Are you ready to explore the world of syndicated investments? In this exciting venture, a group of investors come together to pool their resources, enabling them to tackle larger projects and maximize returns. Each participant plays a crucial role, sharing the risks and rewards while accessing opportunities that may have been out of reach individually. Join us as we delve deeper into the intricacies of syndicated investments and discover how you can be part of this dynamic process!

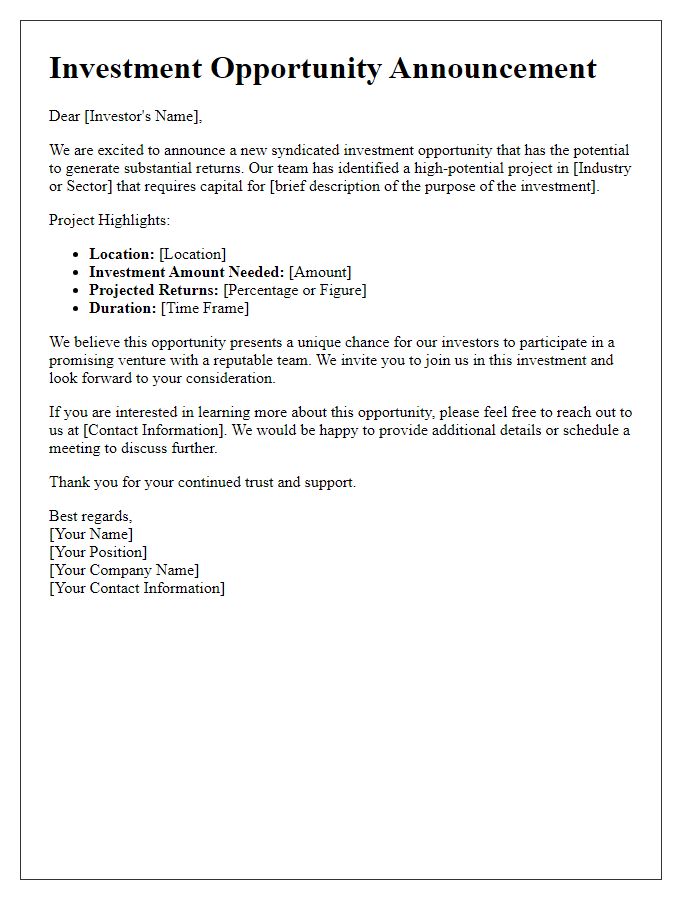

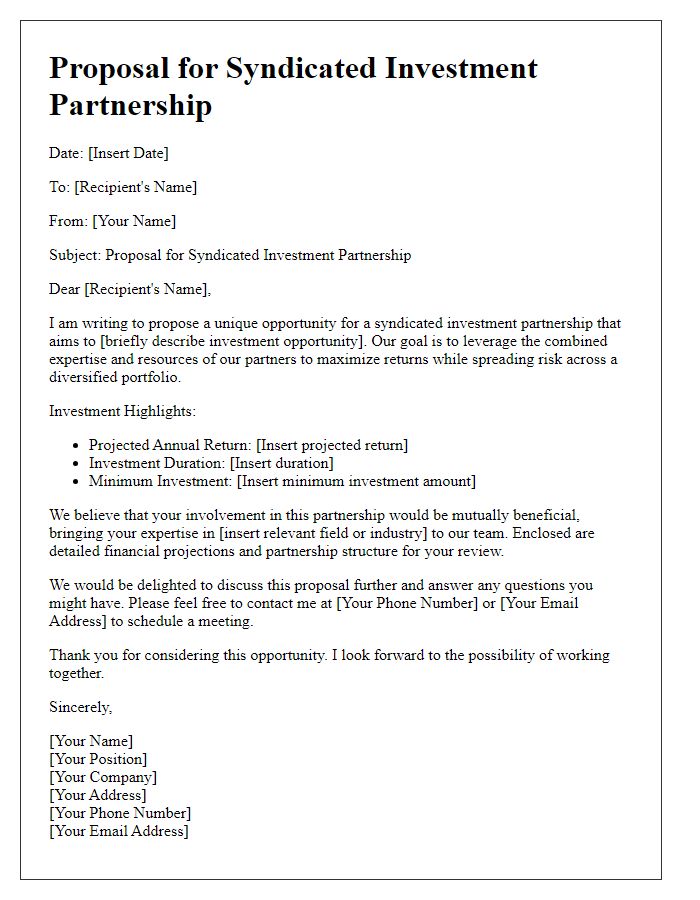

Clear Subject Line

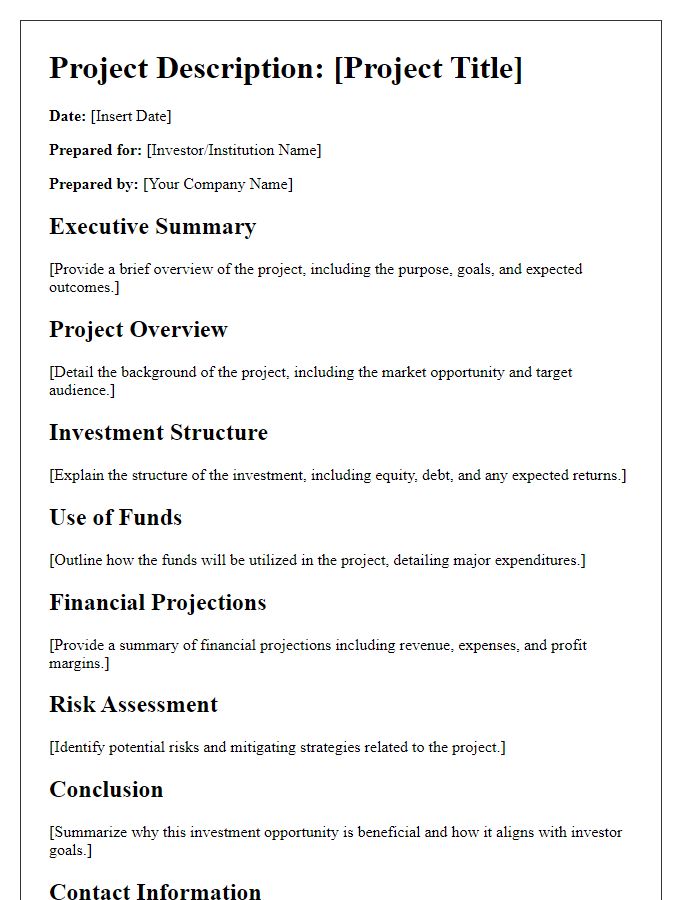

Syndicated investment opportunities present unique chances for stakeholders in the financial sector, focusing particularly on high-value projects. Notably, multi-tiered structures, such as those seen in commercial real estate developments or renewable energy ventures, allow investors to diversify their portfolios while maximizing returns. Typically, minimum investment thresholds range from $25,000 to $100,000, depending on the project's scale and potential yield. Industry-specific analysis, projections, and due diligence reports play crucial roles in informing investors about market trends and associated risks. Furthermore, collaboration among investment groups can enhance capital pooling, granting access to larger ventures. Overall, the syndication model fosters collective resource management, spreading risk across multiple parties while enabling participation in significant financial undertakings.

Investment Details

The syndicated investment notice outlines crucial investment details related to a multi-million-dollar fund aimed at diversifying portfolios. Key figures include the total capitalization amount of $50 million, allocated over various sectors such as technology, renewable energy, and healthcare, each representing potential high returns, especially given the current market trends. The investment duration spans five years, with projected returns estimated at an annual rate of 8 percent, benefiting from emerging market dynamics and innovation. The primary focus on geographical areas like North America and Europe ensures access to established industries and growth opportunities, enhancing overall portfolio stability. Investors must review the due diligence package, ensuring informed decision-making in this collaborative investment.

Legal Disclosures

