Are you looking to secure your hard-earned money while maximizing potential growth? Investing in capital protection strategies is a smart way to safeguard your assets while still having the opportunity to benefit from market gains. With various options available, you can tailor your investment to align with your risk tolerance and financial goals. Let's dive deeper to explore how you can effectively protect your capital while navigating the investment landscape!

Investor Details

Capital protection investment schemes primarily focus on safeguarding the principal amount while providing limited returns. These tailored financial products often appeal to risk-averse investors seeking security in volatile markets. Typically offered by banks and financial institutions, such as JPMorgan Chase or Goldman Sachs, these investments might involve structured notes linked to market indices like the S&P 500. The investment duration usually spans several years, ensuring that the investor's initial capital remains intact, even during economic downturns marked by significant fluctuations, often exceeding 20% declines. Additionally, these products may incorporate features such as a guaranteed minimum return or participation rate in market gains, providing a balance between safety and modest growth. Understanding the specifics of each offering, including fees and term lengths, is crucial for investors looking to secure their capital effectively.

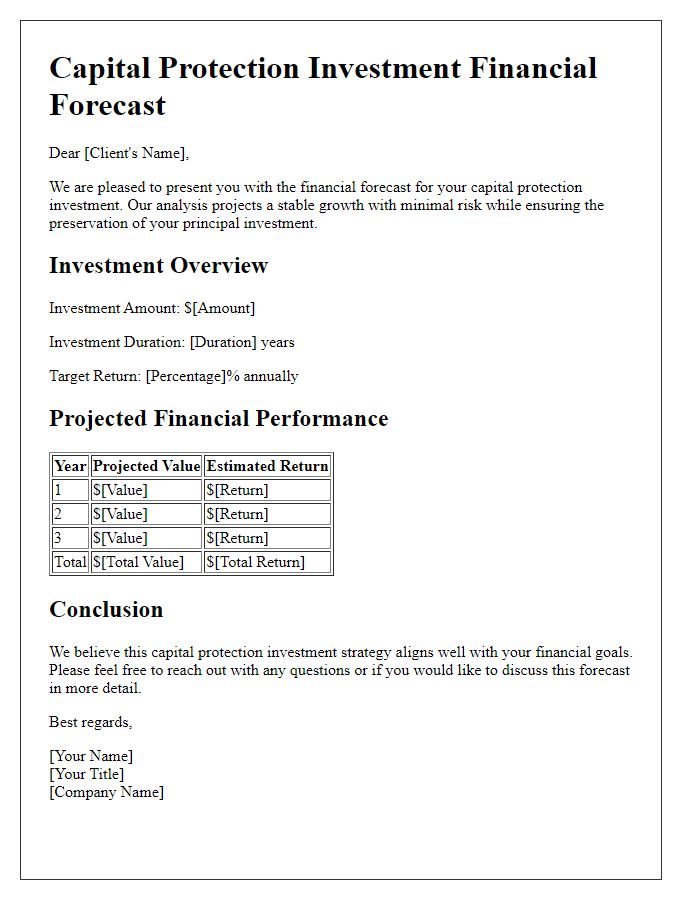

Investment Summary

Capital protection investment strategies focus on safeguarding the principal amount while providing limited upside potential during market fluctuations. These investments typically utilize financial instruments such as government bonds or fixed-income securities, often issued by countries like the United States or Germany, which are known for their low-risk profiles. Additionally, structured products may be employed, combining equity exposure with protection features, often designed to ensure the original investment amount remains intact, even in adverse market conditions. The investment horizon generally ranges from three to ten years, appealing to risk-averse investors seeking stability amidst economic volatility. Historical data suggests that returns are constrained, usually ranging from 2% to 6% annually, reflecting the trade-off between security and yield inherent in capital protection schemes.

