In the ever-evolving landscape of financial services, understanding regulations is more crucial than ever. Whether you're a seasoned professional or just starting out, navigating the complex web of rules can be daunting. This article will provide you with valuable insights into the latest regulatory updates and their implications for your business. So, buckle up and get ready to dive deeper into the essentials of financial services regulationâlet's explore together!

Compliance Requirements

Financial services regulation mandates strict compliance requirements to ensure stability and integrity within the financial sector. Regulatory bodies such as the Financial Conduct Authority (FCA) and the Securities and Exchange Commission (SEC) implement standards that govern practices of financial institutions, including banks, investment firms, and insurance companies. Compliance encompasses various aspects, including Anti-Money Laundering (AML) protocols, Know Your Customer (KYC) procedures, and adherence to capital adequacy ratios set forth in guidelines like Basel III. Failure to comply can result in significant penalties, including fines in excess of millions of dollars and reputational damage. Ongoing monitoring and reporting are essential, ensuring that organizations maintain transparency and align with evolving regulations. Additionally, comprehensive training programs for staff are vital in fostering a culture of compliance within the organization.

Regulatory Framework

The regulatory framework governing financial services encompasses a complex structure of laws, regulations, and guidelines established to ensure the stability and integrity of the financial system. Key entities include the Financial Stability Oversight Council (FSOC) in the United States, which monitors systemic risk; the European Securities and Markets Authority (ESMA) in the European Union, which oversees securities markets; and the Financial Conduct Authority (FCA) in the UK, focusing on consumer protection and market integrity. Regulations like the Dodd-Frank Act, implemented after the 2008 financial crisis, aim to prevent excessive risk-taking by financial institutions, while Basel III establishes requirements for bank capital and liquidity. Compliance with anti-money laundering (AML) and know your customer (KYC) regulations is crucial for financial entities to mitigate risks associated with illicit activities. Frequent assessments and updates to these regulations address emerging threats, technological advancements, and changing market dynamics, ensuring a resilient financial ecosystem adaptable to new challenges.

Risk Assessment

Risk assessments for financial services regulations involve evaluating potential hazards that may affect financial markets such as credit risk, market risk, and operational risk. Financial institutions, such as banks and investment firms, must analyze these risks continuously to ensure compliance with regulatory frameworks established by authorities like the Financial Conduct Authority (FCA) in the United Kingdom. This process often includes quantifying risks using statistical models and stress testing scenarios that simulate adverse market conditions. For instance, during a financial crisis, institutions may experience liquidity issues leading to an inability to meet short-term obligations. Documenting these assessments ensures transparency and accountability, helping stakeholders understand risk exposure and implement effective risk management strategies.

Disclosure Obligations

Disclosure obligations in financial services, particularly under regulations like the Dodd-Frank Act (enacted in 2010 in the United States), require institutions to transparently communicate material information to clients. These obligations ensure that consumers receive clear information regarding fees, risks, and potential conflicts of interest associated with financial products. For example, mutual funds must provide a prospectus detailing investment objectives, risks, and performance history. In addition to compliance, organizations must develop policies to regularly update and disseminate this information to adhere to standards set by governing bodies like the Securities and Exchange Commission (SEC). By fostering transparency, these regulations aim to enhance consumer protection and promote informed decision-making in financial markets.

Consumer Protection Policies

The implementation of comprehensive Consumer Protection Policies in financial services is crucial for safeguarding client interests, particularly in the realm of banking institutions and investment firms. Key elements include clear disclosures regarding fees and terms associated with financial products, such as mortgages or mutual funds, which foster transparency. Enforcement mechanisms, including regular audits by regulatory bodies like the Financial Conduct Authority (FCA) in the United Kingdom, ensure compliance with established standards. Additionally, effective dispute resolution systems empower consumers, providing avenues for redress in cases of fraud or misrepresentation. Ongoing education programs enhance consumer awareness, particularly regarding risk factors in investment portfolios. An emphasis on responsible lending practices prevents predatory behaviors, ultimately contributing to a more trustworthy financial ecosystem.

