Are you currently facing challenges with your utility bill deadlines? It's completely understandable to need some extra time to manage your finances. In this article, we'll walk you through how to inquire about extending your utility bill payment due date, ensuring you know exactly what to say and whom to contact. So, let's dive in and explore the simple steps you can take to ease your financial stress!

Account Information

Utility bill extensions can provide temporary relief for customers facing financial difficulties. Customers seeking an extension typically must verify their account status, including account number and billing address, to ensure eligibility. Many utility companies, such as Pacific Gas and Electric (PG&E) in California or Con Edison in New York, require customers to submit a formal request either online or via customer service representatives. Additionally, some companies may ask for supporting documentation to confirm financial hardship, including recent pay stubs or unemployment verification. Extensions often come with clear deadlines, requiring prompt action from the customer to avoid late fees or service interruptions.

Reason for Extension Request

Utility bill extension requests stem from various financial circumstances, such as unexpected job loss, medical emergencies, or temporary reductions in income. Individuals may face challenges in managing monthly payments to service providers, including electricity, water, and gas companies. Specific situations can include recent layoffs impacting family budgets, significant medical expenses arising unexpectedly, or seasonal jobs resulting in fluctuating incomes. In many regions, utility companies, such as Pacific Gas and Electric in California or Con Edison in New York, may have established protocols or policies to assist customers facing genuine hardship, allowing for extensions or payment plans. It's essential for consumers to communicate their unique situations to expedite resolution and help maintain vital services.

Proposed Payment Plan

Utility bill extensions can provide crucial financial relief during challenging times, particularly for families facing unforeseen expenses. Many utility providers, such as electricity and water companies, offer options to create customized payment plans, allowing customers to spread payments over several months. For example, the city of San Jose's water department may allow an extension of payment due dates and even reduced late fees for qualifying households. This can prevent service interruptions, which could impact daily life significantly, especially for those relying on electricity for heating or air conditioning. Understanding the requirements, such as income eligibility or proof of hardship, is essential for customers seeking extensions. Inquiries about these programs can usually be directed to customer service representatives or specific departments focusing on financial assistance, which may enhance the likelihood of securing much-needed aid.

Contact Information

Utility bills, such as electricity or water services, often require timely payments to maintain continuous service. Customers may seek extensions due to unexpected events or financial difficulties. Utility companies, including Pacific Gas and Electric (PG&E) or Con Edison, generally have specific policies regarding extensions. These policies can depend on the account status, payment history, and state regulations. Customers should provide pertinent contact information, including their account number, phone number, and email address, to facilitate efficient communication regarding their request for an extension. Clear documentation and a brief explanation of the circumstances leading to the extension request can improve the likelihood of a favorable response.

Deadline for Response

When seeking a utility bill extension, it is essential to clearly communicate with the respective utility company, such as local electric or water services. An extension request usually requires submission at least 7 to 14 days before the original due date to allow sufficient processing time. Each provider typically has its own guidelines, requiring detailed information about the account number, the requested extension period (often up to 30 days), and the reason for the delay in payment. Prompt inquiries can prevent service disruption, especially in peak billing seasons like winter or summer. It's advisable to request a response by a specific deadline (for example, within 5 business days) to ensure timely confirmation and peace of mind regarding payment arrangements.

