In today's rapidly evolving digital landscape, understanding the legal intricacies of blockchain transactions has become increasingly vital. As more individuals and organizations venture into the world of cryptocurrency, clarity around regulations and compliance is essential to navigate potential risks. In this article, we'll break down the key elements of blockchain transaction legality, providing insights tailored to both newcomers and seasoned traders alike. So, join us as we delve deeper into this fascinating subject and empower your blockchain journey!

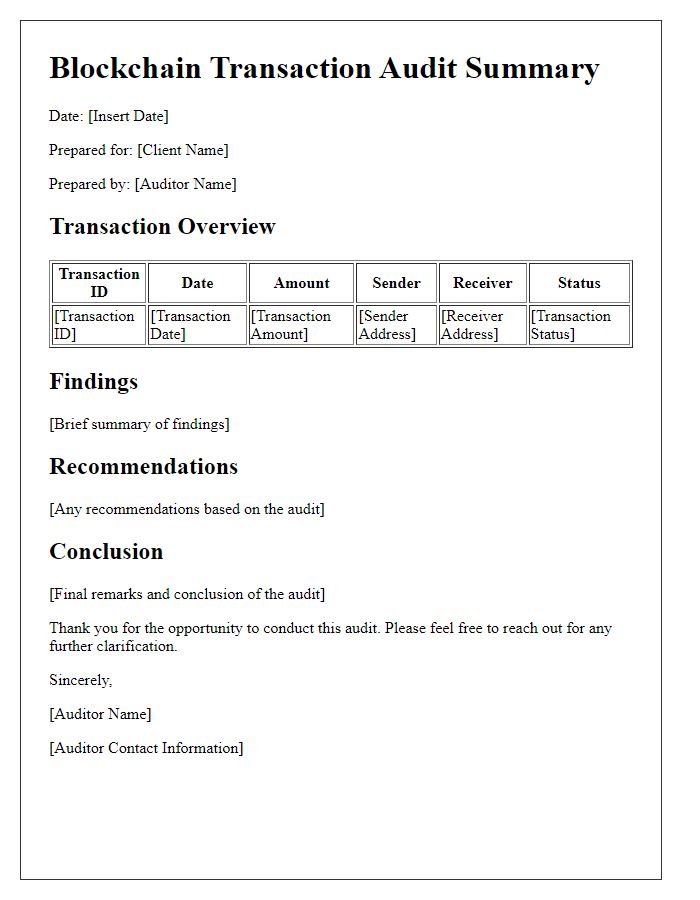

Transaction Overview and Parties Involved

A blockchain transaction analysis involves several key elements, ensuring clarity regarding the entities involved and the purpose of the transaction. The transaction must identify parties such as individual users, businesses, or decentralized applications (dApps) participating in the process. Each party should be characterized by relevant details, such as the wallet addresses corresponding to their digital identities, which are represented as alphanumeric strings (e.g., 0x123abc...) on Ethereum-based networks. Additionally, the nature and purpose of the transaction need to be specified, whether it be a financial transfer, a smart contract execution, or an asset tokenization. Timestamp data (UTC format) will provide insights into when the transaction occurred, adding to the record's integrity and tracing capabilities within the immutable ledger framework of blockchain technology.

Regulatory Compliance and Legal Framework

Blockchain technology operates within a complex landscape of regulatory compliance and legal frameworks. Various jurisdictions, including the United States, European Union, and Asia-Pacific region, have different approaches to blockchain regulation, impacting digital currencies, initial coin offerings (ICOs), and non-fungible tokens (NFTs). Regulatory bodies such as the Securities and Exchange Commission (SEC) in the U.S. scrutinize ICOs for compliance with securities laws, affecting fundraising efforts. Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations is essential for exchange platforms, influencing their operational processes significantly. Additionally, the lack of a unified global legal standard presents challenges for cross-border transactions, as companies must navigate diverse legal environments, from data privacy regulations like GDPR in Europe to varying tax implications worldwide. Legal considerations surrounding smart contracts and their enforceability further complicate the blockchain ecosystem, highlighting the importance of thorough legal analysis in blockchain transactions.

Risk Assessment and Mitigation Strategies

Blockchain transactions carry distinct legal implications requiring thorough risk assessment and proactive mitigation strategies. Key risks include regulatory compliance challenges associated with jurisdictions, such as the United States and the European Union, which impose varying requirements on cryptocurrency activities. Misrepresentation of assets during token offerings can lead to legal disputes, necessitating diligent verification processes. Additionally, cybersecurity threats pose a significant concern; breaches affecting private keys can result in substantial financial loss, estimated in the billions of dollars annually. It is essential to implement robust security protocols, including multi-signature wallets and regular audits, to safeguard digital assets and ensure legal protection. Furthermore, developing comprehensive user agreements can help clarify responsibilities and reduce liability in the event of transactional disputes.

Intellectual Property Considerations

Blockchain technology offers a transformative landscape for intellectual property (IP) management, requiring careful legal analysis to ensure compliance with existing frameworks, such as the Berne Convention and the TRIPS Agreement. Smart contracts, self-executing contracts coded on platforms like Ethereum, present unique opportunities for automating IP licensing and royalty payments, requiring thorough examination of their enforceability across jurisdictions. Moreover, blockchain's decentralized nature poses challenges in identifying and addressing ownership issues related to digital assets, emphasizing the need for clarity regarding authorship and rights. IP infringement possibilities also arise in tokenized assets, necessitating a review of copyright implications and potential liability for creators and distributors. Furthermore, emerging NFT (Non-Fungible Token) marketplaces, like OpenSea, innovate IP validation methods, underscoring the relevance of trademark protection against counterfeit tokens. Legal professionals must navigate these complexities to effectively safeguard intellectual property within the blockchain ecosystem.

Confidentiality and Data Protection Requirements

Confidentiality in blockchain transactions relies heavily on data protection regulations, such as the General Data Protection Regulation (GDPR) established in the European Union. Blockchain, with its immutable ledger across decentralized networks, presents unique challenges that require careful navigation to comply with Article 5 principles, including data minimization and purpose limitation. Smart contracts, self-executing contracts on blockchain platforms like Ethereum, can automate compliance processes but must also be designed to ensure they do not inadvertently expose personal data. Furthermore, organizations must assess their role as data controllers or processors, evaluating the implications of data subject rights under GDPR, notably the right to erasure (often referred to as the 'right to be forgotten') in a landscape where data permanence is a core feature. Organizations should implement strategies such as data encryption, pseudonymization, and access controls to protect sensitive information while balancing the need for transparency and accountability inherent in blockchain technology.

Comments