Are you ready to take the next step in your career with a regulatory compliance position? Crafting a compelling cover letter is essential to showcase your skills and dedication to adhering to guidelines and standards. In this article, we will explore effective tips and templates that will help you create a standout application tailored for the regulatory compliance field. So, let's dive in and discover how to make your application shine!

Tailored Introduction

Regulatory compliance roles, particularly in finance and healthcare, require an in-depth understanding of laws and regulations. Professionals in this field, such as compliance officers, must stay updated on regulations from agencies like the SEC (Securities and Exchange Commission) and FDA (Food and Drug Administration). These roles involve ensuring organizations comply with internal policies and external regulations to mitigate legal risks. Essential skills include proficiency in risk assessment, knowledge of auditing processes, and excellent communication abilities to facilitate training programs. Key metrics, such as compliance audit scores and incident reports, help gauge the effectiveness of compliance initiatives within organizations.

Relevant Experience

A regulatory compliance role requires an intricate understanding of industry-specific regulations, such as the Sarbanes-Oxley Act (2002), the General Data Protection Regulation (GDPR) in Europe, and the Food and Drug Administration (FDA) regulations in the United States. Experience in assessing compliance frameworks is crucial, particularly regarding financial reporting practices or data protection strategies. Familiarity with risk management frameworks, such as ISO 31000, enables effective identification and mitigation of compliance risks. Certifications like Certified Compliance and Ethics Professional (CCEP) or Certified Information Systems Auditor (CISA) can enhance an applicant's qualifications and credibility in the field. Previous roles in sectors such as finance, healthcare, or pharmaceuticals, where adherence to strict guidelines is mandatory, greatly enrich an applicant's background. Collaboration with cross-functional teams ensures a well-rounded approach to compliance, promoting organizational integrity and accountability.

Specific Skills in Compliance

In the realm of regulatory compliance, a nuanced understanding of industry standards and meticulous attention to detail are paramount. Individuals proficient in interpreting regulations, such as the Sarbanes-Oxley Act for financial transparency or GDPR for data protection, can effectively navigate complex legal frameworks. Knowledge of risk management frameworks, including ISO 31000 or COSO, equips compliance professionals to identify potential risks within organizational processes. Familiarity with compliance management software, such as MetricStream or RSA Archer, enhances the ability to monitor adherence to regulatory requirements across different departments. Effective communication skills are essential, enabling these professionals to articulate compliance issues and collaborate with diverse teams, including legal, finance, and operations divisions, to ensure that policies are implemented effectively and maintained consistently.

Knowledge of Regulations

Regulatory compliance involves navigating complex frameworks such as the Sarbanes-Oxley Act (SOX) and the General Data Protection Regulation (GDPR). Knowledge of SOX is essential for ensuring accurate financial reporting within publicly traded companies in the United States, emphasizing internal controls over financial processes. The GDPR highlights data protection standards across the European Union, affecting organizations handling personal data of EU citizens. Familiarity with key regulatory agencies, such as the Securities and Exchange Commission (SEC) and the Federal Trade Commission (FTC), is crucial for compliance professionals. Monitoring updates in regulations, understanding enforcement actions, and implementing compliance programs are essential activities that ensure adherence to legal requirements and protect organizations from significant penalties.

Professional Certifications

Obtaining professional certifications, such as Certified Compliance and Ethics Professional (CCEP) or Certified Regulatory Compliance Manager (CRCM), can significantly enhance one's qualifications in the regulatory compliance field. These certifications demonstrate a deep understanding of compliance regulations, industry standards, and best practices essential for ensuring organizational adherence to laws and regulations. Specifically, companies operating within highly regulated industries like pharmaceuticals or finance, governed by entities such as the Food and Drug Administration (FDA) or the Securities and Exchange Commission (SEC), often prioritize candidates who possess these credentials. In 2022, the job market saw a 30% increase in demand for compliance professionals with recognized certifications, highlighting their importance in navigating complex compliance landscapes.

