Are you ready to ensure that your property is fully protected? Keeping your property insurance up-to-date is essential for safeguarding your investment and peace of mind. Whether you've made upgrades to your home or added new belongings, it's important to revisit your coverage regularly. Join us as we explore the key elements of property insurance updates that everyone should be aware of.

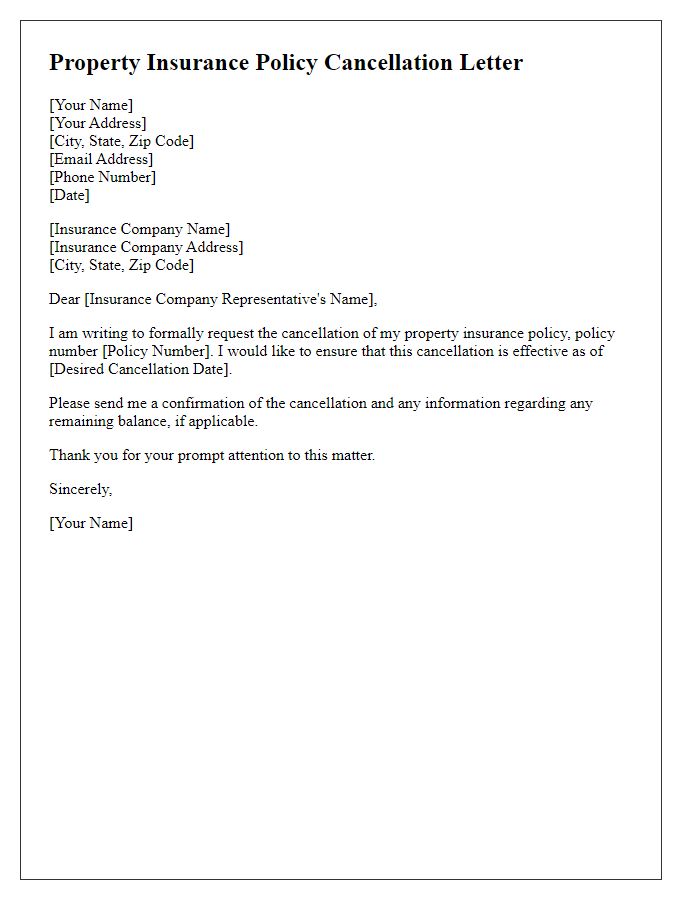

Contact Information (Insured and Insurer)

Property insurance updates require precise contact details to ensure clear communication between the insured party (homeowner, property owner) and the insurance provider (insurance company, agent). Essential information includes the insured's full name (John Smith), address (123 Maple Avenue, Springfield), and phone number (555-1234) for accessibility. The insurer's details encompass the company's name (ABC Insurance Co.), contact representative (Jane Doe), address (456 Elm Street, Springfield), phone number (555-5678), and email (contact@abcinsurance.com) for correspondence. This comprehensive information facilitates efficient updates, claims processing, and customer service inquiries.

Policy Number and Details

Property insurance policies are essential for safeguarding assets against potential risks. Policy numbers are unique identifiers, often consisting of alphanumeric characters, assigned to specific insurance contracts. Key details include the coverage limits, deductibles, and specific perils covered. For example, a standard home insurance policy may cover fire damage up to $300,000 and theft up to $100,000. It's important to review annual statements to ensure coverage remains adequate, especially after major renovations or market changes in localities such as Los Angeles or New York. Policy updates may also reflect changes in deductible amounts, adjusting from $1,000 to $2,500 based on the homeowner's preferences and risk assessments.

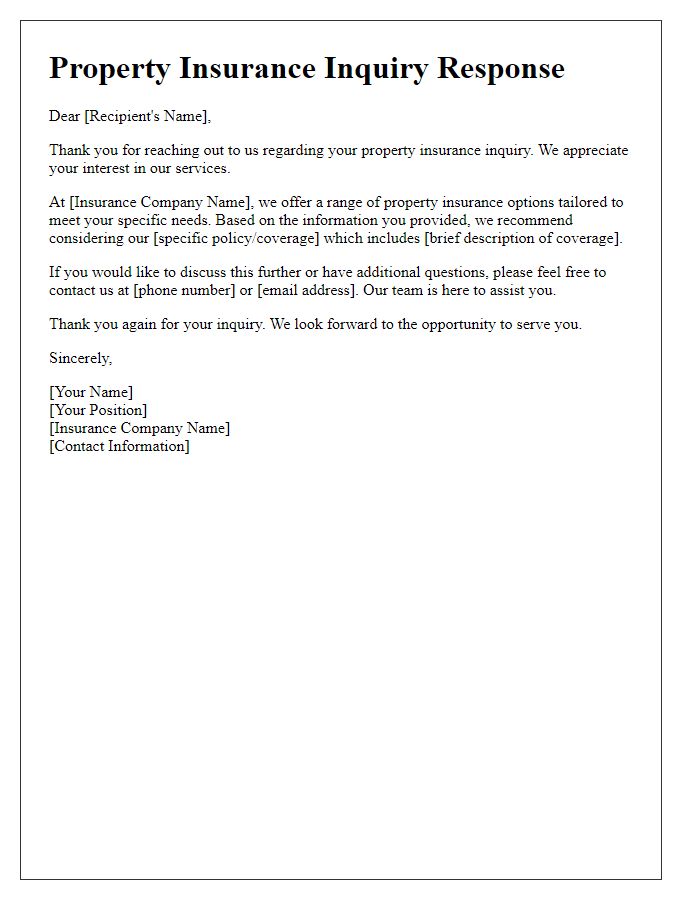

Coverage Changes or Updates

Property insurance often undergoes updates or changes that can significantly affect coverage. Homeowners may increase or decrease dwelling protection limits based on updated property values, often determined by current real estate market conditions. Liability coverage adjustments can occur in response to changes in personal assets or risk factors associated with new property features, such as a swimming pool or renovation. Additionally, policyholders might add endorsements for specific risks, including natural disasters or valuable possessions, to ensure comprehensive protection. Regular policy reviews, typically conducted annually, help homeowners and insurance providers align coverage options with evolving needs and financial considerations.

Effective Date of Changes

Property insurance updates can include substantial changes in coverage terms, premium rates, or policy limits. The effective date of such changes is crucial, typically specified in insurance policy documentation. For instance, a modification in coverage may commence from the first day of the month following the notification, ensuring all stakeholders are aware of the transition period. For example, in case of a property located in Hurricane-prone Florida, changes might include enhanced storm coverage effective from June 1, just before the hurricane season begins. Such notices are critical for property owners, ensuring compliance with financial obligations and safeguarding assets.

Request for Confirmation and Acknowledgment

An update regarding property insurance policies is crucial for homeowners seeking to ensure adequate coverage for their residential assets. This type of communication often requests confirmation and acknowledgment (typically via email or written response) from the insurance provider, ensuring that all recent changes, such as increased home value due to renovations, are accurately reflected. Specific details like policy numbers, coverage limits, and any additional riders or exclusions must be addressed to maintain compliance with regulations set by governing bodies like the National Association of Insurance Commissioners (NAIC). Timely communication is essential; responses are usually expected within 7 to 14 business days to prevent any lapse in coverage.

Comments