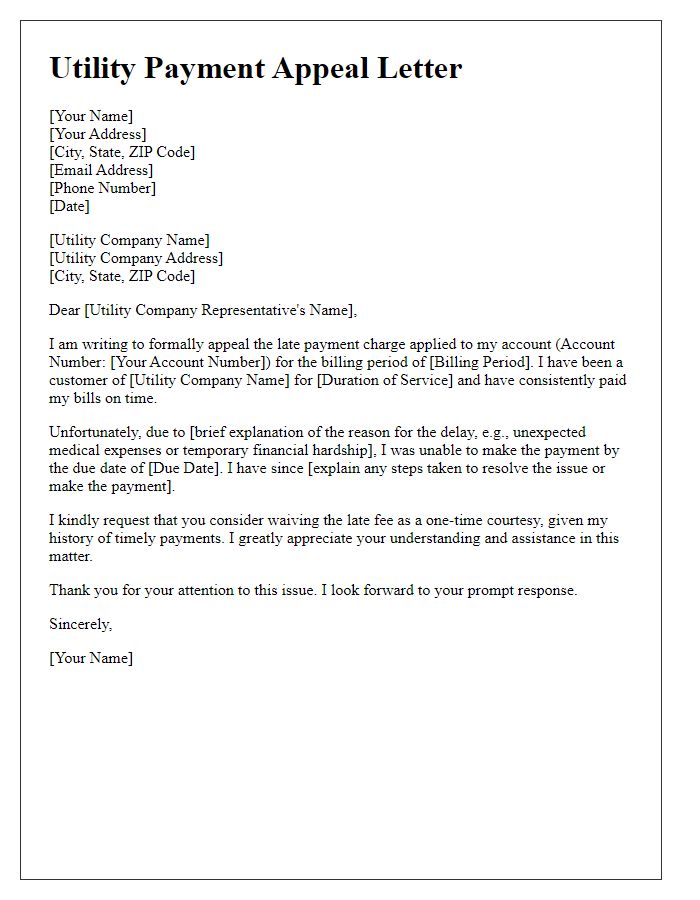

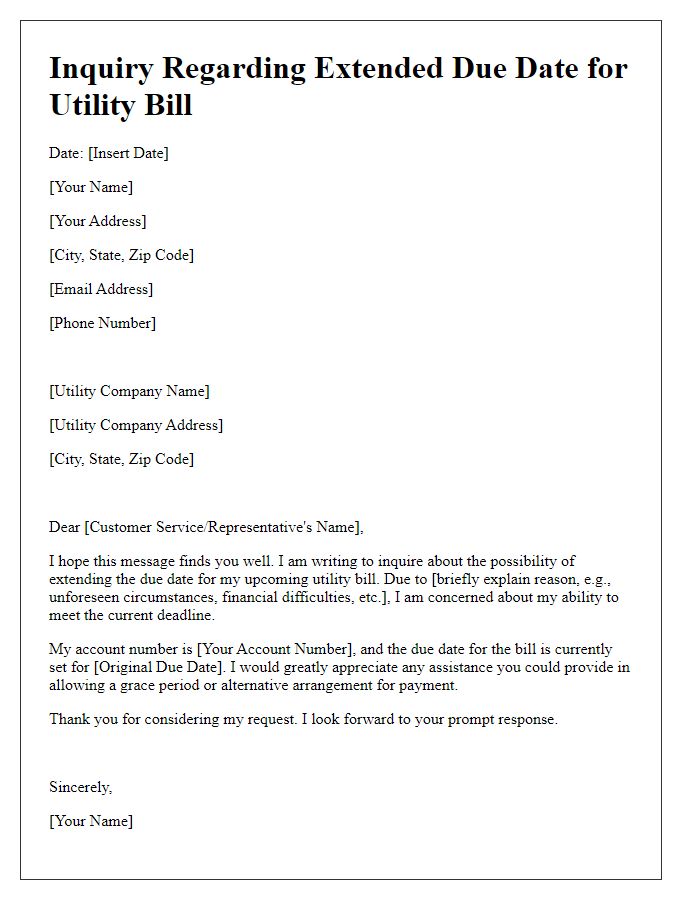

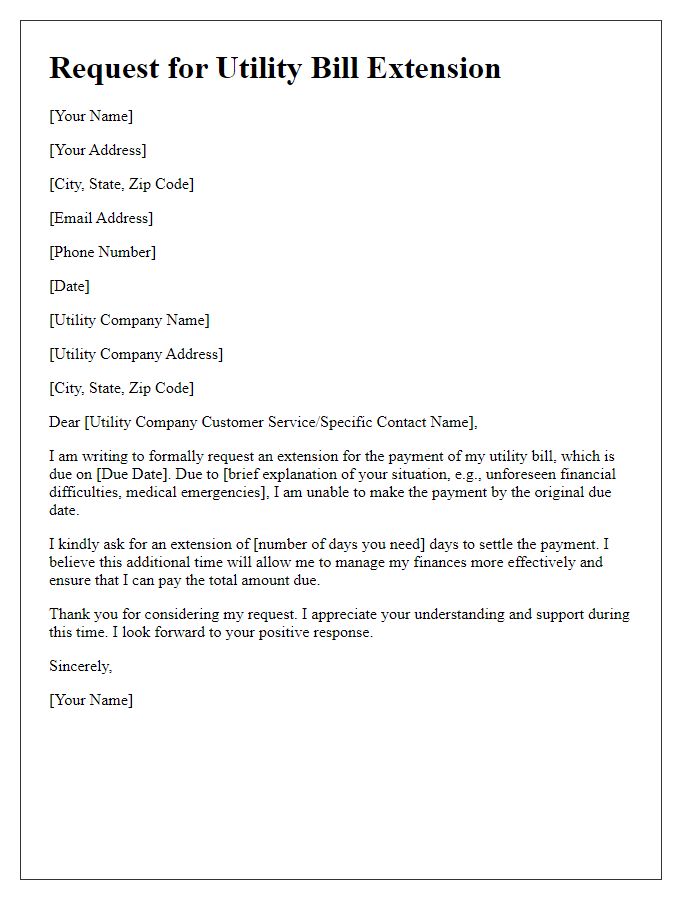

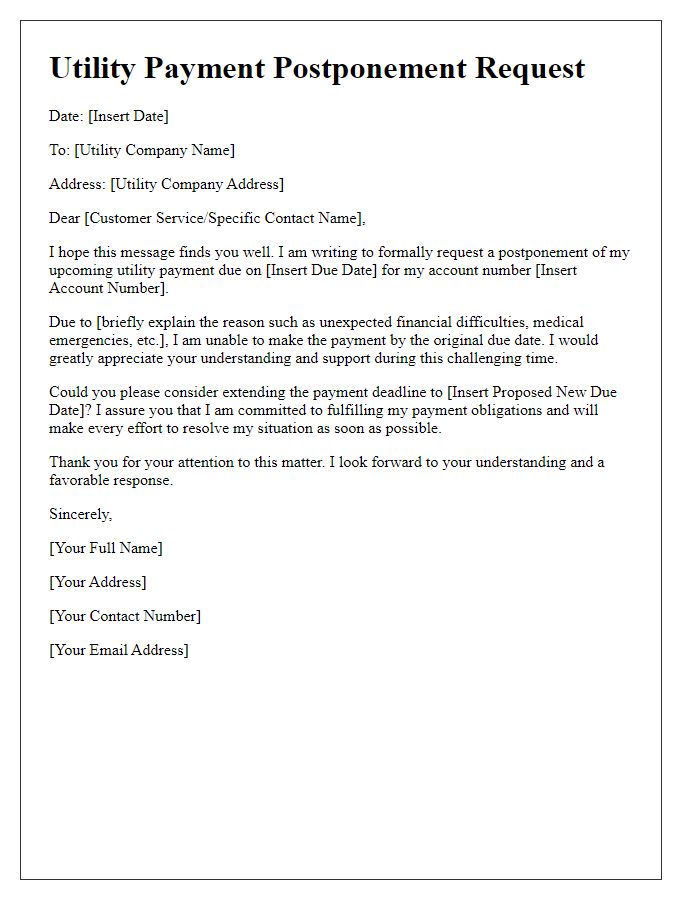