Letter Template For Regulatory Compliance Job Application Samples

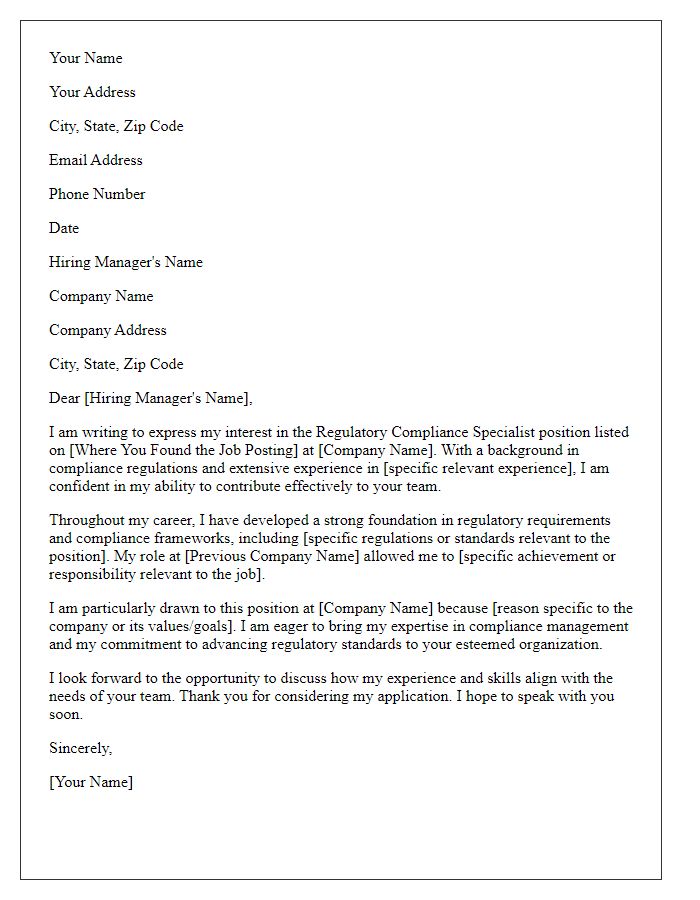

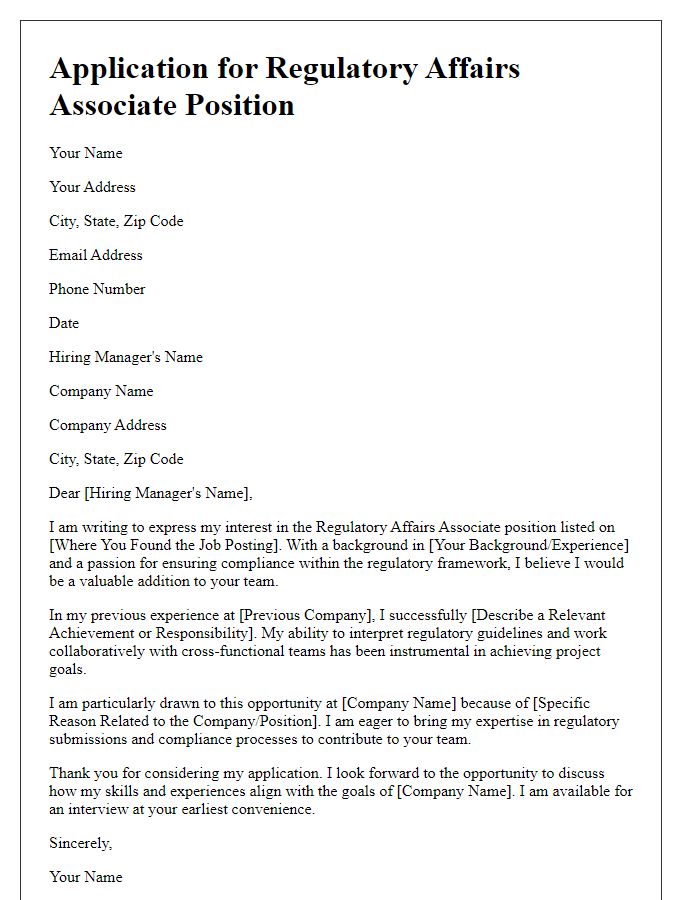

Letter template of application for