Syndicated investments, particularly those involving multiple investors pooling resources, necessitate comprehensive legal disclosures to ensure compliance with regulations. The Securities and Exchange Commission (SEC) mandates transparency regarding potential risks associated with investments, including market volatility and liquidity concerns. Investors must be informed about the syndication structure, fees, and expenses, which can significantly impact returns. Legal documents, such as the Private Placement Memorandum (PPM), provide crucial information on the offering, including financial projections and management background. Additionally, investors should be aware of their rights and obligations specified under state laws, as well as any potential tax implications based on their jurisdiction. Proper legal disclosures are not simply formalities; they serve as essential safeguards for investors navigating complex financial landscapes.

Contact Information

Investors interested in syndicated investments often require clear and concise communication. Syndicated investment notices should include essential contact information for effective correspondence. Key contact details must contain the name of the investment firm, alongside physical addresses, phone numbers, and email addresses. Emergency contacts can enhance accessibility, ensuring quick resolutions. Including social media handles can also facilitate real-time updates and engagement. Furthermore, providing a website link where investors can access additional resources or investment documents consolidates trust and offers transparency in financial dealings.

Call to Action

Investment opportunities in syndicated funds can provide substantial returns for investors seeking diversified portfolios. Noteworthy events like the recent merger between high-profile firms illustrate the potential for significant profit gains (often exceeding 15 percent annually). Geographic region trends, particularly in technology hubs like Silicon Valley, showcase rising valuations and demand for startups. Engaging in these investments entails understanding key assets such as real estate, private equity, or venture capital, which can mitigate risks through collective funding strategies. As investment regulations evolve, aligning with licensed syndicators is crucial to ensure legal compliance and maximize potential gains. Join the push towards financial growth by exploring these lucrative options today.

Comments