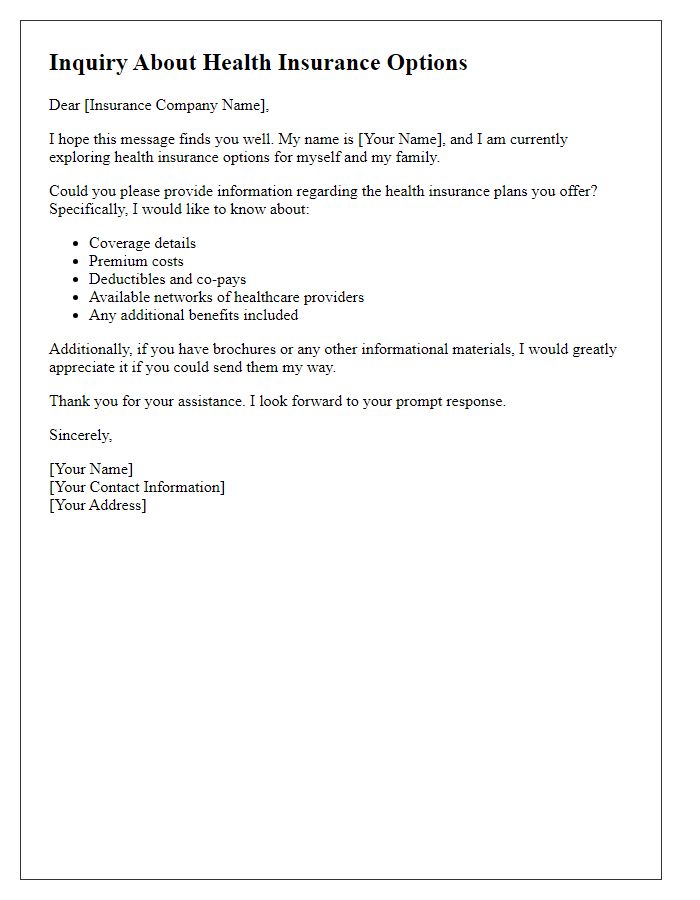

Are you feeling overwhelmed by the complexities of health insurance and unsure about your coverage options? You're not alone! Many individuals find themselves needing clarity on their health insurance policies and what they encompass. In this article, we'll guide you through the essentials of crafting the perfect inquiry letter to address your health insurance coverage concernsâso let's dive in!

