Are you ready to take a closer look at your payment portfolio? Whether you're a seasoned finance professional or just starting out, understanding your payment options and their performance is essential for optimizing your cash flow. In this article, we'll dive into the key factors to consider when reviewing your payment portfolio and provide actionable insights to enhance your financial strategies. So grab a cup of coffee and let's explore the world of payment portfolios together!

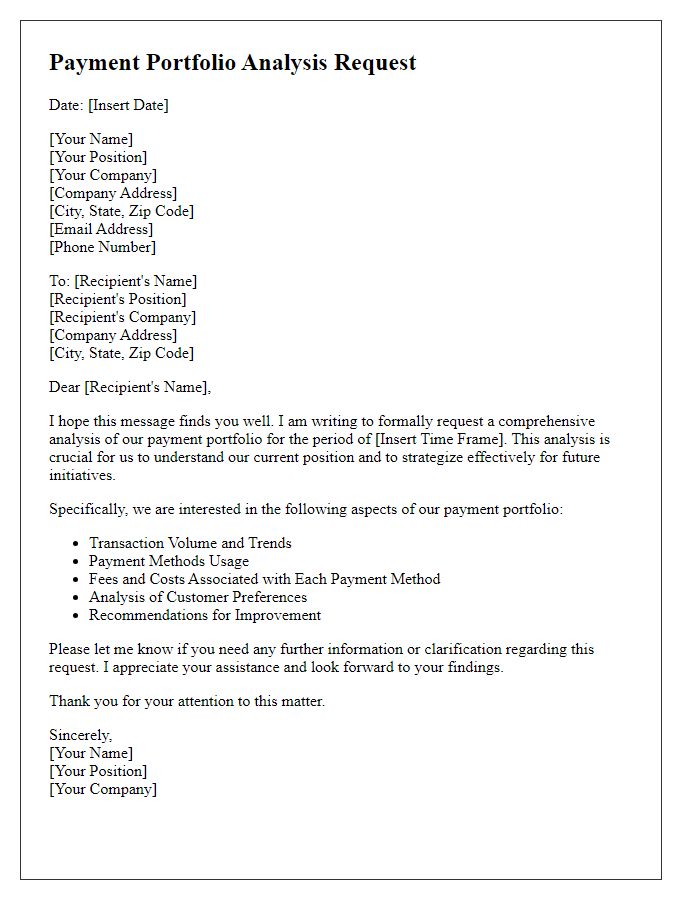

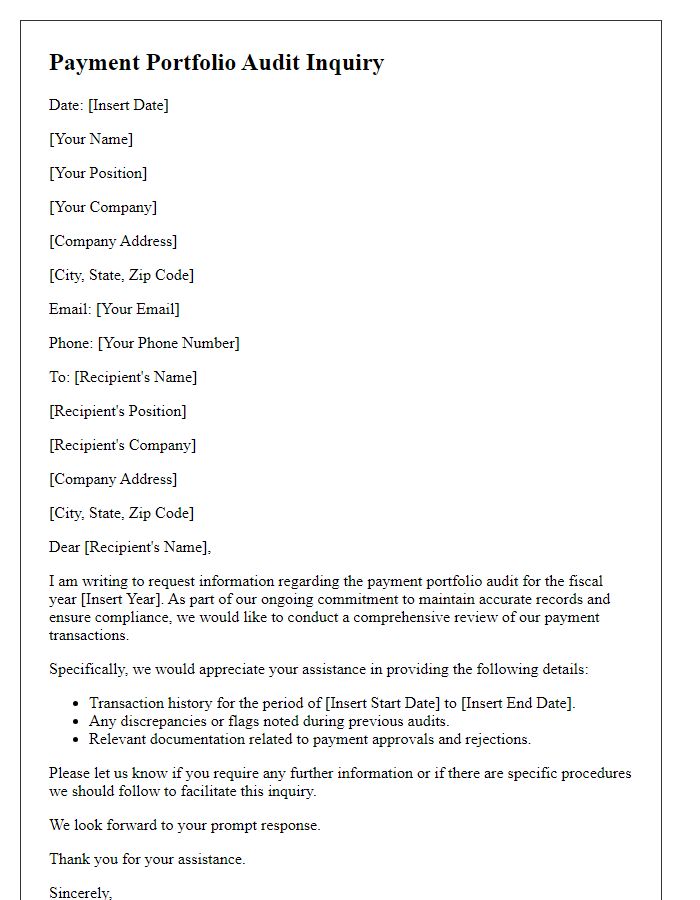

Clearly define the purpose and objective of the review.

