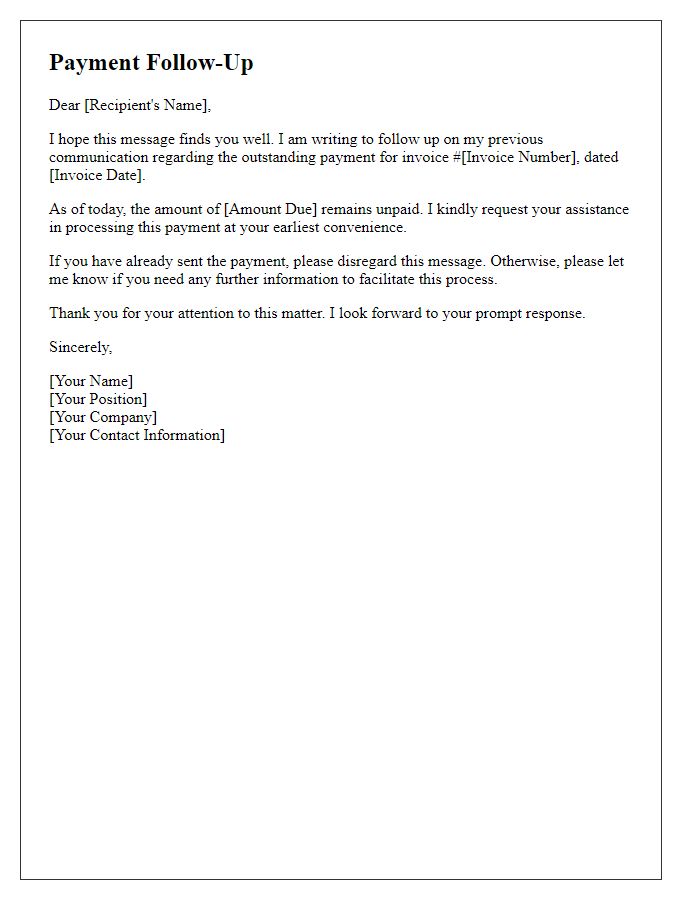

Are you tired of chasing after payments and feeling frustrated by delayed responses? In the world of business, clear communication is key, especially when it comes to financial matters. A well-crafted demand for payment letter not only conveys your message effectively but also maintains professionalism and encourages timely resolution. Read on to discover how to create an impactful payment request that gets results!