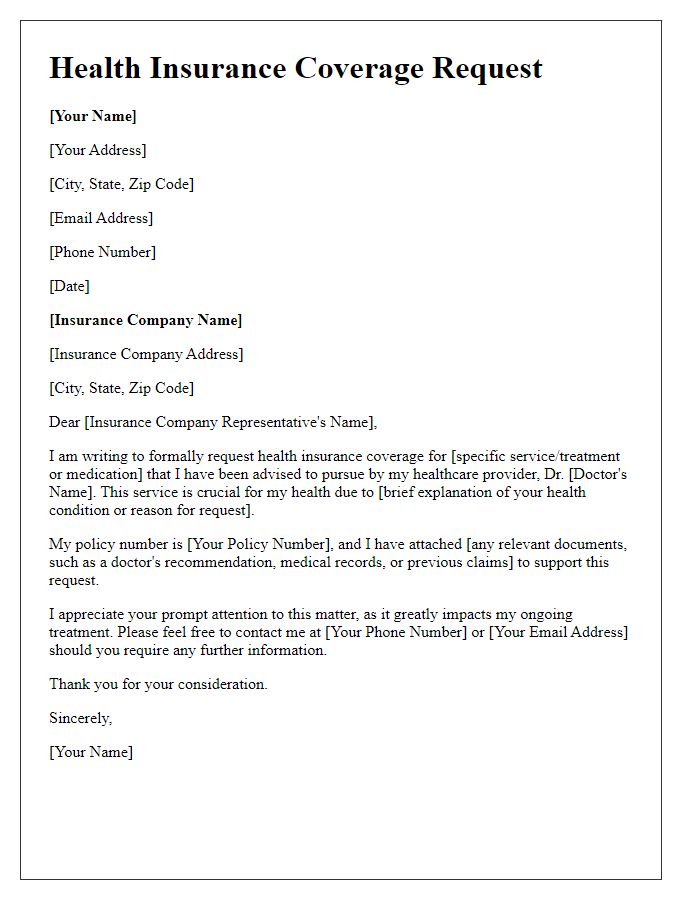

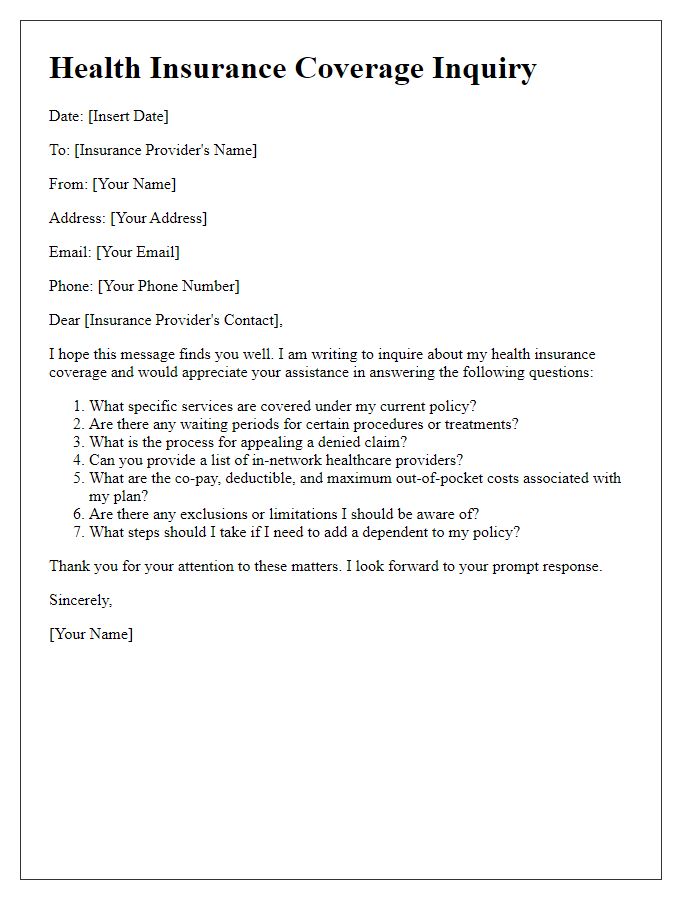

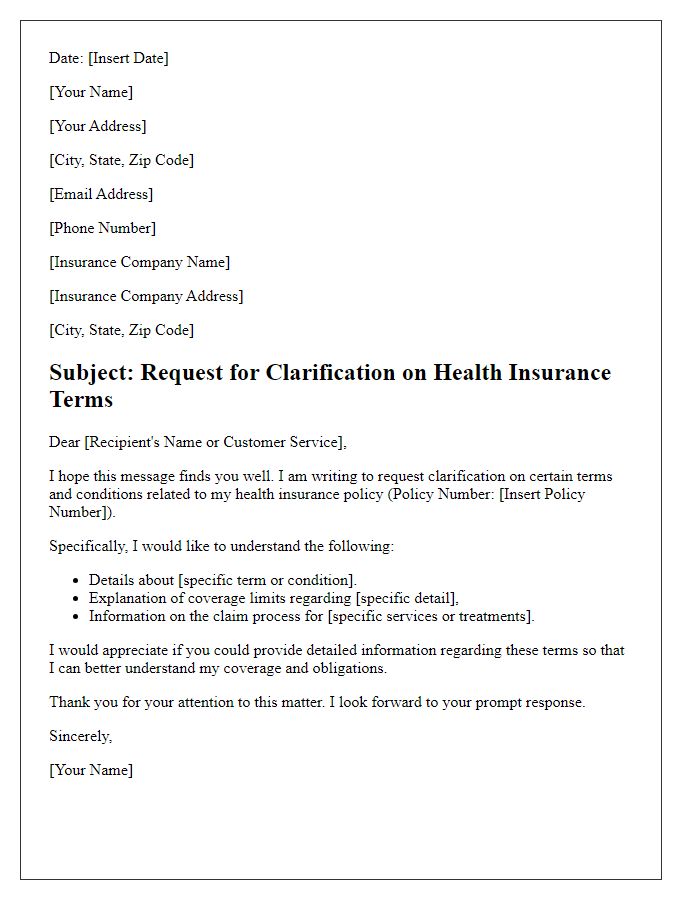

Personal Information

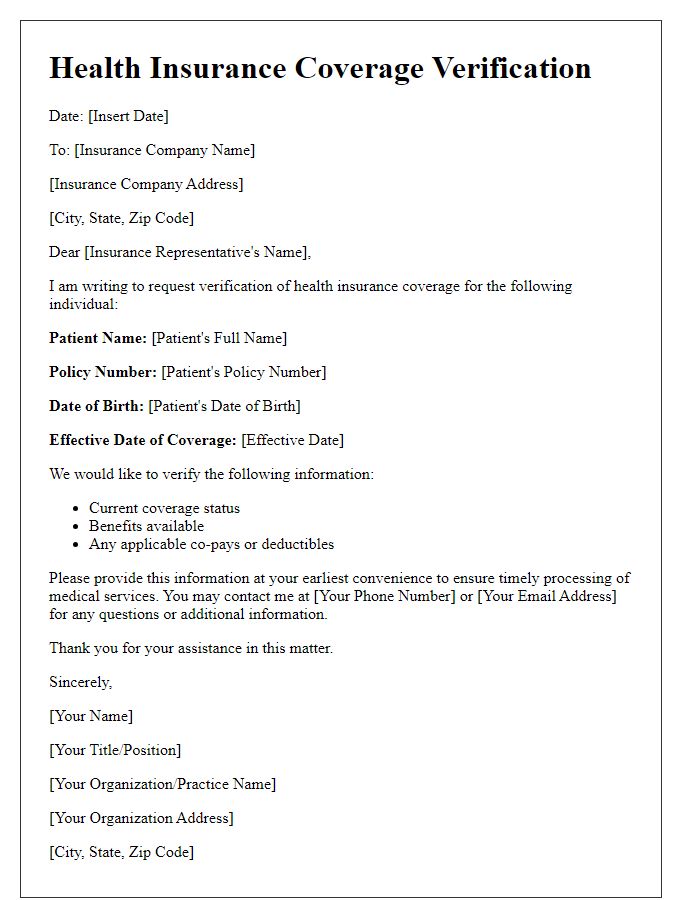

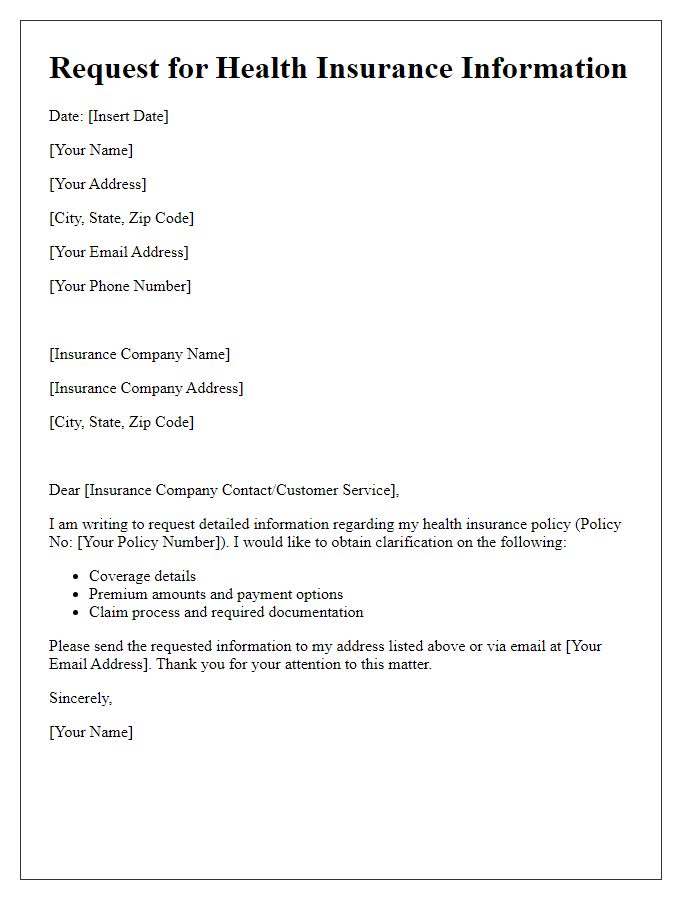

Health insurance coverage inquiries often revolve around specific policies and benefits. Individuals seeking information typically provide personal details such as full name (first name and last name), date of birth (to verify identity, often formatted as MM/DD/YYYY), policy number (unique identifier for insurance plans), and contact information (phone number and email address for follow-up). Address details (street, city, state, zip code) may also be relevant for regional coverage specifics. Additionally, individuals may include group number (related to employer-sponsored plans), which assists in determining eligibility for certain health services or benefits. Providing this information allows insurance companies to deliver accurate and personalized responses regarding coverage options and health services.