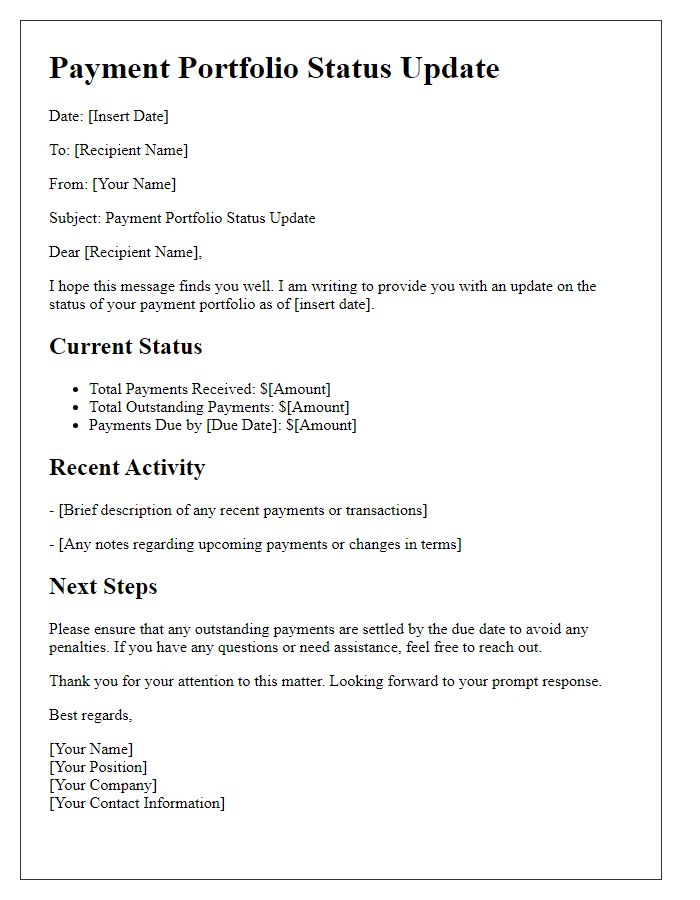

The payment portfolio audit aims to evaluate the efficiency and effectiveness of various payment methods utilized within the company's financial ecosystem. This review focuses on understanding transaction trends across digital wallets, credit cards, and ACH transfers, while assessing related fees, processing times, and user satisfaction rates. Evaluating the payment portfolio ensures alignment with competitive benchmarks, improving cash flow and enhancing customer experience significantly. Analyzing historical transaction data from 2022 to the present facilitates informed decision-making regarding potential optimizations and adaptations for emerging payment technologies.