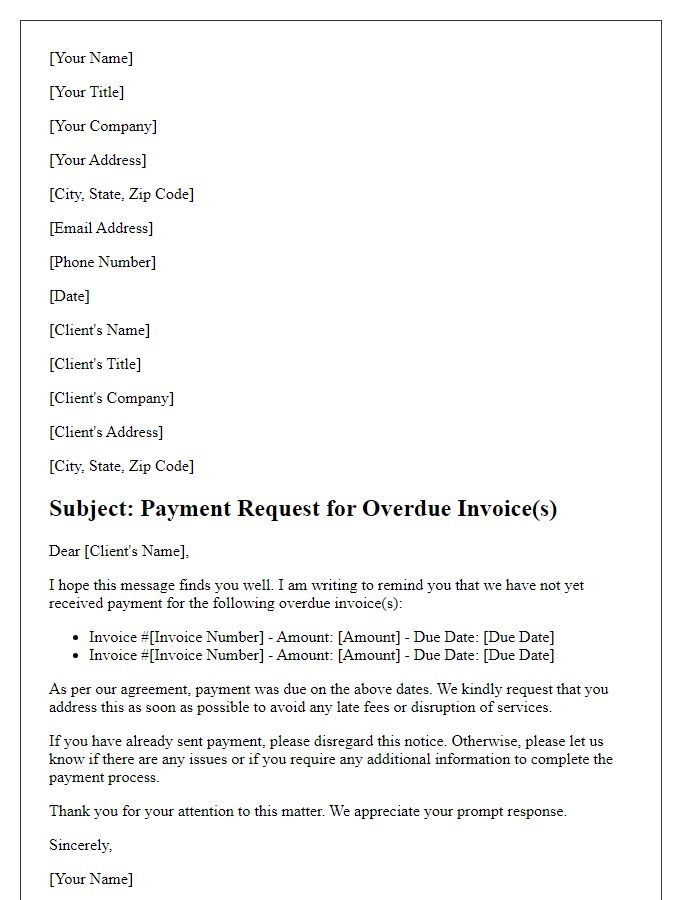

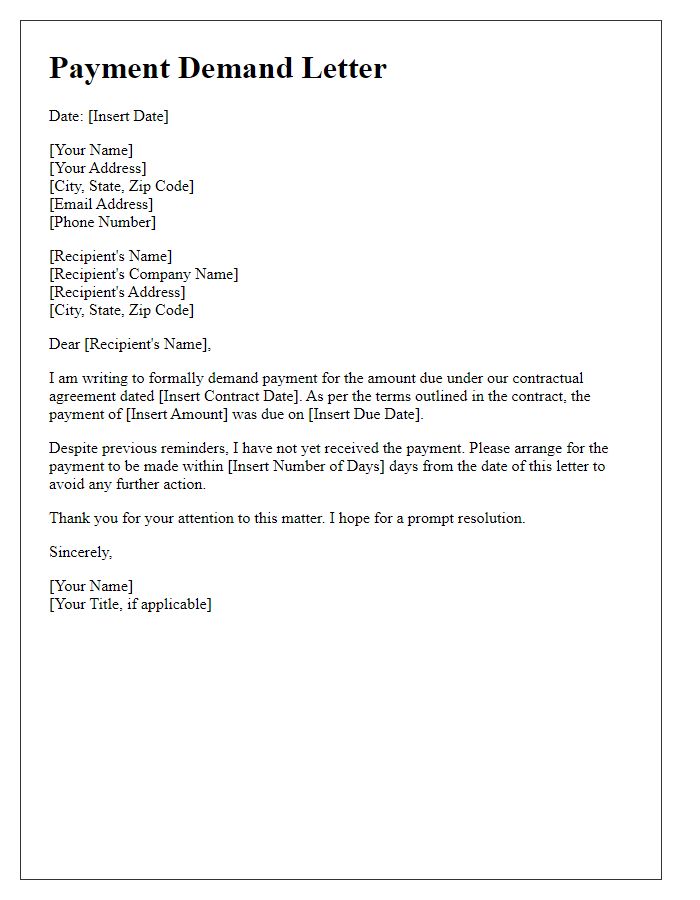

Clear Identification of Debtor and Creditor

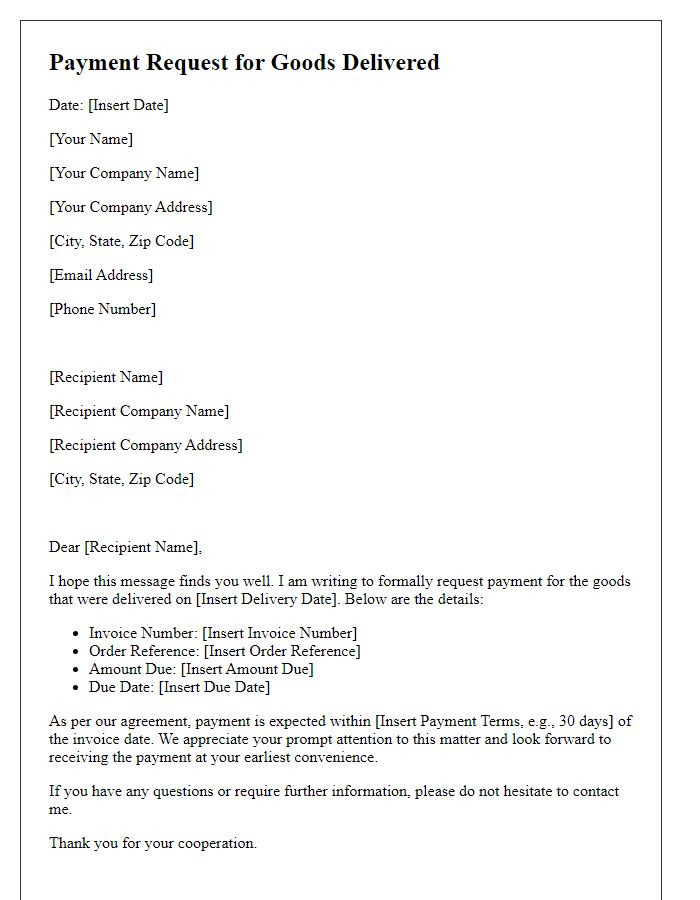

A demand for payment request should feature clear identification of parties involved. The debtor, such as John Doe, located at 123 Main Street, Springfield, must be explicitly named alongside their account number (789456). The creditor, such as ABC Financial Services, situated at 456 Elm Street, Springfield, should also be identified, complete with contact details and account reference information. Including precise amounts owed, like $1,500, with a breakdown of services rendered or payments missed is essential for clarity. Additionally, specifying any deadlines for payment, such as "due within 30 days from the date of the letter," will create urgency and instigate prompt action. This clear identification fosters transparency and helps facilitate resolution.