Letter Template For Financial Services Regulation Samples

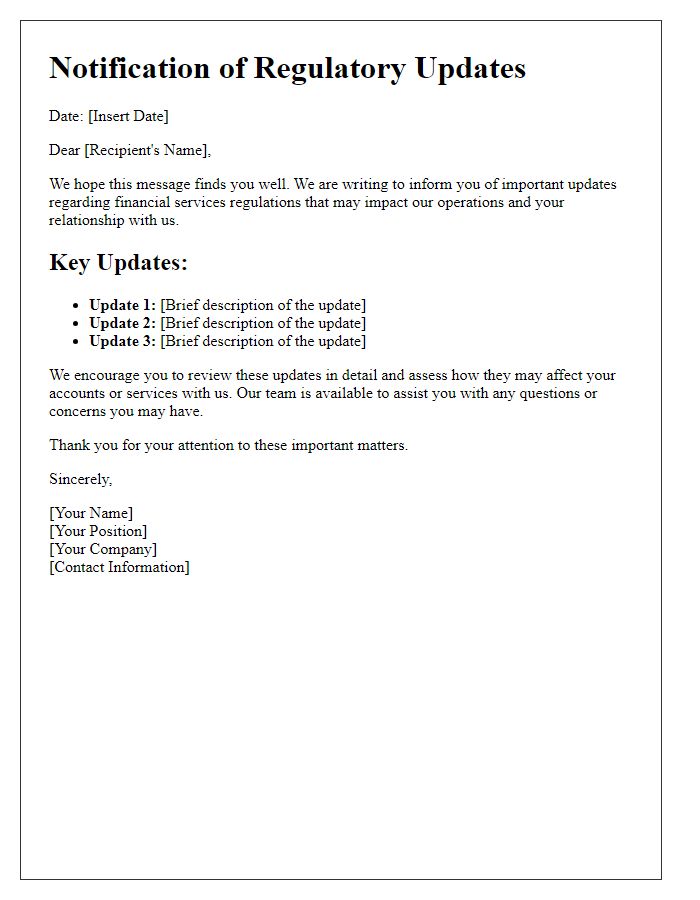

Letter template of notification for financial services regulatory updates.

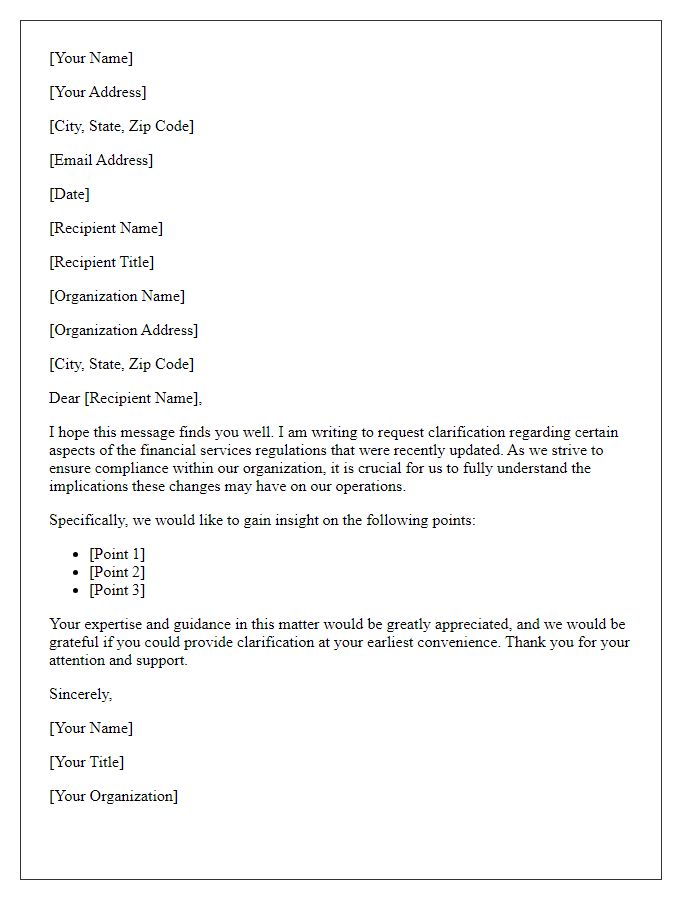

Letter template of request for clarification on financial services regulation.

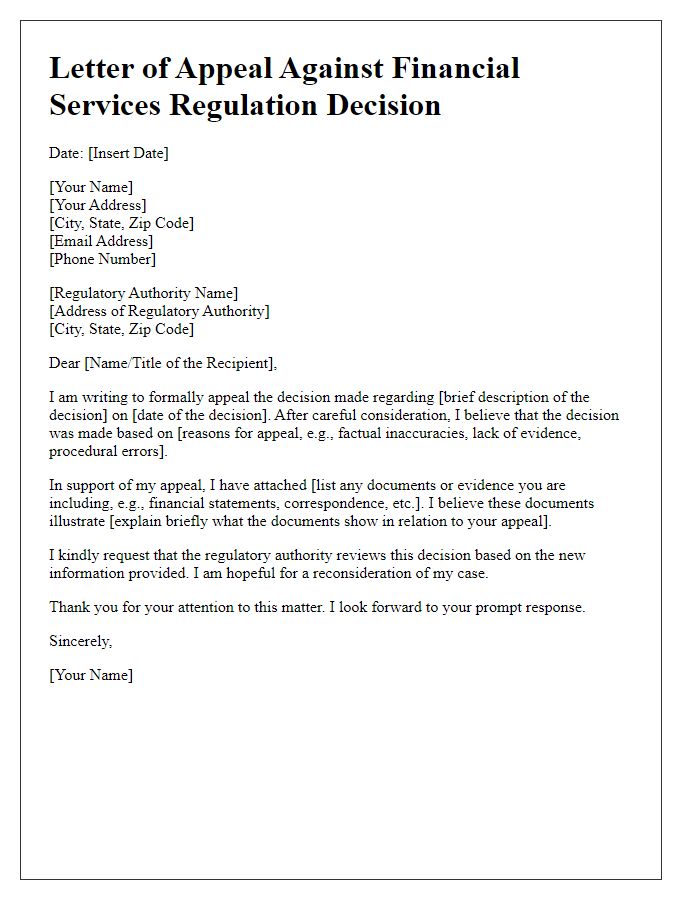

Letter template of appeal against financial services regulation decision.

Letter template of confirmation for adherence to financial services regulation.

Comments