Navigating the world of health insurance can often feel overwhelming, especially when unexpected medical emergencies arise. If you ever find yourself in a situation needing urgent care, having the right emergency medical coverage becomes crucial. This letter template is designed to help you request coverage effectively, ensuring you're prepared for any situation that may come your way. Ready to learn more about how to safeguard your health and finances? Read on!

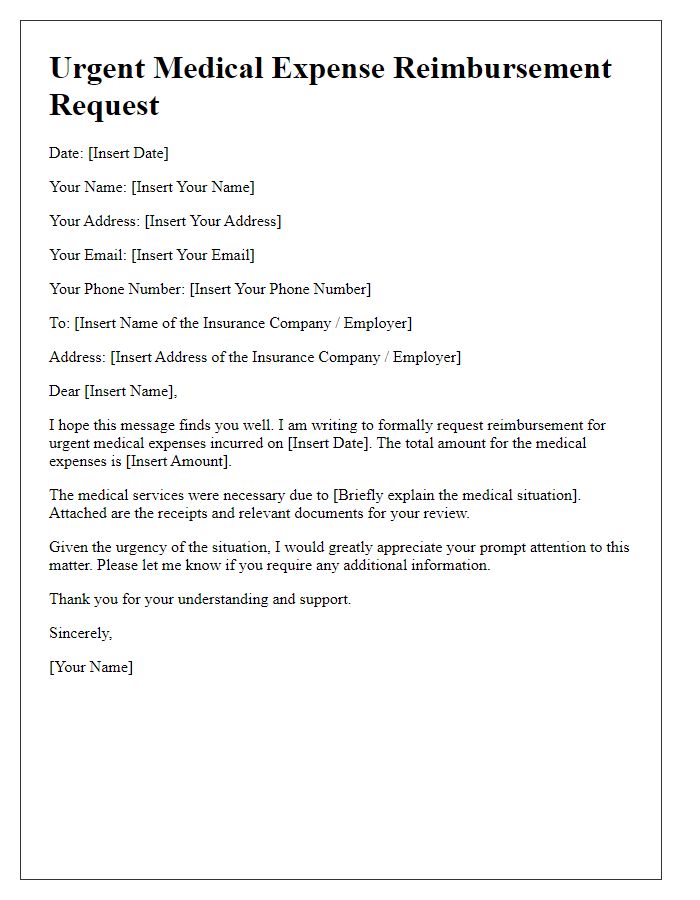

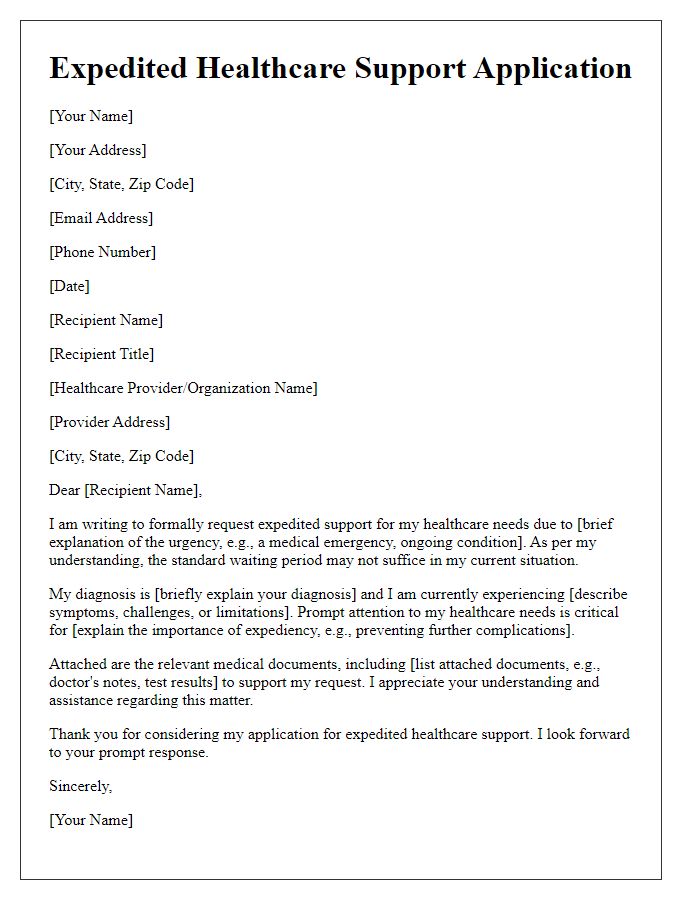

Patient's Personal Information

Emergency medical coverage requests require precise documentation of patient details for prompt processing. Essential patient information includes full name, including middle initial, date of birth (specific format: MM/DD/YYYY), primary residential address (including city, state, and ZIP code), and insurance policy number. Additionally, details about the patient's medical condition leading to the emergency, date and time of the emergency incident, and contact information for immediate family members or guardians should be