Are you considering diving into the world of cryptocurrency investment but unsure where to start? You're not alone; many are curious about how to navigate this rapidly evolving landscape. This article will guide you through the essential steps, tips, and resources you need to feel confident in your investment journey. So, grab a cup of coffee and let's explore what cryptocurrency can offer â read on to discover more!

Personal introduction and background

Cryptocurrency investment opportunities are rapidly evolving, attracting individuals keen on diversifying their portfolios. Background in finance or technology can provide insight into digital currencies like Bitcoin or Ethereum. Understanding blockchain technology (the decentralized digital ledger) is crucial for any investor. The rise of decentralized finance (DeFi) platforms, enabling peer-to-peer transactions without intermediaries, presents unique opportunities and risks. Noteworthy events such as the 2021 bull run, where Bitcoin reached an all-time high of nearly $64,000, emphasize market volatility and potential for substantial gains or losses. Engaging with reputable exchanges like Coinbase or Binance is essential for secure trading experiences. Networking with industry experts or attending webinars focused on cryptocurrency market trends can enhance knowledge and assist in making informed investment decisions.

Purpose of inquiry and specific interests

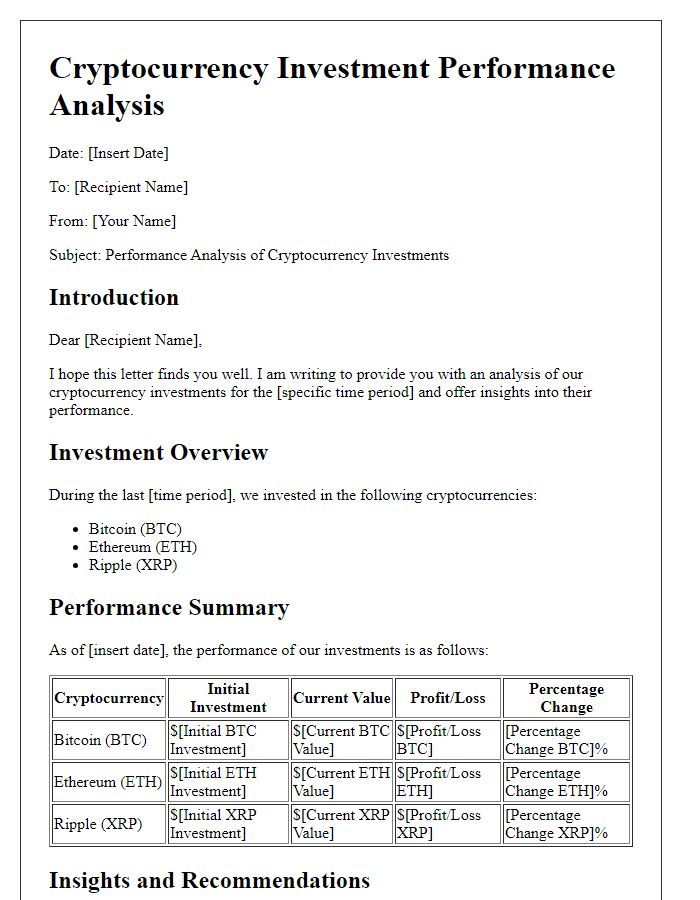

Investing in cryptocurrencies, particularly Bitcoin,Ethereum, and Litecoin, has gained immense popularity among investors looking for high returns. The cryptocurrency market, characterized by volatility and rapid developments, offers opportunities for diversifying portfolios. Innovations such as decentralized finance (DeFi) platforms and non-fungible tokens (NFTs) are reshaping investment landscapes. Investors often seek insights into market trends, regulatory implications, and technological advancements to make informed decisions. Understanding this complex ecosystem can not only mitigate risks but also enhance potential returns. Numerous exchanges and platforms like Binance and Coinbase facilitate easy access to trading, while detailed analysis of historical price movements can help to identify patterns and forecast future performance.

Understanding of the cryptocurrency market

Understanding the cryptocurrency market requires knowledge of various digital assets like Bitcoin (BTC) and Ethereum (ETH), both launched in 2009 and 2015 respectively, that have shaped the industry. Market capitalization metrics reveal Bitcoin's dominance, presenting a significant percentage of the total crypto market cap, which surpassed $2 trillion in recent years. Various exchanges, such as Binance and Coinbase, facilitate trading, with millions of active users. Volatility is a hallmark, highlighted by Bitcoin experiencing price swings exceeding 20% within short timeframes, driven by factors like regulatory news, adoption rates, and technological advancements including smart contracts. Security concerns also arise, exemplified by high-profile hacks like the Mt. Gox incident in 2014, where approximately 850,000 BTC were stolen. Understanding these elements is crucial for navigating investment opportunities, assessing risks, and formulating strategies for participation in this dynamic financial landscape.

Questions regarding investment strategies and risks

Cryptocurrency investments, like Bitcoin and Ethereum, carry significant volatility risks, often experiencing price fluctuations of over 10% in a single day. Investors must consider market volatility, regulatory changes, and the security of exchanges where trades occur. Strategies such as dollar-cost averaging can mitigate risk by spreading investments over time, while diversification across various altcoins spreads exposure. Regulatory landscape varies greatly by country; for instance, countries like China have stringent bans, while nations like El Salvador embrace Bitcoin as legal tender. It's crucial to understand the underlying technology, such as blockchain, and stay updated on market trends, including institutional adoption and emerging DeFi (decentralized finance) platforms, which could greatly impact investment performance.

Contact information and preferred communication method

Investing in cryptocurrencies requires careful consideration of various factors, such as volatility and market trends. In 2023, Bitcoin and Ethereum remain leading players, with Bitcoin reaching market values over $800 billion and Ethereum expanding through its transition to Ethereum 2.0. Interested investors should evaluate platforms like Coinbase, Binance, and Kraken for secure investments and user-friendly interfaces. Regulations vary by country and impact investment strategies, especially in regions like the European Union and the United States, where guidelines continue to evolve. It remains vital to keep up with news from reputable sources, including CoinDesk or CoinTelegraph, to make informed decisions.

Letter Template For Cryptocurrency Investment Inquiry Samples

Letter template of cryptocurrency investment information session invitation

Comments