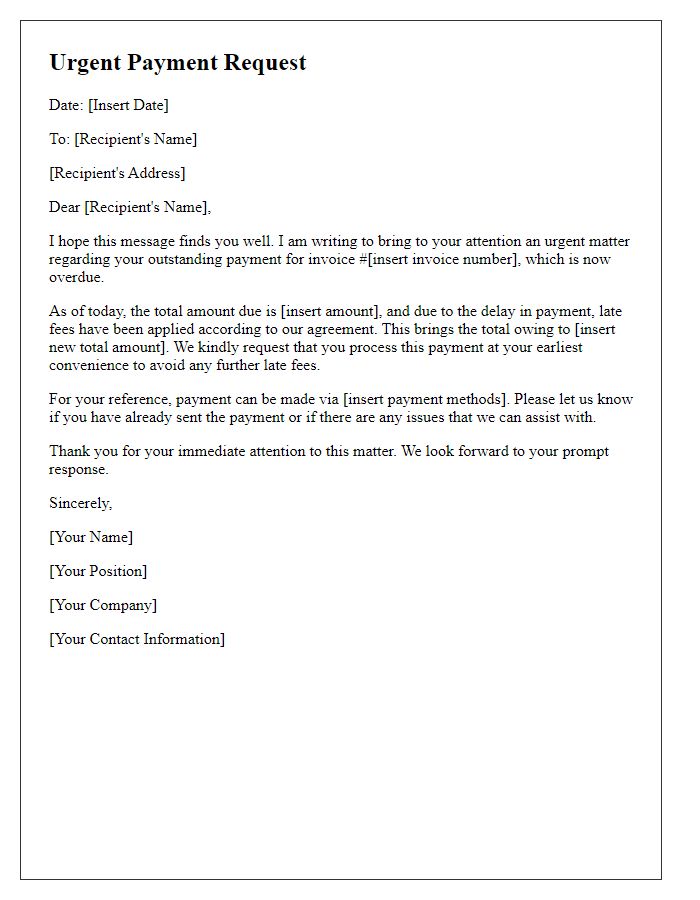

Specific Details of the Outstanding Debt

Outstanding debts can pose significant challenges for individuals and businesses alike, impacting cash flow and financial stability. Specific details of an outstanding debt, such as the total amount owed (e.g., $5,000), date of the original transaction (e.g., March 15, 2023), and invoice number (e.g., INV-2023-457), are crucial for clarity in payment requests. A solid understanding of the agreed-upon payment terms further enhances the communication process; for example, the due date was set for April 15, 2023, with a 5% late fee applicable after this period. It is also important to reference previous communications regarding the debt, including reminder letters sent on June 1, 2023, and July 1, 2023, which serve as evidence of the request and the urgency to resolve the payment issue promptly.