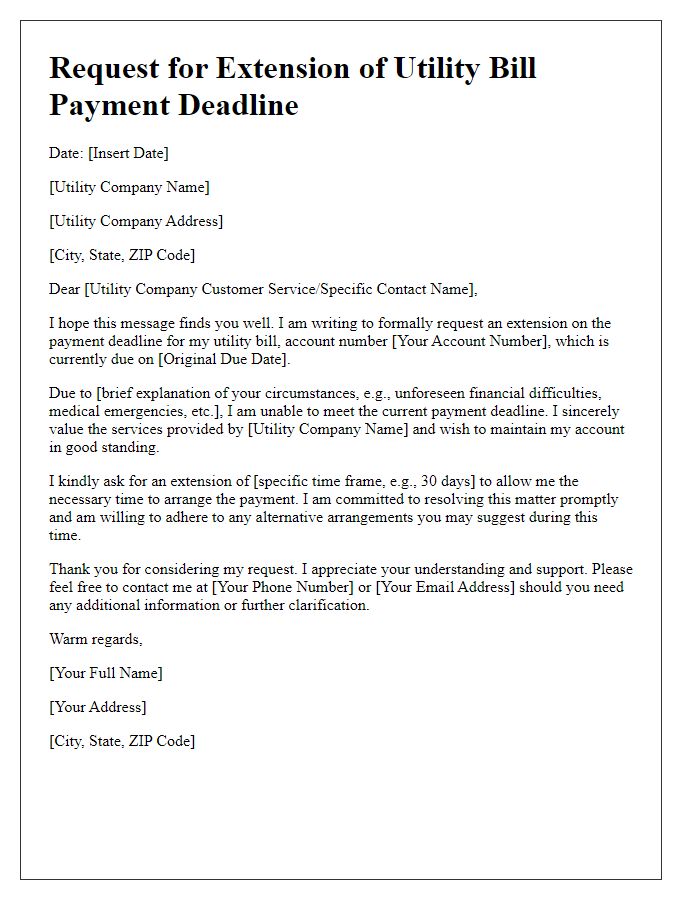

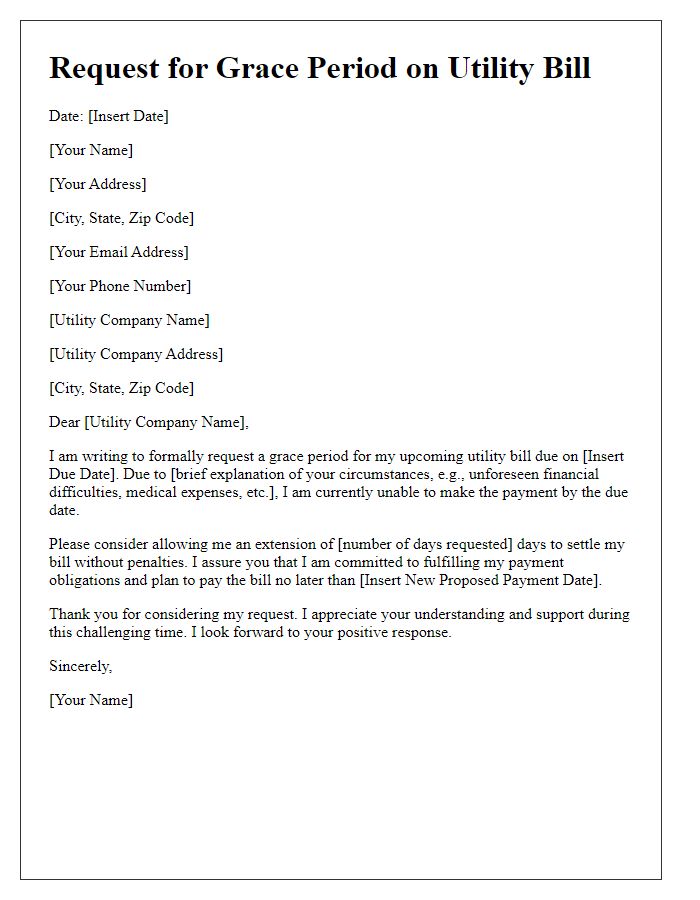

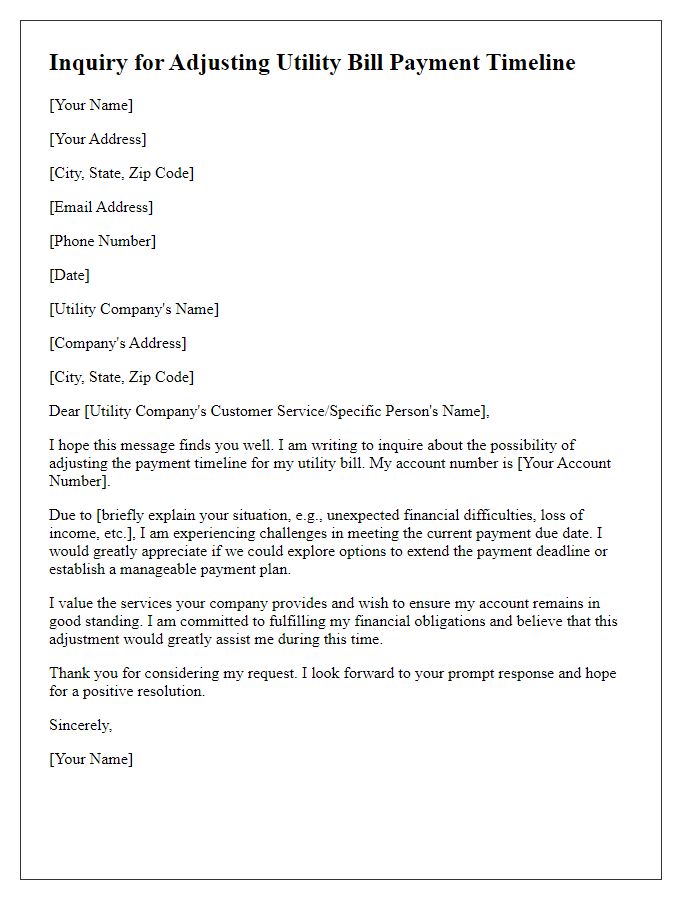