regulatory compliance specialist position

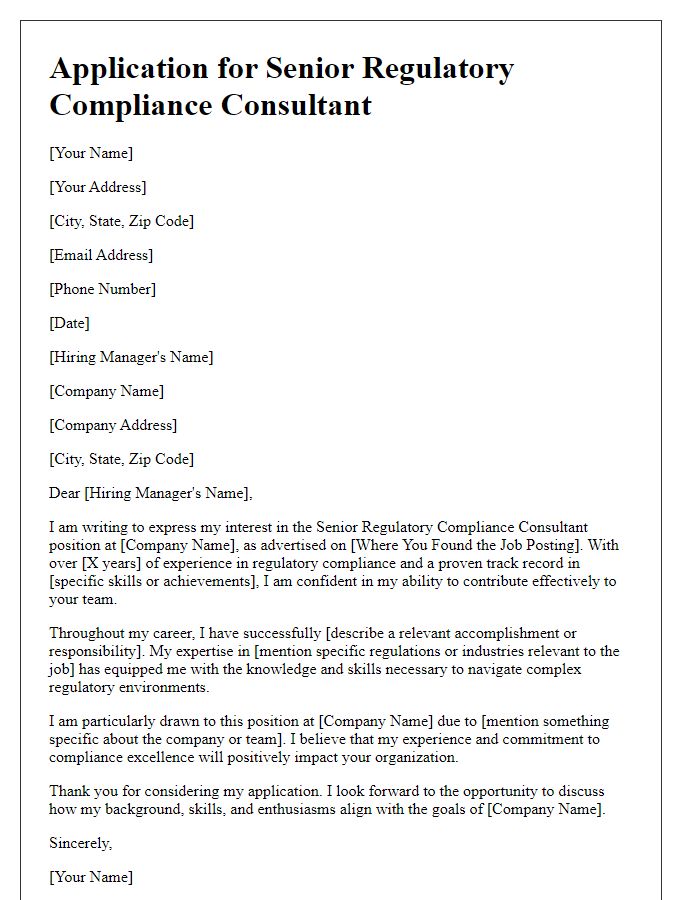

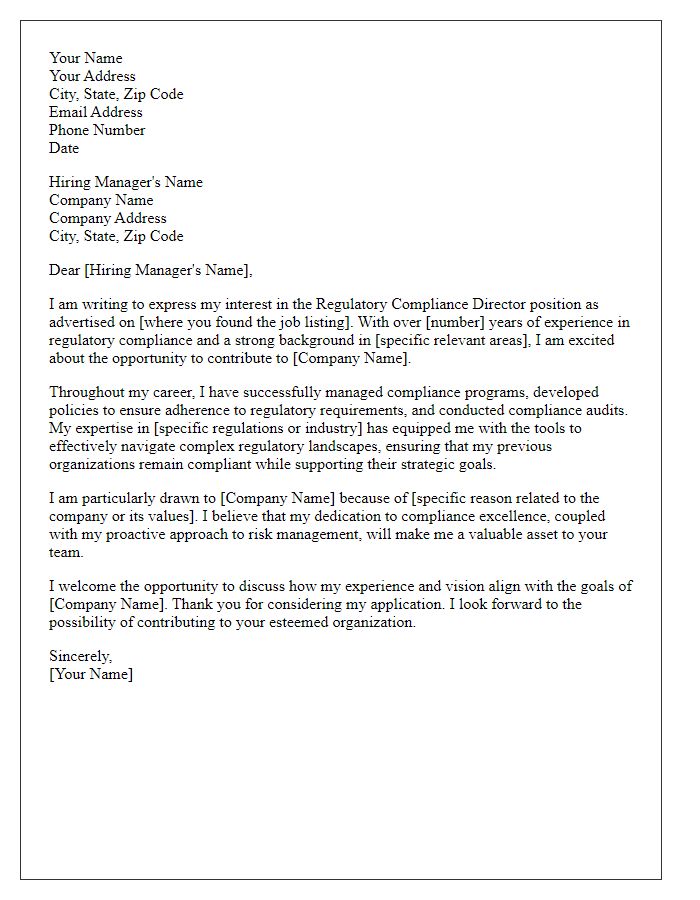

Letter template of application for senior regulatory compliance consultant