included. Collecting this data ensures healthcare providers can evaluate coverage eligibility effectively and expedites approval from insurance companies, such as Blue Cross Blue Shield, whose policies often emphasize coverage for urgent medical interventions.

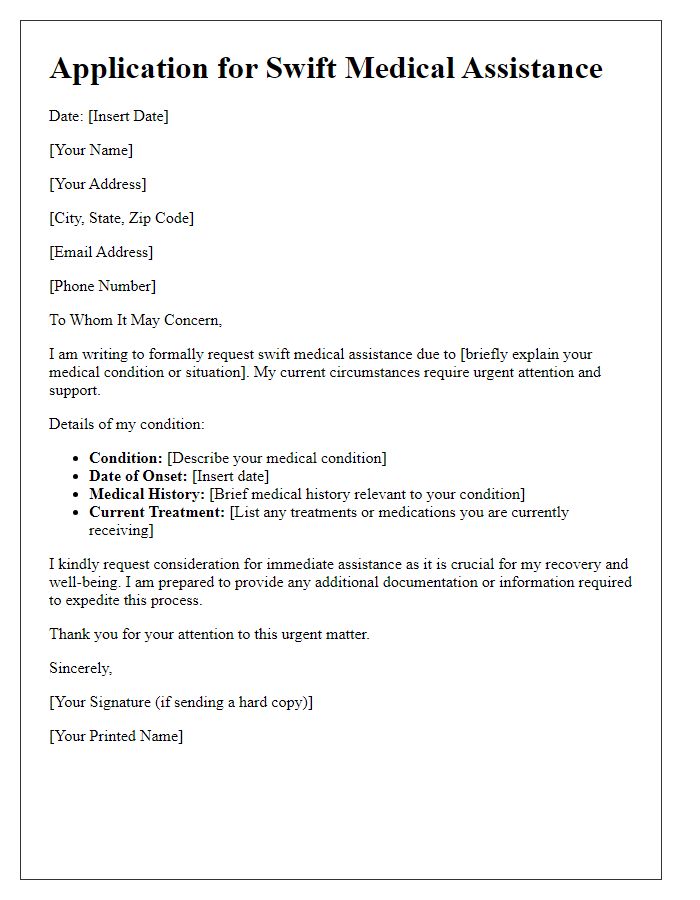

Medical Diagnosis and Urgency

Emergency medical coverage requests often stem from critical health situations requiring immediate attention. Patients experiencing severe conditions, such as a heart attack or stroke, must have rapid access to emergency services, including ambulance transport and hospital treatment. Medical diagnoses, like myocardial infarction (heart attack) or cerebrovascular accident (stroke), highlight the urgency of immediate intervention to prevent further complications or fatalities. Insurance policies must outline coverage specifics, such as inpatient care costs at designated facilities, ambulance fees, and any necessary specialized treatments. Timely approval of such coverage can be life-saving, ensuring patients receive essential medical interventions without financial barriers.

