Are you considering a personal loan to help manage your finances or fund a special project? We know that navigating the world of loans can be overwhelming, and having the right information is key to making an informed decision. In this article, we'll walk you through how to effectively craft a letter template for your personal loan inquiry request, ensuring that you request all essential information to find the best option for your needs. So, let's dive in and explore what you need to include in your request!

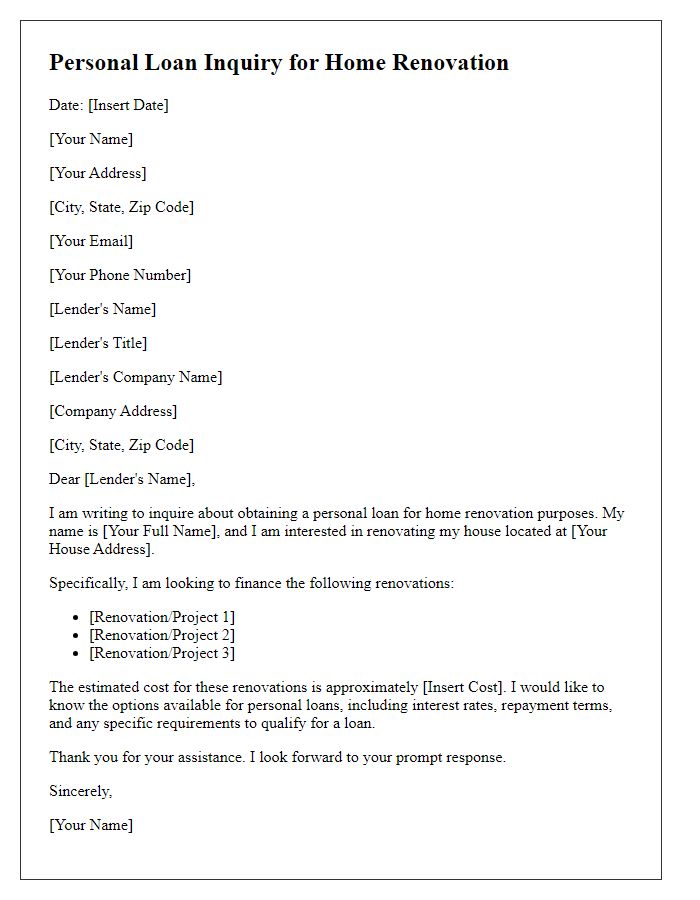

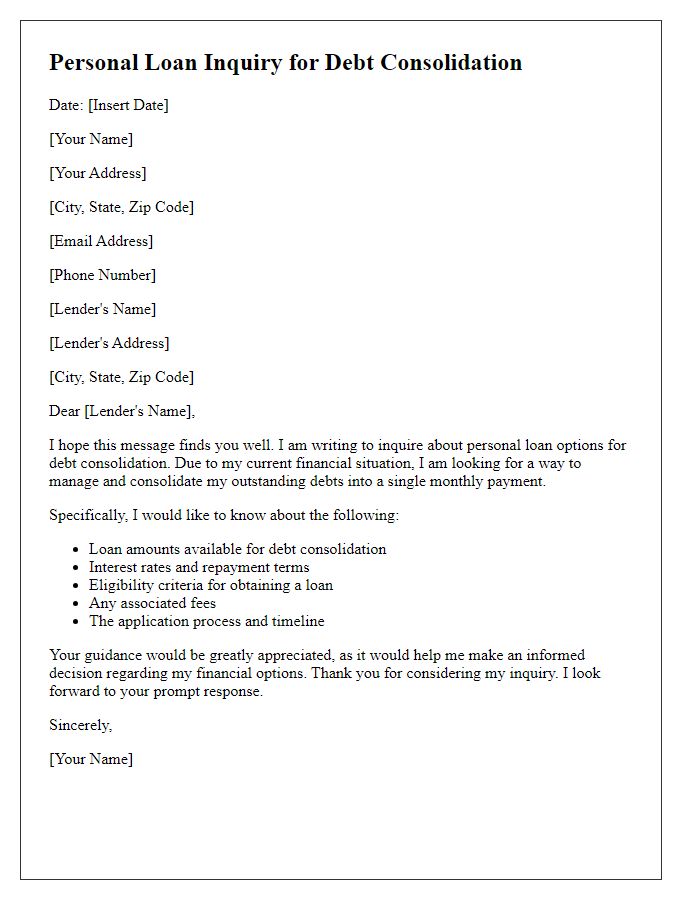

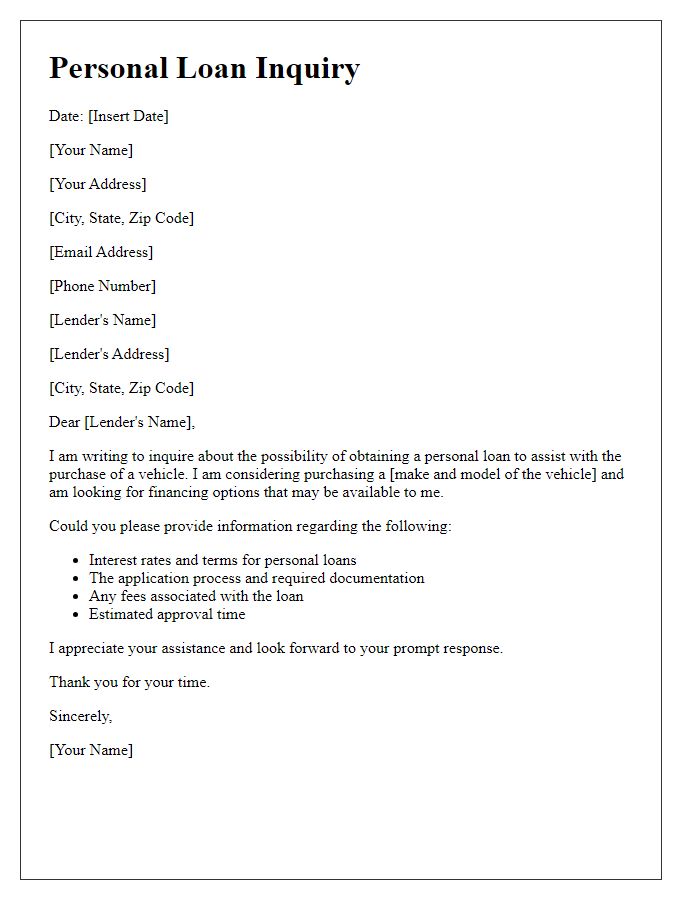

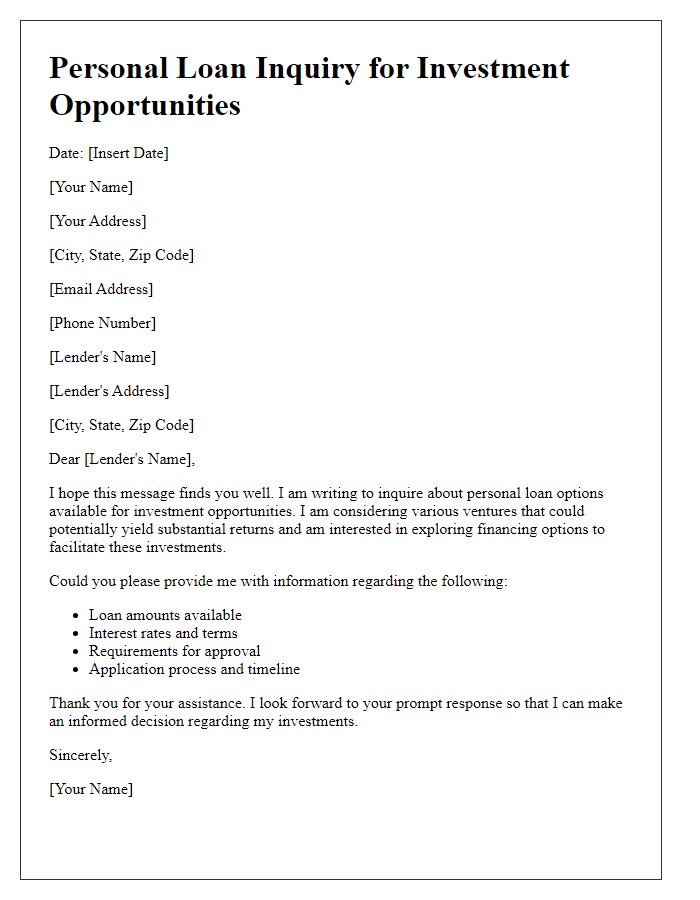

Purpose and Specific Amount

When considering a personal loan, borrowers often specify a clear purpose such as home renovations, medical expenses, or debt consolidation (averaging $15,000 for many). For example, requesting a personal loan amount of $10,000 can assist with kitchen remodeling projects, which typically cost between $5,000 and $50,000, depending