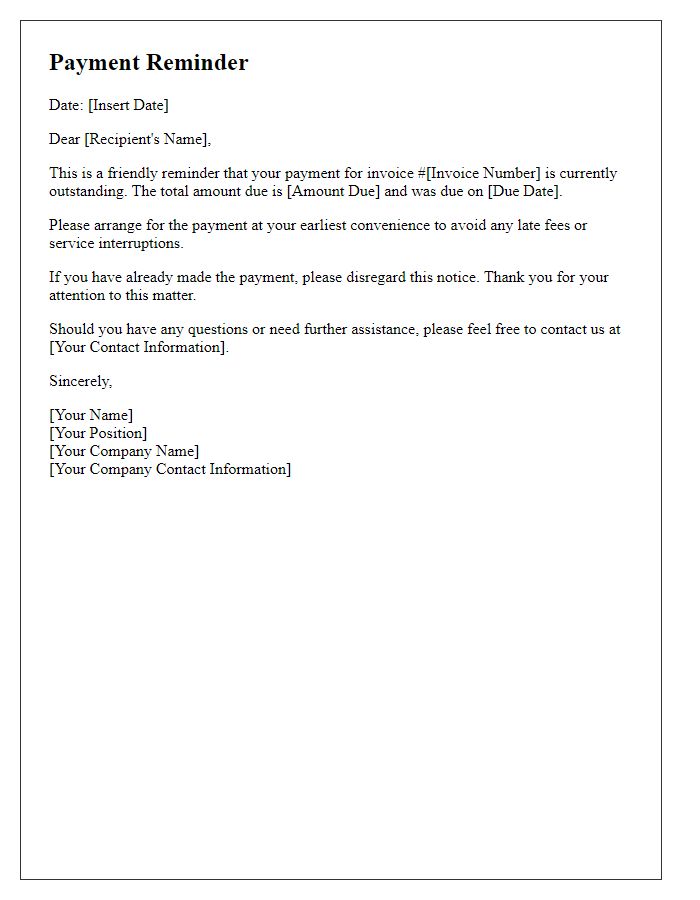

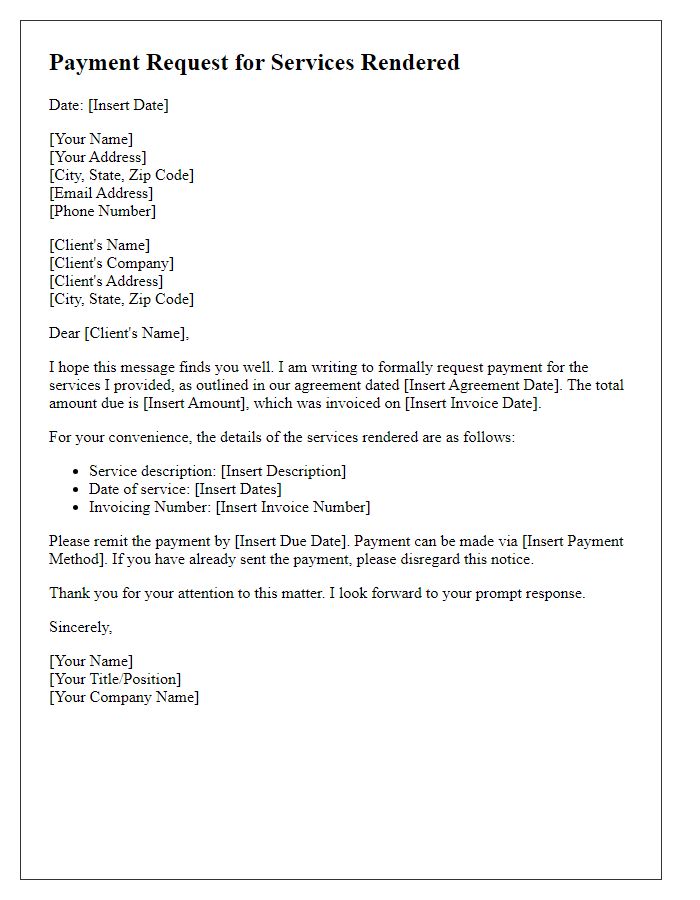

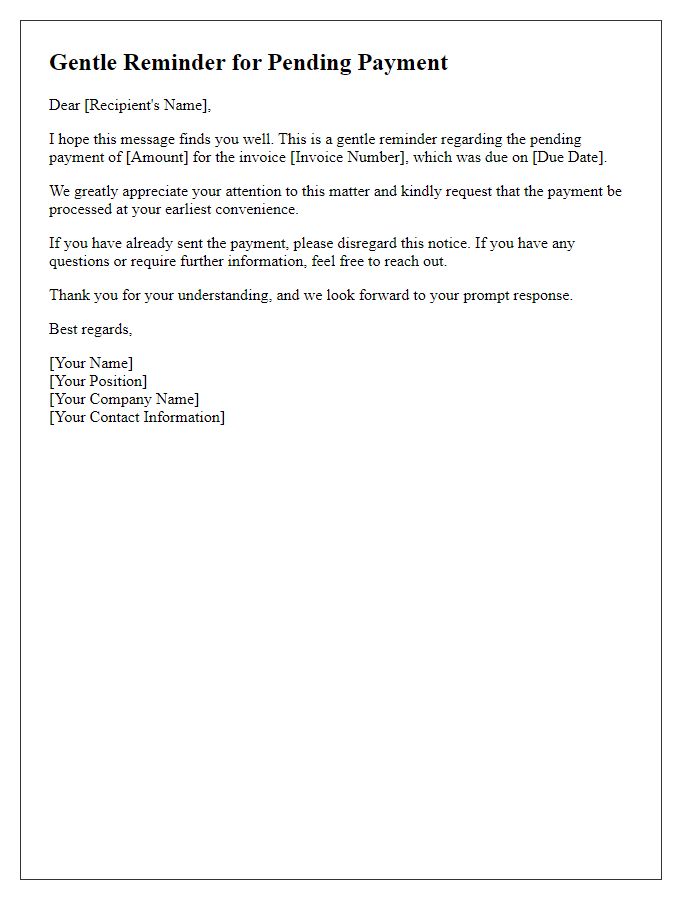

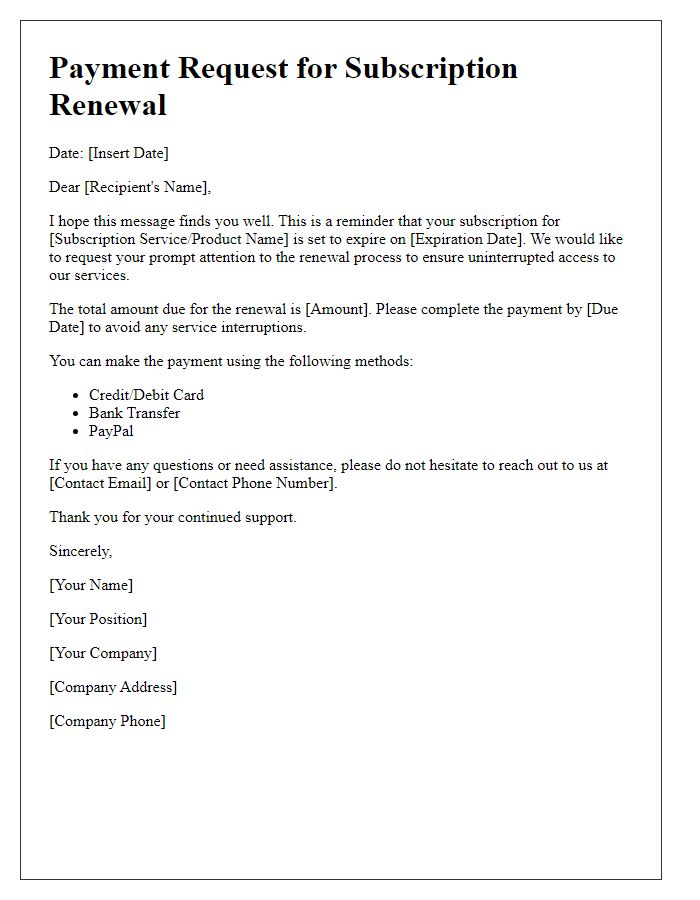

Clear Payment Instructions and Methods

When requesting payment, it is essential to provide clear instructions and methods to ensure prompt processing. Outline all relevant details such as the payment amount, invoice number, and due date to avoid confusion. Specify accepted payment methods, including bank transfers through specific banks such as JPMorgan Chase or PayPal, which allows for transactions using credit cards. Indicate any additional options like checks mailed to a specific address or payment via mobile apps like Venmo or Cash App. Including a deadline for payment encourages timely response, while offering assistance for any questions about the process enhances customer service relations.

