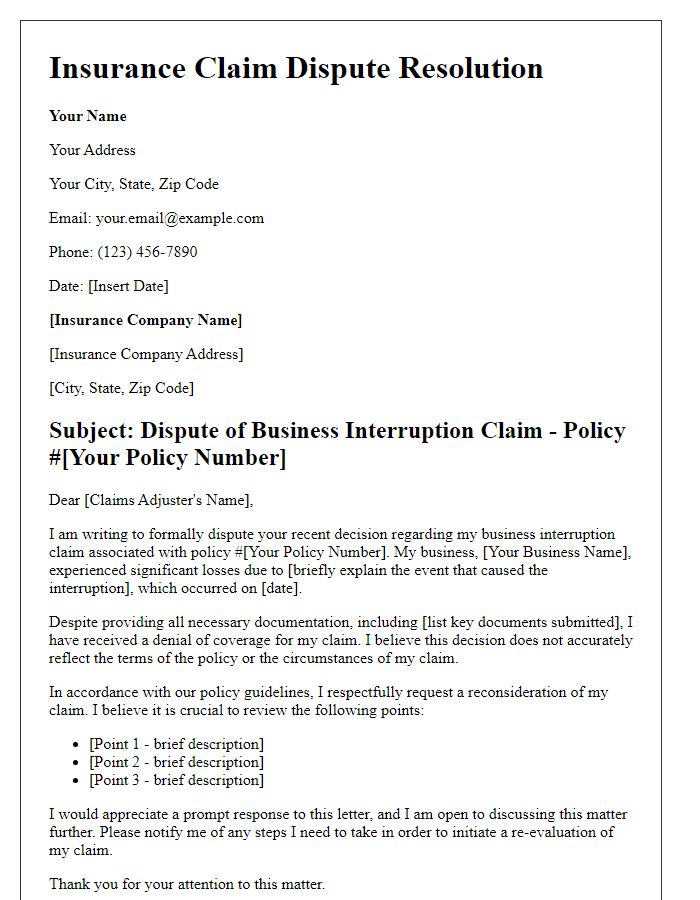

Letter template of insurance claim dispute resolution for business interruption.

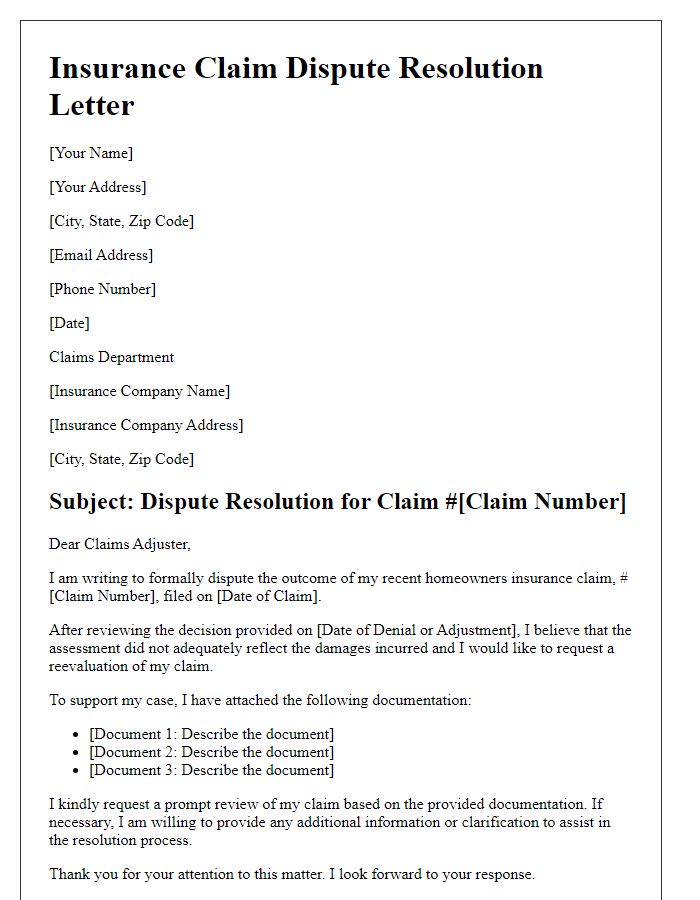

Letter template of insurance claim dispute resolution for homeowners insurance.