on scope. Borrowers may also seek funds for unexpected medical bills, with the average cost of emergency care reaching around $2,500 or more. Additionally, consolidating high-interest debts often leads to financial relief, enabling individuals to manage payments more effectively and lowering their overall interest rates significantly.

Financial Background and Stability

Financial stability plays a crucial role in the evaluation of personal loan applications, particularly for individuals seeking amounts over $10,000. Employment history, lasting more than three years, can significantly enhance an applicant's credibility, while a steady income exceeding $50,000 annually demonstrates ability to repay. Credit scores, typically above 700, indicate responsible management of previous financial commitments. Additionally, maintaining a low debt-to-income ratio (ideally below 36%) showcases financial prudence. Assets such as savings accounts with balances over $5,000, retirement funds, or property ownership further strengthen the applicant's position, signaling reliability and foresight in financial planning. All these elements create a compelling case for loan consideration from lenders.

Repayment Plan and Schedule

Understanding a personal loan inquiry involves reviewing the details surrounding repayment plans and schedules. Personal loans, often ranging from $1,000 to $50,000, typically come with a fixed interest rate and a repayment period of two to seven years. Borrowers should consider the monthly payment amounts based on the total loan amount, interest rates, and the length of the repayment term. It's crucial to analyze how these factors impact the overall cost of the loan, including the total interest paid over time. Lenders often provide amortization schedules, detailing each payment's allocation toward principal and interest, aiding borrowers in financial planning. Evaluating different loan offers and understanding the specific terms from financial institutions can ensure a well-informed decision regarding personal borrowing options.

