Are you curious about how your mutual fund investments are performing? In this article, we'll explore the key metrics that can help you assess the progress of your portfolio, including returns, volatility, and expense ratios. We'll also discuss strategies to maximize your investment potential and make informed decisions for your financial future. So, if you're ready to dive deeper into the world of mutual fund performance reviews, keep reading!

Fund Objective & Strategy Alignment

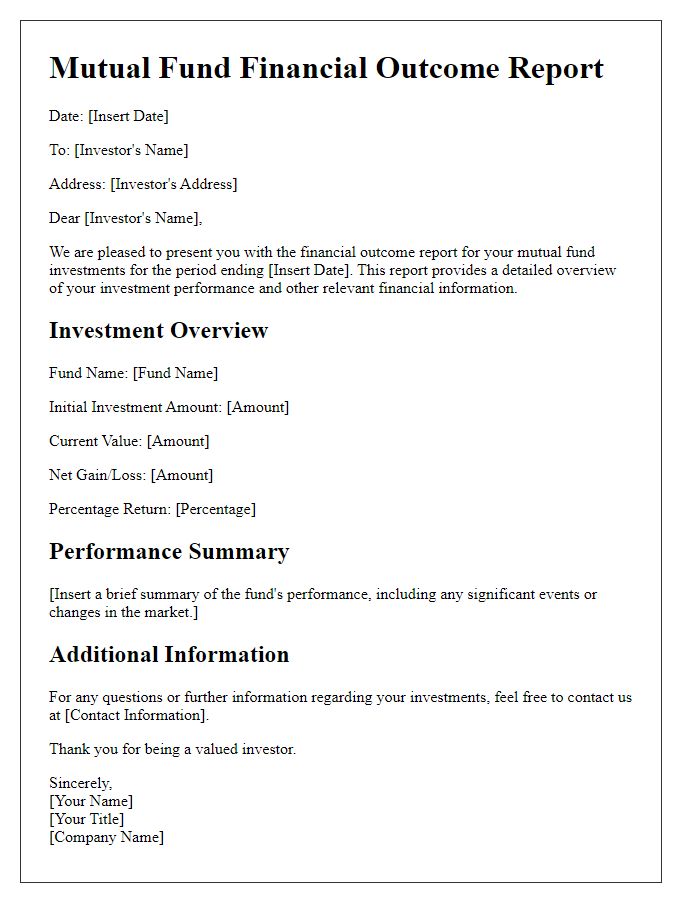

The mutual fund's objective focuses on long-term capital appreciation through a diversified portfolio of equities and fixed-income securities. This strategy aligns with the investment goals of risk-averse individuals seeking steady growth, target return rates exceeding 7% annually. The fund, managed by a team of seasoned professionals based in New York City, benefits from a systematic approach to sector allocation, emphasizing technology, healthcare, and consumer goods. Over the past year, the fund's performance demonstrates a 10% increase, outperforming the benchmark index, the S&P 500, which recorded a 6% gain. Rigorous analysis of market trends and economic indicators further supports the fund's adaptability, maintaining a balance between aggressive growth opportunities and stable investments. Overall, the alignment of fund objectives with market realities showcases a commitment to maximizing investor value while managing risks effectively.