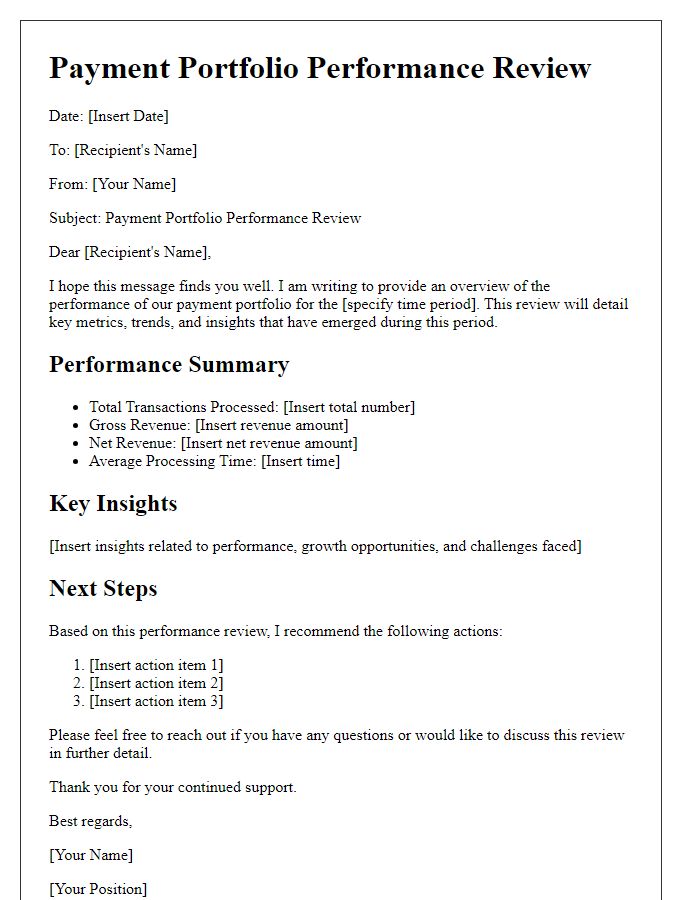

Summarize key financial metrics and performance indicators.

The payment portfolio's financial metrics showcase an overall growth trajectory, with total transaction volume reaching $150 million in Q3 2023, reflecting a 25% increase year-over-year. Merchant acquisition has expanded, resulting in a 15% rise in active merchants, bringing the total to 8,000. Payment processing fees have averaged 2.5%, contributing to a revenue boost of $3.75 million for the quarter. Additionally, chargeback rates remain low at 0.5%, indicating robust transaction integrity and customer satisfaction. Key performance indicators such as average transaction size ($75) and monthly active users (MAUs, totaling 50,000) further highlight the portfolio's efficiency and user engagement.

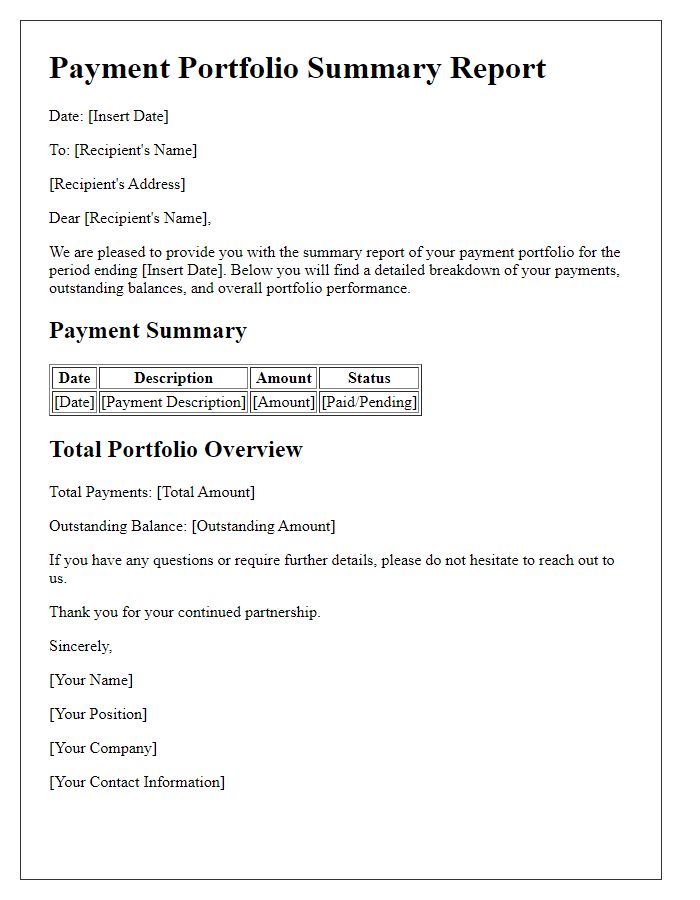

Identify and address any discrepancies or overdue payments.