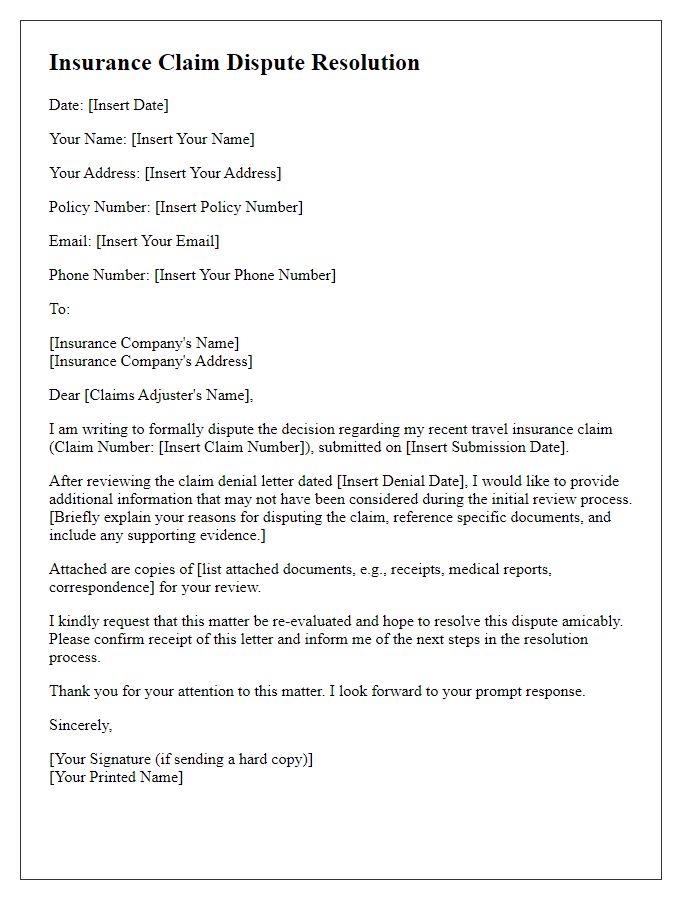

Letter template of insurance claim dispute resolution for travel insurance.

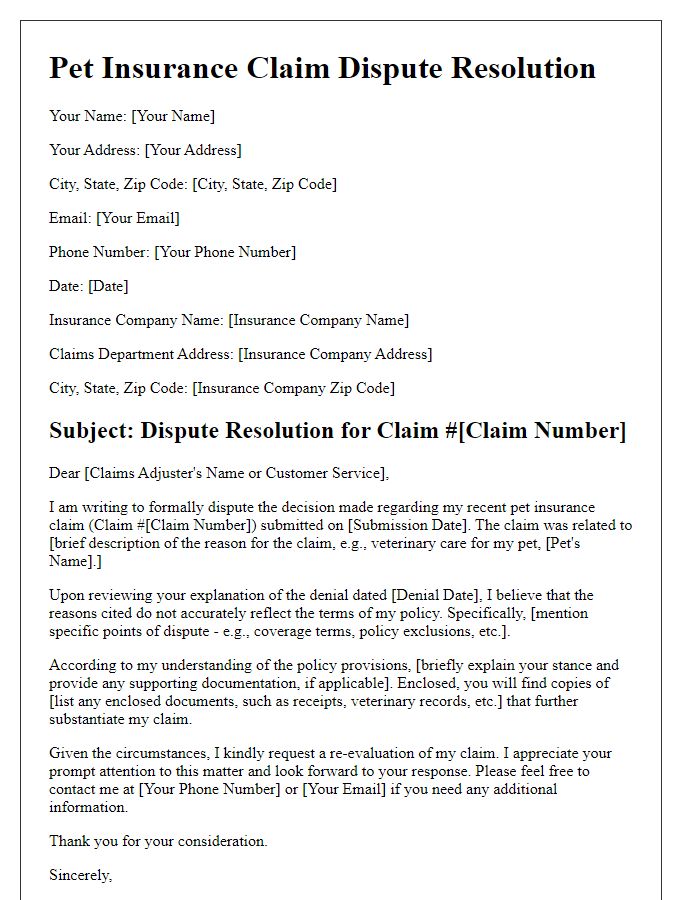

Letter template of insurance claim dispute resolution for pet insurance.

Comments