As we wrap up another fiscal year, it's essential to reflect on our investment performance and the journey we've embarked on together. This annual report highlights not only the numbers but also the strategies that have propelled our success and the challenges we've navigated along the way. We believe transparency is key to strengthening our partnership, so we've detailed every aspect of our investment activities and outcomes. Join us as we dive deeper into the insights and stories behind this year's resultsâread on to discover what the future holds!

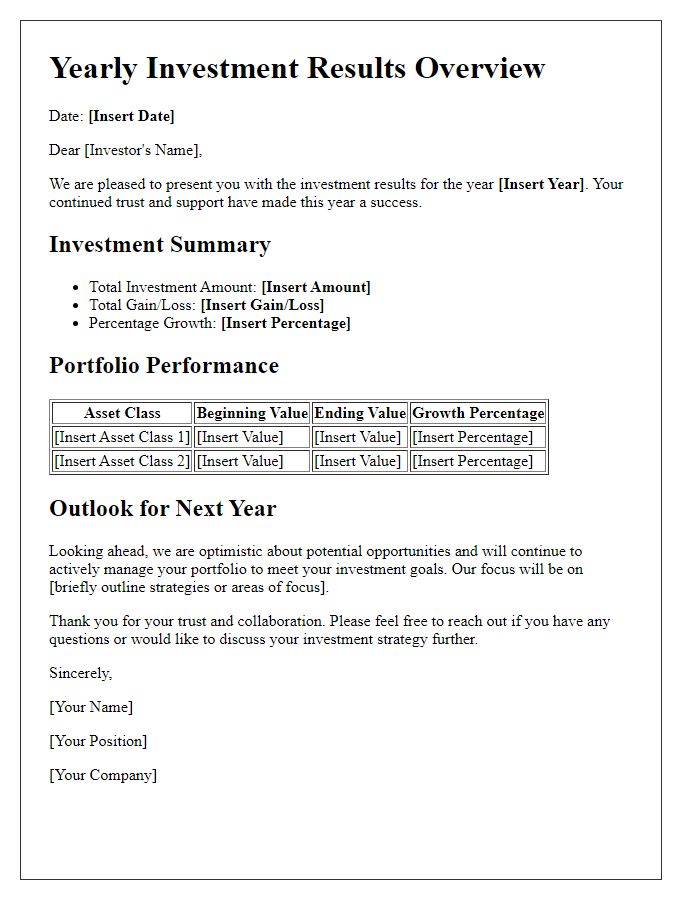

Investment Summary

An investment summary provides an overview of financial performance across various assets, key metrics, and strategic insights. In 2023, the S&P 500 Index experienced a growth of approximately 15.2%, reflecting robust corporate earnings and economic recovery post-pandemic. Real estate investment trusts (REITs), particularly in urban areas such as New York and San Francisco, showed resilience with returns exceeding 10%, driven by increasing rental demand. Additionally, the bond market, represented by the Bloomberg U.S. Aggregate Bond Index, saw a modest decline of 2%, influenced by rising interest rates from the Federal Reserve. Asset allocation diversified across equities, fixed income, and alternative investments reinforced portfolio stability, with a focus on sustainable investing in sectors like renewable energy and technology emerging as high-growth areas.

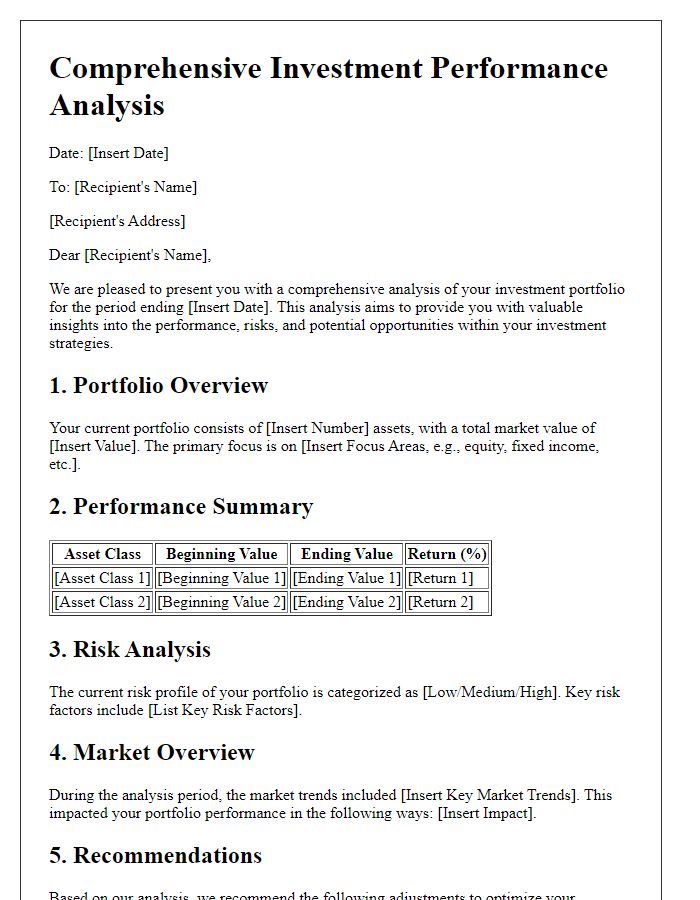

Performance Metrics

Annual investment performance reports are essential documents that outline the financial performance metrics of investment portfolios over the previous year. Key performance indicators (KPIs) such as return on investment (ROI) and annualized return percentage reflect the profitability of investments. Benchmark comparisons, like the S&P 500 index or MSCI World Index, provide a frame of reference to gauge portfolio performance against market standards. Factors influencing these metrics include market volatility, economic conditions, and asset allocation strategies. Historical data trends indicate growth patterns and risks associated with specific sectors, while performance attribution analyzes the contributions of individual investments to overall portfolio results. These comprehensive metrics ultimately assist investors in making informed decisions for future investment strategies.