Letter Template For Utility Bill Extension Inquiry Samples

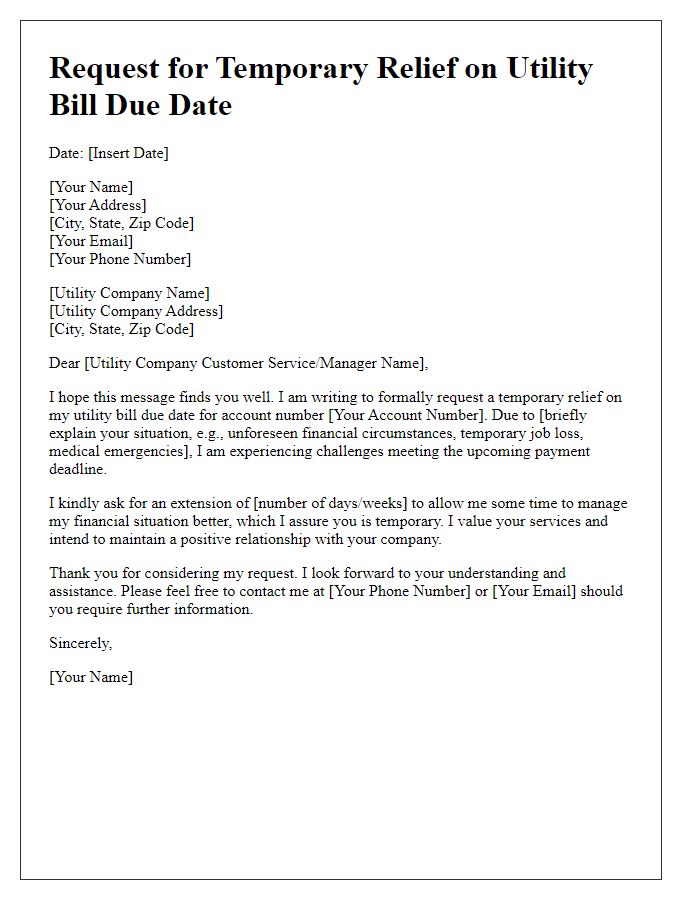

Letter template of request for temporary relief