Are you ready to unlock new opportunities for growth and success? In our latest investment prospectus, we outline an exciting array of opportunities designed to help you navigate the complexities of today's market. This letter serves as your gateway to understanding how our investment strategies can align with your financial goals. Join us as we delve deeper into these potential venturesâlet's explore the possibilities together!

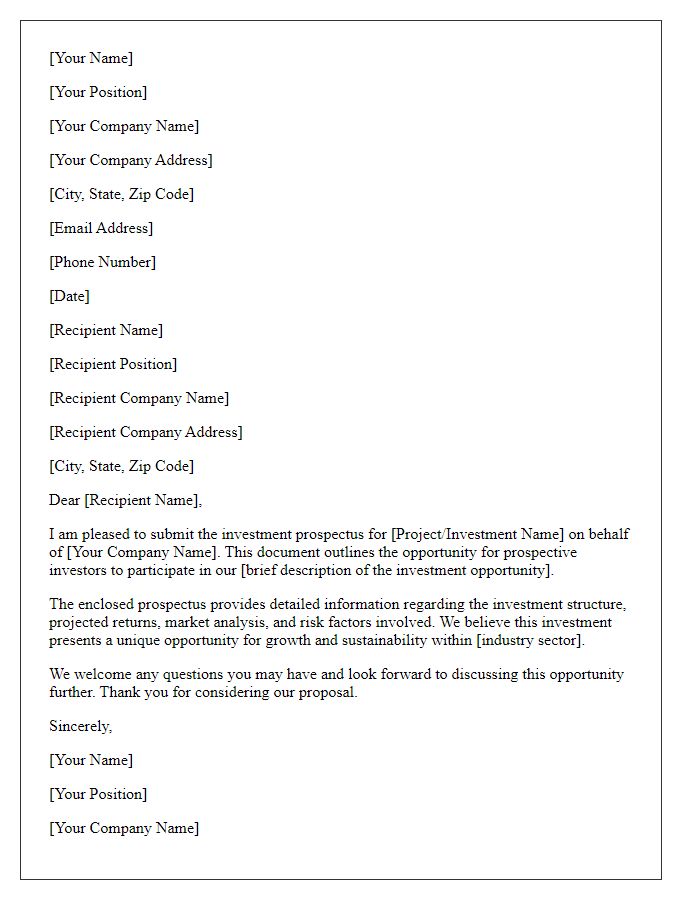

Recipient's Information

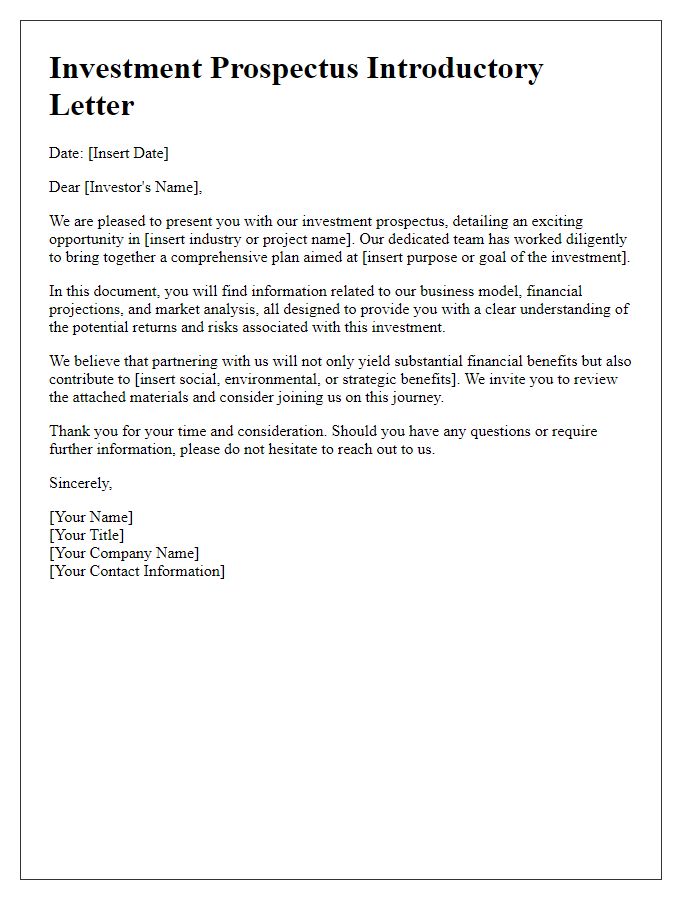

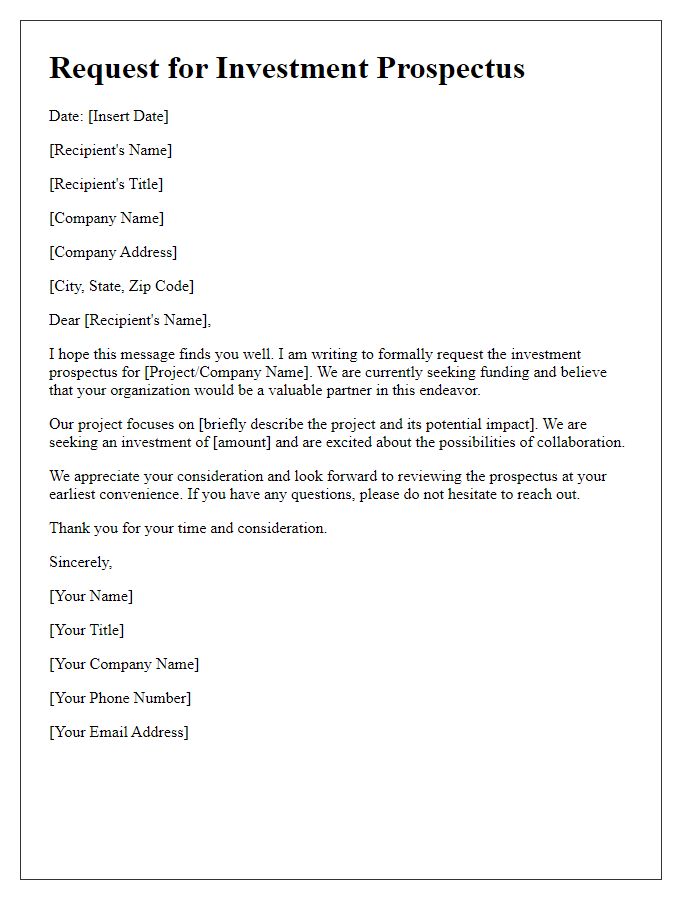

Creating a compelling investment prospectus cover letter is essential for attracting potential investors. The cover letter should be personalized to the recipient, clearly outlining key information about the investment opportunity. Include the recipient's name, title, company name, and address at the top. Addressing the recipient directly establishes a professional tone. Highlight the potential returns, growth metrics, and any unique selling propositions relevant to the investment opportunity. Use concise language while ensuring all critical details regarding market trends, financial forecasts, and company history are emphasized, making it easy for recipients to grasp the value of the investment quickly.

Introduction and Purpose

The investment prospectus cover letter serves as an essential tool to introduce potential investors to the investment opportunity at hand. The aim is to provide a concise overview of the investment's purpose, highlighting its unique features, expected returns, and associated risks. It should emphasize the market potential and the strategic vision behind the investment, capturing the attention of investors while encouraging them to delve into the details of the prospectus. This letter sets the tone for the overall investment narrative, aligning the interests of potential investors with the financial goals of the project.

Overview of Investment Opportunity