Portfolio Allocation

Annual investment performance reports present vital insights into portfolio allocation strategies, assessing the distribution of assets among various investment categories like stocks, bonds, and real estate. A balanced portfolio typically consists of asset classes such as equities (often encompassing large-cap and small-cap stocks, which can significantly differ in volatility), fixed income (including government and corporate bonds with varying maturities), and alternative investments (such as real estate investment trusts, or REITs). The allocation percentages can indicate risk tolerance, with aggressive portfolios favoring higher stock allocation (potentially over 70%) and conservative portfolios emphasizing bonds (often exceeding 50%). Historical market events, such as the 2008 financial crisis or the COVID-19 pandemic, highlight the importance of diversification to mitigate risks while maximizing returns over time. Performance analytics tools measure the effectiveness of these allocations, guiding adjustments to align with changing market conditions and individual investment goals.

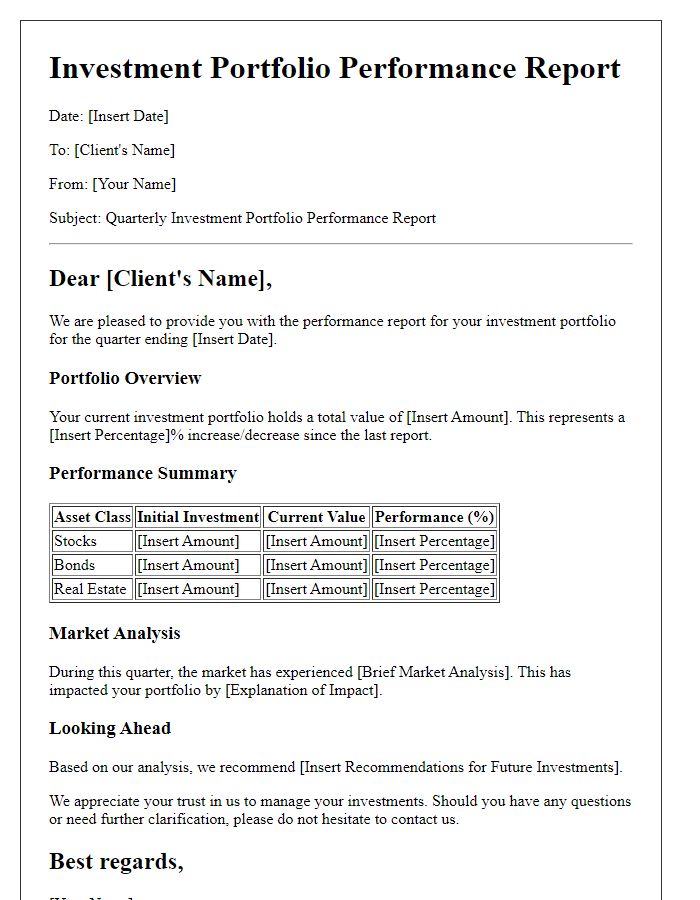

Market Analysis

The annual investment performance report highlights significant market trends impacting financial portfolios. In 2023, global equity markets, notably the S&P 500 index, demonstrated an overall increase of approximately 14%, driven by technology stocks like Apple and Microsoft, alongside rising consumer demand post-pandemic. Interest rates, adjusted by the Federal Reserve, stabilized around 5% aiming to curb inflation, influencing fixed income securities and bond yields. Emerging markets such as India exhibited robust growth rates of 7% due to increased foreign investments and governmental reforms. Geopolitical events, including trade negotiations between the United States and China, added volatility to commodity prices, particularly oil, fluctuating between $70 and $90 per barrel. Currency exchange rates, especially USD against EUR, impacted international investments and travel sectors, emphasizing the need for diversified asset allocation strategies.

Future Outlook

The future outlook for the investment landscape in 2024 appears to hold significant potential driven by emerging technologies and shifting market dynamics. Increased advancements in artificial intelligence, anticipated to account for $15.7 trillion in economic contributions by 2030, may alter investment strategies. Additionally, the global push for sustainable energy, highlighted by the 2021 United Nations Climate Change Conference in Glasgow, is likely to spur growth in sectors such as renewable energy and electric vehicles, projected to reach $7 trillion by 2030. Rising inflation rates, currently at 6.2% in the U.S. as of early 2024, will compel investors to adopt a diversified asset allocation approach to mitigate risks. Interest rates, influenced by Federal Reserve policies, will play a crucial role in shaping credit markets and investment returns. A careful examination of geopolitical developments, particularly those involving trade relations among major economies like the U.S. and China, will be essential for strategizing future investment movements.

Comments