Navigating investment losses can be a challenging experience, and it's crucial to communicate effectively about them. In this article, we'll explore how to articulate the nuances of investment losses, from the initial impact to potential recovery strategies. We'll also discuss the emotional aspect of these setbacks, ensuring you approach the conversation with clarity and empathy. So if you're looking to improve your understanding of how to explain investment losses, read on for valuable insights!

Clear and concise language

An investment loss can occur due to various factors such as market volatility, economic downturns, or specific company performance issues. During the recent financial quarter, factors like inflation rates exceeding 7%, significant declines in technology stocks, and geopolitical tensions contributed heavily to portfolio underperformance. For instance, shares in leading tech firms like XYZ Corp dropped by over 30%, impacting overall returns significantly. Additionally, industry trends towards increased regulation negatively influenced market sentiment, causing widespread selling. These essential elements illustrate the current investment landscape and provide context for the observed losses.

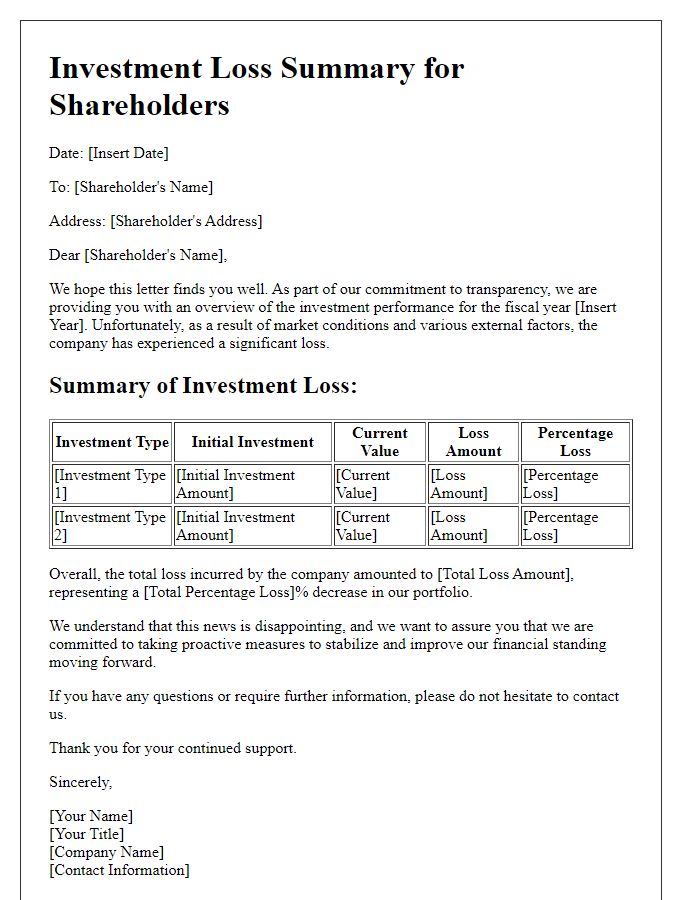

Specific investment details

The investment in XYZ Corporation witnessed a significant decline, losing approximately 30% of its value within a six-month period, dropping from $150 per share to $105 per share. The volatility stemmed from unforeseen market conditions, particularly the global supply chain disruptions affecting technology stocks in the second quarter of 2023. Additionally, XYZ Corporation reported disappointing earnings in August 2023, citing lower demand for its flagship product. These factors collectively contributed to the decline, exacerbating investor concerns about future growth prospects. Market analysts predict continued pressure on the technology sector, suggesting a cautious outlook for investors.

Reasons for the loss

In 2023, numerous factors contributed to the significant investment loss experienced by the portfolio, particularly in technology and renewable energy sectors. Economic downturns, fueled by rising inflation rates of 7.5% in July, led to decreased consumer spending across various markets, directly impacting revenue projections. The geopolitical tensions, especially the ongoing conflict between Russia and Ukraine, also disrupted supply chains, causing delayed product launches and increased operational costs for several key companies, such as Tesla and NVIDIA. Furthermore, the Federal Reserve's interest rate hikes, culminating in a rate of 5.25% by September, resulted in reduced access to capital for growth-oriented companies, further exacerbating stock price declines. Volatility in the cryptocurrency market, with Bitcoin experiencing a drop of over 50% year-to-date, introduced additional uncertainty, affecting investor sentiment and leading to widespread sell-offs across various asset classes.

Impact assessment

Investment losses can significantly impact an investor's financial portfolio, particularly during economic downturns like the 2008 financial crisis, where market indexes such as the S&P 500 fell over 37%. Individual assets, including stocks and bonds, may experience depreciation, adversely affecting overall asset allocation. Sector-specific downturns, like those experienced in technology and energy industries due to fluctuating oil prices or changes in regulatory policies, can exacerbate these losses. Investors may also face capital gains tax implications when liquidating underperforming assets, further reducing net worth. Emotional stress and decision-making paralysis often accompany financial losses, complicating recovery efforts and future investment strategies. Regular assessments and analyses are essential to understand the extent of financial impact and to adjust investment tactics based on evolving market conditions.

Future action plan

In response to the recent investment losses, a thorough analysis of the portfolio performance has been conducted. Numerous factors contributed to this decline, including market volatility linked to geopolitical tensions and unexpected economic indicators such as inflation rates surpassing 8% in several regions. The investment strategy will now incorporate a more diversified approach, allocating funds towards emerging sectors, such as renewable energy and technology innovations. Regular performance reviews will be scheduled quarterly, allowing for timely adjustments to the investment strategy based on market trends and financial forecasts. Enhanced risk assessment protocols will be implemented to better navigate potential downturns in the future. Communication with stakeholders will prioritize transparency, providing detailed reports on both challenges and proactive measures undertaken.

Comments