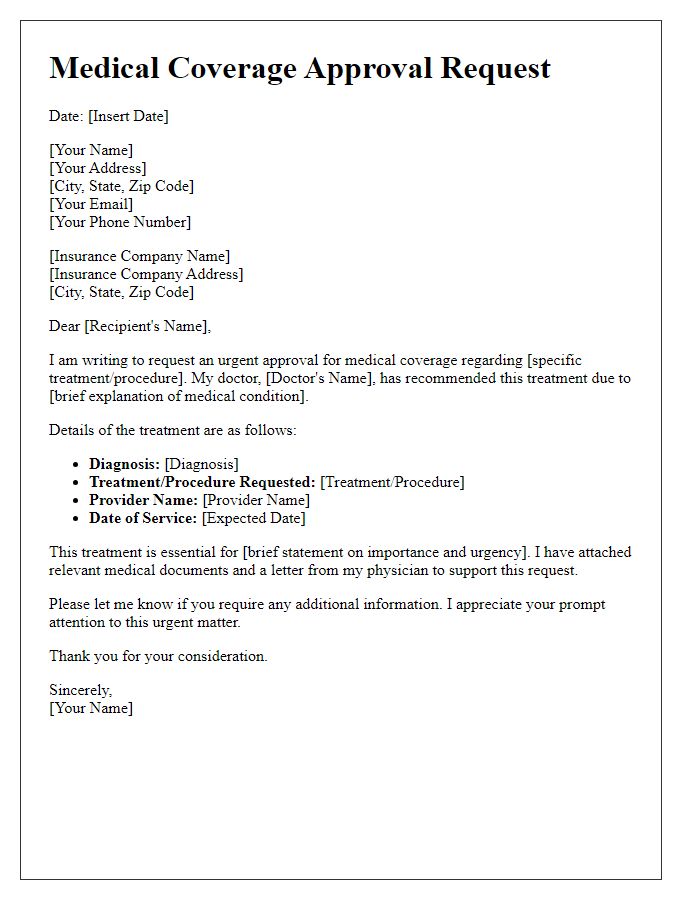

Specific Treatment or Procedure Details

Emergency medical coverage requests often involve specific treatments or procedures that require detailed documentation. For example, an urgent surgical procedure, such as an appendectomy, performed at a facility like Johns Hopkins Hospital, must be justified with clinical findings indicating acute appendicitis. The medical necessity of imaging studies, including CT scans revealing inflammation, should be emphasized to support the urgency. Explicit details about the patient's condition, such as a fever exceeding 101 degrees Fahrenheit or severe abdominal pain rated at 9 out of 10, are critical to establish the need for immediate intervention. Furthermore, the costs associated with treatment, including estimated surgical fees averaging $20,000, should be outlined to ensure proper coverage evaluation by the insurance provider.