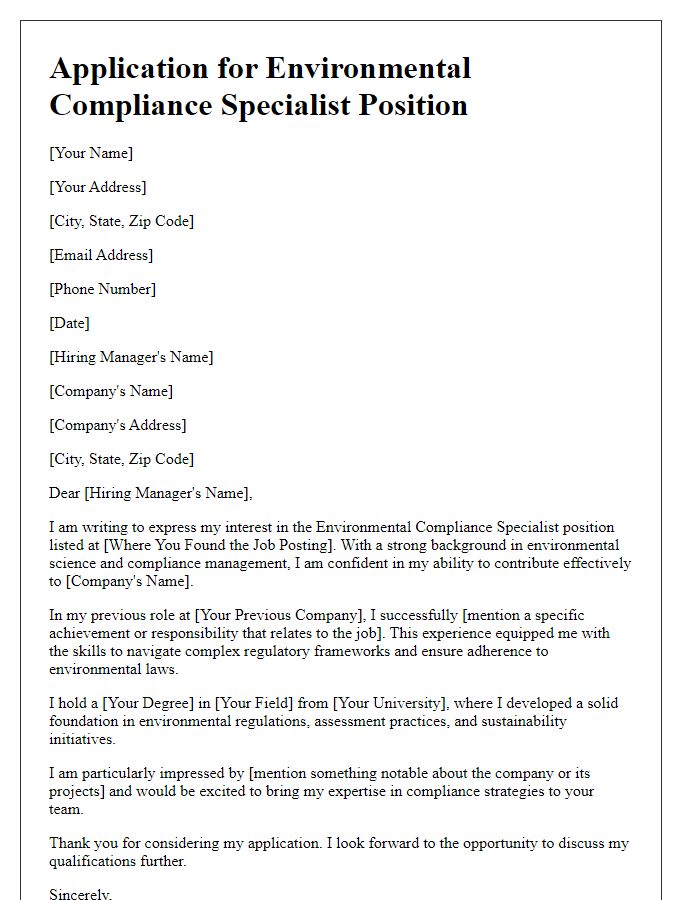

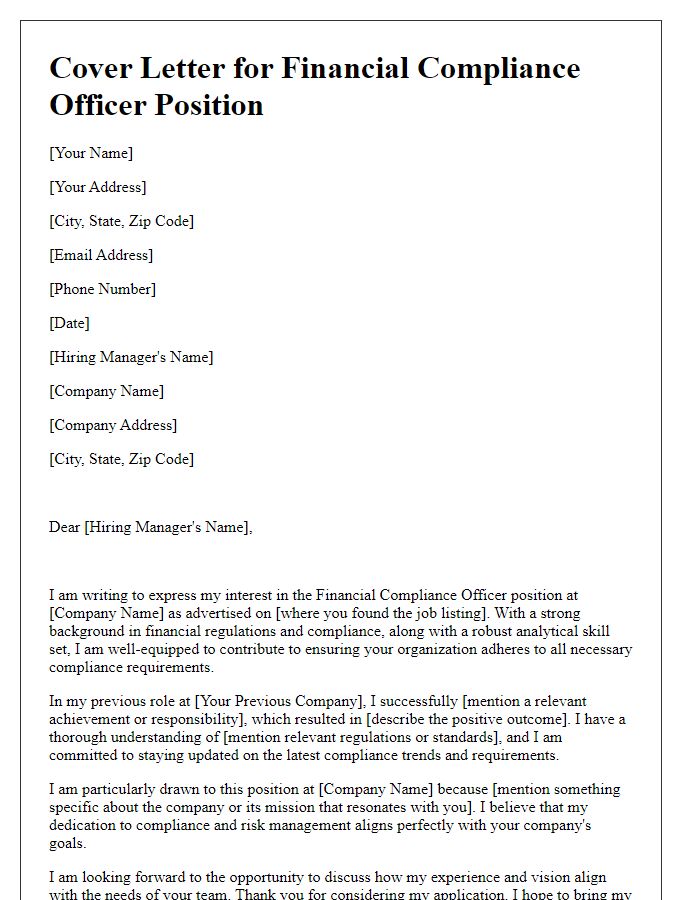

Letter template of application for environmental compliance specialist job

Comments