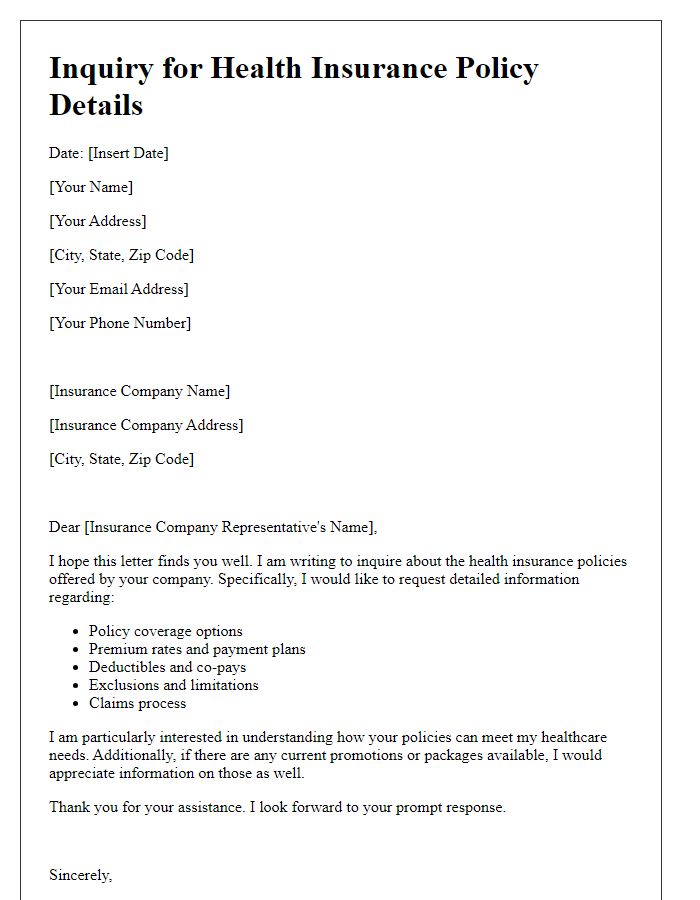

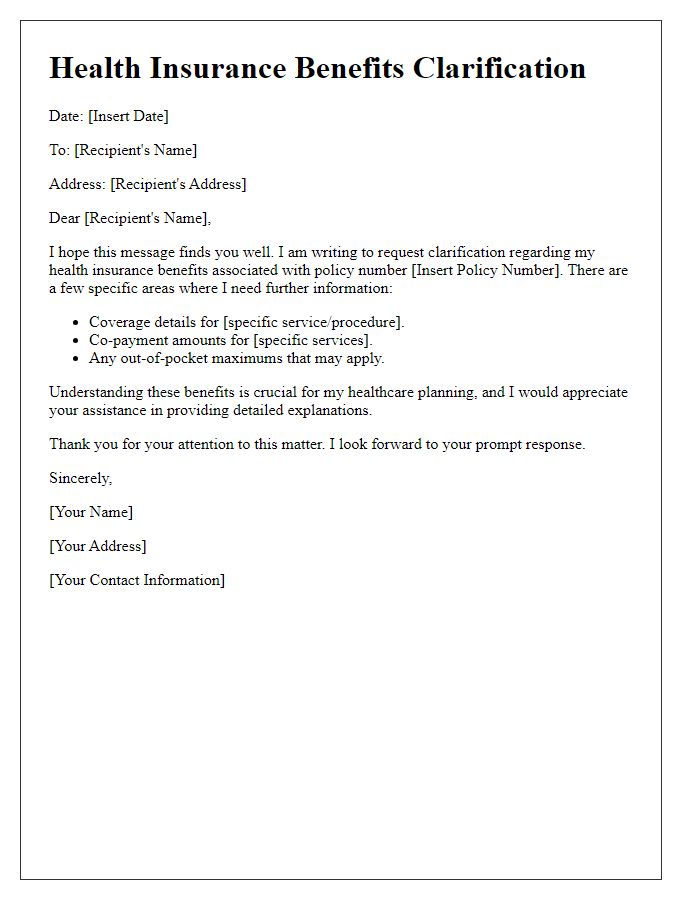

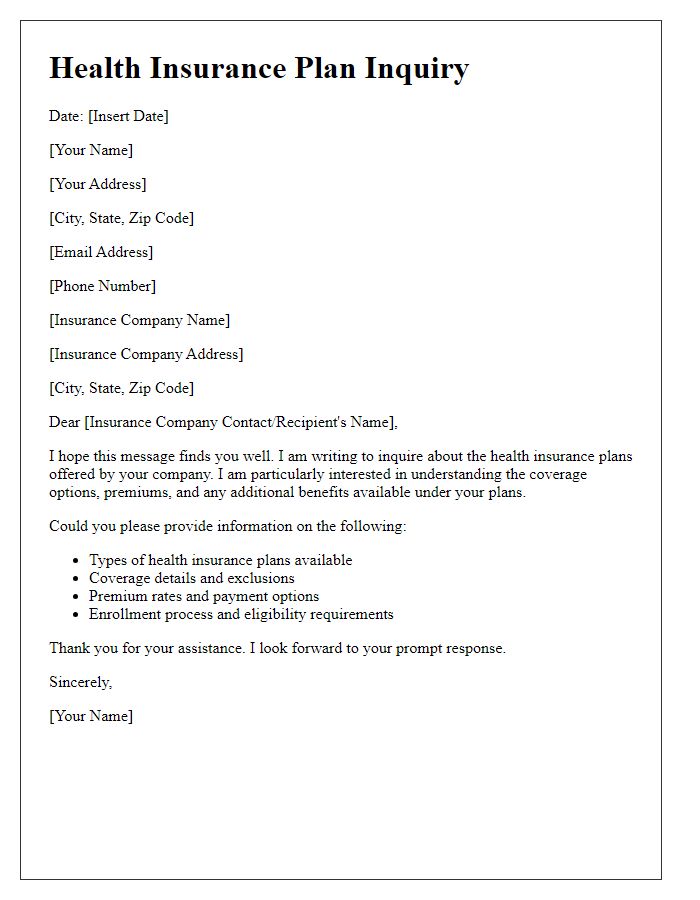

Policy Details

Health insurance coverage inquiries often relate to specific policy details such as coverage limits, exclusions, and claim processes. Each health insurance provider has unique terms that define the extent of their policies. For example, policy number (for identification) can specify coverage for hospitalization, outpatient services, and preventive care, typically outlined in plan documents. Family coverage plans vary, often supporting diverse needs, from maternity care to specialized treatments like mental health services. It's crucial to note critical dates such as renewal deadlines or open enrollment periods that impact coverage options. Understanding these elements can significantly influence healthcare choices and out-of-pocket expenses.