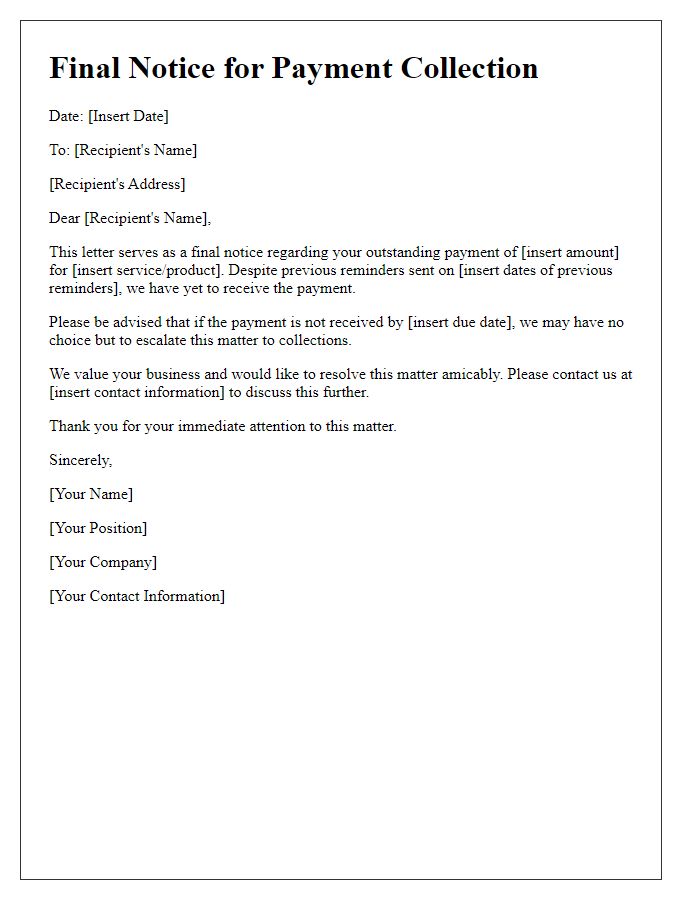

Deadline for Payment and Consequences

Late payment penalties negatively impact small businesses, creating cash flow issues essential for operational stability. Specific timelines, like a 30-day payment period post-invoice date, often reflect industry standards. Failure to adhere may result in accruing interest rates, typically ranging from 1.5% to 2% monthly, significantly increasing the total owed amount. Additionally, prolonged non-payment can lead to collection agency involvement, which may incur additional costs and damage business relationships. Legal actions, including lawsuits, can be considered, with the risk of court fees potentially exceeding the original payment due. Clear communication regarding payment expectations is crucial to maintaining positive client relations while ensuring financial health.

Professional Tone and Legal Compliance

A demand for payment request is a formal communication that seeks to recover unpaid debts. It typically includes critical information such as the amount owed, the due date, and relevant contract or invoice references. The communication maintains a professional tone, often backed by legal compliance, indicating potential consequences of continued non-payment. Key details include the creditor's name, the debtor's name, the specific payment terms outlined in the original agreement, and clear instructions on how to remit payment. Reference to applicable laws can strengthen the message, ensuring the recipient understands their obligations and the seriousness of the request.

Comments