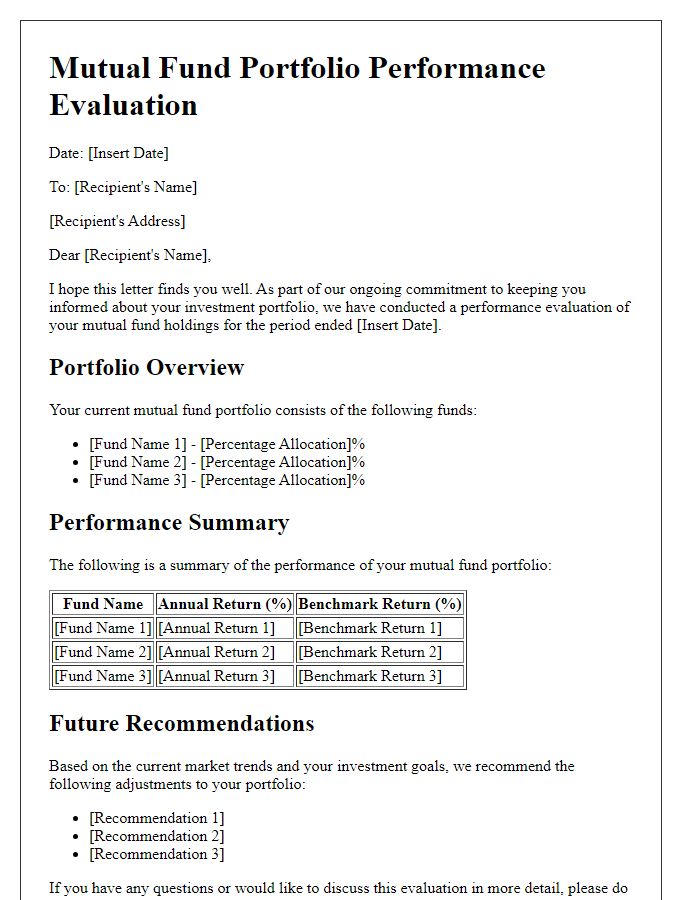

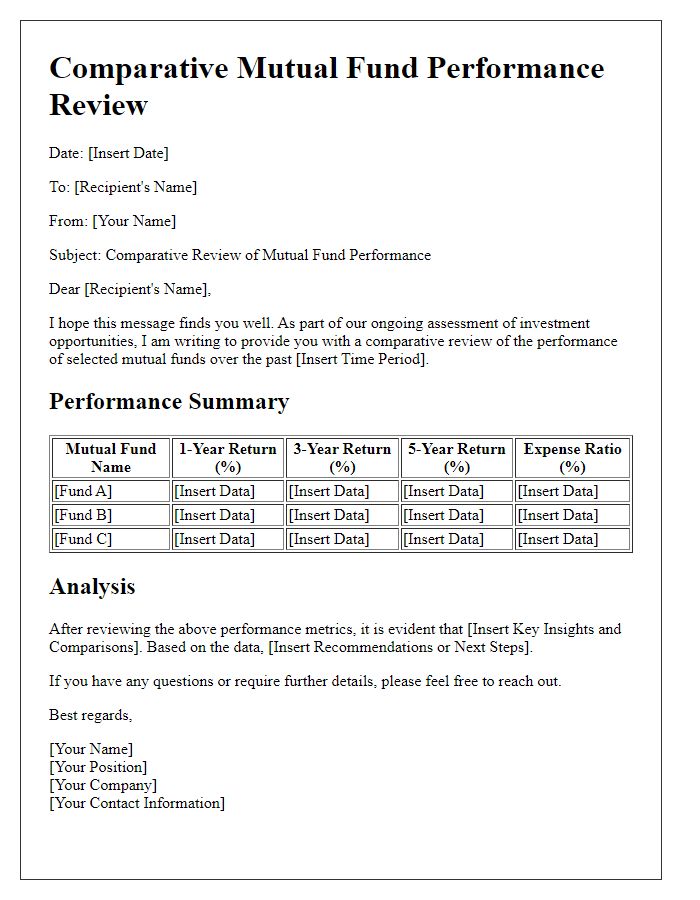

Performance Metrics & Benchmarks

Performance metrics for mutual fund investments can provide valuable insights into management effectiveness and overall fund health. Key indicators include the Fund's Total Return, which measures the overall return inclusive of capital gains, distributions, and reinvested dividends, typically presented as an annualized figure over one, three, five, and ten years. Another crucial metric is the Expense Ratio, which indicates the fund's operating expenses relative to its assets under management, often measured as a percentage. Sharpe Ratio evaluates risk-adjusted return and helps investors determine if higher returns compensate for higher risk levels. Comparisons against appropriate benchmarks, such as the S&P 500 for equity funds or the Bloomberg Barclays U.S. Aggregate Bond Index for bond funds, provide context for performance evaluation, reflecting how the fund performs relative to its market segment. Furthermore, Morningstar Ratings can offer an additional layer of assessment based on past performance and risk, guiding investors in their decision-making processes.

Risk-Adjusted Returns

Risk-adjusted returns serve as a crucial metric for evaluating mutual fund performance, providing a comprehensive perspective on investment efficiency relative to the risk taken. Common measures such as the Sharpe Ratio, which quantifies excess return per unit of volatility, allow investors to discern which funds, like the Vanguard 500 Index Fund, are delivering superior performance while managing risk effectively. Data from Morningstar indicates that funds achieving higher risk-adjusted returns during volatile market periods, such as the 2020 pandemic-triggered downturn, demonstrate better resilience. Analyzing these metrics assists investors in making informed decisions, ensuring their portfolios align with personal risk tolerance and financial goals.

Fund Manager's Commentary

Mutual fund performance evaluations are crucial for investors, particularly those investing in equity markets, such as the S&P 500 index, which reflects the market performance of 500 large companies in the United States. The fund manager's commentary provides insights into market conditions, such as economic shifts or geopolitical events that influence investment strategies. For example, fluctuations in interest rates, such as the recent 0.25% increase by the Federal Reserve, directly impact bond market performance and overall fund returns. Additionally, sector performances, like technology and healthcare, can greatly affect the fund's allocation, showcasing how different industries contribute to overall growth or decline. Understanding these factors aids investors in assessing the fund's alignment with their financial goals and the overall market outlook.

Market Conditions & Outlook

Current market conditions indicate increased volatility, driven by inflationary pressures, interest rate hikes by central banks, and geopolitical tensions impacting global trade. For instance, the U.S. Federal Reserve has raised interest rates several times in the past year, currently positioning rates between 4.5% to 5%, to combat rising inflation rates hitting nearly 8%. As a result, stock prices in sectors like technology and consumer discretionary have fluctuated significantly, with the NASDAQ Composite Index experiencing a decline of over 25% year-to-date. Looking ahead, analysts predict a mixed outlook for equities, with ongoing uncertainty surrounding economic recovery and potential recession risks. Experts suggest a diversification strategy across sectors such as healthcare and energy, which may offer resilience in challenging market environments.

Comments