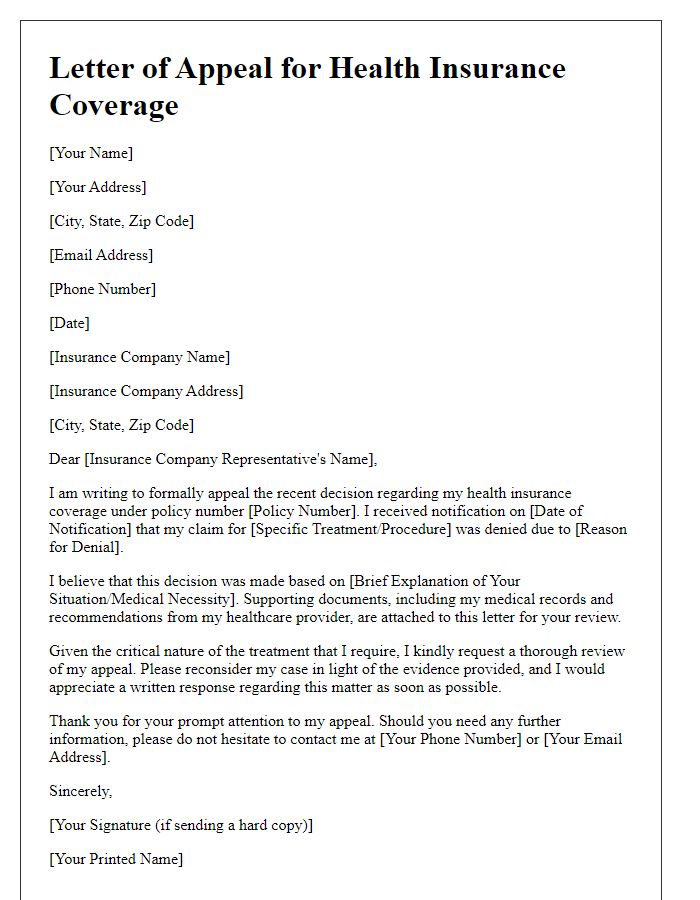

Specific Coverage Questions

Navigating health insurance coverage can be intricate, especially with specific procedures like MRI scans (Magnetic Resonance Imaging) often used for detailed internal body imaging. Coverage policies may vary significantly among insurance providers, such as UnitedHealthcare or Aetna, influencing whether costs for particular services are fully or partially covered. Pre-authorization requirements may also arise, necessitating documentation from healthcare professionals, particularly for diagnostic tests related to conditions like cancer or neurological disorders. Patients should verify their deductibles, co-pays, and out-of-pocket maximums, often defined within their specific plan (e.g., PPO or HMO), to understand potential financial responsibilities related to treatment. Furthermore, understanding the in-network versus out-of-network provider nuances can directly impact coverage levels and out-of-pocket expenses associated with surgeries or specialist consultations.

Contact Information

Health insurance coverage inquiries often require several essential pieces of information to facilitate a prompt response from insurance providers. Key details include the full name of the policyholder, policy number (a unique identifier assigned to the insurance plan), and contact information (such as the email address and phone number for effective communication). Additionally, it is beneficial to specify the nature of the inquiry, whether it concerns claims, benefits, or eligibility. Providing a concise description of the issue will ensure that the inquiry is directed to the appropriate department for resolution. It is also advisable to include relevant dates, such as the date of service or the date of claim submission, to expedite the investigation process.

Request for Timely Response

Health insurance policies often have specific coverage limits and exclusions which can impact access to medical services. For instance, a policy may cover surgical procedures after a waiting period of six months. However, certain treatments such as experimental therapies might not be covered at all, regardless of medical necessity. Additionally, understanding the benefits offered by providers, like copayment options or out-of-pocket expenses, is critical. For instance, some plans might require a 20% copay for specialist visits, while others may have higher thresholds. Timely responses from insurers regarding coverage inquiries greatly influence patient decision-making and access to timely health care services.

Comments