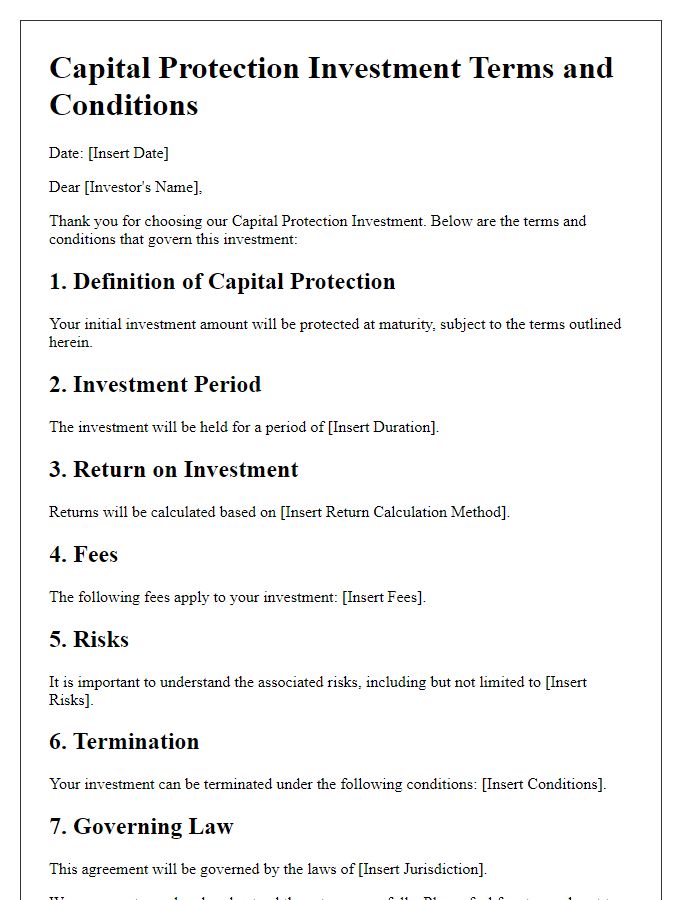

Capital Protection Terms

Capital protection investment strategies are designed to safeguard principal amounts while allowing for potential growth through various financial instruments such as bonds or structured products. These investment vehicles typically aim to provide full or partial protection of the initial investment, often guaranteeing returns at maturity. In scenarios reflecting market volatility, investments may focus on instruments with safety features, such as inflation-linked bonds or government securities, minimizing risk exposure. The terms outlined in such investments must ensure clear understanding of conditions, potential returns, and timelines, emphasizing the importance of thorough due diligence. Investors should also note any fees, penalties for early withdrawal, and the mechanism of principal return at maturity to make informed decisions.

Risk Assessment

Capital protection investments specialize in safeguarding the initial principal while aiming for returns through various strategies. Risk assessment focuses on evaluating potential threats to the invested capital, including market volatility, interest rate changes, and credit risks associated with underlying securities. For instance, investments linked to government bonds generally offer lower yields but provide higher security against default. Conversely, equities can present greater returns, reflecting higher volatility and potential loss of capital. Additionally, inflation risk remains a crucial factor, as increasing prices can erode purchasing power over time. Structured products, including capital guaranteed funds, often serve as a part of the strategy, offering specific maturity dates and conditions that outline risk exposure. Understanding each factor within the investment landscape ensures better decision-making for capital preservation.

Contact Information

Capital protection investment strategies focus on preserving the principal amount while providing potential returns. Institutions like banks or hedge funds often manage these investments, ensuring a safety net through various financial instruments. For example, treasury bonds (considered low-risk) can be used alongside derivatives such as options to hedge against market volatility. Investors typically look for products that guarantee their initial capital, even when facing fluctuations in the financial markets. Details about fees, investment duration, and expected returns are crucial when selecting a suitable capital protection investment, enabling informed decision-making.

Letter Template For Capital Protection Investment Samples

Letter template of capital protection investment compliance notification

Comments