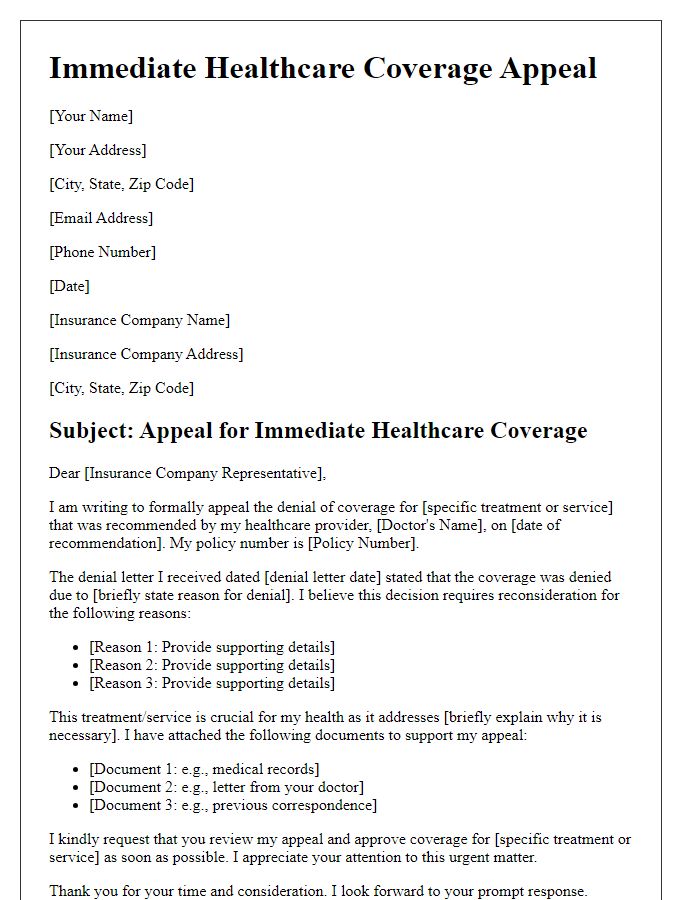

Doctor's Recommendation and Justification

Emergency medical coverage requests require detailed documentation that includes the healthcare provider's endorsement. A physician's recommendation outlining the urgency of the medical situation is critical. For instance, in severe cases like acute appendicitis, which requires immediate intervention, the doctor must provide a clear justification indicating the necessity of surgical procedures. Medical codes, such as ICD-10 codes for diagnosis, must accompany the recommendation to substantiate the nature of the medical condition. Additionally, documenting treatment plans, expected costs, and potential complications if coverage is denied can strengthen the request. This thorough approach ensures that insurance providers have a comprehensive understanding of the medical necessity and urgency involved.

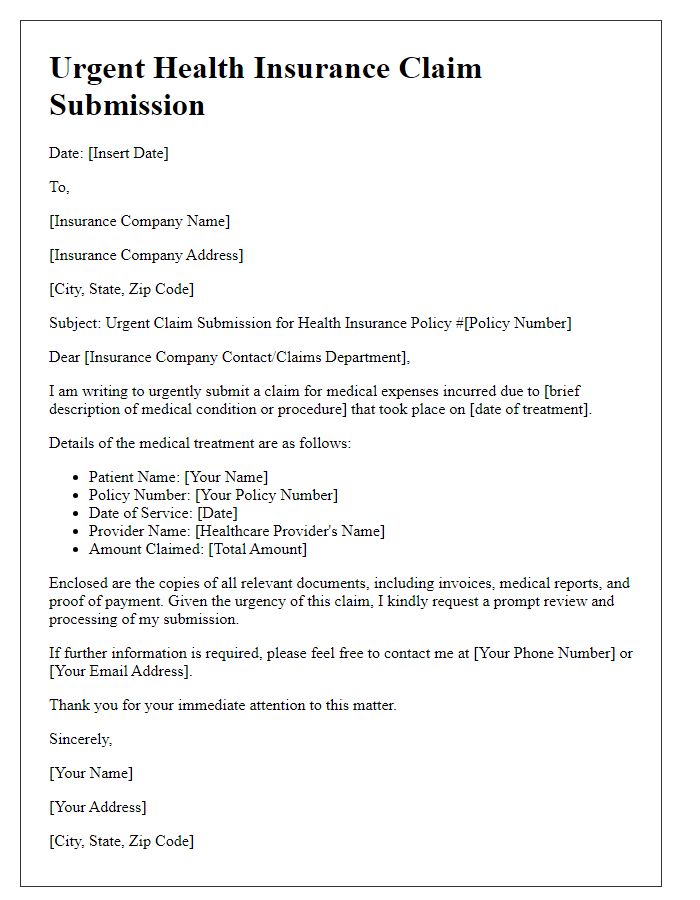

Insurance Policy Reference and Coverage Request

Emergency medical coverage requests often require detailed information about the incident, insurance policies, and personal data. Insurance policies, such as those issued by companies like Blue Cross Blue Shield or Aetna, typically have reference numbers containing alphanumeric codes unique to each policyholder. Details about the medical incident, including dates, locations (such as hospitals or clinics), and the nature of the emergency (like acute injuries or sudden illnesses), must be included to substantiate the request. Providing thorough documentation, including medical reports, bills, and previous correspondence with healthcare providers, ensures a comprehensive review. Timely submission of the request maximizes the chances of approval for coverage.

Comments