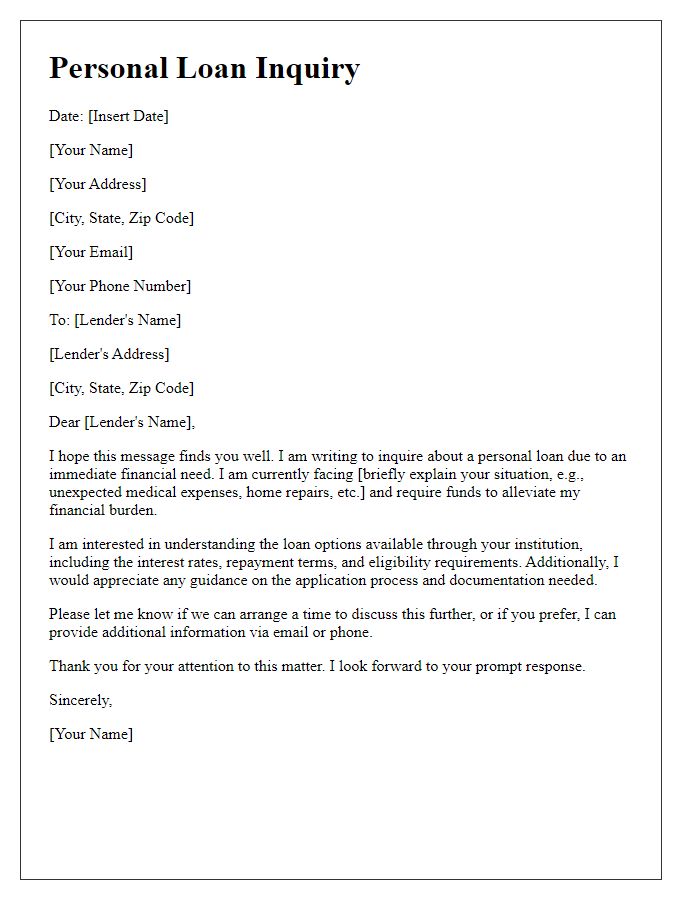

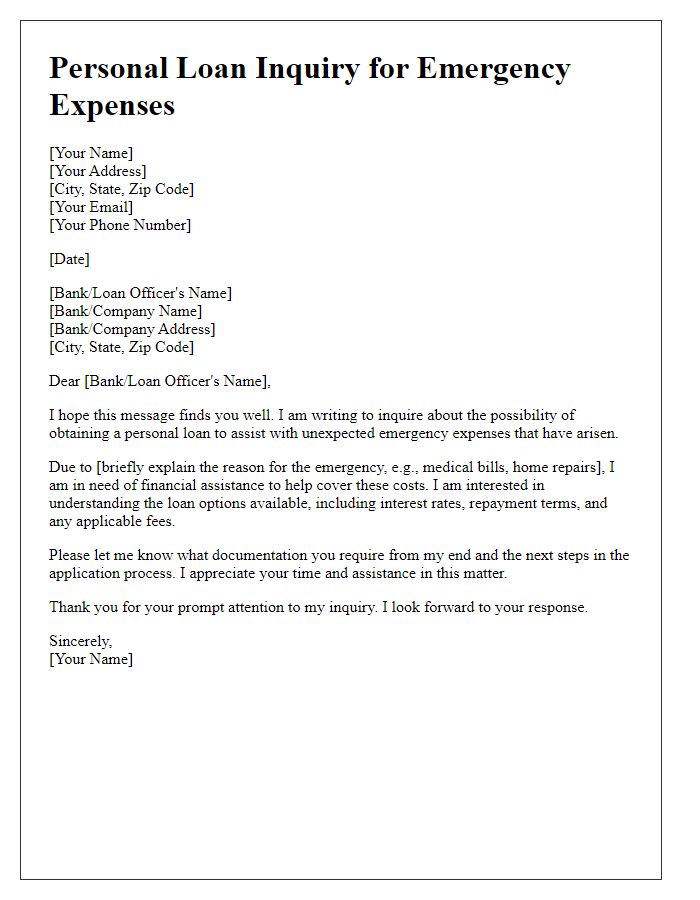

Contact Information and Preferred Communication

Inquiries regarding personal loans often require precise and comprehensive contact information to enable financial institutions to provide timely responses. Essential details include the applicant's full name (for identification purposes), current residential address (to verify residency), and phone number (for direct communication). Additionally, an email address (for digital correspondence) is critical, especially in today's tech-oriented landscape. Indicating a preferred mode of communication--whether by phone call, email, or postal mail--can streamline the inquiry process. Applicants may also consider including their availability for contact to facilitate a smooth dialogue. Providing this information can enhance the efficiency of the loan inquiry process and ensure effective communication with potential lenders.

Assurance and Documentation

In the dynamic world of personal finance, securing a personal loan often necessitates comprehensive assurance and meticulous documentation. Lenders typically require essential documents such as proof of income (pay stubs or tax returns from the previous year), credit history (credit score reports from agencies like Experian or TransUnion), and personal identification (government-issued IDs). The assurance aspect reinforces financial credibility, with collateral information (for secured loans) or co-signer details provided to enhance approval chances. Understanding this documentation process is crucial in navigating various financial institutions (banks, credit unions, or online lenders), and timely preparation can streamline loan approvals to meet personal or emergency needs effectively.

Comments