on utility bill due date

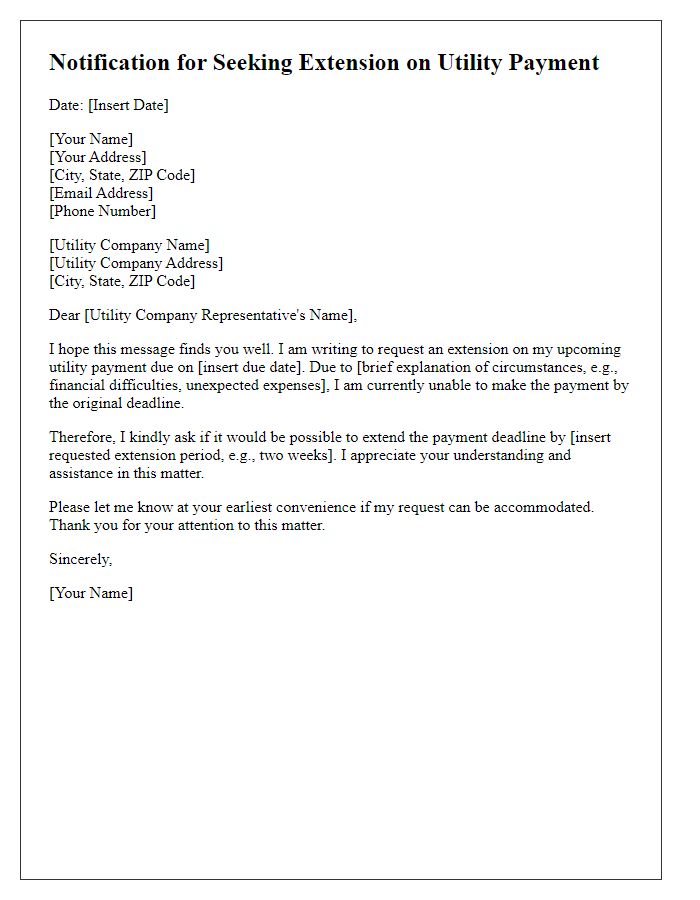

Letter template of notification for seeking extension on utility payment

Comments