A thorough review of the payment portfolio reveals several discrepancies and overdue payments requiring immediate attention. Notable accounts include the client ABC Corp., with an outstanding balance of $12,000 from Invoice #45678, due on March 15, 2023. Another concern is the overdue payment from XYZ Ltd., amounting to $7,500 from Invoice #12345, which has not been settled since April 22, 2023. In addition, there are inconsistencies in the payment records for DEF Inc., where a reported payment of $5,000 from March 2, 2023, appears to be unverified. Prompt action on these accounts is essential to maintain healthy cash flow and strengthen client relationships.

Provide actionable recommendations for improvement.

The analysis of the payment portfolio reveals several areas for enhancement. Streamlining transaction processes can reduce processing times, currently averaging 3-5 business days for bank transfers. Implementing advanced fraud detection technologies can lower instances of chargebacks, which have increased by 15% in the last quarter alone. Furthermore, offering mobile payment options via platforms like Apple Pay or Google Wallet can improve user experience, given that 70% of consumers prefer mobile transactions for their convenience. Regularly reviewing fees associated with each payment method will ensure competitiveness; for example, credit card processing fees typically range from 1.5% to 3.5%. Finally, integrating customer feedback systems could identify pain points, with 65% of users indicating a desire for more transparency in transaction statuses.

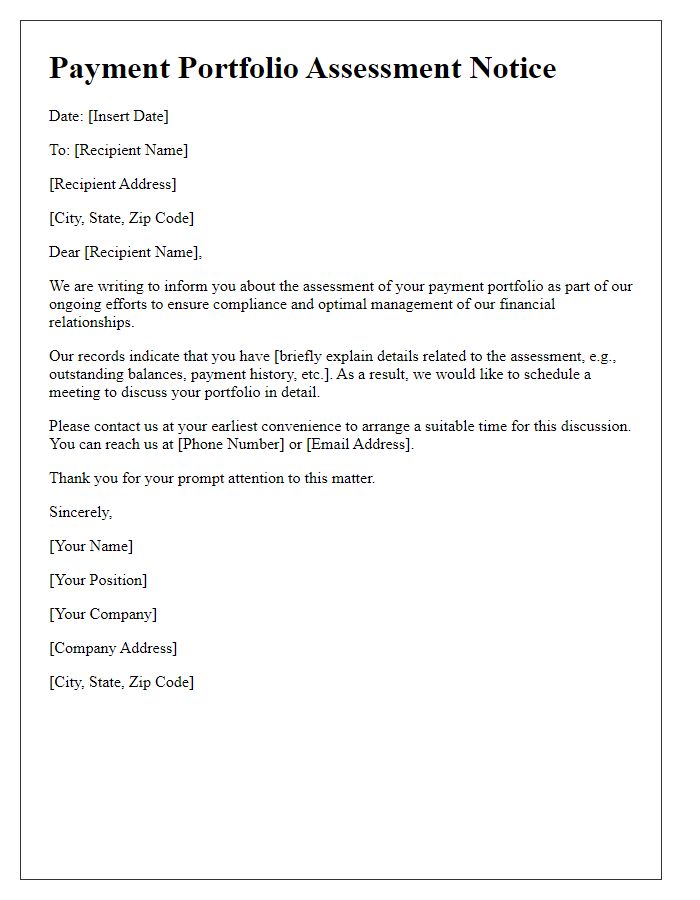

Establish a timeline for follow-up and future evaluations.

A comprehensive review of the payment portfolio reveals critical insights regarding transaction volume and processing efficiency. The payment portfolio, encompassing diverse methods like credit cards, ACH transfers, and digital wallets, demonstrates varied performance metrics identified from Q1 to Q4 of 2023. The timeline for follow-up evaluations is set to occur quarterly, specifically in January, April, July, and October, allowing for timely adjustments based on consumer trends and regulatory changes. Future evaluations will focus on transaction success rates, chargeback incidents, and integration with emerging payment technologies. This structured approach aims to enhance financial outcomes and customer satisfaction across all payment channels.

Comments