The investment opportunity presented involves a strategically located commercial real estate property in the bustling downtown area of Austin, Texas. This prime location, situated near key attractions such as the Texas State Capitol and the vibrant nightlife of Sixth Street, encompasses approximately 15,000 square feet of versatile retail and office space. Current market trends indicate an annual growth rate of 6.5% in the real estate sector for Austin, driven by a significant population increase and robust job market expansion. Investors can anticipate an attractive return on investment, projected at 12% over the next five years, fueled by a diverse tenant mix and long-term lease agreements. This opportunity combines a solid investment foundation with the potential for substantial appreciation, positioning it as a compelling addition to any investment portfolio.

Strategic Benefits and Objectives

The strategic benefits of investing in renewable energy projects, particularly solar and wind, are notable for institutions seeking long-term growth and sustainability. With global investment in renewable energy expected to exceed $2 trillion by 2025, driven by increasing government incentives and consumer awareness, these projects not only yield substantial financial returns but also promote environmental stewardship. For instance, the landmark 2021 Infrastructure Investment and Jobs Act in the United States allocated $65 billion to enhance grid resilience and encourage clean energy production. Additionally, energy sources such as offshore wind farms in places like the North Sea can generate continuous power supply, thus reducing dependency on fossil fuels and enhancing energy security. Moreover, aligning investments with the UN Sustainable Development Goals (SDGs), particularly Goal 7, can bolster corporate reputations and attract ESG-focused investors, ultimately leading to a more robust financial portfolio.

Call to Action and Contact Details

A compelling investment prospectus cover letter serves as a critical component in attracting potential investors. Engaging language emphasizes unique investment opportunities, outlining the potential for growth and ROI. Specific metrics, such as projected revenue increases of 25% over the next fiscal year, capture attention, while market trends provide context for anticipated success. Contact details, including phone numbers and email addresses, ensure easy access for inquiries. Inviting a sense of urgency, a clear call to action encourages scheduling meetings or making investments promptly, reinforcing the importance of timely participation in the investment opportunity.

Comments